Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.39% to 7,763.70.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

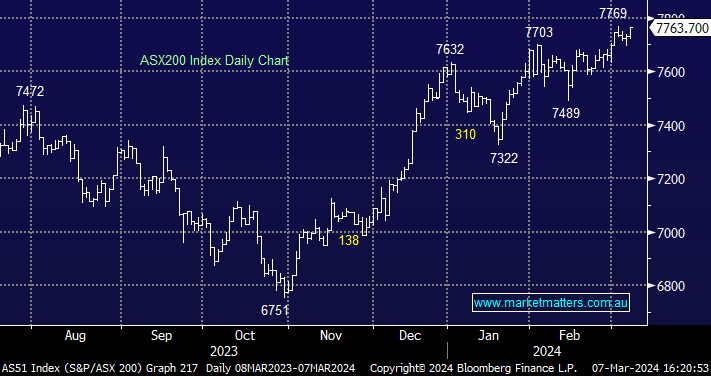

The highest-ever close for the ASX200 today at 7763, particularly impressive with BHP and Woodside trading ex-dividend! Strength was broad-based, more than 150 stocks in the 200 closed higher as we continue to bask in the glory of a supportive economic and monetary policy scenario, for now at least!

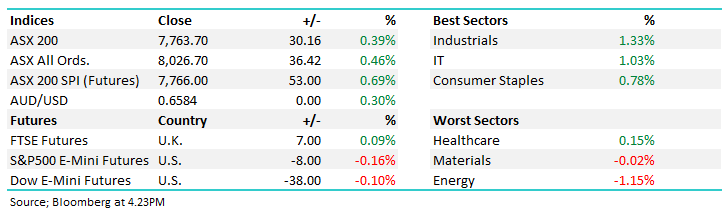

- The ASX 200 added +30pts/ +0.39% to 7763.

- Industrials (+1.33%) a standout, IT was solid (+1.03%) while Staples (+0.78%) improved

- Energy (-1.15%) and Materials (-0.02%) hurt by large weights trading ex-dividend.

- Portfolio Performance has been updated in the portfolio section of the website for the published (website) portfolios, and we’ll cover this in a video tomorrow.

- The ASX 200 Accumulation Index was up 0.8% in Feb, the standouts for us were the Active Growth Portfolio +1.7% and the Emerging Companies Portfolio +3.69%.

- The International Equities Portfolio +2.82% was positive but lagged its benchmark and so too did the Active Income Portfolio -1.33%.

- The Core ETF Portfolio we launched in April 2023 is gaining a solid track record, ahead of its benchmark on all time frames, up +1.16% in February and up 7.37% since inception.

- UBS has turned from uber bear (and right) on Zip Co Ltd (ASX: ZIP) to the most bullish in the market with a buy and $1.43 PT, although it rallied +7.69% today to close at $1.26, not far off.

- Resmed CDI (ASX: RMD) +5.45% caught our eye today after pulling back throughout February in a constructive pattern, the release of the AirFit 40, an ultra-compact full face mask the catalyst. The stock looks very good here for another leg higher.

- BHP Group Ltd (ASX: BHP) -1.1%/49c fell in price terms but traded ex-dividend for $1.10 + franking, worth $1.57, so a solid session really.

- Deep Yellow Limited (ASX: DYL) were halted after announcing a $250m capital raise through Bells at $1.225, a very tight 3.9% discount. Proceeds used to fund the Tumas Uranium project in Namibia, and it was well understood they needed the cash.

- PEXA Group Ltd (ASX: PXA) +0.88% announced a few changes to the structure, PEXA is bringing in country heads for Australia & the UK alongside some slight changes to the executive set-up. Small, but likely to improve execution.

- GQG Partners Inc (ASX: GQG) +2.75% saw $US1.1b of inflows in Feb while performance added a further ~$US9.5b FUM grew to $US137.5b.

- Gold edged higher in Asia today, up another $US8 to $US2156 – momentum continues to build.

- Iron Ore was up ~1% in Asia today – a better session after recent weakness.

- Stocks in China were off 0.10% while Hong Kong was down -0.5%

- US Futures are lower, down ~0.20%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

• MMG Raised to Buy at Huatai Research; PT HK$2.90

• National Tyre & Wheel Ltd (ASX: NTD) Cut to Speculative Buy at Taylor Collison

• Zip Co. Raised to Buy at UBS; PT A$1.43

• Accent Group Ltd (ASX: AX1) Raised to Neutral at UBS; PT A$2.05

• Liontown Resources Ltd (ASX: LTR) Cut to Neutral at UBS; PT A$1.40

• IGO Ltd (ASX: IGO) Cut to Sell at UBS; PT A$7.65

• PYC Therapeutics Ltd (ASX: PYC) Rated New Overweight at Wilsons

• Ingenia Communities Group (ASX: INA) Raised to Accumulate at CLSA; PT A$5.51

• Charter Hall Long WALE REIT (ASX: CLW) Raised to Accumulate at CLSA; PT A$13.74

• Arena REIT No 1 (ASX: ARF) Raised to Overweight at Barrenjoey; PT A$3.75

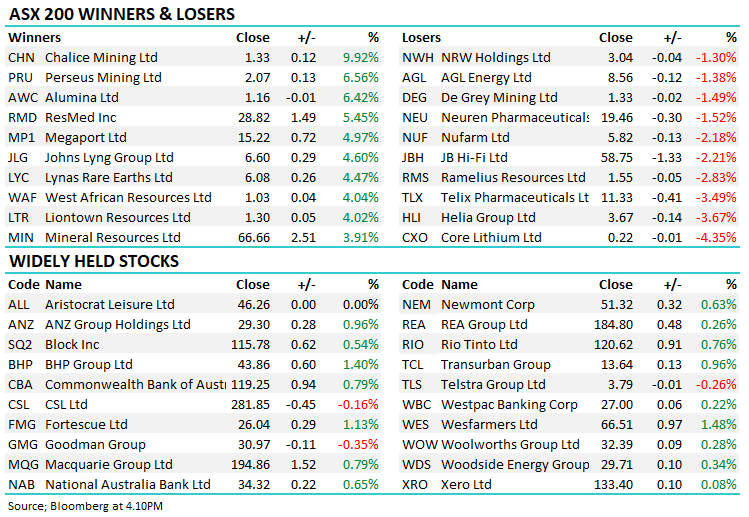

Movers & Losers