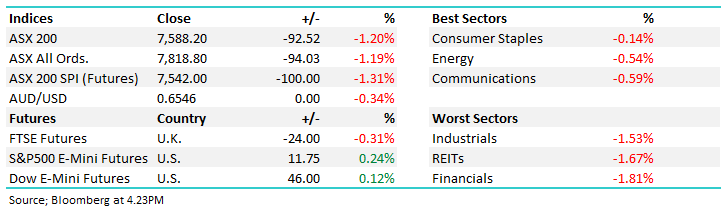

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -1.20% to 7,588.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Jerome Powell and the Fed put a swift end to the local equity rally that had taken the ASX200 to all-time highs yesterday, as they left rates unchanged overnight as expected, however, the press conference had a few more fireworks as the Chair poured cold water on any imminent rate cut expectations.

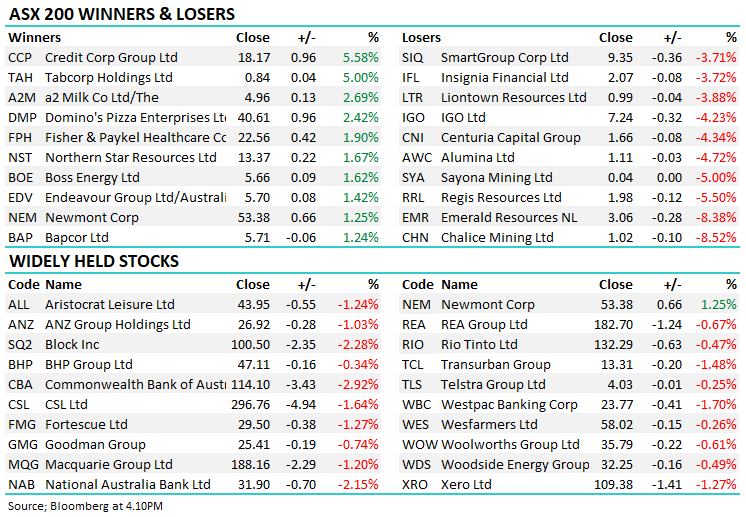

That led to a sell-off locally, the index had its worst day since January 3 with all sectors trading lower, ~85% of the market finishing in the red. As we’ve been saying over recent weeks, the doves were too optimistic on cuts, and this has come to the fore overnight, and locally today.

While the macro picture has improved with rate cuts likely over the coming year if the markets are looking for, say, 6 and it only gets 3, then stocks are unlikely to maintain their upside momentum, which could easily lead to some further profit-taking after the surge higher since 3Q of 2023.

- The ASX 200 finished down -92pts/ -1.20% to 7680

- The Staples sector (-0.14%) held up best from a relative perspective but still finished lower, Energy (-0.54%) and Communications (-0.59%) also did better than the soft market.

- Financials (-1.81%) felt the brunt while Property (-1.67%) and Industrials (-1.53%) gave back yesterday’s gains.

- For January, the ASX 200 put on 1.18%, a solid start to the year, although that was wiped out on the first day of Feb!

- Metcash Limited (ASX: MTS) is in a trading halt today as they put together a bid for food wholesaler Superior Food Group. The PE-owned company is expected to fetch around $500m, and MTS would probably need to do an equity raise.

- Regis Resources Ltd (ASX: RRL) -5.5%% has been dragged into a spat with IGO & South32 (S32) where S32 is seeking to be back paid for royalties on the Tropicana Gold Mine which Regis purchased a 30% stake from IGO Ltd (ASX: IGO) back in 2021. A mouthful – but Regis could be up for $40m in an adverse decision.

- Bapcor Ltd (ASX: BAP) +1.24% went against the grain, hitting 2-month highs despite the CEO retiring and Chairwoman announcing she wouldn’t seek re-election. Ex-Total Tools CEO Paul Dumbrell will take the CEO role from May.

- Nufarm Ltd (ASX: NUF) -1.08% said the 1H is facing some challenges in speeches made at the company’s AGM. Shares rallied off lows though, management is confident in the demand for their seed offering in the 2H.

- Skycity Entertainment Group Ltd (ASX: SKC) +6.23% increased their provisions ahead of a case brought against them by AUSTRAC relating to money laundering. A decision will be handed down in June.

- Pinnacle Investment Management Group Ltd (ASX: PNI) -2.63% was down inline with the broader market ahead of their results after market.

- Iron ore was down -0.62% in Asia

- Asian stocks were mixed, Hong Kong up 1%, Japan was down -1.07% and China was flat.

- Companies we own still to report in the US this week: Apple Inc (NASDAQ: AAPL) reports tonight.

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE and PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Newmark Property REIT (ASX: NPR) Cut to Hold at Moelis & Co (NYSE: MC); PT A$1.45

- IGO Cut to Hold at Bell Potter; PT A$7.80

- Deterra Royalties Ltd (ASX: DRR) Cut to Sell at CLSA; PT A$4.95

- IGO Ltd Raised to Accumulate at CLSA; PT A$8.75

- JB Hi-Fi Limited (ASX: JBH) Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$57

- Sayona Mining Ltd (ASX: SYA) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT 4 Australian cents

- Pointsbet Holdings Ltd (ASX: PBH) Cut to Hold at Jefferies; PT A$1.01

Movers & Losers