What are utilities?

Utilities are companies that produce and deliver basic essential services such as electricity, natural gas and water. These services are delivered by a network of assets that require the use of public rights-of-way. Crucially, these networks exhibit attributes of a natural monopoly: the extensive capital required to construct the assets make it difficult for another company to compete profitably against the incumbent.

Due to this natural monopoly, governments have generally operated utilities but in recent decades they have handed the responsibility to private operators under licence.

To gain this licence, a utility agrees to submit to economic regulation governing the rates it can charge customers. In exchange, the regulator promises to set prices fairly so that the utility can cover its costs effectively and make a reasonable profit considering the risks involved. While returns set by regulators can be modest compared with other sectors, utilities are often assured a minimum return regardless of how the economy is performing because demand for their services is constant. The minimum returns provide an incentive for future or potential asset owners to invest in new or existing infrastructure. This means utility stocks can provide stable earnings and cash flows.

The Electricity Network

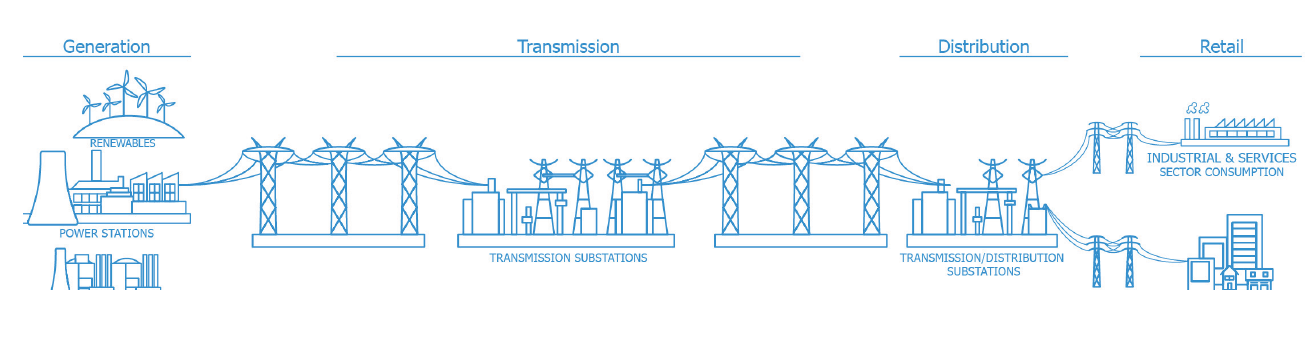

Electricity is delivered over a network where each segment serves a specific function and displays different economic characteristics, as displayed below:

Generation

Electricity is generated using fuels such as nuclear, coal, natural gas or renewables (hydro, solar, wind and biomass). Many companies making electricity are merchant generators, which means their output is sold at competitive prices in unregulated markets. As such, earnings can fluctuate due to unexpected changes in demand (e.g. weather) and input costs. Some generation assets, however, are regulated. Power prices from these assets have typically been set or agreed upon by the regulator.

Transmission

The power plant or substation provides electricity to a local distribution network. This is facilitated via high-voltage lines that carry electricity over long distances. Most transmission assets are common carriers, which are entities granted a licence by the regulator to provide services to the public. As common carriers, transmission owners sell access to their network under regulated terms. The terms of these contracts usually allow the transmission owner a fair return regardless of demand, while ensuring that the company operates without discrimination or preference.

Distribution

This is the stage when electricity is delivered to the end user. Distribution assets are lower voltage and cover shorter distances. Like transmission, owners of distribution lines charge a regulated rent for access to the network irrespective of demand. In most cases, the distribution company is owned by the utility that exclusively services an area.

Retail

This stage covers the companies interacting with electricity users. In some cases, the customer chooses a provider from a number of competitors. This occurs in markets where third parties can compete with the incumbent utility. While competition benefits customers (through lower prices), it can be difficult for the utility and third-party retailers to generate stable earnings because of customer switching.

