Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.057% to 7,519.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

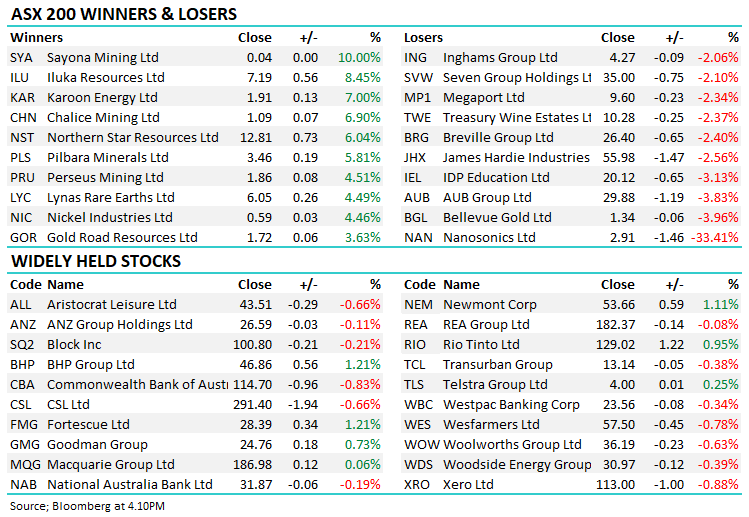

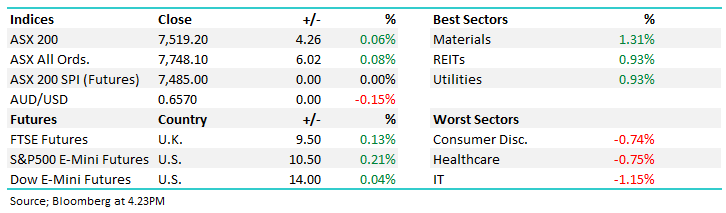

A choppy session played out locally with the market hot early only to give back the morning gains by the close, a ~60-point trading range and a fair dose of volatility at the stock level thanks to a flurry of company updates, particularly in the mining sector.

- The ASX 200 eventually finished up +4pts/ +0.06% to 7519.

- The Materials sector (+1.31%) was strong as were REITs (+0.93%) & Utilities (0.93%).

- IT (-1.15%), Healthcare (-0.75%) and Consumer Discretionary (-0.74%) the weakest links.

- Pilbara Minerals Ltd (ASX: PLS) +5.81% rallied on a quarterly production update that highlighted their strong financial position and ability to handle weak Lithium prices better than many others, though quarterly earnings have halved.

- Northern Star Resources Ltd (ASX: NST) +6.04% delivered December quarter production numbers that were all in order, while they maintained their FY24 guidance.

- Woodside Energy Group Ltd (ASX: WDS) -0.39% recut 2024 guidance, they now expect 185 – 195 mmboe, which compares to current market expectations of 198.5 mmboe

- Kogan.com Ltd (ASX: KGN) +14.87% delivered strong 1H margins which helped the stock rally today despite weaker revenues.

- Nanosonics Ltd (ASX: NAN) -33.41% smacked as 1H sales came in weaker than expected – very hard to justify current valuation.

- Newmark Property REIT (ASX: NPR) +36.6% the landlord for many Bunnings, Kmart & Officeworks sites attracted an all-scrip takeover bid from BWP Trust (ASX: BWP) at a 43% premium based on yesterday’s close prices. The stock closed today at $1.325, however, to tame the excitement, their listing price was $1.90 in December 2021!

- Iluka Resources Limited (ASX: ILU) +8.45% had a strong session on the back of multiple broker upgrades following yesterday’s production numbers, as suggested in recent days, we think this looks very interesting deep value turnaround opportunity.

- Chrysos Corporation Ltd (ASX: C79) -5.5% fell after signalling that installed assay units may be soft in FY24 due to a lack of contractor availability and customer readiness. One we are watching.

- Iron ore was up 0.8% in Asia

- Asian stocks were mixed, Hong Kong added 0.8%, though Japan was off -1.15%% while China dipped -0.3%.

- US Futures are up, led by Nasdaq Futures +0.6%

- Companies we own reporting in the US this week: Resmed Inc (NYSE: RMD) & Freeport-McMoRan Inc (NYSE: FCX) tonight, Blackstone Inc (NYSE: BX) 25th Jan

- We wrote a note this morning looking at how venture capitalists are thinking about technology – read the opinion here with some stock ideas to consider.

- Market Matters Reporting Calendar should be out tomorrow

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Pilbara Minerals (PLS) $3.46

PLS +5.81%: Rallied today on a quarterly production update that highlighted their strong financial position and ability to handle weak Lithium prices better than many others.

The December quarter saw them produce 176k tonnes of Spodumene Concentrate, up 22% q/q at an average realised price of $1,113 per ton vs $2,240 in 1Q. The material decline in pricing clearly has an impact on their financial metrics, with $246m revenue for the qtr down 46%, however, they showed good cost control (unit operating cost (FOB)/t A$639, -14% q/q), and are being prudent around their balance sheet, flagging no dividend at the half while they reduced FY24 capex guidance from $875m-$975m to a new range of $820m-$875m, a number of non-essential new projects and enhancements deferred.

Their cash balance was inline with expectations at $2.14bn, showing their balance sheet strength.

