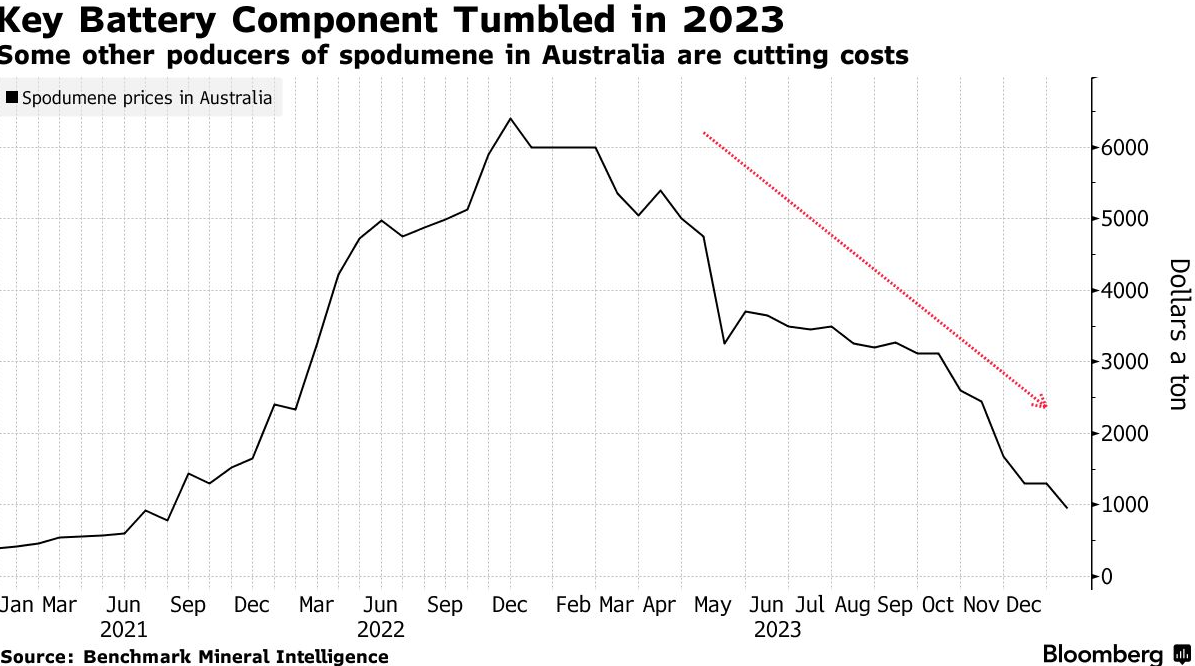

Much has been said about the rapid rise and fall of lithium. It was the hottest sector on the Aussie market from 2020 to the peak in November 2022, driven by an incredible 600% increase in lithium prices.

We saw developers such as Liontown Resources Ltd (ASX: LTR) go from a penny dreadful 10c stock to one of the largest takeover stories for a pre-production mining company in years, at an eye-watering $6.6 billion valuation (which was torn apart by Gina Rinehart).

The country’s largest hard rock lithium mine, Greenbushes, made (almost) the same profit as Commonwealth Bank of Australia (ASX: CBA) in FY23 at over $10 billion.

One operating asset making more money than a nearly $200 billion behemoth bank is truly incredible.

The cyclicality of commodities

But as quickly as commodity prices rise in times of mania, they fall in times of desperation. The response by mining companies was to increase output as quickly as possible to take advantage of mania prices, no matter the cost.

