Experienced investors are likely familiar with the core/satellite approach to building a portfolio. Low cost, broadly diversified ETFs can be an effective way to build out the core of your portfolio, but what about the satellite portion?

Thematic ETFs are designed to provide exposure to a range of industries that stand to benefit from long-term, structural megatrends, such as climate change, technological innovation, and demographic change.

With climate change and data security at the front of mind for consumers, governments, and investors alike, these two thematics could be well positioned for revenue growth in the months and years ahead if these long-term transformational trends play out.

Growth in cybersecurity

The recent Medibank and Optus cyber breaches were a reminder of the threat cybercrime poses to the everyday functioning of society. No industry is as necessary to facilitate a safe digitalised future than cybersecurity.

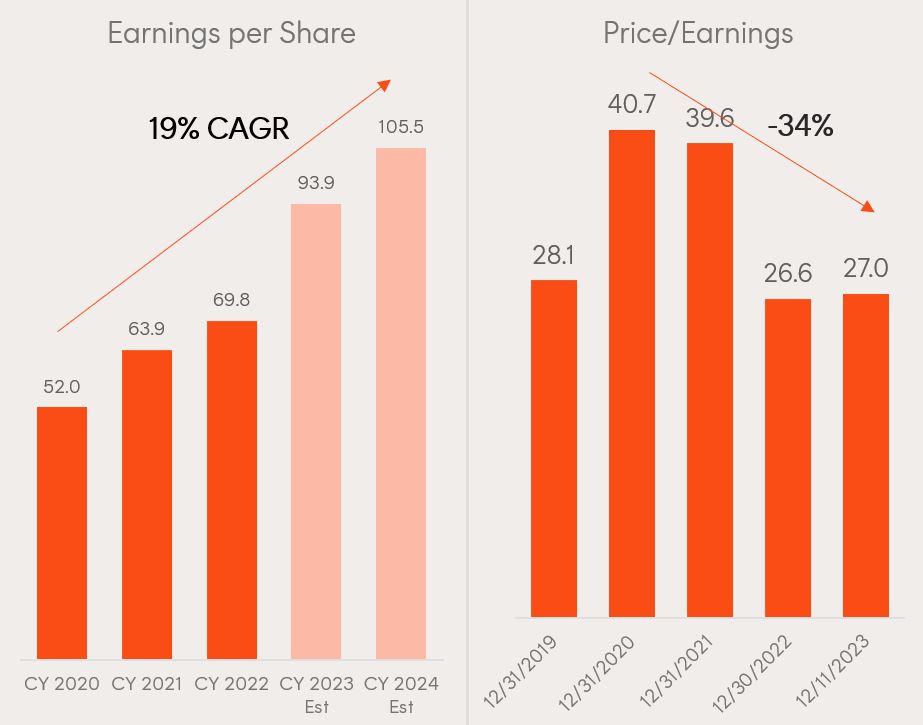

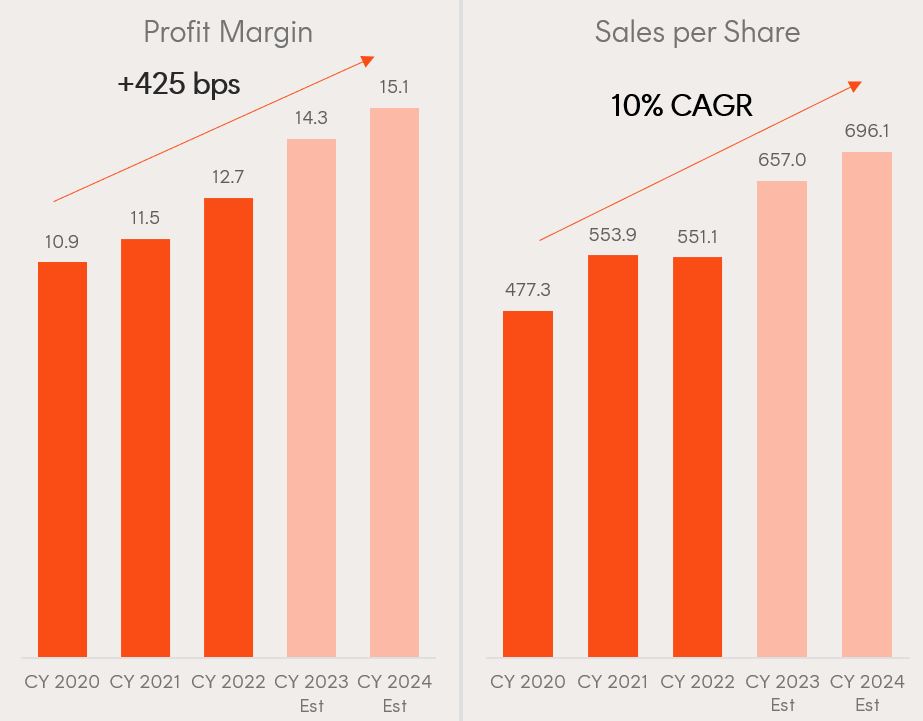

Looking ahead to 2024 and further, the accessibility of artificial intelligence, continued broad digitalisation across industries, and a severe undersupply of private cybersecurity professionals are the biggest trends expected to continue spurring growth for the largest global cybersecurity companies. Strong tailwinds like these have seen Betashares Global Cybersecurity Etf’s (ASX: HACK) index constituents experience fundamental growth with a CAGR of 19% in EPS since 2020.

Betashares Global Cybersecurity ETF (ASX: HACK)

HACK serves as Australia’s longest running and largest global cybersecurity ETF allowing investors to gain exposure to this critical industry. Having returned 19% p.a. over the past five years (to 31 December 2023), HACK has been one of Australia’s best performing ETFs.

Further, HACK’s performance has historically responded positively to significant cyber incidents and geopolitical events, potentially proving a good proxy for investors to growing cyber threats and the companies defending against them.

Consequently, HACK may also provide some level of hedging for investors’ portfolios in cases where an individual company’s share price suffers due falling victim to a cyber-attack.

Quick facts:

