There is no doubt that commodities move in cycles. These are well-established. We see it all the time, and none more dramatic and violent than the lithium price. From hero to zero in a year. Truly astonishing. But there is a reason for this. It is a new material. Long-term price trends, supply, and demand have not settled down as yet.

Not only that, but we have also gone from relatively unsophisticated investors like car companies frantically trying to tie down supply and ensure continuity and certainty, to new battery technology and chemistry affecting the near-term sentiment and possibly even the long-term viability of this nascent material.

Did someone say sodium ion batteries?

With uranium, things are different

Uranium has been around for decades. The average age of the US nuclear power plant is 42 years. Even Homer Simpson works in one!

The price of the underlying commodity is relatively slow-moving. Contracts are long term and there is a huge amount of politics (and emotion) wrapped around nuclear power, fuel and enrichment. And more importantly, there is no substitute. No cheaper version of it to take its place. No sodium, or even recycling.

Where lithium is a capricious teenager, uranium is a dowdy middle-aged metal. Lack of investment due to sustained low prices has led to a market dominated by a few large players. Few new mines have come on stream. More importantly, the dominant suppliers are from places that are a little inconvenient. Russia (decommissioned nuclear warheads for many years), Kazakhstan with the world’s biggest in Kazatomprom, here in Australia, BHP Group Ltd (ASX: BHP) is the fourth biggest producer at Olympic Dam.

Recent political events have thrown uranium into focus. COP28 had an unprecedented 22 countries sign on the dotted line to expand their use of nuclear power to triple the size by 2050. Preferably like Germany, with its power policy, outsourcing the actual location of the nuclear power plants. France has been convenient in this respect and gets 70% of its power from nuclear. Sells a lot to Germany which closed its nuclear industry.

Currently, there is a hope that small modular reactors (SMRs) become the solution to baseload power combined with renewables. An inconvenient issue is that the poster child for this, Nuscale Power Corp (NYSE: SMR), had to abandon its proposed power plant in the US because it was just going to be too expensive. SMR remains a new untested technology in the West.

China, though, is building new capabilities. Over the past decade, China has added 37 nuclear reactors, for a total of 55, according to the International Atomic Energy Agency, a UN body. During that same period, America, which leads the world with 93 reactors, added two. Most of the new reactors are being built in Asia or India.

Supply is a huge issue. The US has a dependence on Russia for its enriched uranium and very small production capacity. For obvious reasons, the US would really like to get away from Russian dependency. It has plans, but these things take time. It is especially dependent on Russia for enriched products. One potential winner here could be Silex Systems Ltd (ASX: SLX) with its 3rd generation enrichment technology which has been in development for 30 years. Things do move slowly!

Here in Australia, we have a number of listed uranium wannabes. Most are restarting previously shuttered mines like Paladin Energy Ltd (ASX: PDN), or searching for treasure in Namibia and other African nations. BHP hardly mentions uranium in its press releases. More focus on potash. Politics with nuclear power is everywhere. That is part of the reason it is a slow-moving commodity. Secrets, long-term contracts, and the ability of nuclear fuel to be dual-purpose are sub-optimal. Making bombs is slightly frowned upon.

Uranium is not the new lithium. From my chemistry days, I remember lithium has a propensity to burst into flames and be very tricky to extinguish. In my school days, it was a dramatic lesson. Always good fun to see stuff go up in flames. Plenty of e-bikes seem to be recreating those experiments too. The reaction of lithium seems a good metaphor for the underlying price. Uranium has no such problems and has to be enriched with centrifugal technology to become useful.

There are several ways to play uranium on the S&P/ASX 200 (INDEXASX: XJO). The highest profile and the go-to stock-wise is Paladin Energy Ltd. But Boss Energy Ltd (ASX: BOE), with its soon-to-be-producing Honeymoon Project, is equally as attractive. Plus, it has a good geographical spread. Its recent acquisition of Alta Mesa in Texas has helped and gives it a foothold in the US. Pretty important with Biden’s IRA plans.

There have been some rumblings on Namibia trying to get a bigger slice of the resource pie. A slight risk for some.

Another stock to consider would be a Canadian goliath in Nexgen Energy (Canada) CDI (ASX: NXG). Deep Yellow Limited (ASX: DYL) is another Namibian hopeful having a resurgence.

