This deep-dive into ResMed Inc (ASX: RMD) shares and Magellan Financial Group Ltd (ASX: MFG) shares was written by Rask’s Chief Investment Officer, Owen Rask, and published to Rask Core members on November 17th, 2023. Take special note of that date. You can become a Rask Core member and get expert share research and Core ETF portfolios by clicking here. This is the editor’s note.

This week on Rask LIVE I made the case for ResMed Inc (ASX: RMD) and Magellan Financial Group (ASX: MFG), for totally separate reasons.

Viewers loved it. And I found it nice to return to showcasing how to pop the hood to identify potential value hiding in plain sight.

Please note: these companies are NOT part of my Core investment portfolio or even part of my building blocks, which as you know is mostly based on Exchange-Traded Funds (ETFs), LICs or funds. What’s more, Magellan is much more of a deep value play – which for me makes it a ‘special situations’ idea. I rarely try and identify turnarounds or ‘deep value stocks’, since they seldom turn. I think most of the ‘valuation’ game people try and play is frivolous, arrogant and rarely works in the modern world. In short, it means I’m aware of the very high likelihood I could be wrong on Magellan, so my position would be small and could change at any time, if I took any at all.

The stock discussion starts ~51:54.

Resmed

Resmed was founded in 1989 by Peter Farrell in Australia but is now based in San Diego, California. It is a medical equipment company that provides cloud-connectable continuous positive airway pressure, or CPAP, machines for the treatment of obstructive sleep apnea (OSA). If Resmed’s name or financial reports look different it’s because Resmed’s ASX shares are CDIs and its primary listing is the NYSE.

Resmed operates on a global scale, with 10,000+ employees and a presence in over 140 countries. It has two primary business units: Sleep and Respiratory Care, and Software as a Service (SaaS).

Within Sleep and Respiratory Care, ResMed provides industry-leading CPAP machines for sleep apnea. Other devices are often marketed in this space but CPAP is the most effective therapy for all severities of OSA. The Respiratory Care unit covers patients ranging from those who only require therapy from CPAP systems at night to those who are dependent on non-invasive or invasive ventilation for life-support.

Within the SaaS unit Resmed providers that assists durable or home medical equipment (DME/HME). Basically, it assists in out-of-hospital care.

The opportunity with Resmed

The opportunity with Resmed comes in the form of Ozempic, a weight loss ‘wonder drug’ that helps obese people lose some weight by limiting their hunger. While side effects exist, the basic idea is if you don’t feel as hungry, so you don’t eat as much. Here are the findings of one study you can view online:

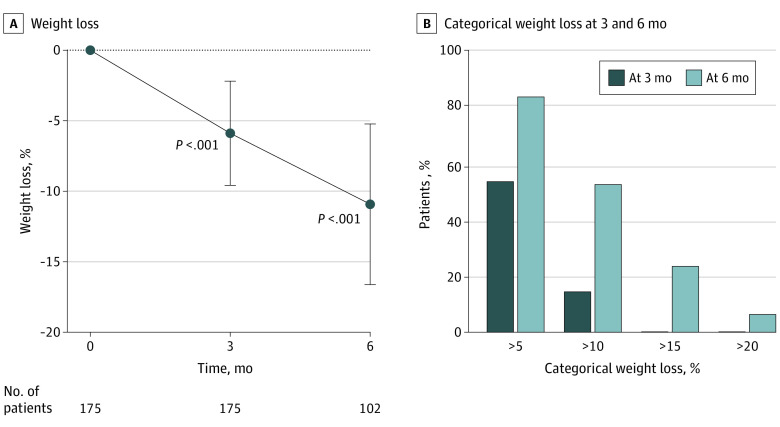

“In this cohort study of 175 patients with overweight or obesity, the total body weight loss percentages achieved were 5.9% at 3 months and 10.9% at 6 months.”

Of the 102 patients who were followed up at 6 months, 89 (87.3%) achieved weight loss of 5% or more, 56 (54.9%) achieved weight loss of 10% or more, 24 (23.5%) achieved weight loss of 15% or more, and 8 (7.8%) achieved weight loss of 20% or more. “

Weight Loss Outcomes Associated With Semaglutide Treatment for Patients With Overweight or Obesity (2022 research paper)

Basically, if fewer people are staying overweight thanks to this wonder drug, it would stand to reason they won’t need to buy as many Resmed masks, ventilators or connected devices.