- Operationally, PLS are doing very well and controlling what they can. The weak pricing environment (Spodumene down from ~$6000/mt to ~$1000/mt) will send many higher-cost producers or non-revenue generating explorers to the wall and in that environment, we’d expect consolidation to pick up with PLS well-positioned.

We have recently bought PLS in the Active Growth Portfolio, on the expectation that Lithium prices will start to respond to the prospect of lower production.

Pilbara Minerals (PLS)

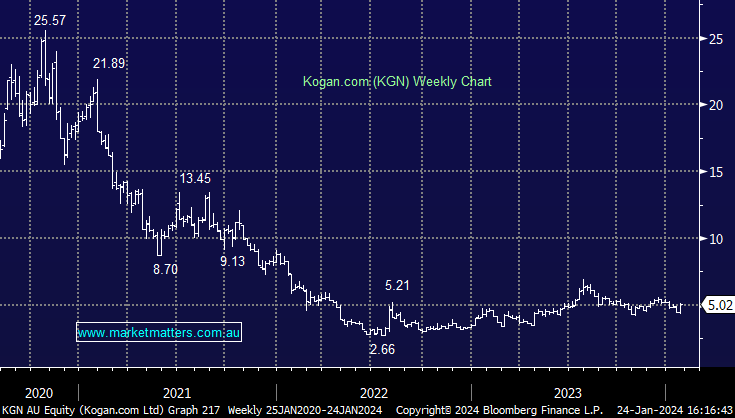

Kogan.com (KGN) $5.02

KGN +14.87%: today’s trading update from e-commerce retailer Kogan was a positive one highlighting how far the business has turned around in ~12 months despite facing consumer headwinds.

Gross sales are expected to fall 5.6% vs 1HFY23, thanks in part to a shift towards platform sales. This shift has helped reduce inventory risks, an issue that plagued the company last year, as well as lift margins with Gross Profit Margin rising from 34.4% to 36% in the half vs 2HFY23, Gross Profit up 42% YoY as a result.

KGN expects first half EBIT of $14m when the company reports next month vs FY consensus of $17m, on track for a strong beat though no guidance was provided.

Kogan.com (KGN)

Northern Star Resources (NST) $12.81

NST +6.04%: A good session from the gold miner today as they delivered December quarter production numbers that were all in order, while they maintained their FY24 guidance across the board.

They sold 411,613 oz which was +11% q/q at an all-in sustaining costs/oz A$1,824 which was down -5.9% q/q. They still expect to sell and impressive 1.6-1.75m ounces of gold for the year at an all in sustaining cost/oz A$1,730 to A$1,790, which stacks up well versus a Gold price in AUS terms that is above $3000/oz.

They ended the quarter with A$1.089b cash and bullion.

- All in all, a good update from NST and the stock deserved to rally.

Northern Star Resources (NST)

Nanosonics (NAN) $2.91

NAN -33.41%: the disinfectant device company fell to 5-year lows today after they flagged slow sales after market yesterday.

Their TROPHON product, used on ultrasound transfusers, has seen upgrades in the first half down 22.5% on 1HFY23, and new installed units dropped 13.4%.

Nanosonics has blamed tighter budgets in hospitals and longer sales cycles pushing out deals into the second half for the soft performance. They’re continuing to work on bringing its new CORIS product, used on endoscopes, to market, a much-delayed process that is still awaiting FDA approval.

While the product is a market leader, Nanosonics is facing some headwinds market-wise and of their own creation.

Nanosonics (NAN)

Woodside Energy (WDS) $30.97

WDS -0.39%: Always a complicated deck of numbers from Woodside with 4Q sales revenue up 3% qoq thanks to higher commodity prices however that was offset by lower traded LNG volumes and timing of condensate sales from its LNG operations.

Without digging further into the detail given we don’t own and are not looking to buy it at this stage, the aspect that stood out was their recut 2024 guidance, they now expect 185 – 195 mmboe, which compares to current market expectations of 198.5 mmboe, that will therefore feed into incrementally lower forecasts and slight earnings revisions.

While not huge, with operational complexity + the uncertainty around the future of their commodities, MM is very 50/50 on the outlook for WDS, so we think it’s best avoided.

Woodside Energy (WDS)

Broker Moves

- Cochlear Limited (ASX: COH) Cut to Sell at Citigroup Inc (NYSE: C); PT A$255

- Dexus (ASX: DXS) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$7.36

- EML Payments Ltd (ASX: EML) Cut to Sector Perform at RBC; PT A$1.20

- HomeCo Daily Needs REIT (ASX: HDN) Cut to Neutral at Macquarie; PT A$1.24

- ILU AU: Iluka Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$8

- ILU AU: Iluka Raised to Neutral at Barrenjoey; PT A$7.20

- ILU AU: Iluka Raised to Hold at Canaccord Genuity Group Inc (TSE: CF); PT A$7

- NAN AU: Nanosonics Cut to Underweight at JPMorgan; PT A$3.40

- Pro Medicus Limited (ASX: PME) Cut to Sell at Citi; PT A$72

- Polynovo Ltd (ASX: PNV) Cut to Hold at Morgans Financial Limited; PT A$1.95

- Viva Energy Group Ltd (ASX: VEA) Raised to Neutral at JPMorgan; PT A$3.30

Major Movers Today