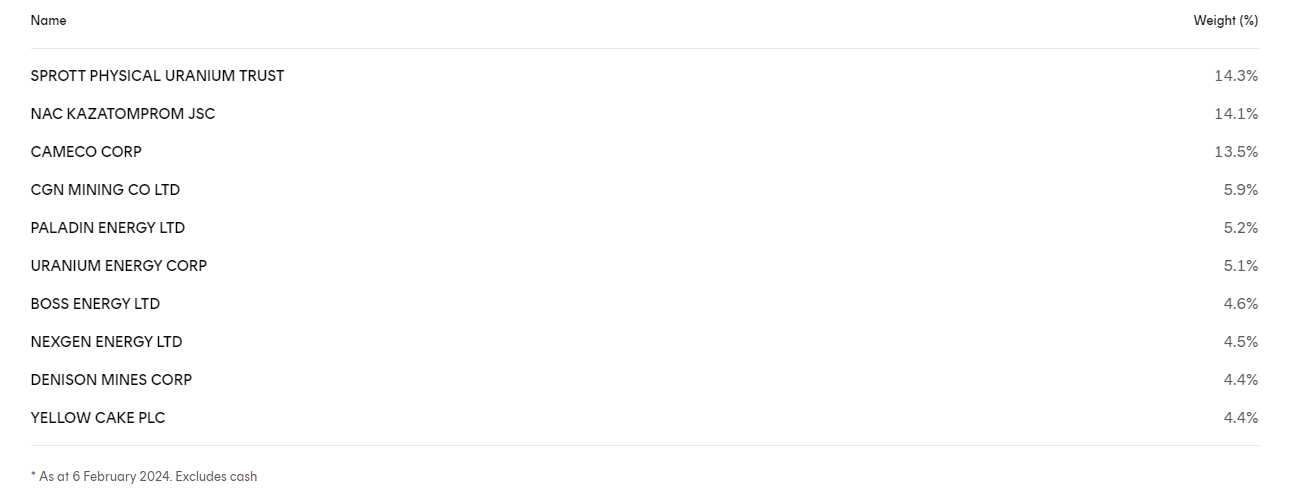

For the more conservative investors who are after exposure to the metal, together with the biggest producers, there is the Betashares Global Uranium ETF (ASX: URNM).

In the last few weeks, production warnings have come out of Joint Stock Company National Atomic GDR (OTCMKTS: NATKY) due to a shortage of sulfuric acid, which is used to leach the uranium from the rock. It is called in-situ leaching (ISL). Warnings too from Cameco on issues in Africa.

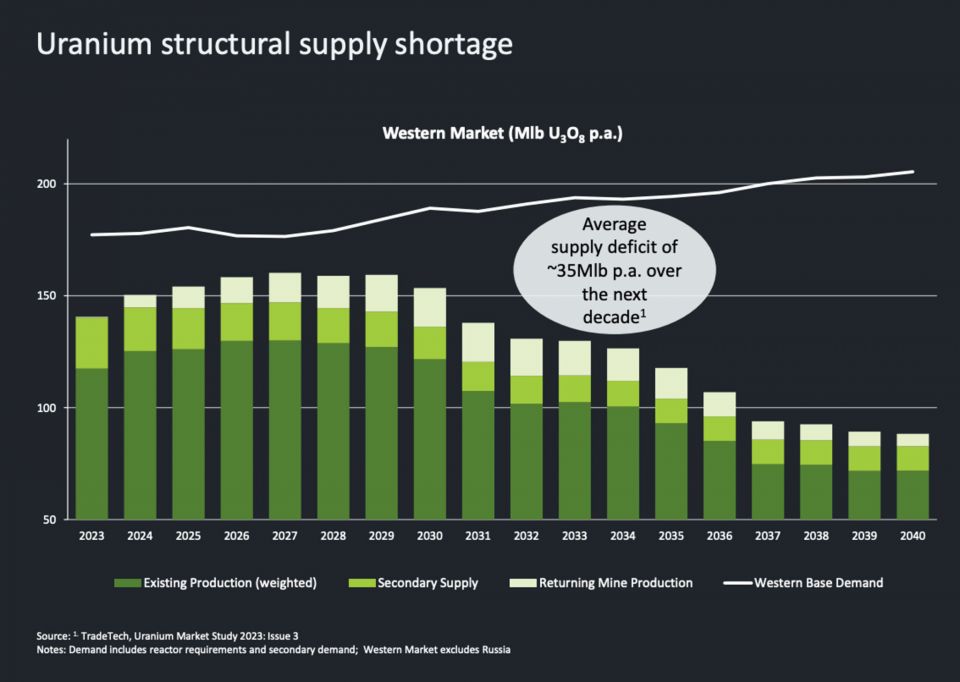

In short, demand is strong on climate change aspirations, a political will to remove some of the country’s risks in supply, and production is suffering both in Canada and Kazakhstan, and new production is taking its time.

Paladin’s Langer Heinrich Project in Namibia seems to have been years in the planning and is only just on the cusp of production again. And in the big scheme of things, it will not touch the sides in terms of satisfying that demand.

The whole sector has run pretty hard in the last few months as the fast money has switched from playing lithium hopefuls to uranium explorers. It needs to consolidate, but it could be the pause that refreshes. We seem to have had some panic buying after the spot move above US$100, which is easing so investors can be slightly more discerning in their picks of the sector. A little bit of patience could see better prices achieved.

It seems after years in the wilderness, uranium is finally starting to seize the day. One local broker has a US$150 target for the spot price next year. So far, in the last year, uranium is up 116%. No lithium, but then do you really want that wild ride in this strategically sensitive metal? No boom and bust here. A long slow grind higher on fundamentals. Cyclical yes, but the cycle is only just starting to turn. Lithium has fallen 90% in a year. Uranium is up over 100% in a year. I know where I would be looking for gains. Lithium has yet to show signs of turning.