The average weight of people in the study was 118 kg.

48.6% of patients experienced adverse effects from Semaglutide (commonly called Ozempic), including ~37% reported vomiting, 8.6% diarrhoea, 6.3% fatigue and so on. Approximately 11% rated it as moderate or severe.

This matters because a lot of obese and overweight people have trouble sleeping and with their respiratory system, which is Resmed’s target market.

Among the risk factors for OSA, obesity is probably the most important. Several cross-sectional studies have consistently found an association between increased body weight and the risk of OSA. Significant sleep apnea is present in ≈40% of obese individuals, and ≈70% of OSA patients are obese.

AHAJournals.org. “Obesity, Sleep Apnea, and Hypertension”. Research.

“Studies have shown that sleep apnea is present in approximately 83% of patients with drug-resistant hypertension, approximately 77% of patients with obesity, approximately 76% of patients with chronic heart failure, and approximately 72% of patients with type 2 diabetes.”

Resmed Inc, 2022 10k Annual Report. Page 3.

Put another way, 23% of people with OSA are not obese – so zero impact from Ozempic.

Keep in mind, it’s also been found that approximately 24% of middle-age men and 9% of women suffer from OSA. In order words, it’s an enormous market opportunity for Resmed, whether people are obese or not.

My understanding is more drugs are on their way, but so too are studies to back up (or not) the previous findings. As you’ll see in the remarks made by Resmed further down the page.

What’s the impact

Basically, most analysts have only scratched the surface on the long-term implications (it’s impossible to know for certain after all, that’s why they do trials!). Here’s what management said in the most recent analyst call about GLP-1 (Ozempic style drugs):

In terms of existing patients in our installed base, we are actively tracking a cohort of many thousands of patients on these GLP-1 medications and APAP therapy. We are not seeing any significant change in the PAP adherence rates nor any reduced participation in resupply programs versus control groups. These data indicate that there is a cohort of patients on combined therapies in a stable state.

In terms of new patients activated into the funnel, we are seeing the number of new patients activated into the health care funnel picking up. We see patient flow is not only strong but increasing. We believe in treating the whole person here at ResMed, including a combination of cardiovascular exercise, diet and nutrition as well as good sleep and breathing. That combination was called the Triumvirate of health by Professor Bill Dement from Stanford, may he rest in peace. And we think a combination of these 3 elements will result in the best outcomes for patients. It is quite possible that this new class of drugs may become as large or even larger than the cholesterol class or the blood pressure treatment class of pharmaceuticals.

If this is the case, we will see a whole new population of patients activated with their primary care providers that we may never have seen in the health care system. If this comes to pass, we may see benefits for the entire health system and for the people being treated themselves and for ResMed, as more and more people are evaluated and screened for sleep apnea, respiratory insufficiency and other key chronic conditions as part of their primary care evaluations. Our data are showing an all-time high of patient flow and that supports this thesis.

Resmed goes on to say that is has modelled aggressive estimates for these drugs in the market, and even still, has estimated 1.2 billion people will suffer from sleep apnea by 2050. They currently have 21.5 million patients in the market, and assume single-digit growth for devices and high-single-digit for masks. That gets them to around 109 million patients by 2050 – 9% reach of market.

One of the interesting things supporting Resmed’s view that GLP-1 might actually be good for them is that people with extremely high levels of obesity often avoid the health care system altogether, so GLP-1s might bring them into the system, and thus reach Resmed’s door sooner.

“…I can tell you, every bit of clinical data that we have going forward and every bit we have going retrospectively. And we’ve got the biggest database in the world, and it’s 21.5 million patients. As we look at that split between mild, moderate and severe, we’re not seeing changes.”

Resmed quarterly transcript, CEO Michael Farrell

In short, there is no impact so far on Resmed. But everyone expects more drugs to come to market and more study results. So investors in Resmed should be aware that the stock may be volatile.

What’s on offer for investors

Basically, it’s extremely rare you get to buy a super-high quality compounder, with a completive advantage, in a growing market, at a reasonable price. If someone knows where to find all the ‘perfect and cheap’ stocks, let me know. Almost always, many people have to disagree with you for a great company to trade at good prices.