The Natural Gas Value Chain

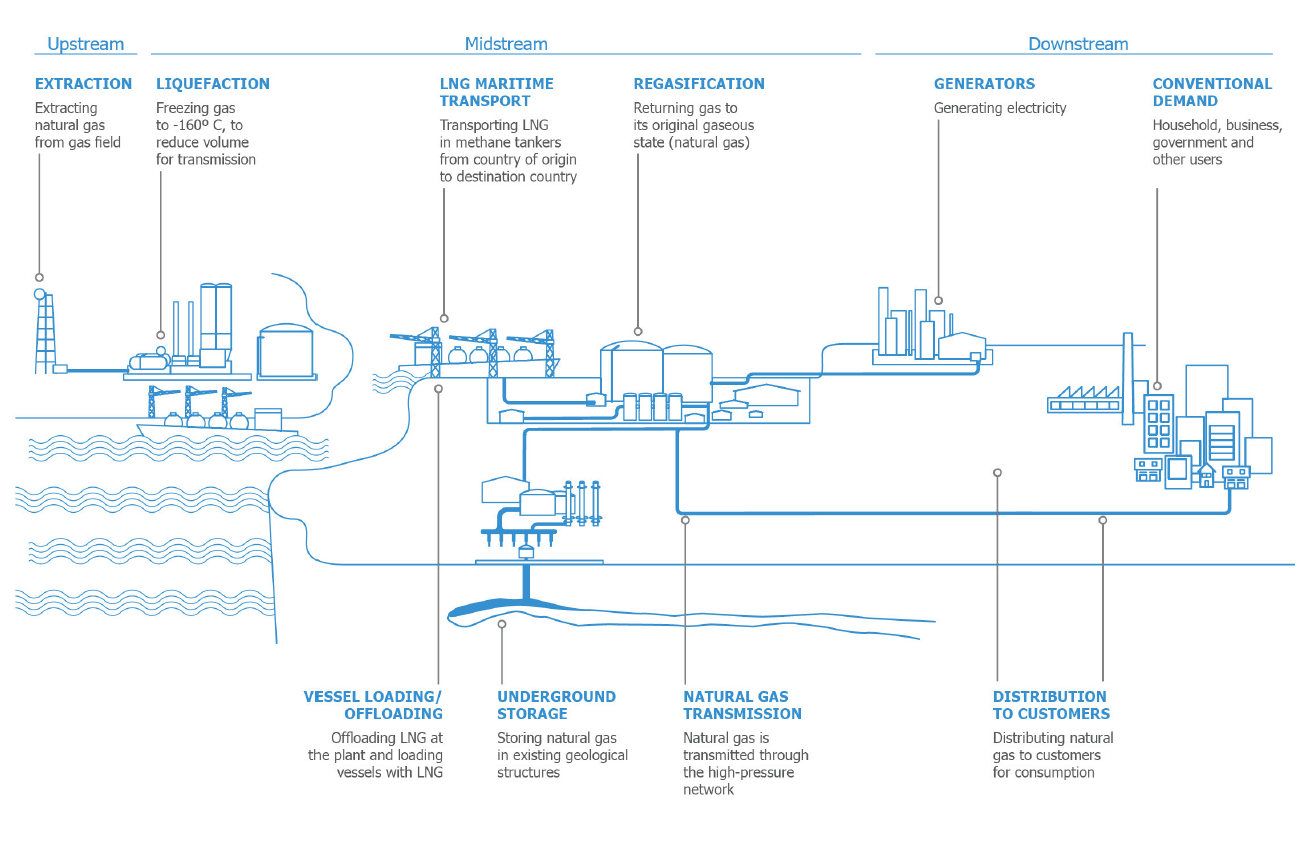

The natural gas value chain can be broadly viewed in three segments; upstream, midstream and downstream.

