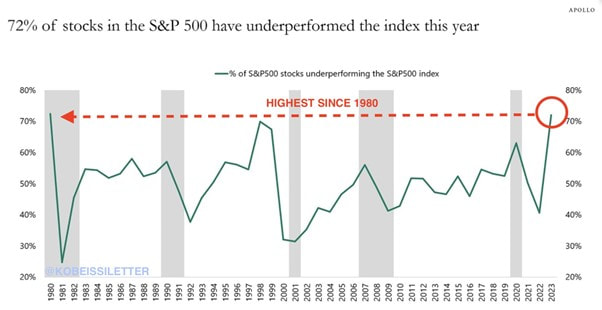

Global equity markets finished the year on a tear as investors gained confidence that inflation had abated and interest rate hikes were in the rear vision mirror. There was a clear bifurcation however, with the bounce led by a small number of suspects (we’re looking at you big tech) while 70% of companies in the S&P 500 (INDEXSP: .INX) underperformed the index in 2023.

The rise of the magnificent seven has meant the remainder of the US market, particularly mid-caps, look extremely cheap. Japan remains attractive, owing to an undervalued currency, increased shareholder-friendly practices and established corporates operating in large and growing markets. As you would have read previously, we continue to seek companies that meet needs over wants. Naturally, these companies have few substitutes and therefore pass on costs more easily, enabling them to retain market share and protect profits. Below we share three such companies in the portfolio.

1. Corning Inc

Corning Inc (NYSE: GLW) is a US-based advanced materials manufacturer serving end markets such as telecommunications, automobiles, consumer electronics and renewable energy. Over 170 years the business has built enviable expertise and intellectual property (over 12,000 patents), across three key technologies: optical physics, glass and ceramics science. Corning invented the world’s first low-loss optical fibre which supplanted existing copper-based wires used for internet networks. The ceramics division created a cost-effective and efficient substrate that is the standard for catalytic converters today.

Since 2020, Corning’s operations and end markets have been disrupted by the wide-reaching impact of the pandemic and subsequent inflation pressures. Supply chain shortages meant the business needed to retain higher inventory, while elevated staffing levels to protect the large manufacturing workforce crimped productivity. Undoubtedly, management made the correct decision to protect employees and customers. However, the short-term result was muted cash conversion and profitability. Recent interest rate hikes and a softening consumer have also impacted quarterly earnings, with cars and electronic sales below historical trends. This confluence of short-term headwinds has meant the overarching investment thesis has gone unnoticed by the market – Corning’s share price has traded sideways since 2020.

Despite recent turbulence, Corning is well-placed to benefit from several megatrends including connected devices, cloud computing and decarbonisation. For example, growth in the ceramics division will be underpinned by new US EPA protections that mandate automakers curtail tailpipe emissions. Corning is the inventor and clear market leader in gasoline particulate filters used to trap harmful pollutants. Moreover, inflation is abating, supply chains have normalised and recent price increases have fortified margins. We expect investors will soon appreciate the structural tailwinds supporting end markets and the competitive advantages Corning holds across its three core technologies.

2. EMCOR Group

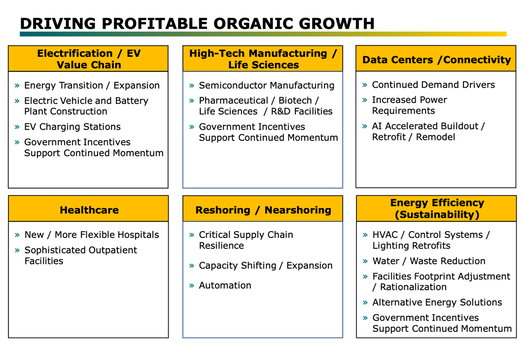

Emcor Group Inc (NYSE: EME) is a specialist electrical and mechanical contractor in the United States. The business has significant expertise in large-scale infrastructure projects including utilities, batteries, hospitals, advanced manufacturing (semiconductors, biotech) and data centres. Few businesses can deliver said projects to the specified safety and time requirements, creating large barriers to entry for new competitors to win contracts.

We have harped on previously about the generational underinvestment in infrastructure, and this is best illustrated by the current state of the US power grid. The North American Electricity Reliability Association highlights several large and notable parts of the US at significant risk of power outages including vast swathes in the middle, east and west coast. The body notes that peak power loads are rising at an alarming rate, primarily due to the introduction of intermittent generation (solar, wind) in addition to nuclear and fossil retirements which account for 7% of existing installed capacity.

As a contractor of choice, EMCOR well well-positioned to benefit from the need for more robust power grids to support populations and the energy transition. The reshoring of critical industries such as semiconductors, supported by the recent Inflation Reduction and CHIPS Acts will also bolster demand for specialist construction services. Put simply, EMCOR is an established contractor ready to deliver and benefit from future infrastructure projects.

3. ZOZO Inc

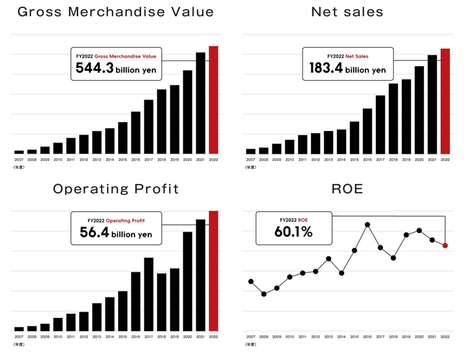

ZOZO Inc (TYO: 3092) is the largest online fashion retailer in Japan. The ZOZOTOWN website operates a consignment model, where retailers open a virtual store and inventory is held and sent from ZOZO distribution centres. The website currently has over 1,500 stores offering 8,400 brands. The retailer has built tremendous brand loyalty, with most sales to repeat customers who have purchased within the last twelve months. The business has used this to launch new initiatives such as ZOZOCOSME for cosmetics, ZOZOSHOES for shoes and a growing advertising business. ZOZO also owns WEAR, a popular app with 16 million downloads that allows users to post and search outfits.

Unlike most online retailers, which are at best breakeven or more commonly losing money, ZOZO has been profitable for several years. Last year, ZOZO recorded $580 million in operating profits. Japan is an incredibly attractive market for investors owing to the recent shift towards shareholder-friendly practices. ZOZO recently increased its dividend policy from 50% of profits to 70%, in addition to buying back shares.

Despite online penetration remaining below other developed countries – likely owing to Japan’s older population demography – we expect ZOZO to continue to take market share and retain its title as the go-to destination for online fashion.