Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.06% to 7,680.70.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

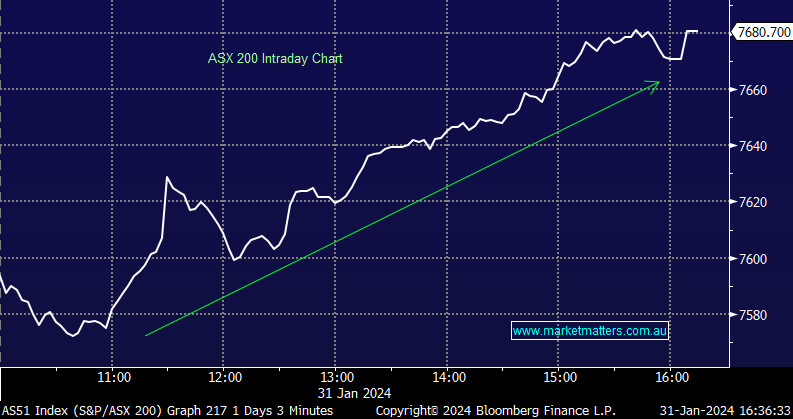

The ASX200 hit a new all-time high today closing at 7680 supported by a more benign read on inflation released at 11.30am that underpins the chorus for rate cuts, sooner rather than later it would seem.

Bond yields fell, the Aussie 3 years down 14bps to 3.57% with the first rate cut now priced in by June.

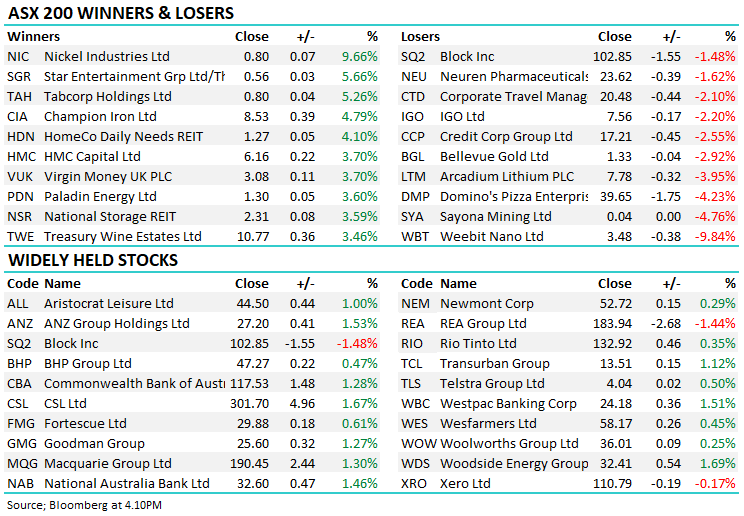

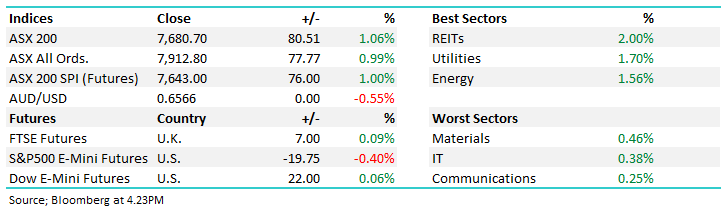

- The ASX 200 finished up +80pts/ +1.06% to 7680

- The Property sector (+2.00%) was strong as were Utilities (+1.70%), not the two areas you’d expect to lead on a bullish day, however expectations around interest rates the catalyst.

- Communications (+0.25%), IT (+0.38%) and Materials (+0.46%) were up but underperformed the strength.

- Q4 inflation printed 0.6% vs expectations for 0.8% QoQ.

- YoY the rate of 4.1% was below the 4.3% expected and down from 5.4% in the prior quarter, clearly heading in the right direction.

- This data got a rocket under the sectors that benefit from lower interest rates, property the obvious one but some of the more defensive infrastructure stocks also did well.

- Reporting kicked off here locally with some land mines to navigate, we think this will be indicative of what comes next and for that reason, we trimmed several holdings today and reduced market exposure in our Active Growth Portfolio.

- Credit Corp Group Limited (ASX: CCP) -2.55% 1H results today, continuing to see a difficult collection environment in the US, and without a big 2H, they’ll struggle to meet FY guidance.

