Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.11% to 7,712.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A far more stable session today after yesterday’s fireworks, the local market looked to recoup some of the pain of Monday’s trade early on.

The bounce didn’t last long though, up +32pts/+0.4% at its best early only on close just marginally higher – much of the headwind came from BHP Group Ltd (ASX: BHP) which hit its lowest level since May last year.

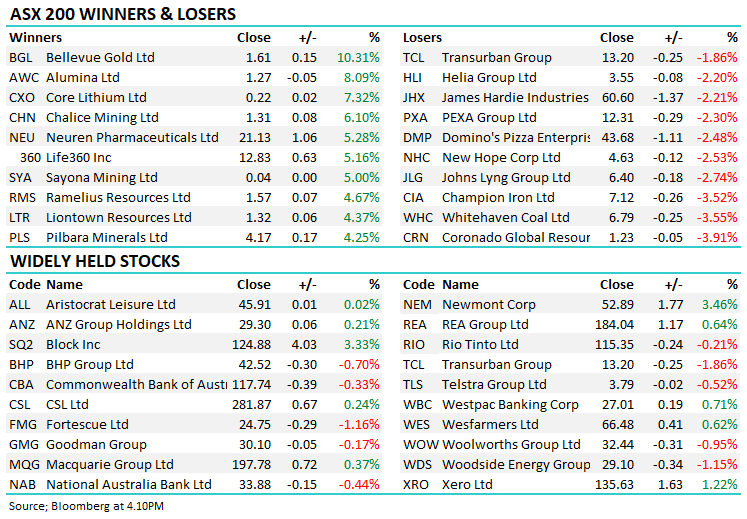

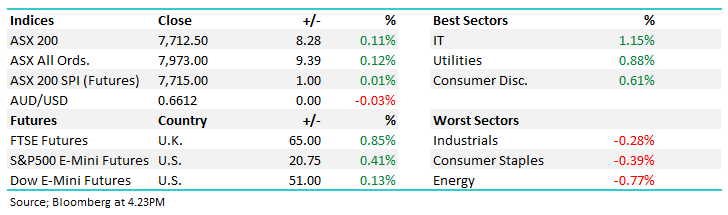

- The ASX 200 finished up +8pts/+0.11% at 7712.

- The Tech sector was best on Ground (+1.15%) while Utilities (+0.88%) & Consumer Discretionary (+0.61%) also outperformed.

- Energy (-0.77%), Staples (-0.39%), Industrials (-0.28%) and Telcos (-0.16%) were the four to finish lower.

- Alumina Ltd (ASX: AWC) +8.09% entered into a binding agreement to be taken over by Joint Venture partner Alcoa Corp (NYSE: AA). The deal at 0.02854 AA US shares for each AWC is worth ~$1.315/sh based on last night’s close.

- Metcash Ltd (ASX: MTS) +3.15% held an investor day today to cover off on their plans for the years ahead including the integration of Super Foods, a company they bought not long ago. The trading update was better than expected, total sales +0.9% for the first 10 months of the financial year. More on this in tomorrow’s AM report.

- Appen Ltd (ASX: APX) +29.52% has surged in recent weeks, the ASX sending out a please explain regarding the rally. We expect to hear more from the company tomorrow

- Bellevue Gold Ltd (ASX: BGL) +10.31% up on a strong production update, gold numbers up ~27% in Feb vs Jan with grades improving, on track to meet guidance as they ramp up production at Deacon.

- Pilbara Minerals Ltd (ASX: PLS) +4.25% signed a decent offtake agreement with China’s Yahua, up to 160kt in 2025 and 2026.

- Adairs Ltd (ASX: ADH) +8.23% up the Chairman resigning – the stock hit 2 year highs on Chenoweth’s departure…

- Gold was softened marginally, just -US$4/oz, trading at US$2177 at our close.

- Asian stocks were again mixed. The Nikkei 225 (INDEXNIKKEI: NI225) continues to lag, -0.4% today, joined in the red by China -0.25%. Hong Kong was better though, adding +2.1%.

- US Futures are stronger, S&P 500 (INDEXSP: .INX) futures +0.4%, Nasdaq Composite (INDEXNASDAQ: .IXIC) better at +0.6%.

- US Inflation data is in focus tonight, the market looking for Core +0.3% month on month, and Headline +0.4%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Zip Co Ltd (ASX: ZIP) Raised to Buy at Citigroup Inc (NYSE: C); PT A$1.40

- Regal Partners Ltd (ASX: RPL) Rated New Buy at Ord Minnett; PT A$3.60

- Ora Banda Mining Ltd (ASX: OBM) Rated New Buy at Moelis & Co (NYSE: MC)

- Transurban Group (ASX: TCL) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$13.69

- Proteomics International Laboratories Ltd (ASX: PIQ) Cut to Hold at Morgans Financial Limited; PT A$1.38

Major Movers Today