Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.22% to 7,729.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

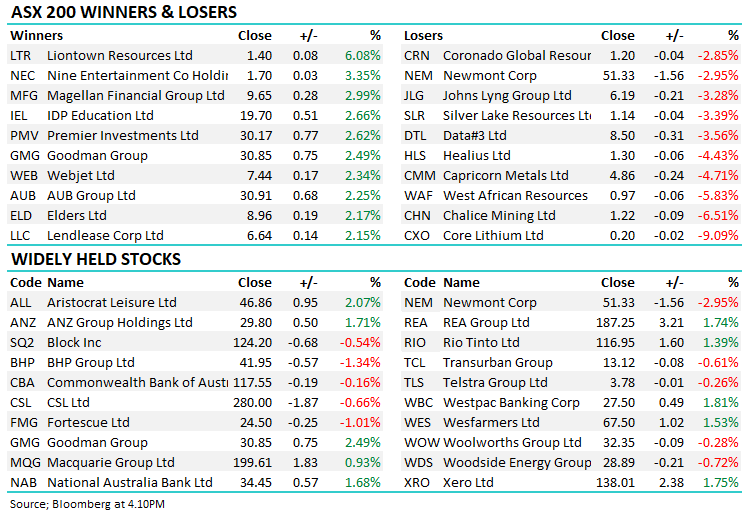

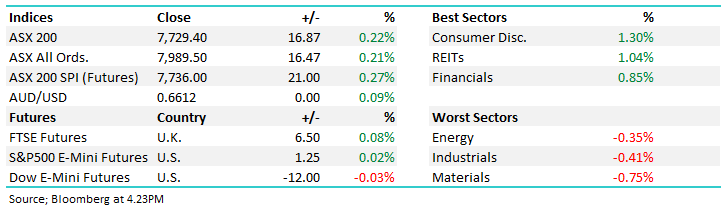

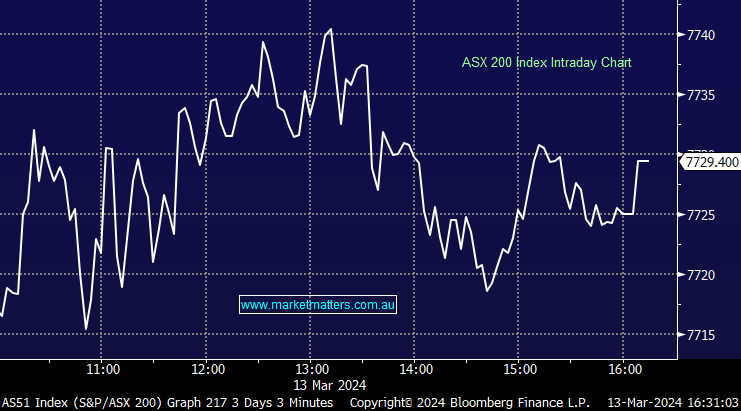

A choppy but mildly positive session with exactly half the stocks in the ASX 200 up, while half fell, the retailers attracted some buying into recent weakness while the material stocks remained on the nose despite a recent bounce in Chinese equities- BHP is back testing the bottom of its trading range ~$42.

- The ASX 200 added +16pts/ +0.22% to 7729.

- Consumer Discretionary (+1.30%) and Property (+1.04%) the standouts while Financials (+0.85%) also did well.

- Materials (-0.75%), Industrials (-0.41%) and Energy (-0.35%) weighed.

-

Treasury Wine Estates Ltd (ASX: TWE) +1.47% saw the best of it early up more than 4% on a draft determination from China that strongly implies wine tariffs will be removed.

-

Appen Ltd (ASX: APX) -10.23% fell after confirming a takeover approach, the news had clearly leaked yesterday with the shares being halted early afternoon after rallying ~30% to $1.075, the news this morning said a highly conditional offer had been received at an implied equity value of 70c. APX closed today at 98c, the market clearly thinking more will play out here but nice to see those trading on a rumour getting their fingers burnt…

-

Liontown Resources Ltd (ASX: LTR )+6.08% rallied after finalising a new $550m debt package, the stock was up ~18% early but tapered off from the highs. ~200m shares held short in this one which adds to the volatility.

-

Core Lithium Ltd (ASX: CXO) -9.09% went the other way as CEO Gareth Manderson stepped down – it doesn’t look like their NT mine will get off the ground.

- We had the PMs from WAM Capital Limited (ASX: WAM) in this morning discussing stocks and portfolio positioning. They were talking their book but they’re extremely bullish on small caps, and still think consumer discretionary is very cheap.

-

Macquarie Group Ltd (ASX: MQG)+0.93% traded above $200 for the first time since April 2022.

-

Regal Partners Ltd (ASX: RPL) +5.54% rallied on an initiation report from Ords with a buy rating and $3.60 PT. Hard to see any broker having anything but a positive recommendation on Regal. Closed today at $3.05.

- Gold was up $US2 in Asia, trading at $US2160/oz at our close, Gold stocks had a tough day given weakness overnight,

Evolution Mining Ltd (ASX: EVN) -2.45%, Newmont Corporation CDI (ASX: NEM) -2.95%.

- Iron Ore was off -0.75% at $US109.40

- Stocks in Asia were mixed, Hong Kong +0.4%, Chinese equities dipped -0.07%, while Japan was flat

- US Futures are unchanged.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

James Gerrish on Ausbiz

Portfolio Manager James Gerrish on Ausbiz this morning talking about Treasury Wines (TWE), Liontown (LTR) and Appen (APX).

Broker Moves

-

TASK Group Holdings Limited (ASX: TSK) Cut to Hold at Ord Minnett; PT 81 Australian cents

- Core Lithium Cut to Sell at Canaccord Genuity Group Inc (TSE: CF); PT 14 Australian cents

- Accent Group Ltd (ASX: AX1) Raised to Overweight at Morgan Stanley (NYSE: MS); PT A$2.45

- Metcash Raised to Outperform at Macquarie; PT A$4.30

- Metcash Raised to Buy at CLSA; PT A$4.60

- CSR Ltd (ASX: CSR) Cut to Reduce at CLSA; PT A$9

-

Brickworks Limited (ASX: BKW) Cut to Reduce at CLSA; PT A$31.60

- James Hardie Industries Plc (ASX: JHX) GDRs Cut to Reduce at CLSA; PT A$64.50

- Boral Ltd (ASX: BLD) Cut to Reduce at CLSA; PT A$6.25

- Telstra Group Ltd (ASX: TLS) Raised to Buy at Bell Potter; PT A$4.25

- Task Group Cut to Hold at Bell Potter; PT 85 Australian cents

- Omni Bridgeway Ltd (ASX: OBL) Cut to Speculative Buy at Taylor Collison

Movers & Losers