- Top five holdings: Broadcom Inc (NASDAQ: AVGO), Crowdstrike Holdings Inc (NASDAQ: CRWD), Palo Alto Networks Inc (NASDAQ: PANW), Infosys Ltd (NSE: INFY), Cisco Systems Inc (NASDAQ: CSCO)

- FUM: $850m (Betashares’ largest thematic ETF)

- Index: Nasdaq Consumer Technology Association Cybersecurity Index

- Management cost: 0.67% p.a.

- Inception date: 30 August 2016

- Investment risks include: market risk, cybersecurity companies risk, concentration risk and currency risk

The nuclear energy renaissance

A new “nuclear renaissance” is emerging, with a 22-country partnership pledging to triple nuclear energy capacity by 2050 at the COP28 climate change conference. Governments from Japan to Europe now view nuclear energy as a necessary part of the energy mix, both to meet their net-zero emissions goals with reliable base load power, and to provide greater energy security in a time of heightened geopolitical tension.

In the 2010s, unfavourable US energy policy and cheap fracked gas undercut the nuclear industry. But a change in sentiment and significant funding and tax credits made available through the Inflation Reduction Act has changed the outlook in the US. This has resulted in a concerted push to extend the life of existing nuclear reactors, and the first new reactor build in the US for decades – the Vogtle Plant in Georgia.

Betashares Global Uranium ETF (URNM)

While there is a compelling long-term investment case for uranium, trying to select individual ASX-listed uranium miners yourself introduces significant stock specific risk. No uranium companies currently rank in the S&P/ASX 100 [XTO] (INDEXASX: XTO), and all are pre-production – introducing project execution and regulatory risk. Betashares Global Uranium ETF (ASX: URNM) is worth considering, it provides diversified exposure to leading uranium miners from across the globe.

Quick facts:

- Top five holdings: Cameco Corp (NYSE: CCJ), Joint Stock Company National Atomic GDR (OTCMKTS: NATKY), Sprott Physical Uranium Trust (OTCMKTS: SRUUF), CGN Mining Co Ltd (HKG: 1164), Uranium Energy Corp (NYSEAMERICAN: UEC)

- FUM: $87M

- Index: North Shore Uranium Mining Index

- Management Costs: 0.69% p.a.

- Inception date: 8 Jun 2022

- Investment risks include: market risk, sector concentration risk, international investment risk and regulatory risk