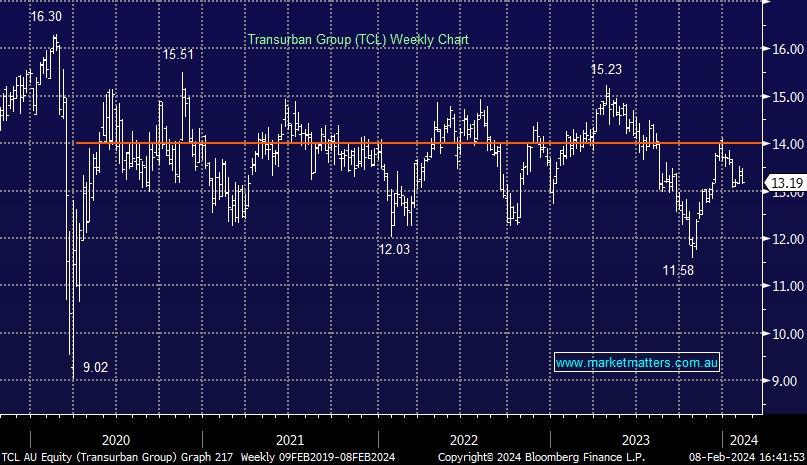

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.31% to 7,639.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

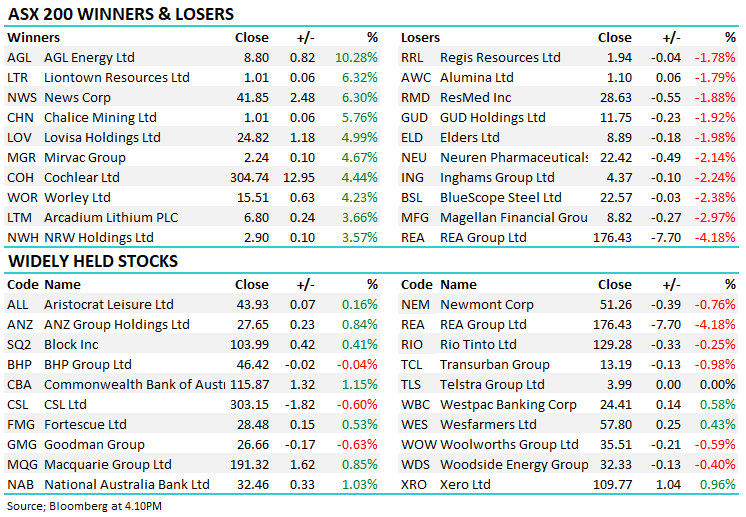

Another small gain for the market today took the ASX200 to around 1% below the all-time highs set last week. The banks did the heavy lifting, the Big 4 accounting for around half of the gain by the index, joined by strength in Tech, Utilities and Real Estate.

- The ASX 200 finished up +23pts / +0.34% to 7639.

- The Tech sector (+1.18%) was best on ground, followed by Utilities (+0.97%), Financials (+0.88%) & Real Estate (+0.74%).

- Energy (-0.52%), Staples (-0.45%) and Consumer Discretionary (-0.33%) were notable laggards.

- Transurban Group (ASX: TCL) -0.98% results were largely in line, though analysts we relooking for an upgrade to dividend guidance which didn’t come.

- AGL Energy Limited (ASX: AGL) +10.28% recovered all of the last fortnight’s share price weakness today on a strong 1H and an upgrade to FY guidance.

- Mirvac Group (ASX: MGR) +4.67% popped higher despite a ~10% miss on EPS, though guidance was left unchanged. Interest costs were the main culprit for the miss, a headwind that has likely eased.

- Rea Group Ltd (ASX: REA) -4.18% grew earnings 22% in the first half, supported by strong Sydney/Melbourne listing volumes. Cost guidance was worse than expected, likely to weigh on the 2H.

- Cochlear Limited (ASX: COH) +4.44% upgraded FY24 guidance on strong implant volumes, now expecting 26-31% profit growth for the year. First half revenue grew 20% in constant currency terms with HY results due on 19 Feb.

- Calix Ltd (ASX: CXL) +18.24% surged after reiterating Heidelburg Materials was working to find a new site for Leilac-2 following their decision to stop production at the Hanover facility.

