Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -1.82% to 7,704.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

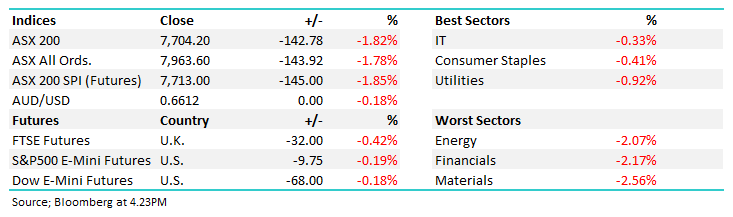

A few cracks appeared in equities today, the index giving back all of the gains banked from last week and peeling back from all-time highs. It was a broad sell-off for the market, with all sectors closing lower in the ASX200’s biggest drop since 10 March 2023, a year ago almost to the day.

- The ASX 200 finished down -142pts/-1.82% at 7733.

- The Tech sector held up the best (-0.33%) while Staples (-0.41%) also outperformed.

- Materials (-2.56%), Financials (-2.17%) and Energy (-2.07%) lagged.

- The Big 4 Banks took off ~40pts today, BHP Group Ltd (ASX: BHP) knocked off -17pts by its own hand while Fortescue Ltd (ASX: FMG) (-8pts) and CSL Ltd (ASX: CSL) (-6pts) also chipped in, the later also trading ex-dividend today.

- Victoria, SA & Tas on a Public Holiday meant there was little appetite to fight the trend which was set early. The market finished ~1% lower than the pre-market SPI futures implied, rolling off with little resistance.

- Pretty limited day in terms of news flow as a result of the Public Holidays as well.

- Worley Ltd (ASX: WOR) -1.9% announced a few new contracts including a deal with Shell for their Holland Hydrogen 1 plant as well as an extension so their deal with Aramco for a further 5 years. Margins on these deals are the key now.

- Deep Yellow Limited (ASX: DYL) -4.71% emerged from a trading halt after raising $220m to advance their Tumas Uranium project in Namibia. A further $79.5m is expected to be raised following a shareholder vote, alongside a $30m Share Purchase Plan for holders.

- Regional Express Holdings Ltd (ASX: REX) +5.06% jumped on a partnership deal with Etihad to connect into international flights from Sydney or Melbourne.

- Iron Ore was weaker in Asia, down 0.76%.

- Gold was up marginally, just +US$2, trading at US$2181 at our close.

- Asian stocks were mixed. The Nikkei 225 (INDEXNIKKEI: NI225) struggled, down -2.89% on the back of strength in the Yen. The BOJ is one only a handful of central banks that is looking at hiking rates.

- Elsewhere Hong Kong was up +1.26% and Chinese stocks added +0.20%.

- US Futures are weaker, S&P 500 (INDEXSP: .INX) futures -0.18%, Nasdaq Composite (INDEXNASDAQ: .IXIC) faring worse off -0.3%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

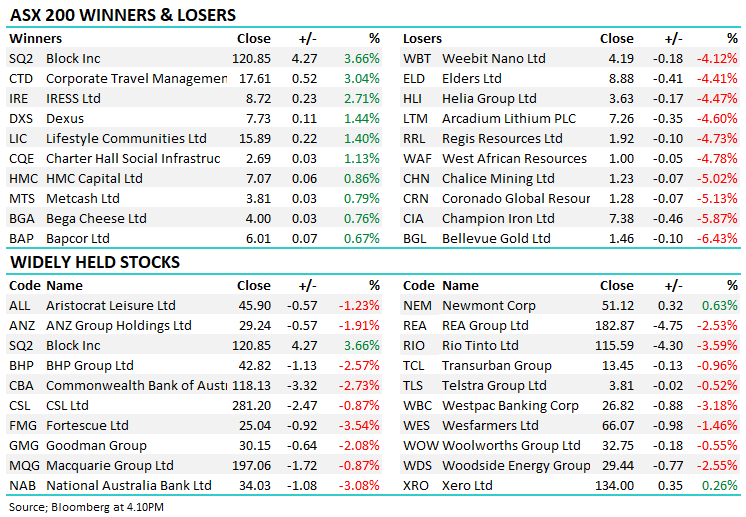

Broker Moves

Major Movers Today