Upstream (exploration and production): The value chain begins where natural gas is extracted from the ground. Natural gas exploration activity is typically determined by prices, which are influenced by: i) the balance between supply and demand, ii) the ease of extraction, iii) the price and availability of alternative fuels, iv) the weather, v) government regulations; and vi) macroeconomic conditions. Revenues of upstream producers will fluctuate as producers typically take ownership of a commodity whose prices can change at any time.

Midstream (pipelines and storage): Natural gas pipelines move gas to local distribution networks. Pipeline operators tend to have stable and predictable revenue across the network for three reasons: i) demand needs to be high to justify the capital cost, ii) pipeline operators don’t own the natural gas; and iii) revenues are typically regulated or are under contract. Contract terms and length can vary though, most owners will seek fee-based or ‘take-or-pay’ provisions. The midstream segment also includes storage assets, which play an important role in the value chain by balancing supply and demand. This balancing role, along with limited commodity exposure, tends to result in relatively stable earnings for storage owners.

Downstream (local distribution companies): Distribution involves the delivery of gas to the consumer. While some customers (commercial and industrial) receive natural gas directly from high-capacity pipelines, the majority of users receive gas from local distribution companies. Due to their highly regulated nature (as a result of their natural monopoly), these distributors benefit from stable and predictable cash flows.

The Water Network

Unlike electric and gas, the water network is typically fully regulated – from the assets collecting water to the waste-water treatment plants.

Regulated water utilities will usually own the physical assets needed to store, pump, treat and transport water to users as well as the assets used to collect, treat, transport and recycle waste water.

Water utilities, generally, do not own the water, but rather, own the access or property rights that allow them to divert water from a source for public consumption. These rights can include the licence to recycle the wastewater or return it to the environment. The defined supply sources may include reservoirs, lakes, rivers and streams, as well as ground water sources such as wells.

As shown above, the water network begins with water collection from the supply source. From there, the water is transported to the water-treatment facility where it is treated and conditioned for consumption. Once treated, the water is distributed through water mains to users. After use, the wastewater is collected via sewer lines and transported to the waste-water treatment facility. The waste water is then treated to meet regulatory standards before it is reused for consumption or returned to the environment.

Key earnings drivers

Under the regulatory compact, the utility submits to rate regulation in exchange for exclusive rights to operate within a market. Regulation allows the utility to recover its costs, as well as earn a reasonable rate of return. For its part, the regulator defines what costs can be recovered and what is a fair rate of return, which help determine the prices a utility can charge.

Determining rates

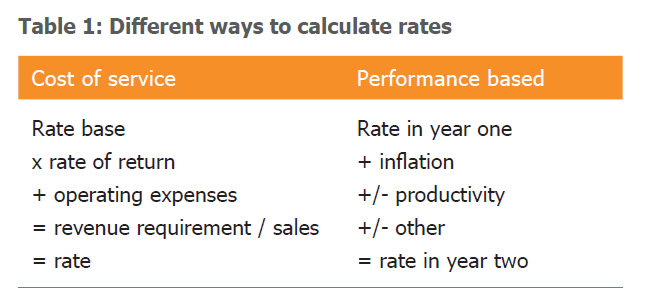

The process by which utility charges or rates are determined differs across countries and jurisdictions. At its core, a utility’s rates are a function of its rate (or asset) base and the authorised rate of return. One of the more common approaches used (particularly in North America) is ‘cost of service’. This approach requires the regulator to determine the revenue requirement, which reflects the amount a utility must collect from its customers to recover its costs and earn a fair and reasonable return.

To put it another way:

Revenue requirement = operating expenses + (asset base multiplied by the rate of return).

The utility tends to focus on its ‘rate base’ and the rate of return, as these factors typically exert the greatest influence on the company’s long-term earning power. By contrast, operating expenses have less impact on returns, as these costs are typically passed through to consumers (i.e. utilities do not earn a return on expenses).

As noted above, the approach to determining rates can differ across markets. In the UK, regulators use performance-based ratemaking to determine customer charges. While similar to cost-of-service ratemaking in some ways, performance-based ratemaking provides the utility with opportunities to increase earnings by reducing or limiting costs (instead of increasing rates). The regulator, for example, may allow a utility to adjust its rates based on pre- determined productivity measures or other factors. The exhibit below provides a comparison of cost-of service and performance- based rates.

