Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.073% to 7,644.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

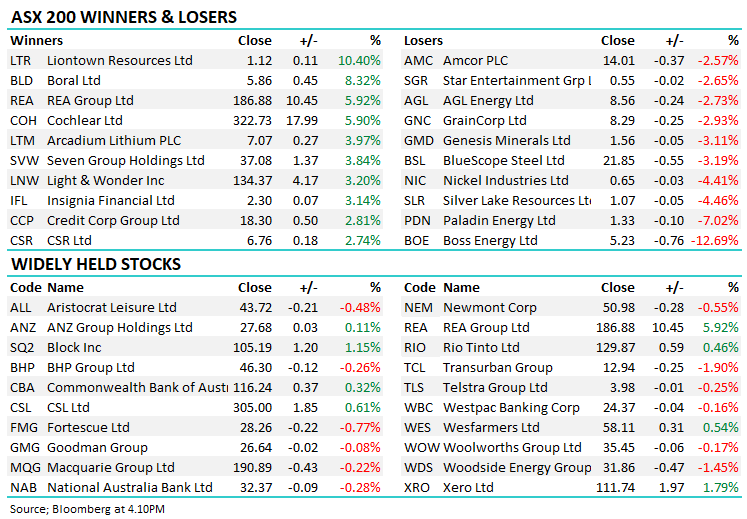

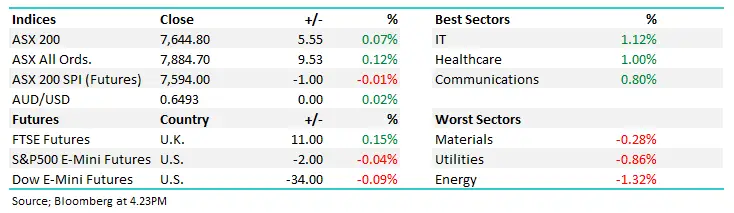

Not a lot to invigorate markets today as the index chopped in and out of positive territory. The Uranium stocks saw the most activity following Cameco’s (CCJ US) quarterly result overnight, a topic we’ll cover below. Elsewhere, IT was as strong as Energy was weak and on a market that did little, it was not surprising that winners and losers were split evenly.

- The ASX 200 added 5pts/ +0.07% to 7644

- The IT sector (+1.12%) was top of the pops while Healthcare (+1%) and Communications (+0.80%) did well.

- Energy (-1.32%), Utilities (-0.86%) and Materials (-0.28%) all struggled.

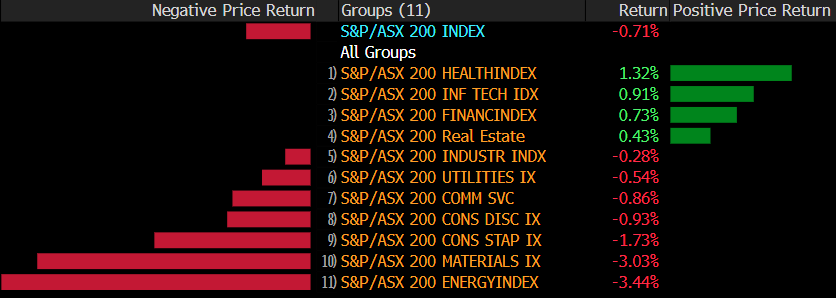

- For the week, the ASX 200 fell –0.71% weighed by energy.

- Earnings so far have been solid, although it’s only early days – it ramps up next week!

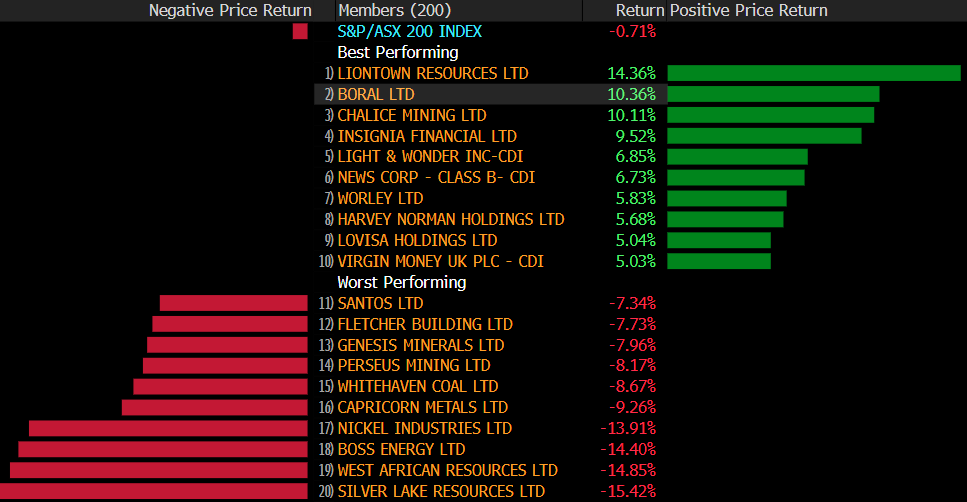

- Boral Ltd (ASX: BLD) +8.32% hit a 2-year high after upgrading guidance

- Unibail-Rodamco-Westfield CDI (ASX: URW) +7.3% rallied after it reported annual earnings that beat expectations and reintroduced dividend payments sooner than expected.

- Uranium stocks fell hard after a strong run, Boss Energy Ltd (ASX: BOE) -12.69%, Paladin Energy Ltd (ASX: PDN) -7.02% & Peninsula Energy Ltd (ASX: PEN) -6.9%.