- Iron roe added +1.7% in Asian trade today.

- Asian stocks were mixed, Japan ripped 2.2%, China +0.95% but Hong Kong -1.1%. China markets will be closed for the next week following today’s session as the region celebrates Lunar New Year.

- US Futures were little changed at the end of our session.

- Companies we own reporting in the US this tonight: Peabody Energy Corp (NYSE: BTU)

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

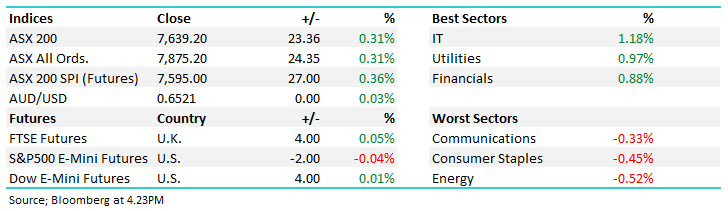

AGL Energy (AGL) $8.80

AGL +10.28%: the energy & gas company posted a strong first half result today, coming in well ahead of expectations coupled with an increase to guidance for the full year. EBITDA of $1.07b was up more than 75% on 1H23 and a 12% beat to expectations, while the 26cps interim dividend was also a 13% beat.

Strong electricity pricing drove the beat however costs came in higher than expected, leading to a miss on margins. Despite that, strength in revenue helped lift Proft and EBITDA guidance in the mid-single digits.

There was plenty of focus on investment in renewables and the outlook of capex and while some clarity was provided, there are some concerns around the capex spending over the next few years while earnings are expected to moderate somewhat.

AGL Energy (AGL)

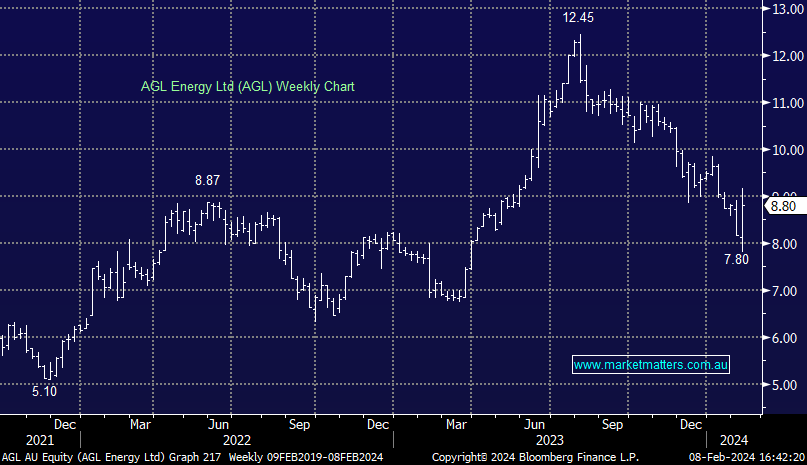

Transurban (TCL) $13.19

TCL -0.98%: the toll road company was out with 1H numbers today showing a largely in line result, though the all-important dividend was pre-announced. Daily traffic numbers were slightly disappointing, only growing 2.1% though Revenue was up 6% while EBITDA grew 7.5% to $1.3b, only the smallest of beats to consensus expectations.

They’ll pay a 30cps interim dividend and left FY guidance for 62c (32c 2H) unchanged however the market was hoping for a small upgrade here. The market was keen to hear about growth plans following the ACCC’s decision to block the acquisition of the only other Australian toll road operator, Horizon Roads which runs East Link in Melbourne, last year.

While no new opportunities were presented, TCL did flag North America as a growth avenue outside of its current asset base.

Transurban (TCL)

Broker Moves

- CSR Ltd (ASX: CSR) Cut to Hold at Morgans Financial Limited; PT A$6.90

- McMillan Shakespeare Ltd (ASX: MMS) Rated New Buy at Canaccord Genuity Group Inc (TSE: CF); PT A$19.60

- BWP Trust (ASX: BWP) Raised to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$3.60

- Smartgroup Corporation Ltd (ASX: SIQ) Rated New Buy at Canaccord; PT A$10.20

- Toro Energy Ltd (ASX: TOE) Rated New Speculative Buy at Euroz; PT A$1

Major Movers Today