As we highlighted in our prior market insight, 2024 is set to be a historic year for elections, with more than 2 billion of the world’s population across 50 countries set to head to the polls.

The most widely publicised is undoubtedly the United States, where the primaries so far seem to indicate a rematch of the 2020 election between Joe Biden and Donald Trump – candidates facing unpopularity, impeachment and felony charges, along with questions about their age and competence to serve out another term.

As Zachary Karbell of the Wall Street Journal recently stated:

“the upcoming 2024 presidential election depresses everyone.”

Karbell goes on to explain that according to most polls, Americans ended 2023 in a sour mood. Their trust in public institutions, ranging from the Supreme Court to the media and the military fell to near record lows.

Furthermore, 80% of Americans are worried about the economy and believe it is deteriorating and two-thirds said that the country is “on the wrong track.”

War in Ukraine and the Middle East created a sense of a world in conflict and the surge in illegal immigration has risen to a level that both parties are beginning to support a forceful response.

Economic gains and (slightly) more equality

Yet despite this pessimism, economic data paints a slightly different picture. U.S. unemployment remains exceptionally low at just 3.7% and job openings remain highly elevated at approximately 8.8 million, more than 20% above pre-pandemic levels.

Gross Domestic Product (GDP) data, a broad indicator of economic growth, has been strong in the past two quarters (3.3% and 5.2% annualised, respectively), both surpassing market pundits’ expectations.

Not only has the U.S. economy rebounded strongly from the pandemic trough, but it has even proved more equitable. The gender pay gap fell to a record low–with women receiving 83.8% of what men were paid in 2023, according to the U.S. Bureau of Labor Statistics.

The period of record low interest rates since the Global Financial Crisis has been extremely detrimental for equality, pampering the wealthy who own the majority of financial and real estate assets, and punishing savers trying to get ahead.

However, severe employment shortages over the past several years have skewed the pendulum slightly back towards employees–as can be witnessed by the strong annual wage growth and the confidence in recent union negotiations, including those by the United Auto Workers, which represents employees at Ford Motor Co (NYSE: F), General Motors Co (NYSE: GM) and Stellantis NV (NVBIT: STLAM) (formerly known as Fiat Chrysler), and the Writers Guild of America, which represents approximately 11,500 screenwriters in the entertainment industry.

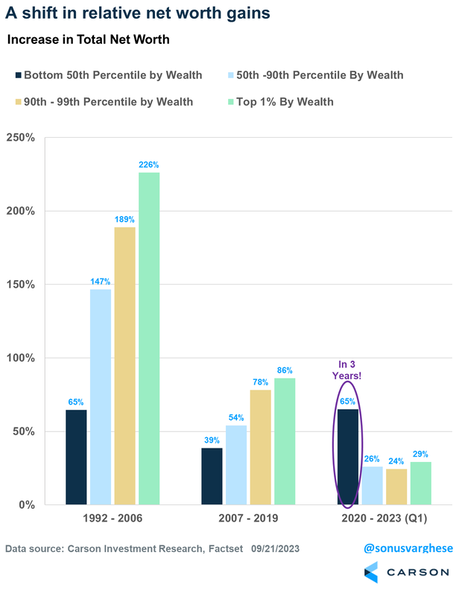

On average, the bottom 50th percentile of Americans saw their net worth rise 65%, the biggest proportional increase of all wealth brackets.

The real (after inflation) net worth of the median household has also performed well, seeing a 37% increase between 2019 and 2022–the largest 3-year increase on record.

