David Bassanese of Betashares gives us the current market update for both S&P/ASX 200 (INDEXASX: XJO) and the S&P 500 (INDEXSP: .INX). Are these share prices undervalued?

Global markets

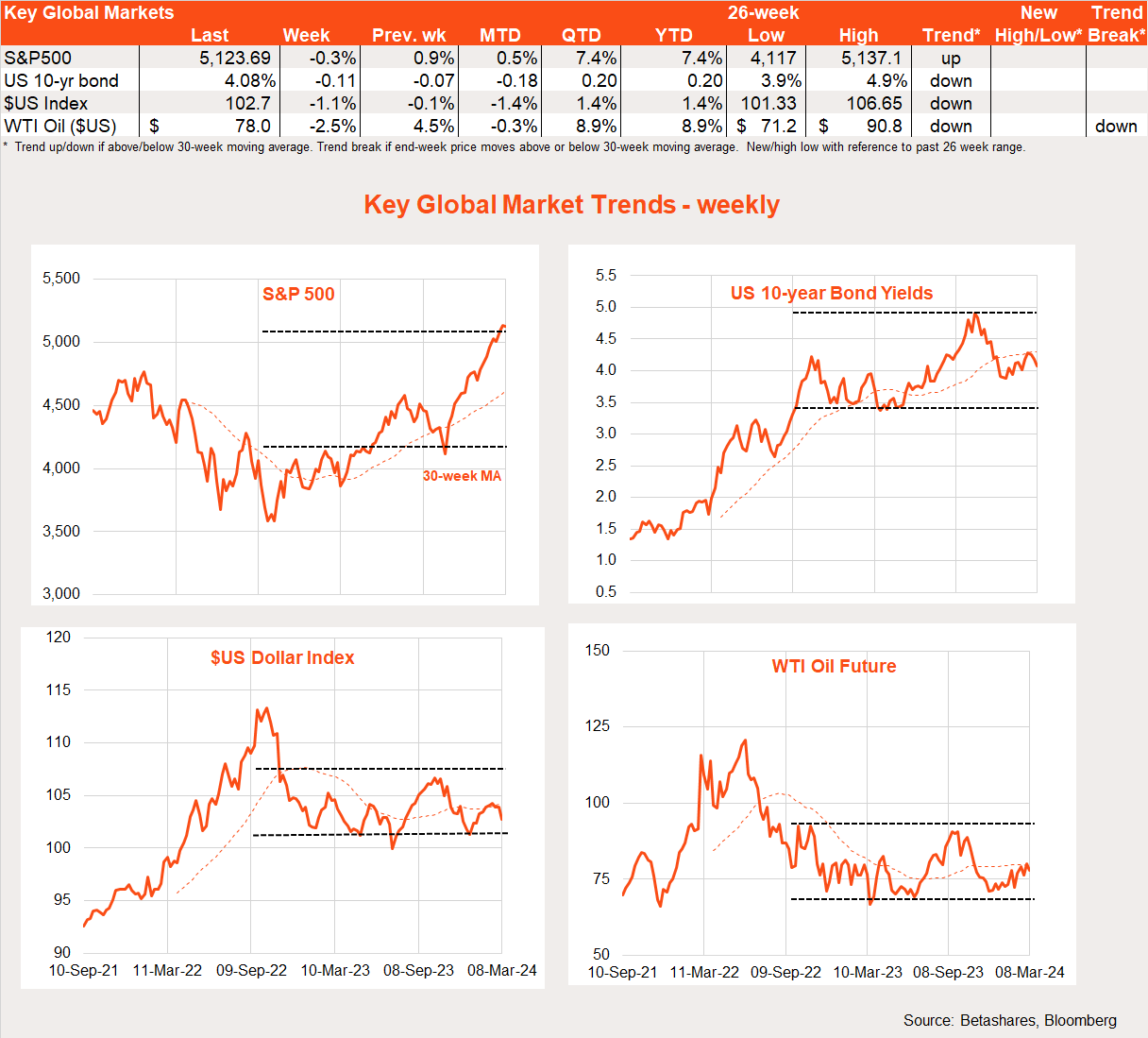

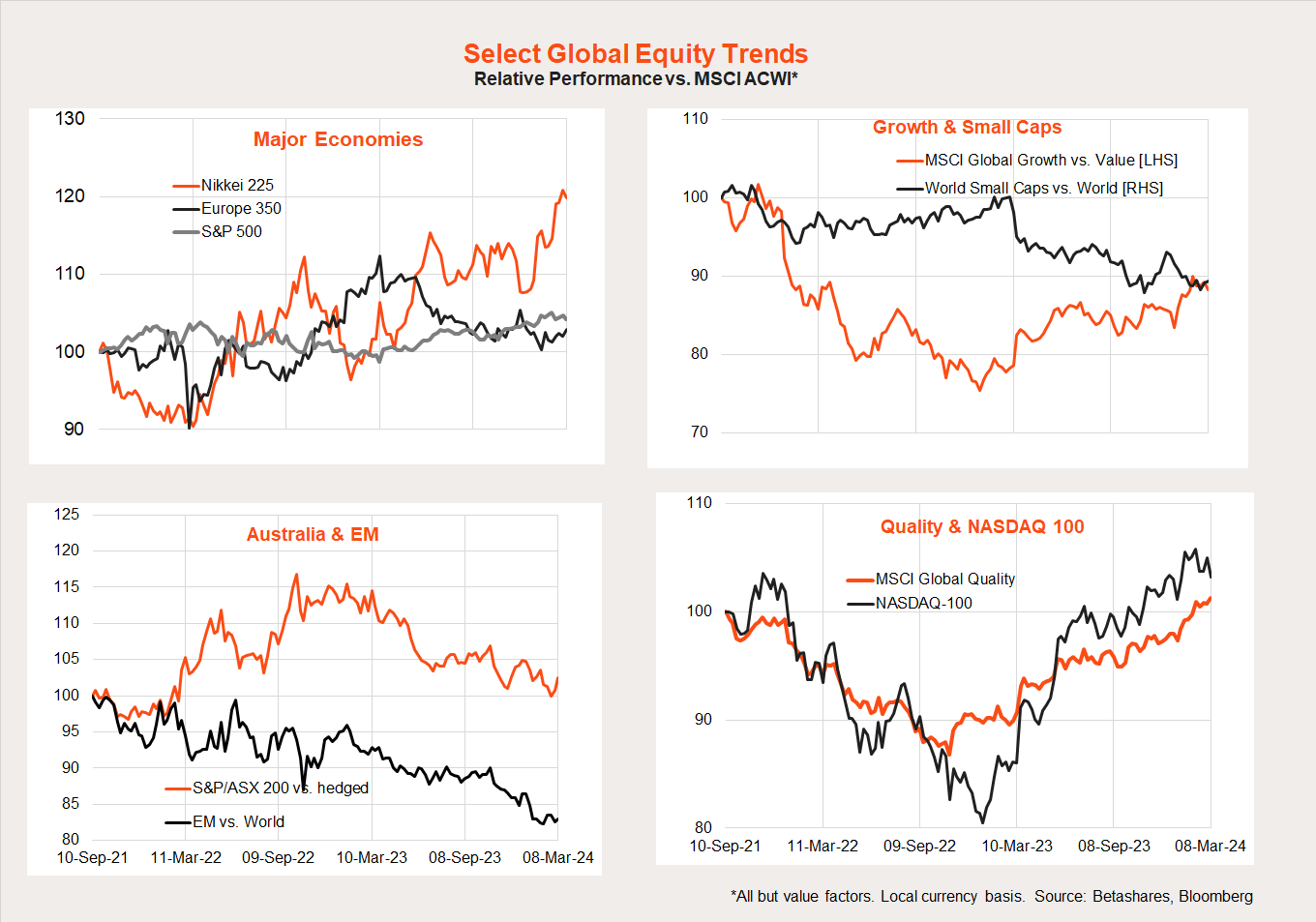

US stocks eased back a touch last week – despite generally encouraging events – suggesting the market is likely just experiencing an element of exhaustion.

Bond yields and the $US eased back reflecting dovish Fed commentary.

Indeed, the highlight last week was commentary from Fed chair Jerome Powell who went as far as to suggest the Fed was “not far” from being confident enough of sustained disinflation to cut interest rates. Markets rejoiced, pricing in a June rate cut with even greater certainty. The benign economic backdrop is also supporting gains in gold prices and bitcoin, both of which reached record highs last week.

Friday’s US payrolls result was a mixed bag, with stronger than expected employment growth yet a rise in unemployment and weaker than expected wage growth. The bottom line is that this combination of results points to still solid growth in labour supply – which is consistent with the “soft landing” scenario. Job vacancies also declined, broadly in line with expectations, but remained reasonably high.

In other news, China released a 5% growth target for 2024 – the same as last year. Despite widespread concerns over the Chinese economic outlook, few seem to think China won’t miraculously achieve its target once again!

What could spoil the party? In a word: inflation.

Last month, the US January consumer price index (CPI) report surprised on the upside, which markets were quick to dismiss as reflecting seasonal distortions. We’ll learn on Tuesday (US time) the extent to which this is true with the release of the February CPI report. Another upside surprise would be very unwelcome, denting the soft landing narrative of declining US inflation.

Based on market expectations, the February CPI is unlikely to be good enough to cause great celebration. Reflecting a lift in oil prices, the market expects the headline CPI to rise by a still firm 0.4% in February (from 0.3% in January), which would keep annual inflation steady at 3.1%. Perhaps of most importance, the core CPI (i.e. excluding food and energy due to their volatility) is expected to rise by 0.3%, down from 0.4% in January – which would allow annual core inflation to ease to 3.7% from 3.9%.

Other key US economic news this week will be retail sales on Thursday, with a 0.8% monthly bounce back expected after a surprise (likely seasonally distorted) slump in January.

