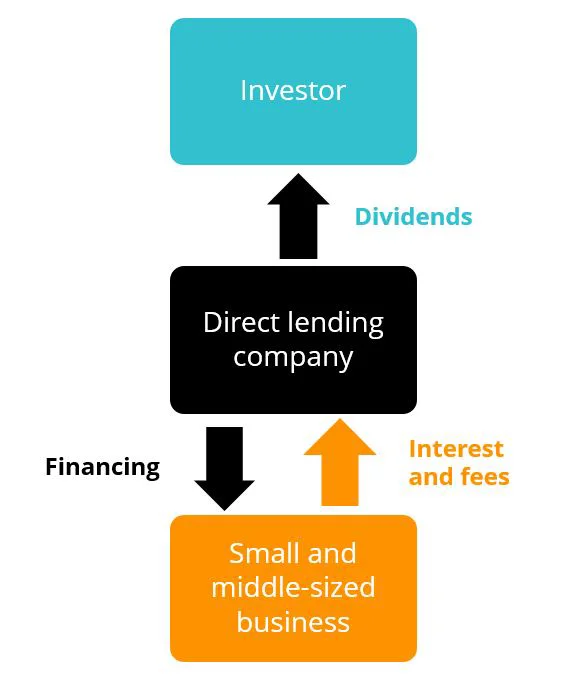

Private credit companies generate income by lending to and investing in non-public businesses using a variety of sources, such as debt and hybrid financial instruments.

In short, they provide capital to small and medium-sized private businesses, and in turn, give investors access to the growth and income potential of private credit that are generally exclusive to large institutions and difficult to access.

Most listed private credit companies are closed-end funds that hold a portfolio of loans and distribute to their investors most of the net income from the private companies they lend to.

You can see in the above, that private credit companies issue loans to small and middle-sized non-public companies. They collect fees and interest on the loans they issue.

In some jurisdictions, there are rules about how much listed private credit companies are required to distribute to their investors. For example, in the US, given their status as a registered investment company under the Investment Company Act of 1940, private credit companies are required to distribute at least 90% of their net investment income to shareholders. For this reason, investing in private credit companies is associated with income investing.

