Broadly speaking, there are four ways to make money:

1. Work for someone – get a job on PAYG, earn 10% super and kick your feet up 4 weeks of the year plus… cough cough… a few days of sick leave. Low stress. Very little flexibility (e.g. can’t pick your team or what your week looks like). And capped upside. But a good wage is probably $100,000 + benefits, and that’s a great life.

2. Become a contractor – you’ll earn more every hour as a contractor, but work isn’t guaranteed and you can forget about the Super thing (unless you set up a BPAY and claim a tax deduction via your Super fund… as I did for years). You’ll have moderate-high stress. Lots of flexibility. Upside is good, but still capped by your labour hours. You’ll probably need to invoice $130,000 every year to have the same benefits as a PAYG earning $100,000.

3. Run your own business – employ people, but prepare for more stress. Also don’t forget the statistics, around half of businesses fail at year 5. But no-one, as far as I’m aware, has ever made the Forbes Rich List without being involved in a business. Expect: High stress (while you scale). Limited flexibility (at first). High risk, upside is unlimited. According to ATO data, there are ~50,000 Aussies businesses generating between $2 million and $10 million per year.

“You have to deserve the life you want” – Charlie Munger

4. Invest in someone else’s business. Even in the FIRE (financial independence, retire early) community, a key ingredient is investing. Usually in a home (typically just to ‘get on the ladder’) then using the equity to reinvest in another property or shares. At the simplest level, you can invest $50 in BHP Group (ASX: BHP), a business someone else runs, a share ETF like Vanguard Australian Shares Index ETF (ASX: VAF), which is a collection of 300 big businesses, or a private business, such as your local bakery. This is the lowest effort, lowest-stress way of creating wealth, but the second-best way to grow seriously wealthy.

Jeff Bezos, founder of Amazon, is worth a jaw-dropping $196 billion but when he’s asked about his wealth he often says something like ‘I might be worth a lot of money, but Amazon has created hundreds of billions of dollars of wealth for other people. That’s what I’m most proud of.’

How I invested in the past

In the past, starting in my early 20s, I invested everything I could save from my wage into direct ASX shares. All types of weird and wonderful things. You name it, I tried it.

My first share was National Australia Bank (ASX: NAB). But my first real winner was Telstra Group (ASX: TLS) – believe it or not.

It took me a few years (maybe it was 2014) to see the writing on the wall and invest in my first ETF, for my mum. From memory, it was the iShares Global Healthcare ETF (ASX: IXJ).

(Don’t worry, her overall portfolio did better than mine.)

In 2017, I started Rask and my life changed.

Financially (massive cash outflows), personally (stress of a startup) and professionally.

As Rask grew – and I’m humbled because it has grown steadily over 6+ years – I could see so many emerging trends in the way people invested and consumed information. Newsletters, podcasts, video, shorter attention span services like Snapchat and Tiktok… now AI and augmented reality.

One blindingly obvious trend in finance was the emergence of ETFs, or Exchange-Traded Funds (ETFs). Today, over 2,000,000 investors have turned to ETFs.

Broadly speaking, compared to traditional stock picking, ETFs are lower risk, just as easy to trade as NAB shares and can be automated. As of January 2024, there are more than 300 ETFs here in Australia.

Finally, ETFs now cover all of the major asset classes I would want to build a core portfolio for creating wealth or to secure retirement, for the next 30-50 years, for our community.

A few years ago, Rask made the switch from shares to ETFs for our primary focus. It’s been one way ever since.

We still do direct shares/company research – analyst stock reports are all included for free inside Rask Core – but our focus is our Core ETF portfolios.