In this instance, it would seem investors are being spooked about ‘what could be’ and not ‘what actually is’. The reality is, these drugs could:

- Be severely disruptive to Resmed – completely replacing decades of OSA therapies (in my opinion, this is unlikely)

- Have a mostly muted effect – slightly positive or negative either side (most likely)

- Be highly complementary – bring more people into Resmed (probably not)

So, for a small position, with shares trading at valuation levels not seen since 2016/2017. I’d be happy to take a small parcel and continue researching while I build conviction and wait for more studies to roll off.

Magellan

Magellan Financial Group Ltd (ASX: MFG) is a funds management business that largely invests in international shares like Facebook and Visa. It was set up in 2006 by Hamish Douglass and Chris Mackay. Since inception, Magellan claims it has been one of the most consistent market outperformers after fees.

The opportunity

Magellan’s story is very different, and probably a result of a riskier business model and key person risk. That’s reflected in my thesis hinging on its current balance sheet assets, not its income statement potential.

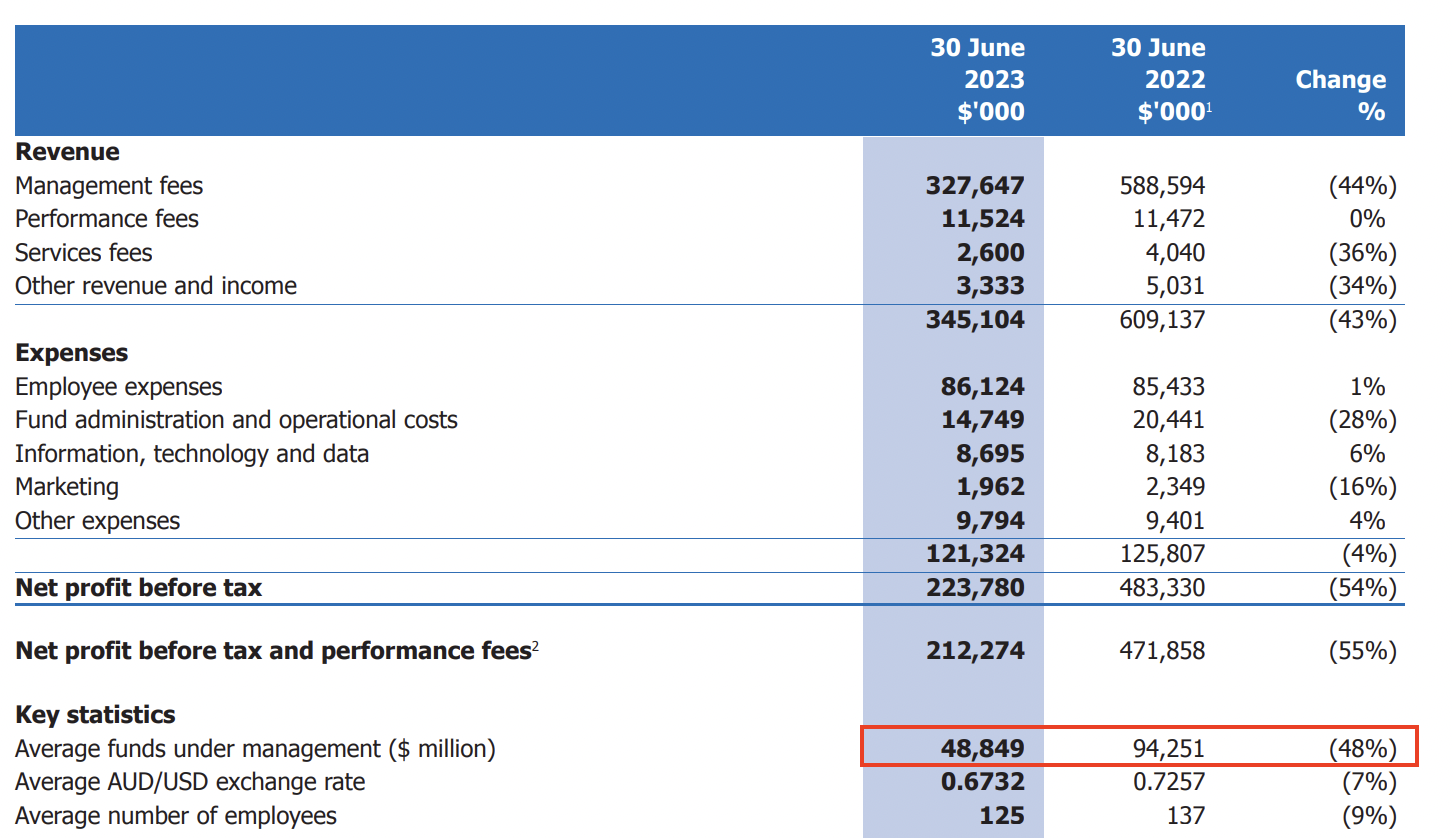

Magellan makes its money by charging a percentage management fee (e.g. 1% per year) and a performance fee (e.g. 20% of anything over a benchmark rate) for investing in its funds or ETFs. Here’s a snippet of the key table in its 2023 annual report.

