Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.45% to 7,615.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

With the RBA call now out of the way, the market focused on stimulus in China and some better-than-expected earnings reports, lifting the index after two weak sessions. Beaten-down resources stocks bounced aggressively, but Utilities & Real Estate was the winner today.

Some M&A news caused Energy to underperform, while the consumer-facing sectors also lagged.

- The ASX 200 added +34pts/ +0.45% to 7615

- The Utilities sector (+1.74%) was best on ground today, joined by strength in Real Estate (+1.11%) and Materials (+1.06%)

- Energy (-0.95%) the hardest hit while Consumer Discretionary (-0.72%) also struggled.

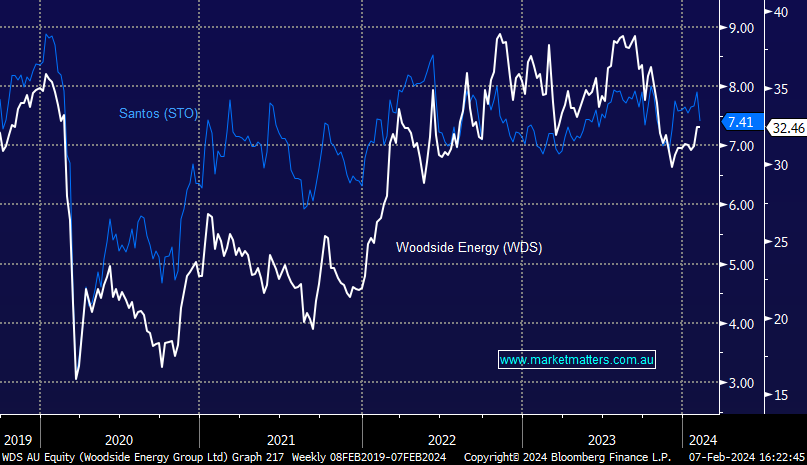

- Santos Ltd (ASX: STO) -5.84% & Woodside Energy Group Ltd (ASX: WDS) +0.53% announced discussions to merge had come to an end without a clear path towards a deal.

- National Australia Bank Ltd (ASX: NAB) -0.22% dipped after the very well-regarded CEO Ross McEwan announced his retirement, with Canadian Andrew Irvine who currently heads its business and private banking to take the reins in April. Ross leaves the bank in good shape, and we remain comfortable in our holding for the Active Growth Portfolio

- Lithium stocks had a better session, Pilbara Minerals Ltd (ASX: PLS) +5.62% and Mineral Resources Ltd (ASX: MIN) +2.93% our two preferred names. Some stimulus news out of China supporting the space, while Pilbara also extended an offtake agreement with an established customer.

- CSR Ltd (ASX: CSR) -4.53% was knocked on a broker downgrade from UBS, they made a very definitive call moving straight from Buy to Sell – we like the clarity in their view.

- Amcor CDI (ASX: AMC) +1.4% moved up after announcing big job cuts at the 1H24 results today which showed a big drop in sales.

- BWP Trust (ASX: BWP) +4.18% reported solid 1H numbers along with a 9.02c dividend, expected to grow to 9.27c in the second half.

- Evolution Mining Ltd (ASX: EVN) +1.3% caught our eye again today after testing ~$3/sh yesterday. Re-testing & bouncing nicely from recent lows is a good technical sign

- Iluka Resources Limited (ASX: ILU) +5.09% rallied on thawing views towards China – this is stock that has simply been hammered and is a great proxy on China.

- GQG Partners Inc (ASX: GQG) +7.38% saw FUM grow to $US127b, up +5.35 in January. The bulk of the growth came from performance, through net inflows also accounted for $US1.9b.

- Cettire Ltd (ASX: CTT) +25.24% surged to 2 year highs on a strong 1H result beating expectations on profitability.

- A mixed day for uranium stocks, some hitting all-time highs (Silex Systems Ltd (ASX: SLX) +6.1% & Paladin Energy Ltd (ASX: PDN) +2.87%), but others struggling (Boss Energy Ltd (ASX: BOE) -2.15% & Nexgen Energy (Canada) CDI (ASX: NXG) -1.51%).

- Iron ore was up 0.9% in Asia.

- Gold was only slightly lower at $US2,035/oz

- Asian stocks were mostly higher, Hong Kong up +2.94%, Japan was flat while China out on +1.8%.

- US Futures are as flat as they come at our close

- Overnight, we had UBS Group AG (NYSE: UBS) report softer quarterly results covered here, while Chipotle Mexican Grill, Inc (NYSE: CMG) reported great numbers after market, which we covered here

- Tonight we have Alibaba Group Holding Ltd – ADR (NYSE: BABA) out with results & Peabody Energy Corp (NYSE: BTU) on the 8th.