- Select Harvests Ltd (ASX: SHV) +16.98% supported by strong almond prices, lower costs and a larger crop yield than expected, now forecast to meet covenants. The stock coming off a very low base.

- Audinate Group Ltd (ASX: AD8) -4.51% cut to neutral at Macquarie, though the PT was increased by 17%., citing reinvestment requirements and margin risk.

- Champion Iron Ltd (ASX: CIA) +4.79% mined 8% more iron roe than the previous quarter on lower costs and higher prices.

- IGO Ltd (ASX: IGO) -2.2% provided an update of their Nickel business, sighting further issues throughout.

- Iron ore was down -2% in Asia

- Asian stocks were mostly lower, Hong Kong off -1.4%, Japan was 0.47% though China dipped -1%.

- US Futures are all down, Alphabet Inc Class A (NASDAQ: GOOGL) down -5.7% after hours following results

- HCA Healthcare Inc (NYSE: HCA) reported overnight – our wrap here. The stock rallied 5%.

- We also hold Microsoft Corp (NASDAQ: MSFT) which reported after close and beat (just) – stock flat after hours.

- Companies we own still to report in the US this week: Apple Inc (NASDAQ: AAPL) and Brunswick Corporation (NYSE: BC) report on the 1st February.

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE and PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

IGO limited (IGO) $7.56

IGO -2.2%: The Nickel/Lithium company was out with a wide-ranging announcement this morning centred on their Nickel business which is grappling with cheap Indonesian supply hitting an oversupplied market, complicated further by operational issues that have plagued the assets purchased during the takeover of Western Areas:

IGO is putting its Cosmos nickel project in Western Australia on care and maintenance and cutting jobs as a consequence.

They’ll write down the value of their Nickel assets by a further ~$190m, having already taken a ~$1bn write down in July. They paid $1.3bn for WSA so they’ve written down the bulk of it! They also said the mine life would be shorter than the 10 years originally expected by Western Areas, and that there would be delays in getting the mine to full capacity to fill the processing plant and further increases in operating and capital costs. Seems a real cluster!

In Lithium, they’re also easing back on production given the unfavourable pricing, and they made no sales of lithium hydroxide in the quarter, but had more than 3000 tonnes of the battery chemical stockpiled.

For the 3 months to December 31, underlying earnings (EBITDA) fell 58% to $153 million

A tough update for IGO as they make some hard decisions around their Nickel business, once again showing how acquisitions can end up being a bag of problems.

IGO Ltd (IGO)

Credit Corp (CCP) $17.21

CCP -2.55%: the lender and debt recovery agency was out with 1H numbers today, kicking off the reporting season on a slightly sour tone. Credit Corp flagged a $45m write down of their US Purchased Debt Ledgers (PDLs) at the AGM in October given a weak collection environment that continued through the end of the year.

The Australian market has seen low market volumes with low credit card balances and bank arrears, taking away from the company’s earnings. The lending side of the business, including Wallet Wizard, has performed well with record lending volumes in the first half against falling 30-day arrears over the last 6 months.

Credit Corp cut the interim dividend by 35% but stuck to FY guidance of $80-90m NPAT (pre-impairment), though this looks a little shaky.

Credit Corp (CCP)

Broker Moves

- 29Metals Ltd (ASX: 29M) Cut to Underperform at Jefferies & Raised to Hold at Canaccord Genuity Group Inc (TSE: CF); PT 41 Australian cents

- AD8 AU: Audinate Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$15.80

- Emerald Resources NL (ASX: EMR) Cut to Underweight at Barrenjoey; PT A$2.90

- GR Engineering Services Ltd (ASX: GNG) Cut to Hold at Argonaut Securities; PT A$2.50

- Keypath Education International Inc (ASX: KED) GDRs Raised to Outperform at Macquarie

- Megaport Ltd (ASX: MP1) Cut to Neutral at Barrenjoey; PT A$12.50

- Siteminder Ltd (ASX: SDR) Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$5.50

- Super Retail Group Ltd (ASX: SUL) Cut to Underweight at Morgan Stanley (NYSE: MS); PT A$13.20

- Westpac Banking Corp (ASX: WBC) Raised to Overweight at Jarden Securities; PT A$23

Movers & Losers