Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.07% to 7,847.00.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Another new all-time high on a very bullish Friday, the ASX 200 trading above 7800 for the first time, as the banks continue to drive gains at the index level.

CY24 to date, the ASX is now up 3.4% excluding dividends as the ‘Goldilocks’ scenario for stocks seems to be playing out.

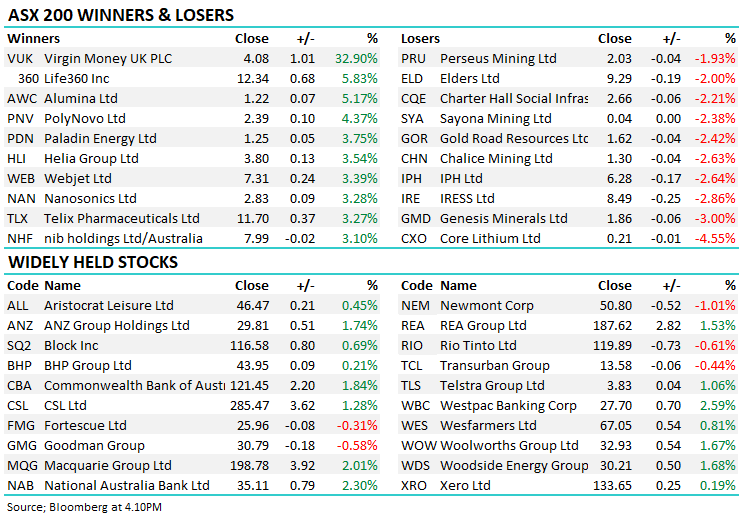

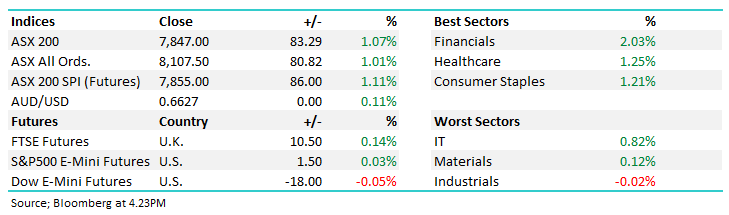

- The ASX 200 added an impressive +83pts/ +1.07% to 7847.

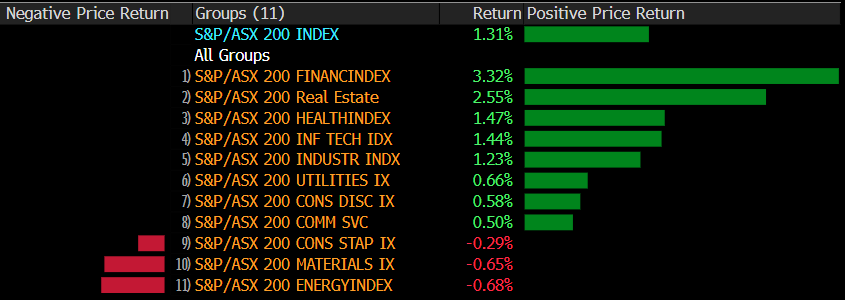

- Financials (+2.03%) a standout, Healthcare was solid (+1.25%) while Staples (+1.21%) improved

- Industrials (-0.02%) the only sector to fall (just) while Materials (+0.12%) and IT (+0.82%) underperformed.

- For the week, the ASX200 had a total return of 2.04% (lots of dividends), while the Small caps outperformed, adding 2.4%.

- Virgin Money UK CDI (ASX: VUK) +32.9% surged after a takeover bid from National Building Society at 220pence, equivalent to ~$4.20/sh in cash which was a 38% premium to yesterday’s close. The deal would create the UK’s second-largest deposit taker and mortgage provider.

- Whitehaven Coal Ltd (ASX: WHC) -1.4% dipped as the proposal to buy Daunia & Blackwater mines became unconditional – should complete in the next month or so.

- Paladin Energy Ltd (ASX: PDN) +3.75% said they would seek shareholder approval for a 1 for 10 share consolidation, hoping to appeal to more international investors who tend to look past lower-priced shares.

- Sandfire Resources Ltd (ASX: SFR) -1.62% fell on a broker downgrade, Jarden cut to hold with a bearish $6.50 price target. Interesting to see UBS go the other way this week, upgrading their PT to $8.85. SFR closed at $7.88.

- In the UBS note they did some sensitivity analysis around value at various price points for Copper. At US$4.5/lb (currently $US3.92), SFR is worth ~$11.50 and at US$5.00/lb, SFR is worth just shy of $15.00, according to UBS.

- Commonwealth Bank of Australia (ASX: CBA) +1.84% traded above $120 / $121.45 close for the first time, leading a strong day from the banking sector that enjoyed the VUK bid and positive comments from Jarden, “We see scope for further upgrades ahead as consensus reduces bad and doubtful debt forecasts, upgrades credit growth and if funding costs remain well behaved.”

- Kogan.com Ltd (ASX: KGN) +1.34% the CFO sold ~40% of his holding in the ecommerce business to “diversify” his holdings. Shares were undeterred.

- SRG Global Ltd (ASX: SRG) +0.65% a small $35m contract win with BlueScope Steel Limited (ASX: BSL), $35m over 2 years for remediation and extension works to a wharf.

- Stocks in Asia were higher Hong Kong +1%, Chinese equities added +0.12%, while Japan was up +0.76%.

- US Futures are largely flat.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week (excluding dividends) – Source Bloomberg

Stocks this week (excluding dividends) – source Bloomberg

Broker Moves

- Sayona Mining Ltd (ASX: SYA) Raised to Speculative Buy at Canaccord Genuity Group Inc (TSE: CF)

- Sandfire Cut to Neutral at Jarden Securities; PT A$6.50

- 29Metals Ltd (ASX: 29M) Cut to Neutral at Jarden Securities

- WA1 Resources Ltd (ASX: WA1) Rated New Speculative Buy at Bell Potter

- Nufarm Ltd (ASX: NUF) Cut to Hold at Bell Potter; PT A$6.35

Movers & Losers