How I’m invested going forward

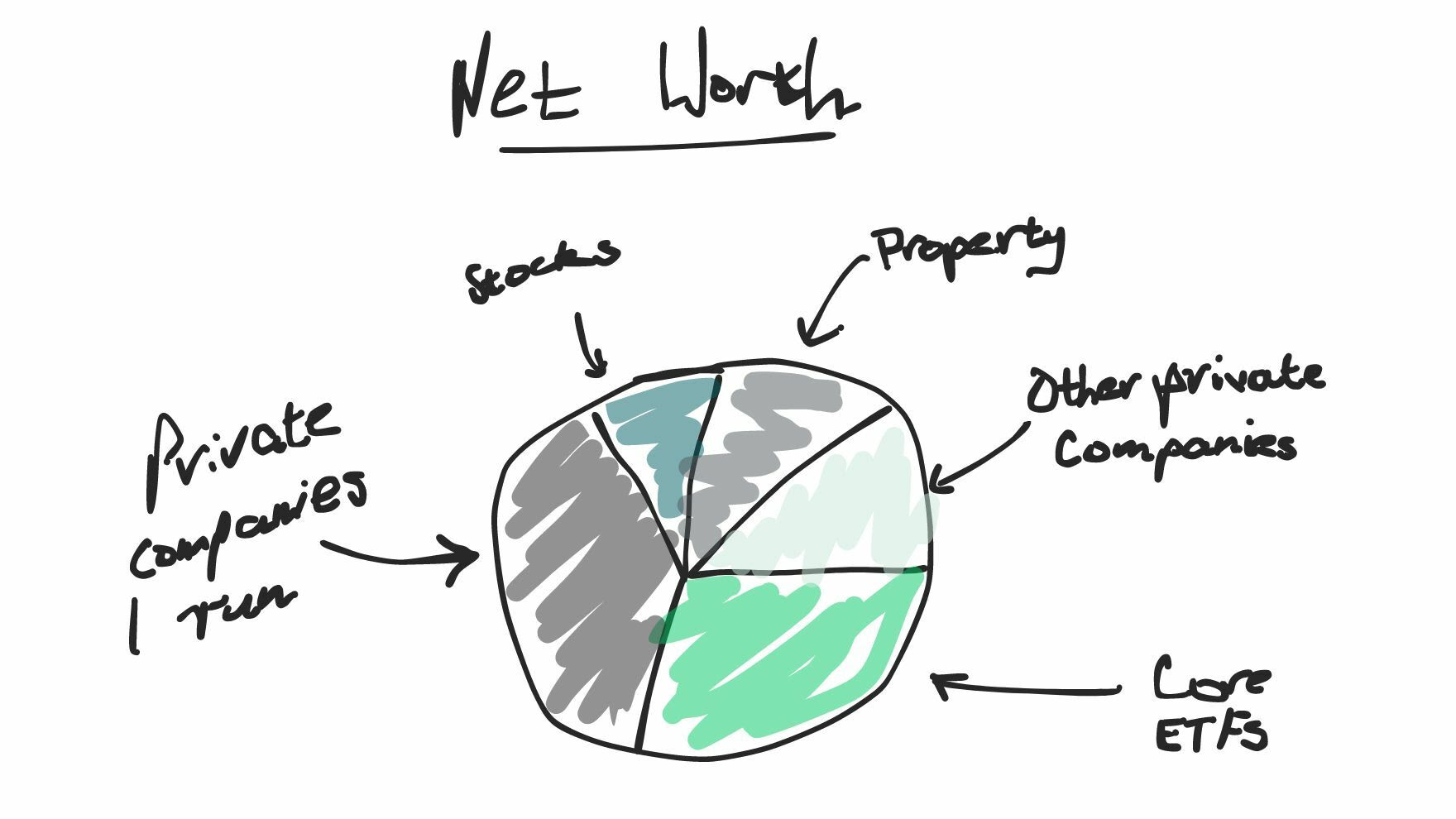

Right now, the overwhelming majority (maybe 90%) of my personal net worth is tied up in shares of private companies (companies not on a stock exchange). Mostly that’s in shares of The Rask Group.