As you can imagine, more funds under management (FUM) = higher revenue, since the overwhelming majority of income comes from management fees.

For those who don’t know, however, having money invested in a massive active fund manager (based on FUM size) is often a BAD idea. It’s extremely difficult to invest $50 billion at a time, versus $500 million, versus $50 million. This is one important reason why genuine small cap fund managers tend to have better long-term performance than large cap fund managers. It’s also a reason why we prefer index funds for blue chip investing and small cap funds for active management.

Magellan has climbed up the ‘asset gathering mountain’ – where a fund manager gets some good performance figures, then everyone piles in – and is now on the other side, coming back down. Platinum Asset Management Ltd (ASX: PTM) went through this 10-15 years ago. Magellan has gone from over $100 billion of FUM a couple of years ago to just $34.3 billion at the end of October 2023.

Based on the average revenue to FUM ratio of ~0.65%, it would mean its current revenue run rate could be around $220 million ($35 billion x 0.65%). A long way from its $609 million in revenue in FY22!

At $220 million of revenue, Magellan should still be quite profitable.

Although, keep in mind, the majority of its income going forward will depend on two things.

- Its brand and reputation. Oftentimes, people and their financial advisers buy/sell their managed funds based solely on what they read online, without doing any actual research into the fund mangers.

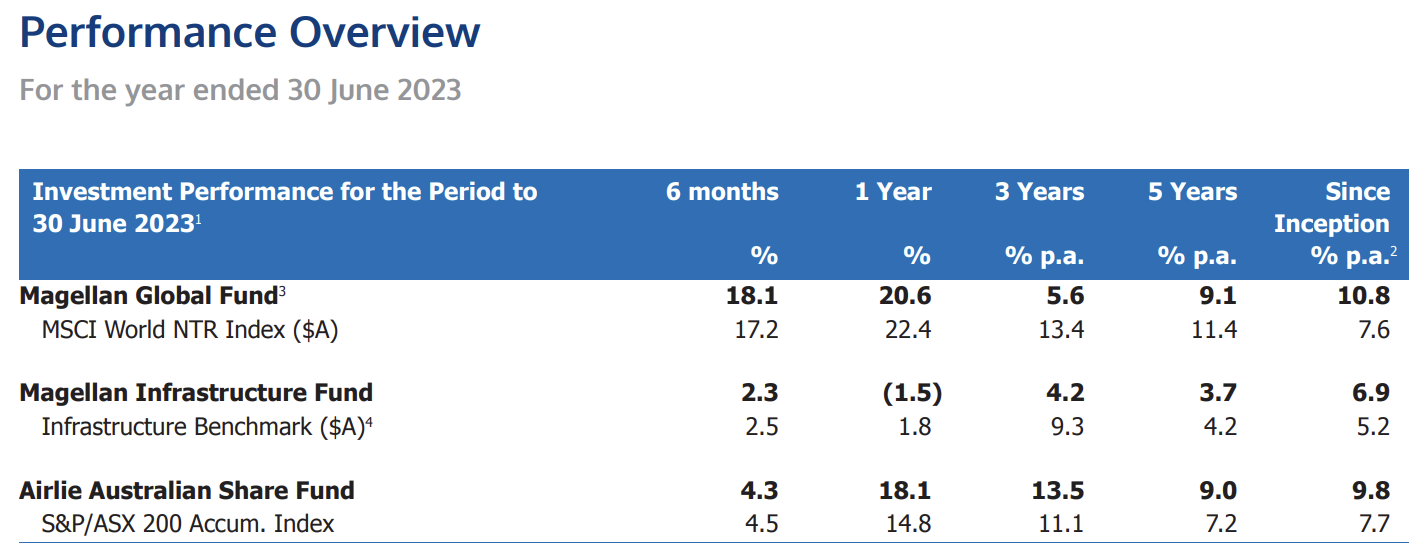

- Magellan’s performance. Especially within its global fund and infrastructure fund. Around $9 of every $10 is invested in these two strategies offered by Magellan.