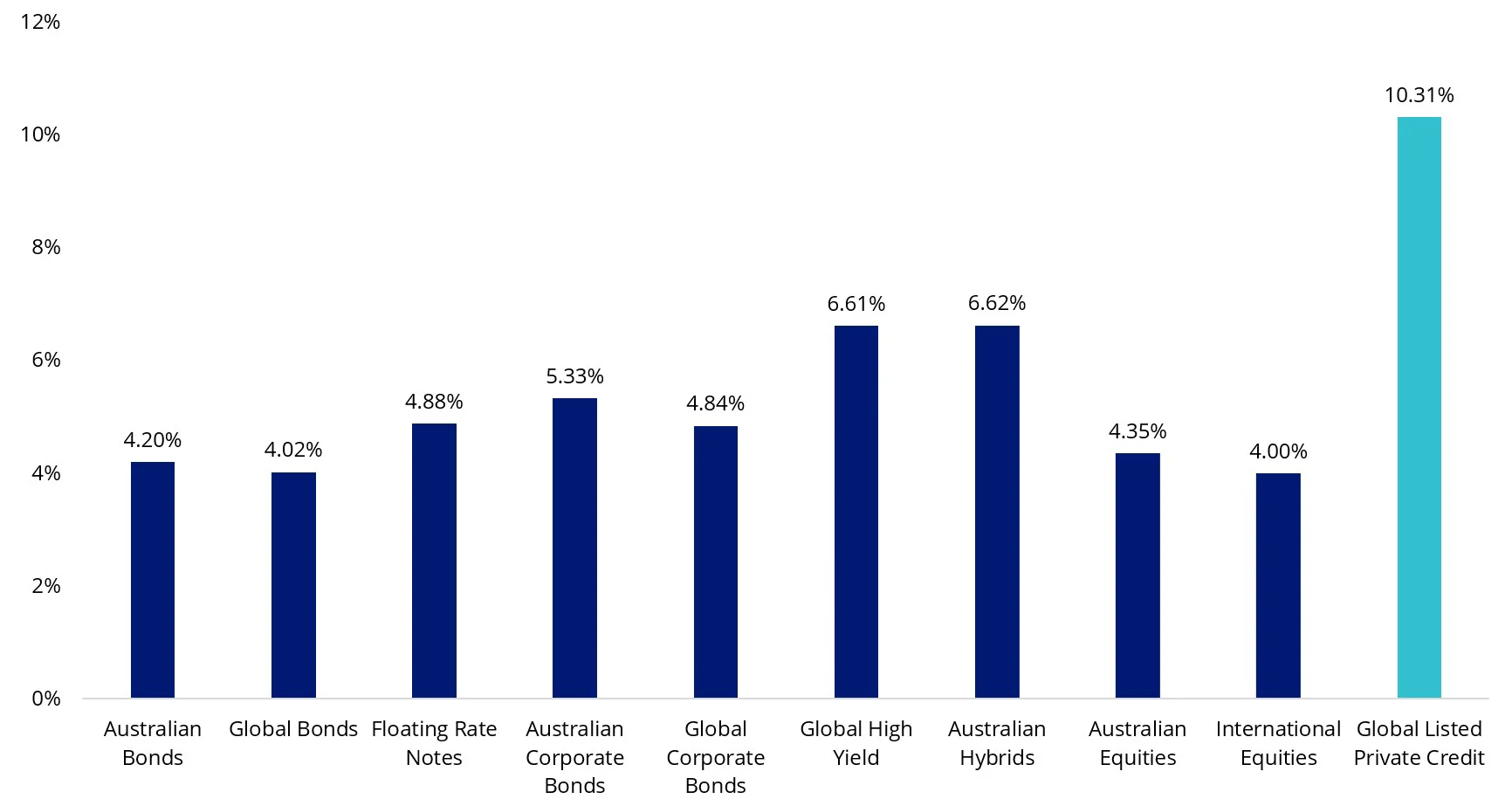

And you can see the allure for investors. Chart 1 below shows the yield of listed private credit, as at 31 December 2023, is significantly higher than other asset classes.