However, after attracting 150,000+ unique podcast listeners, enrolling over 25,000 Aussies in free courses, running our membership for 4,000+ investors, and [INSERT BIG NEWS COMING THIS MONTH], I can feel that we’re finally at an inflection point with Rask’s growth…

We’re going to grow faster, with less effort, thanks to inertia, our team and your support in referring friends and family to Rask.

That means, after years, I reckon I’ll be investing more in 2024.

Inside my share portfolio, I recently sold over 90% of my direct stocks.

As I told Rask Core members a few months ago, I recently sold most of my beloved stocks, like Xero (ASX: XRO) and others.

Why?

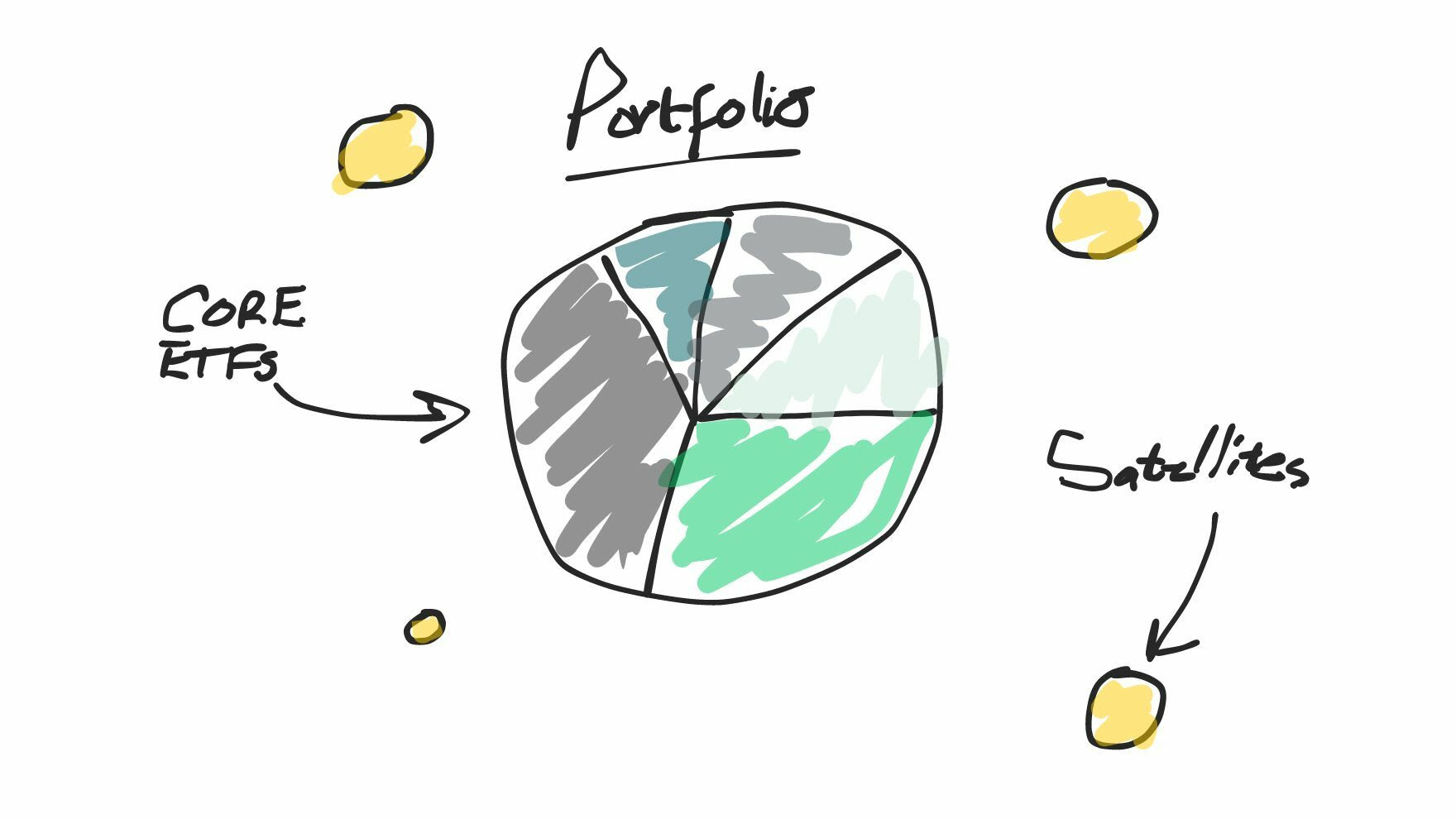

I’m migrating the overwhelming majority of my portfolio just to ETFs (active AND passive).

And going forward, by June this year, I reckon 80% or more of our monthly household savings will go into the new Rask portfolios, which are built using only ETFs [TBA – coming soon].

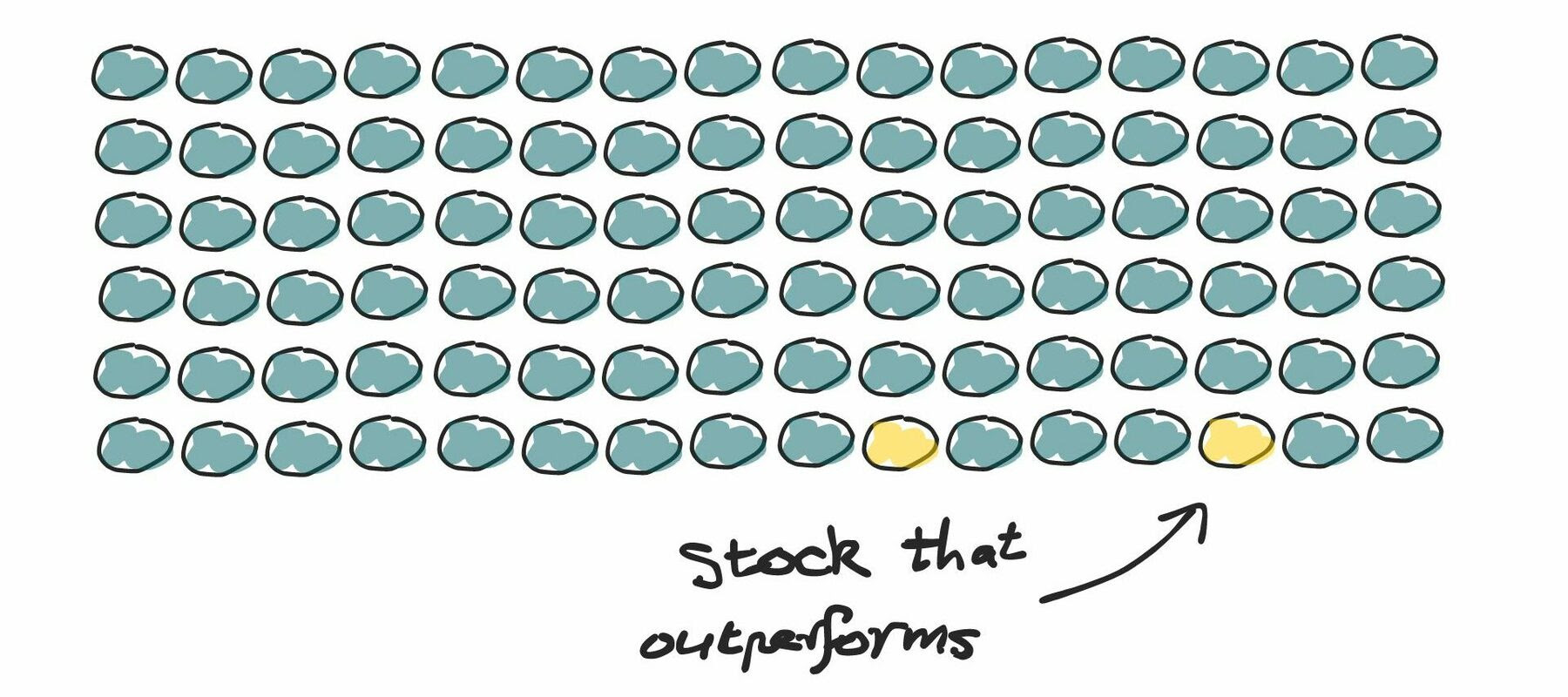

The other 20% of our savings will likely go into direct stocks. Stocks we outline inside Rask Core (our long running membership). A classic Core & Satellite approach.