- Rea Group Ltd (ASX: REA) +5.92% bounced back after yesterday’s weakness

- Liontown Resources Ltd (ASX: LTR) +10.4% was the star in the Lithium sector, we think the worm is turning here.

- Iron ore was down 1.6% in Asia, now trading ~US$128/mt.

- Asian stocks were mostly higher aside from Hong Kong which fell -0.83%, Japan was up 0.24% while China added another 1.3%

- US Futures modestly lower, not by much.

Market Matters Australian Reporting Calendar – Click to download a spreadsheet HERE and PDF document HERE

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Uranium Stocks

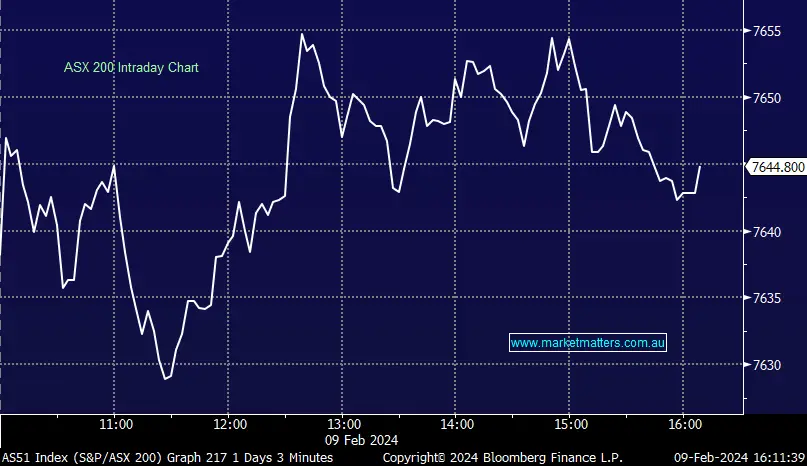

Canadian-based Uranium company Cameco Corp (NYSE: CCJ) which we recently sold in the International Equities Portfolio fell 7% overnight on their quarterly production numbers and that sent the Uranium sector in Australia sharply lower today i.e. Boss Energy (BOE) -12.69, Paladin (PDN) -7.02% and Penisula (PEN) -6.9%. The decline in local stocks is understandable while it’s also a sign that investors are sitting on one side of the canoe here, making stability an issue.

We’ve been (still are) Uranium bulls in the medium/long term, but short term the market has gotten out of whack for a few reasons with Cameco an important cog in our thinking. Cameco has sales contracts of about 29Mlb/yr out to 2027 at an average price of about US$52/lb. It will only produce about 18Mlb in 2023, and is guiding to 22.4Mlb in 2024. The shortfall is made up by purchasing spot uranium. That was fine when spot was below the contract price, but with spot uranium at US$100/lb, Cameco is losing almost US$50/lb on its spot purchases. This issue wawell-knownwn and understood by the market.

What had got airtime in the market over the last few weeks was the prospect that CCJ could actually downgrade 2024 production guidance and as a result, put more pressure on prices in the spot market, which in recent times has become a lot more speculative with the rise of vehicles such as the Sprott Physical Uranium Trust (OTCMKTS: SRUUF) which has been stockpiling pounds.

As it turns out, Cameco actually guided to better production for the year ahead and in doing so, wrong-footed a lot of speculative money that found its way into the Uranium stocks and ETF’s, which also hold large positions in the stocks, and today saw some unwinding of this, and we’d expect more to come in the short term.

- We recently sold our Uranium stocks, looking for a better risk/reward entry point to rejoin the party, in the likes of Boss Energy (BOE), Paladin (PDN) & Co. We think we’ll get them at lower levels.

Boss Energy (BOE)

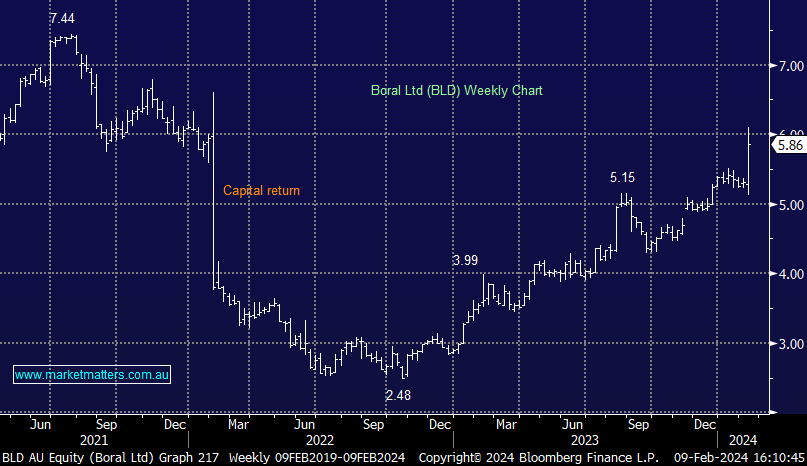

Boral (BLD) $5.86

BLD +8.32%: the building products company beat expectations, surging to long-term highs on a strong 1H result. Revenue was in line, however, EBIT was a strong ~25% beat to expectations, up 111% to $201m.

While cost control was solid (SG&A +3% vs revenue +9%), the bulk of the beat came down to stronger than forecasted margins out of the quarry business while the other segments of their operation were broadly in line or a miss.

Despite upgrading guidance for FY24 (EBIT guidance +4% vs previous expectations), the company is effectively guiding to a 2H miss given the strong 1H numbers announced today.

Boral (BLD)

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- News Corp Class A (NASDAQ: NWSA) Raised to Outperform at Macquarie Group Ltd (ASX: MQG)

- Transurban Group (ASX: TCL) Cut to Hold at Jefferies; PT A$13.42

Movers & Losers