Incentive rate making is another regulatory approach that uses mechanisms to reward utilities for achieving certain operating targets (as opposed to performance-based cost metrics). Incentives may range from higher allowed returns for meeting energy-efficiency goals to return-on-equity adders for making specific investments. Conversely, (negative) incentives are tools used to penalise utilities for failing to meet certain operating standards.

The Rate Base

The rate base represents all capital employed by the utility to serve its customers. These might include

buildings, power plants, poles, wires, transformers and pipelines.

Over time, the rate base declines as the capital base depreciates. Equally, the rate base grows whenever the utility invests in its capital base. For this reason, investors typically view most (regulated) capital investments as positive for earnings growth.

In countries such as Australia, Chile, NZ and the UK, the regulated asset base is the comparable reference used by regulators. It is, however, a term that carries no legislative backing. The regulated asset base, unlike the US ‘rate-base’ model, allows the regulator to amend contracts via an ordered review, the revision or

the renegotiation of licences.

Rate of Return

A utility’s rate of return is an aggregation of costs for the different sources of funding (i.e. weighted-average cost of capital based on the utility’s capital structure).

As each source of funding has different costs, the mix can have a sizeable effect on the overall weighted rate of return. Moreover, a higher share of equity will usually translate into higher rates for consumers because of the higher cost of equity. This often requires regulators to establish limits on a utility’s capital structure.

US utilities have a capital structure that ranges somewhere between 40% and 60% equity, although this can

be higher in other parts of the world. Moreover, US utilities often only concern themselves with their return on equity as the cost of debt is passed through to the customer. In jurisdictions such as the UK, however, regulation considers the entire return on capital.

Those unfamiliar with utilities might find any company with debt comprising more than 50% of the capital structure surprising as other industries typically carry less leverage. But the ability to have a more highly levered balance sheet is a function of earnings predictability, which is borne out of regulation.

Key risk to investing in utilities

There are three key risks for investing in regulated utilities:

Regulatory risk

Utility investments are sensitive to changes in the rate-making and regulatory process. This could come in the form of changes to inputs for determining the rate of return to disallowances for cost recovery. The regulator could amend ratemaking such that it becomes difficult for the utility to earn its authorised return.

Financial results can also be affected by changes in environmental regulations, as well as changes to local, state and federal government policies. Jurisdictions where regulators are elected (as opposed to appointed) will tend to have more customer-friendly rates.

Interest-rate risk

Changes in interest rates can affect how investors view utility stocks. Rising interest rates, for example, can lead to underperformance for the sector. This can happen because income-seeking investors shift to higher-yielding investments and away from stocks with lower income growth such as utilities or because higher rates increase interest payments for companies that are capital intensive and more heavily indebted.

Technology risk

Technological advancements pose a long-term risk for utilities, particularly for electricity utilities. Disruptive technologies such as rooftop solar and battery storage may lead to some customers disconnecting from the grid, which would reduce the value of transmission and distribution assets. In such a scenario, regulators could argue for less investment in the grid, therefore disrupting the reliable earnings profile from these assets.

Why does Magellan consider regulated utilities infrastructure?

For an asset to meet Magellan’s definition of infrastructure, it must have two traits. The first is that it must be essential to the efficient functioning of a community. The other is that it must have earnings that are not sensitive to competition, movements in commodity prices and regulatory risk.

Regulated utilities are a staple holding for any infrastructure portfolio because of their highly stable and predictable stream of earnings that are secured by a lack of competition, regulation and their limited exposure to commodity prices and the economic cycle.

Magellan believes infrastructure assets, when properly defined, should generate reliable earnings and cash flows from the provision of essential services. Over time, the stable and reliable earnings derived from transmission and distribution assets should deliver income and capital growth for investors.

.PNG)