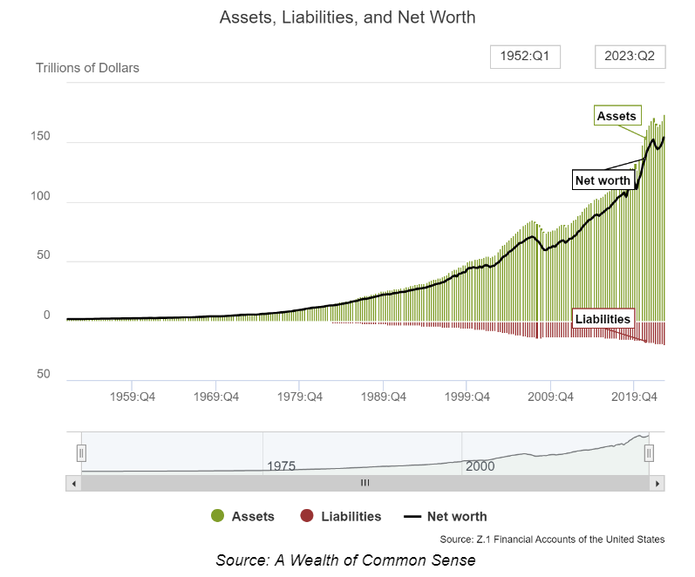

Additionally, Ben Carlson from A Wealth of Common Sense provides an interesting contrast between the current economic situation and prior cycles.

From the dotcom bubble recession in 2001 through the peak of the Global Financial Crisis in 2007, total financial assets grew only 64% while total liabilities grew 94%.

In essence, consumers and businesses took on a level of debt that was not supported by wealth creation in the economy. Conversely, since the bottom of the GFC recession in the second quarter of 2009, assets have grown 136% while liabilities have increased just 40%.

The $100 trillion increase in assets and $5.7 trillion increase in debt has meant that net worth has ballooned by nearly 160% from the bottom of the GFC. (All numbers are as of 30 June 2023 and would likely be more favourable today).

Not to mention that a large portion of this debt is in housing stock, and household debt service ratios (that is, mortgage payments as a percentage of personal disposable income) are currently at their lowest levels in 50 years, outside of the pandemic dip.

Is the vibecession fading?

Strangely, surveys, including the most widely used indicator of consumer sentiment from the University of Michigan, indicate that most Americans feel pretty good about their own financial situation – while insisting that the economy, or other people, are in bad shape.

Commentator Kyla Scanlon coined the term “vibecession” for this phenomenon, which is now widely used to refer to negative views about the economy that appear inconsistent with the data.

Interestingly, while it remains below the levels of late 2019 (when unemployment and inflation were at similar values to today), the Michigan index surged at the end of 2023. Some data, however, indicate that a large part of the remaining negativity is a partisan effect, with Republican respondents to the Michigan survey considering the current economic conditions about as bad as they were in June 1980 – when inflation was more than 14% and unemployment above 7%.

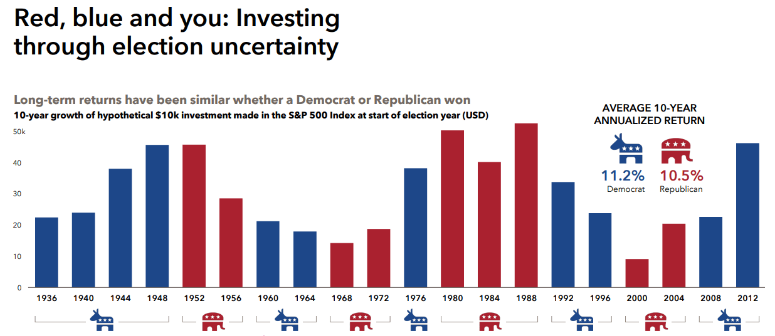

Fortunately, these partisan views appear to be just that – opinions.

The long-term performance of the American economy and its stock market do not appear to be impacted by whether those leaning left or right are in the Oval Office.

For someone investing at the beginning of a new presidency, the average 10-year annualised (that is, compounded) returns for the S&P 500 (INDEXSP: .INX) have been remarkably similar: 11.2% per year for a Democrat in power, and 10.5% for a Republican.

Fade the news

There is no shortage of negative headlines today, despite an easing of the pandemic and inflationary challenges.

It’s also more challenging to escape these headlines, with politicians, social commentators and social media algorithms seeming to flame extremist views. Yet the underlying data of the world’s largest economy suggests that despite this doom and gloom, the situation for many Americans has improved in recent times.

While the succession of interest rate increases has done its job of slowing the economy from a breakneck speed, jobs and profitable investments remain in the land of opportunity.