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE and PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Santos (STO) $7.41 /Woodside Energy (WDS) $32.46

STO -5.84% / WDS +0.53%: Stocks entered a trading halt this morning with the announcement that they’ve called off any potential merger talks because there was no clear value creation on offer. WDS was seen as the buyer, and STO the seller, so STO had been the big beneficiary in terms of relative share prices in recent months.

Santos management is grappling with what they call, consistent underappreciation by the market of the value in their business, although most companies feel the same way!

We’ve long held the view that STO have complicated and challenging assets, particularly those picked up through Oil Search, which in our view is why the market discounts them more heavily, and unlike the clear strategic rationale WDS could demonstrate when buying BHP’s petroleum business, this was always going to be a tougher ask.

- WDS comes out of this looking better than STO, and the pressure remains on the latter to make something happen to create value, however, with their focus being on WDS through the latter part of last year, we don’t think STO is the way to play traditional energy in the short term.

Woodside (WDS) vs Santos (STO)

Cettire (CTT) $3.97

CTT +25.24%: the luxury ecommerce business surged to multi year highs today on a 1H report that showed the leverage in earnings coming through. Sales Revenue was up 89% and EBITDA jumped 56% in the half as they capture the shift into online in the luxury segment.

Cettire were quick to much to profitability when financial markets started to tighten, a move that is paying dividends now. Growth is also continuing into 2H with EBITDA up 80% in January alone. They have $100m in cash, perhaps ready to launch a buyback or grow through acquisition.

- This is a well owned stock, the numbers today still beating the more bullish of forecasts.

Cettire (CTT)

Broker Moves

- Jervois Global Ltd (ASX: JRV) Raised to Speculative Buy at Canaccord Genuity Group Inc (TSE: CF)

- Iluka Cut to Sell at Canaccord; PT A$7

- Core Lithium Ltd (ASX: CXO) Raised to Speculative Buy at Canaccord

- Champion Iron Ltd (ASX: CIA) Raised to Buy at Canaccord

- APM Human Services International Ltd (ASX: APM) Raised to Buy at Canaccord; PT A$2.12

- Sandfire Resources Ltd (ASX: SFR) Cut to Hold at Canaccord; PT A$6.50

- CSR Cut to Sell at UBS; PT A$6.60

- Nick Scali Limited (ASX: NCK) Raised to Overweight at Wilsons; PT A$15.40

- CSR Cut to Sell at CLSA; PT A$6.20

- Nick Scali Raised to Buy at Citigroup Inc (NYSE: C); PT A$15.55

- Peter Warren Automotive Holdings Ltd (ASX: PWR) Cut to Neutral at Citi; PT A$2.50

- GUD Holdings Limited (ASX: GUD) Cut to Neutral at Citi; PT A$12.90

- Eagers Automotive Ltd (ASX: APE) Cut to Sell at Citi; PT A$13.25

- Xero Ltd (ASX: XRO) Cut to Neutral at Jarden Securities; PT A$110

- WiseTech Global Ltd (ASX: WTC) Cut to Neutral at Jarden Securities; PT A$68

- Nick Scali Raised to Overweight at Jarden Securities; PT A$13.87

- Domain Holdings Australia Ltd (ASX: DHG) Rated New Buy at Bell Potter; PT A$3.95

- Rea Group Ltd (ASX: REA) Rated New Hold at Bell Potter; PT A$179

- WA1 Resources Ltd (ASX: WA1) Cut to Hold at Argonaut Securities; PT A$10.23

- Pepper Money Ltd (ASX: PPM) Cut to Neutral at Citi; PT A$1.40

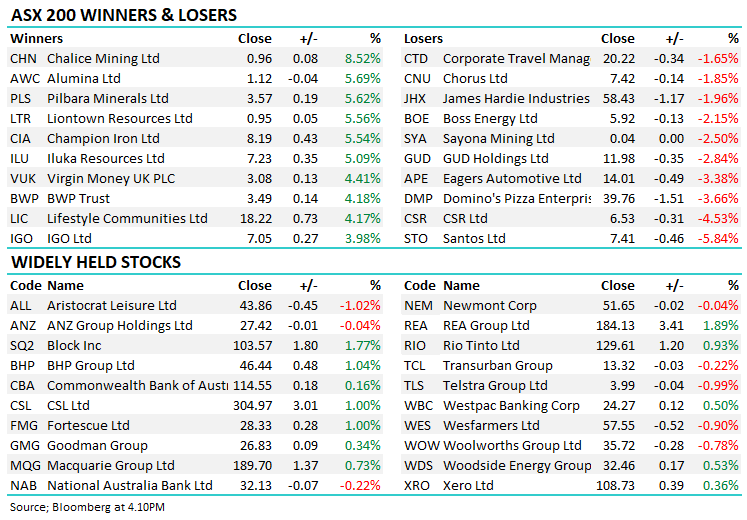

Movers & Losers