(For individual stocks, the team and I are extremely picky. This part of my personal portfolio will only be reserved for the world beaters. For the game changers. The Gorillas. For the All Stars. Companies like REA Group (ASX: REA) – owner of realestate.com.au – 10 years ago. Or Pro Medicus (ASX: PME) a 1,225% multibagger we picked for Rask 1.0 followers back in 2018. But I digress…)

As of 2024, I’m now blessed in that I’m not restricted by my salary as I once was. And through our business we can also reinvest. And, of course, distributions from ETFs I own will also be automatically reinvested. DRPs or not.

How I plan to invest in the future

In all, 10 years from now, I’d expect my portfolio to look something like this…

Please note: There are many reasons I see ETFs playing a bigger role in my stock market portfolio. Many of which I first laid out, in detail, many years ago. You can find a page dedicated to the Rask philosophy and 10 rules of wealth.

Zooming out, my overall net worth will probably look something like this:

Note: This is just a rough approximation. It changes frequently. Keep in mind, an IRS study once found that the average millionaire has 7 sources of income.

As you can see, my strategy is a broad one. Some people would consider it as high risk.

You wouldn’t need to go to this extreme to retire on your own terms (wealthy, early, or both).

However, the thing that I love about our financial structure is my affairs will, one day, enable me to have absolute autonomy over how I spend my time and generate bucket loads of passive income.

I don’t say that with ego. In fact, none at all. 9/10 of Rask community members also identify passive income as their #1 goal. And it’s absolutely achievable with focus.

As Morgan Housel once said, financial freedom means spending your time how you want, when you want, with who you want.

Being a business owner enables many of those perks – provided you are diligent in how you do it. But it can be a hellish road, for sure (for those of you who don’t know, I also coach business owners… so I know for sure it’s not just me!).

Even if you don’t fancy going down a stressful route like starting a business as I did, you can still achieve financial independence – provided you escape from relying on your salary to create wealth AS SOON AS POSSIBLE. Property, $500 in shares, $50 in ETFs, $27,500 per year into Super, a business… it doesn’t matter – just do SOMETHING.

In summary, there are four ways to make wealth for you and your family. The longer you sit and rely on option 1, the harder it’ll be.

Right now you can:

- Invest as little as $50 using some of the most popular brokerage platforms in Australia like Raiz, Pearler (disclosure: Pearler is a current long-term sponsor of our Finance podcast), Sharesies, Commsec Pocket, and more.

- Enrol in one of a dozen free finance courses on Rask Education – we have lots of courses for beginners.

- Invest in your knowledge via free podcasts or newsletters (like this one), or a membership, while you focus on paying down debt or work through relationship or personal challenges.

***

In the next few weeks, I’ll be emailing all free Rask newsletter readers about how all of the topics in this email come together.

For months, we’ve been toiling behind the scenes and I’m so excited to share all of that with you.

Also, in a couple of weeks I will be sharing a very special LIVE event with you: My top 10 shares and ETFs for 2024 & beyond.

Stay tuned and thank you for supporting Rask over many years.

If you have any questions or advice for me (very welcome), please jump into the forums inside Rask Core (membership required) or shoot me a message on Twitter (beware impersonators).

Vale Charlie Munger.

Thanks for being part of Australia’s best* investment, news and financial education network.

Onwards and upwards!

Chief Investment Officer

P.S. soon, you’ll be able to invest directly with me. Learn more about Rask Invest.