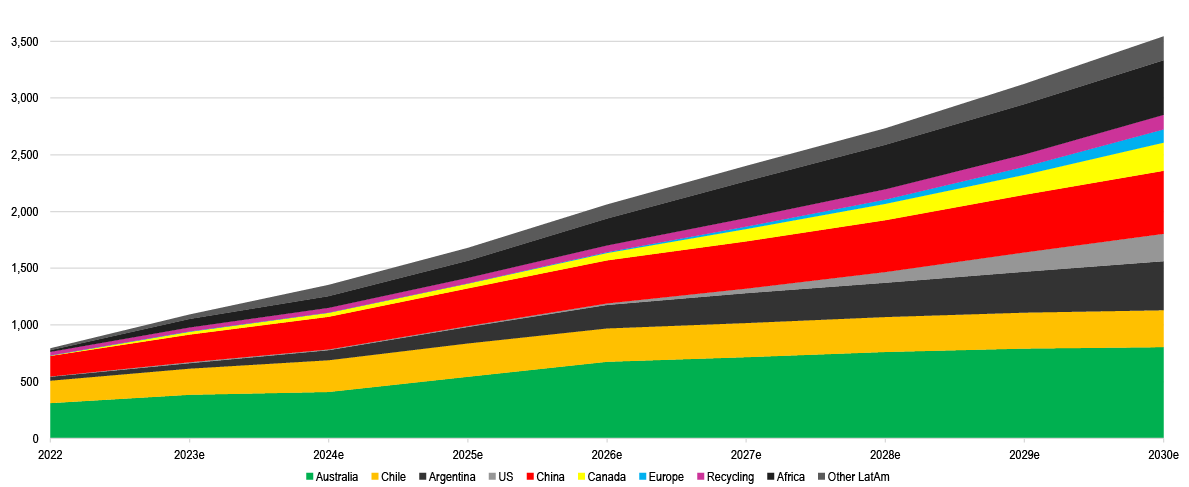

Analysts at Wood Mackenzie suggest that the supply grew 45% in 2023, putting the market into surplus. It gets bleaker once you look at the supply forecasts produced by the investment banks.

Goldman Sachs Group Inc (NYSE: GS) believes the lithium market will be in surplus until 2030. If true, we cannot expect lithium prices to rise above current levels.

However, we should consider that mining and mineral extraction is a tough business and relies on variable factors such as:

- The ability to obtain project finance (take a look at Liontown’s recent updates)

- Government and ministerial permitting, approvals and regulations (~5 years in Aus, ~10 in Canada)

- Ability to mobilise large machinery and equipment (constrained by availability and cost)

- Sufficiently trained workforce; and

- Infrastructure is needed to transport material from the mine site to the end customer (spodumene is a bulk material).

In my view, it would be almost impossible to generate the level of anticipated supply growth as the forecasts suggest over the next 5 years, particularly in geographic locations that may lack the required level of infrastructure (Africa, South America) or lack geologically gifted orebodies (China lepidolite).

Therefore, if demand continues to rise and prices do not appreciate meaningfully, the industry will not experience anywhere near the anticipated supply growth. Hence, the cure for high prices has been high prices, and the cure for low prices in time will be low prices.

This may spark a commodity price rally sometime within the next 12 months, so long as the demand for lithium ion batteries continues to grow.

The risk to this thesis is that:

- The supply of lithium remains robust and ahead of demand.

- Demand for electric vehicles slows and remains in line with lower supply estimates or

- The lithium-ion battery chemistry is displaced by new technologies such as sodium. It is a genuine possibility and something to follow closely.

Where are the opportunities

Higher-cost producers and small-scale operators are being forced to turn off operations. In my view, these represent the most significant risk of financial deterioration and should not be considered investment grade [Sayona Mining Ltd (ASX: SYA), Core Lithium Ltd (ASX: CXO)].

Lithium explorers and developers will struggle to raise finance at reasonable terms and hence may suffer dilutive capital raising or be forced to sell their projects to larger companies. Betting on a buyout is a highly speculative method of stock picking and not a part of our methodology at Stock Doctor.

Finally, the large producers with sufficient balance sheets and excellent assets who continue to make profits will be the best placed to take advantage of a weak market (consolidation, growth, minimal dilution).

Stock picks

My top pick has been Pilbara Minerals Ltd (ASX: PLS), who have a warchest of $2.1 billion in cash, a mine life in excess of 30 years and 100% project ownership to drive their own outcomes. Its valuation has been more resilient than its peers, but it should trade at a premium given its history of operating performance.

Secondly, Mineral Resources Ltd (ASX: MIN) offers investors a diversified company underpinned by one of the highest-quality mining services businesses on the ASX. Its operations may have higher costs and come with lower project ownership. Still, the market should have faith in a management team that is highly aligned with shareholders and has a history of excellent dealmaking and flexibility.

Arcadium Lithium CDI (ASX: LTM) exposes investors to the lowest-cost form of lithium extraction in brine operations. The merger, at this point, remains a black box. Still, Arcadium Lithium has an asset portfolio that can support a 200% increase in output over the medium term, which means the stock will likely have the highest leverage to recover lithium prices.

Finally, IGO Ltd (ASX: IGO) has had a terrible news flow in the past 6 months. Its 25% interest in Greenbushes is the jewel in its crown, but its minority ownership means the business may not have its interests aligned with its larger partners. Tianqi Lithium Corp (SHE: 002466) and Albemarle Corporation (NYSE: ALB) are reducing their spodumene offtakes and forcing the asset to stockpile ore likely until a recovery in market conditions.

It is very unusual for a world-class asset to act like a marginal cost producer, which has been to IGO’s detriment. At this point, long-term investors should be willing to be patient as the new CEO clears the decks and market expectations are revised.

The quality and value of Greenbushes is worth a pretty penny, and it is the sole reason we retain its Star Stock status at this point.