Chart 1: Private credit offers attractive yield

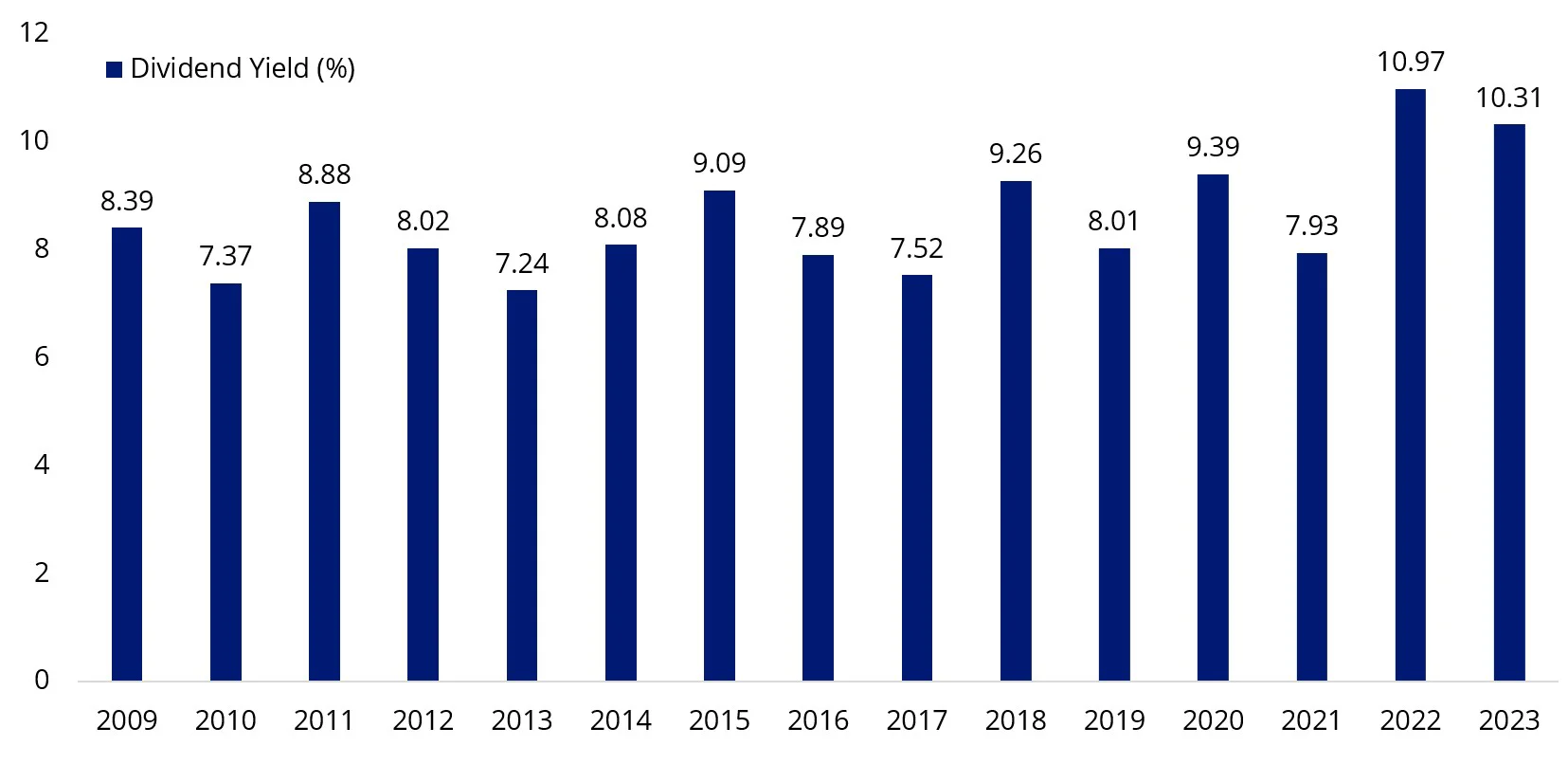

And it has been able to maintain this level of yield over time, even during the low-rate environments following the GFC and COVID. Over the past 15 years, the dividend yield of the Global Listed Private Credit Index has averaged around 8.6% p.a. As always, this is not indicative of the future performance of LEND.

Chart 2: Private credit offers attractive dividend yields: Dividend yield of LPX Listed Private Credit AUD Hedged Index

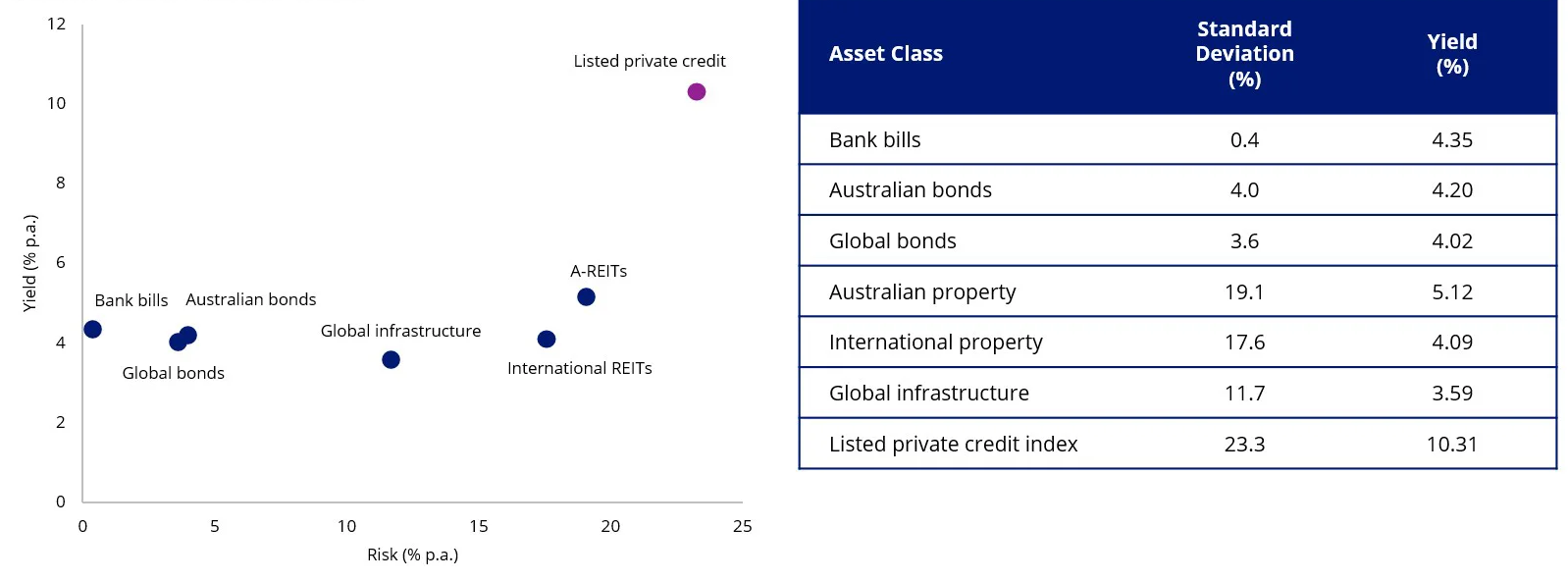

In bond markets higher income generally comes at the cost of higher volatility. This is true of global listed private credit, which historically, while paying a higher yield, experiences more volatility, or risk.

