Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.95% to 7,625.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

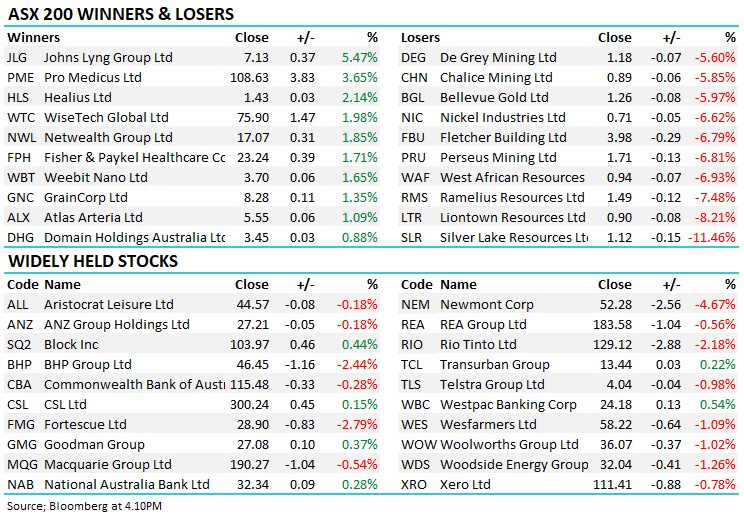

A soggy start to the week for the ASX as weakness in the resources sector weighed heavily on the broader market, although banks traded well up from their session lows and healthcare stocks showed some backbone.

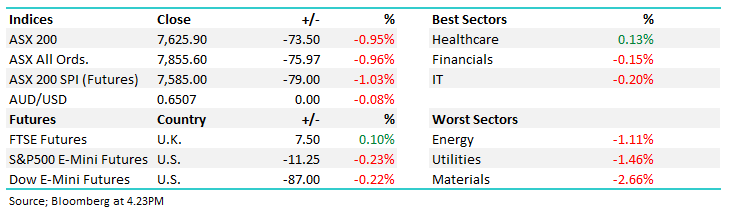

- The ASX 200 finished down -73pts/ -0.95% to 7625

- The Healthcare sector (+0.13%) was the only area to finish in the black.

- Materials (-2.66%) was hardest hit, followed by Utilities (-1.46%) and Energy (-1.11%).

- Aussie Bond Yields followed their US counterparts higher, local 3’s were up 13bps to 3.68% while 10’s are trading 4.1% on the back of strong employment data in the US on Friday.

- Focus turns to the RBA as they enter their first two-day US-style policy meeting today. The new meeting format includes a news conference after the rate decision on Tuesday at 2.30pm, along with updated economic forecasts.

- No change expected to local interest rates tomorrow but the market is currently pricing in 2 cuts this side of Christmas.

- Metcash Limited (ASX: MTS) remains in a halt as they confirmed a $300m fully underwritten institutional placement to fund the purchase of Superior Food Group, as well as hardware companies Bianco and Alpine Truss.

- Argo Investments Limited (ASX: ARG) -0.55% reported lower profit in 1H24 due to lower dividends from the miners, BHP Group Ltd (ASX: BHP) and Rio Tinto Ltd (ASX: RIO).

- Silver Lake Resources Ltd (ASX: SLR) -11.46% & Red 5 Ltd (ASX: RED) +3.03% agreed to a merger that looks to benefit one side more than the other.

- Pro Medicus Limited (ASX: PME) +3.65% launched their diagnostic imaging product on Apple Vision Pro, bringing medical imaging to the VR.

- Fletcher Building Ltd (ASX: FBU) -6.79% balance sheet under a little stress with $NZ180m of provisions relating to cost overruns and lower insurance recoveries weighing on earnings. The provision will likely put Net Debt/EBITDA at the top end of the 1-2x target range – not great!

- Iron ore was flat in Asia

- Asian stocks were mostly lower, Hong Kong fell -2.34%, Japan was up +0.58% though China dipped -0.30%.

- US Futures are down a touch, around 0.3% across the board.

- Companies we own reporting in the US this week: Tomorrow we have Chipotle Mexican Grill, Inc (NYSE: CMG), & UBS Group AG (NYSE: UBS) then Alibaba Group Holding Ltd – ADR (NYSE: BABA) on the 7th & Peabody Energy Corp (NYSE: BTU) on the 8th.

- CMG in particular has been very strong, the position is showing a profit in the International Equities Portfolio of ~60% while UBS will be very interesting, as they provide a comprehensive update on the Credit Suisse integration.

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE and PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Metcash (MTS) $3.64

Shares remained in a trading halt today after Metcash confirmed that it has entered into binding agreements to acquire Superior Food with for up to $412.3m, Bianco Construction Supplies (82.2m) and Alpine Truss ($64m) in a ~$560m deal, that will be funded via a $300m institutional placement at $3.35 (8% discount) and a $25m share purchase plan (SPP) at the same level.

The deal is an interesting one, and overall, we think it stacks up. Completion is expected in 4Q for Bianco and Alpine Truss, and 1Q FY25 for Superior Food, although Bianco and Superior Food acquisitions are subject to ACCC clearance. The deal is expected to the earnings accretive and will improve the depth of the MTS offering.

Metcash (MTS)

Silver Lake Resources (SLR) $1.12

SLR -11.46%: the gold miner’s board has today agreed to a merger with Red 5 (RED) in a deal to create a ~450koz/year mid-tier Aussie gold producer.

Strangely, the Silver Lake board has agreed to a deal at a deep discount to Friday’s close price, at 3.434 RED shares for each SLR, equating to ~$1.13/sh or a ~10% discount. Silver Lake already owns 11.9% of RED shares but would end up with 48.3% of the new group.

While the deal makes sense from the perspective of synergies and the balance sheet, it seems a poor outcome for Silver Lake shareholders in the short term.

Silver Lake Resources (SLR)

Broker Moves

- GPT Group (ASX: GPT) Cut to Hold at Jefferies; PT A$4.50

- Dexus (ASX: DXS) Cut to Hold at Jefferies; PT A$8.13

- Charter Hall Retail REIT (ASX: CQR) Cut to Hold at Jefferies; PT A$3.66

- Pro Medicus Raised to Buy at Jefferies; PT A$120

- Wesfarmers Ltd (ASX: WES) Cut to Hold at Jefferies; PT A$57

- 4DMedical Ltd (ASX: 4DX) Rated New Speculative Buy at Ord Minnett; PT A$1.20

- Imdex Ltd (ASX: IMD) Cut to Sell at Bell Potter; PT A$1.50

Movers & Losers