Fortunately, performance seems to be slowly clawing back into the fight, which might slow the bleeding. But who knows for sure. Magellan now seems to be righting the ship.

So where’s the value?

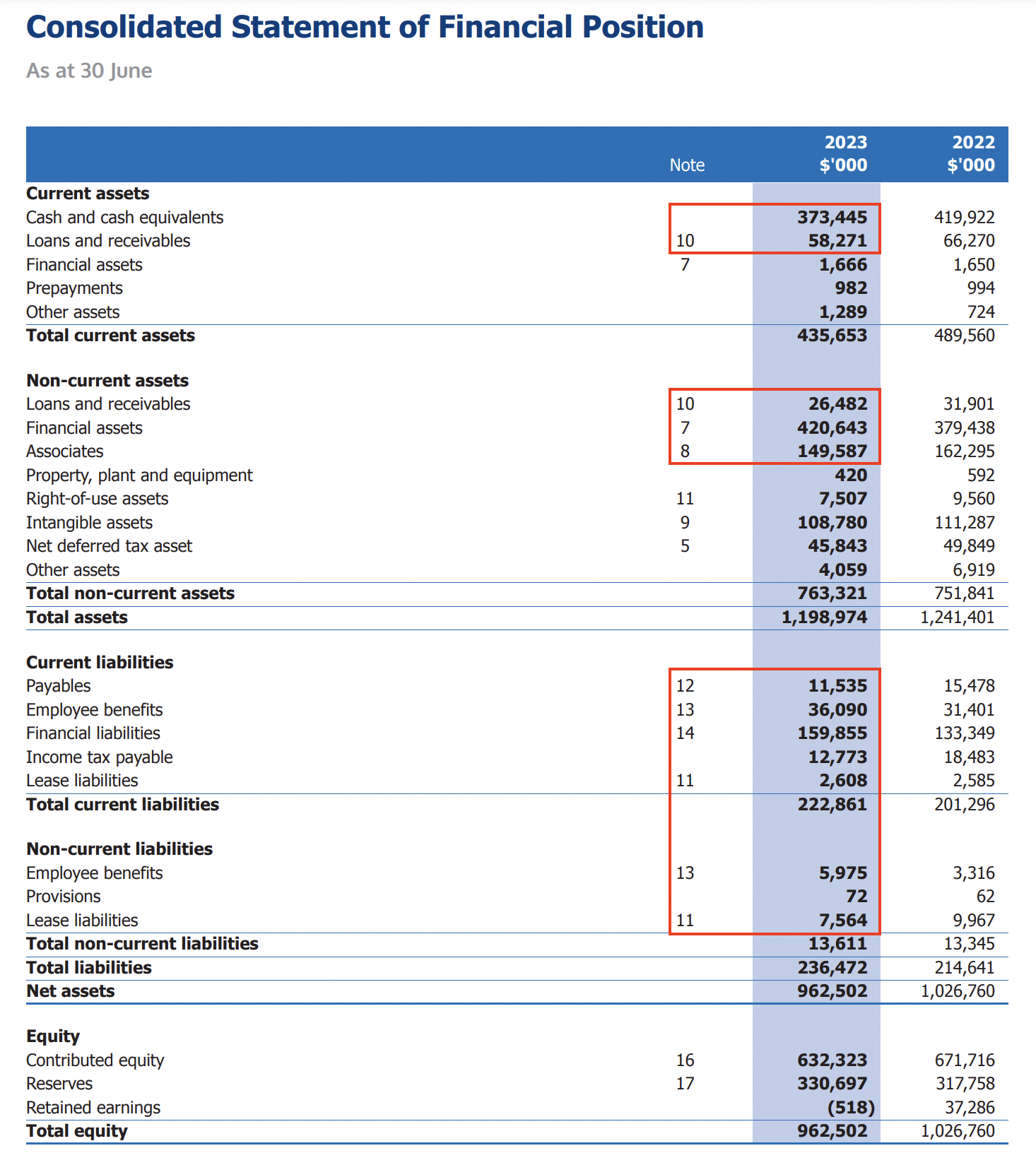

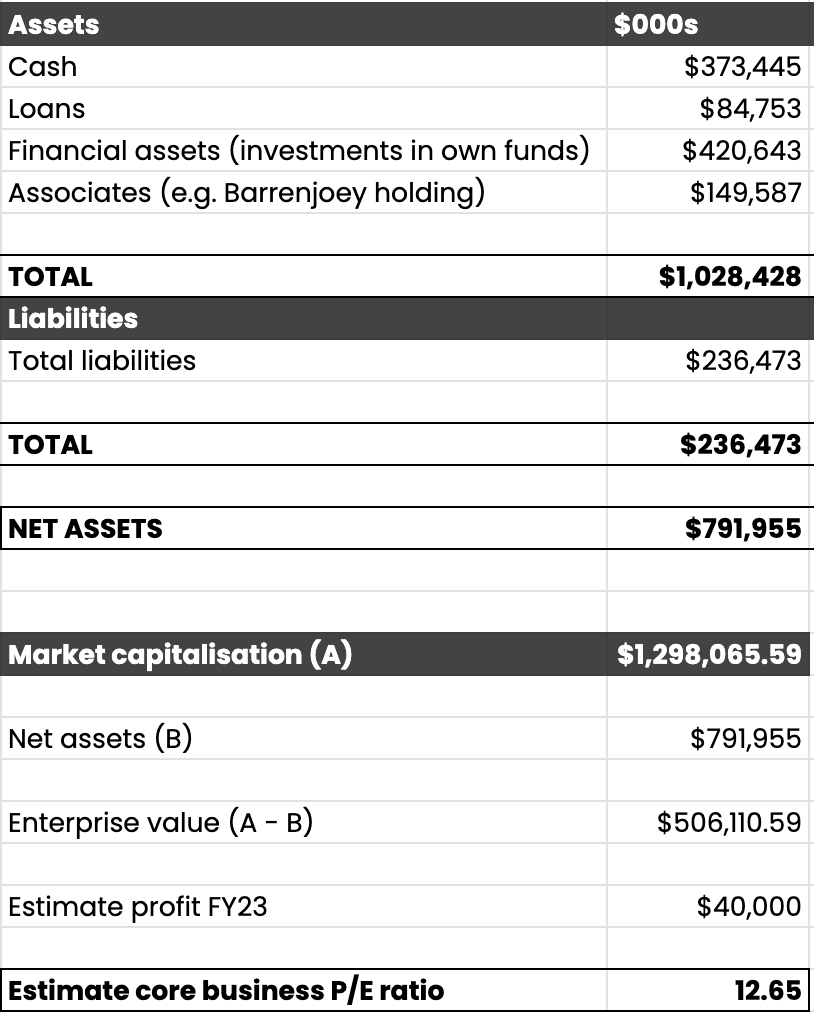

While the ‘funds management’ business is the key cash flow business buried inside Magellan. The value in Magellan stock is on the balance sheet.

In short, as you can see above, investors are being offered a fund manager that ‘could’ turnaround its ship, will likely continue to pay special fully franked dividends (it also has some franking credits at the ATO; it just paid a huge final dividend), do a big buyback, and could possibly get a takeover offer from private equity.

After all of that, the core business might be trading at a price-earnings ratio of 12x (even after adjusting for every liability).

The key things to watch are:

- Performance of the key funds – global fund & infrastructure

- Monthly FUM reports (see ASX announcements)

- CEO appointments & leadership stability

- Takeover rumours (e.g. in the AFR, The Australian, Bloomberg, etc.)

- The board’s plan for capital management (dividend policy, buyback plans, etc.)

Buy, Hold, Sell

I want to be clear. Neither of these companies are a high conviction recommendation from me. As you know, I like to invest for a very long time in compounders, not ‘special situations’.

However, if you like this thinking, you can let me know in the Rask Core forum if you want us to look at other targets, and I’ll ask one of our team to take a closer look in coming months.

In the meantime, Magellan appears that it’s on the way to looking quite cheap. It could go any number of directions from here, and it’s definitely got a fair share of hairs on it (lack of leadership, investment performance is still struggling, recent employee turnover, etc.). However, it’s on my watchlist.

Resmed is the better of the two long-term opportunities in my opinion. It’s a high quality, proven long-term winner. It faces competition from the likes of Phillips and these new drugs, but management have a robust track record for delivering market beating returns. I’d happily take a small stake right now.

Happy hunting!