Australian markets

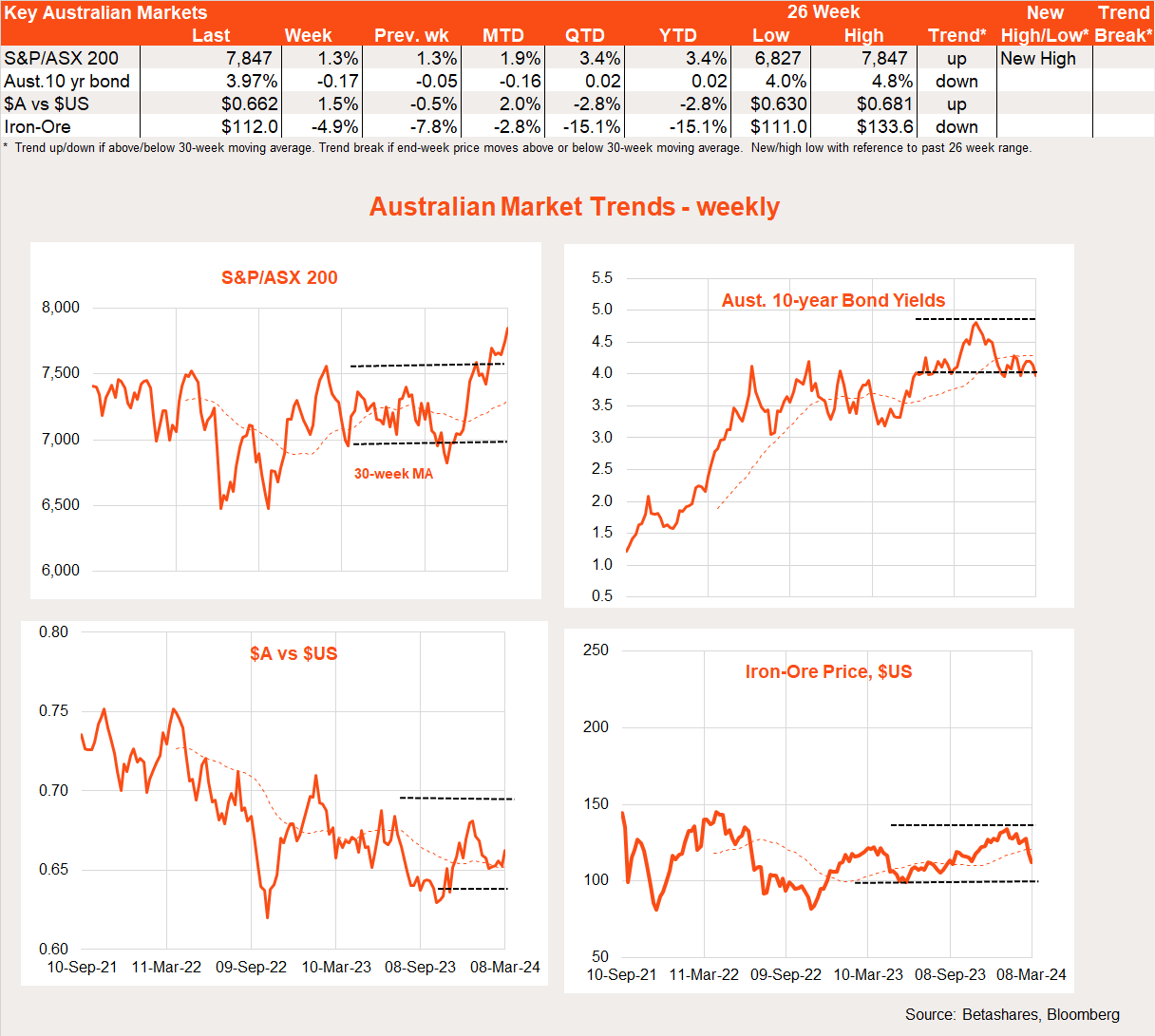

Heightened expectations of local rate cuts – reflecting a soft GDP result and the dovish Fed – saw the S&P/ASX 200 rally push on last week with another 1.3% gain and a new record high.

The $A also rose as the $US eased, despite a further pullback in iron-ore prices due to lingering China concerns.

The market has all but fully priced a rate cut by August, with a follow up rate cut by year-end.

The local highlight last week was the Q4 GDP result, which revealed continued sluggish economic growth weighted down by weak consumer spending. The economy grew a weaker than expected 0.2% (market +0.3%), with consumer spending up only 0.1%. Housing construction also dropped 3.8%. Offsetting this weakness was modest ongoing strength in non-residential construction.

Building approvals and the National Australia Bank Ltd (ASX: NAB) business survey – both due tomorrow – are the only local data highlights this week. Due to poor affordability and pull of labour and materials into non-housing construction, home building approvals are likely to remain soft – despite clear housing shortages around the country!

The NAB survey will be of interest given a recent waning of business sentiment to just below long-run average levels -as the persistent weakness of consumer spending starts to take its toll. Also of interest will be if signs of a pick up in pricing pressure in last month’s survey persists.

Lingering cost and price pressures – against the backdrop of still tight capacity – is a reminder that the economy likely needs to remain soft for a while longer to ensure continued disinflation.

Have a great week!