Chart 3 and table 1: 15 year risk vs yield as at 31 December 2023

To date, private credit investment has been generally limited to high net worth and the big end of town who don’t require immediate access to cash and can take concentrated positions. This is because private credit has generally only been available through restricted closed-end funds that have large minimum investments and are illiquid.

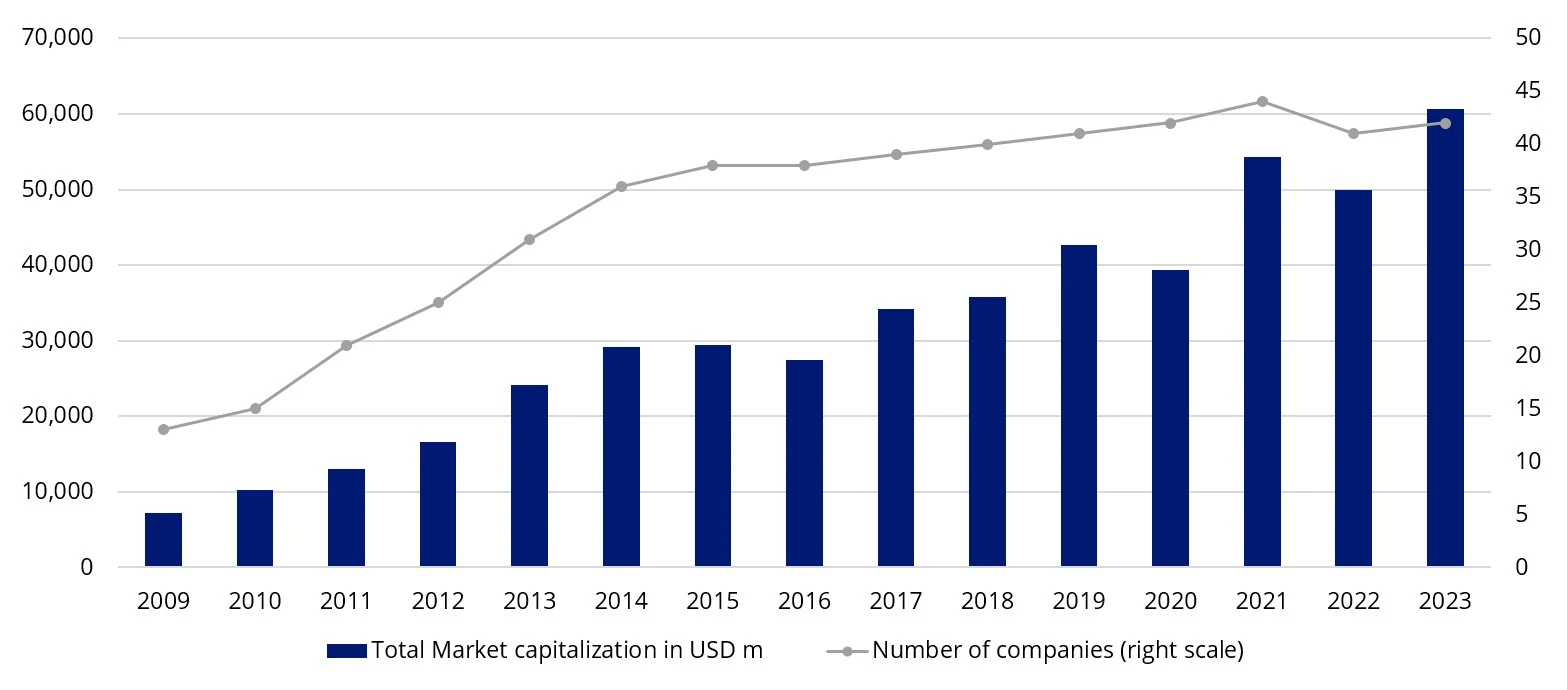

The rise of listed private investment companies has allowed investors to access this asset class via an exchange. According to index provider LPX, the universe of listed private credit companies globally is 42, having been growing since 2009.

Chart 4: The universe of listed private credit companies has been steadily expanding

Listed Private Credit Companies, including those managed by KKR & Co Inc (NYSE: KKR), Ares Management Corp (NYSE: ARES), Blackstone Inc (NYSE: BX) and Goldman Sachs Group Inc (NYSE: GS) may specialise in sectors or loan types and risks vary between companies. For diversity, investors generally need to invest in a portfolio of listed private credit companies.