Patrick Poke of Betashares dives deep into world of uranium shares and tells us how changes in uranium demand affects their prices and distribution. How will these changes impact the current share market?

The uranium spot price rallied 107% in the 12 months to 31 January 2024, while uranium equities jumped 65.3% over the same period.

For those unfamiliar with the sector, it might appear as though the gains have already been made.

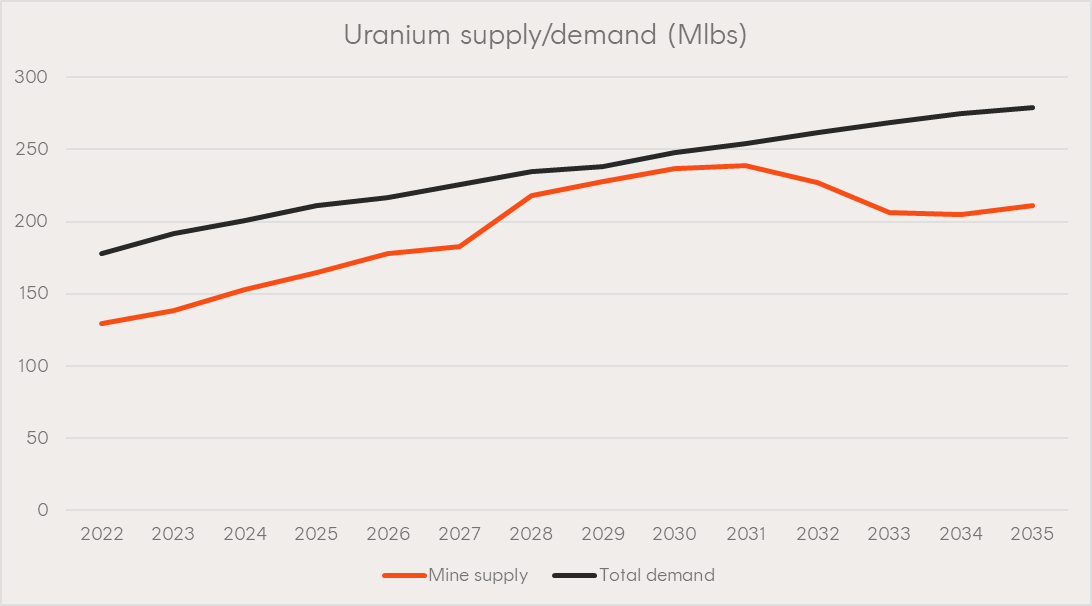

But with a shortfall in supply projected to last for several years, and rising demand as countries turn back to nuclear, further returns could lie ahead.

The uranium thesis in brief

The investment thesis for uranium is relatively straightforward, and at its core, a story of cyclicality like we’ve seen play out in many industries.

It’s a story of supply and demand.

But there are two key differences, which we’ll get to later.

The supply side story

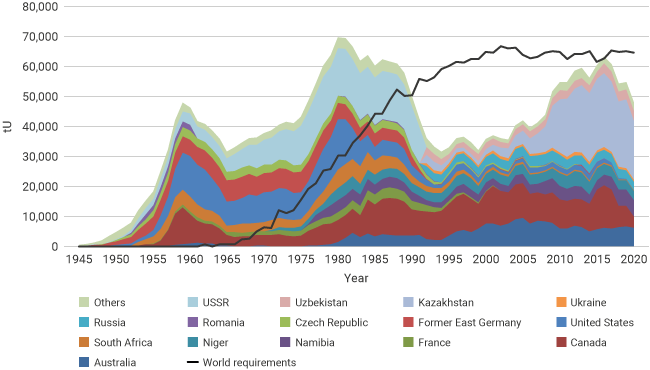

While the last uranium cycle ended in 2011, Kazakhstan, which had only recently entered as a major player, continued to ramp up production until a peak in 2016.

At this point, Kazakhstan accounted for nearly 40% of global production.

Global uranium production from mining

Prices bottomed in December 2016 at around US$17 per pound – from a high of over US$112 per pound in 2007. Low prices disincentivised supply, and mine production had fallen by nearly 25% by 2020.

The uranium price slowly improved, until the second half of 2021, when the price increases gathered pace.

This is normally the part of the story that we’d start to see new supply come online, incentivised by higher prices.

One key difference

In uranium mining, bringing on new supply is not easy.

A handful of companies which had existing mines that had been shut down, and were preparing years in advance, are bringing supply to market. But these projects are not enough to bridge the gap.

The largest producers have promised to increase supply yet have repeatedly faced delays and missed targets.

For new projects to come online, the International Atomic Energy Agency estimates a typical 10 to 15 years of lag time. There is no great surge in production waiting to take advantage of higher prices.

The demand side story

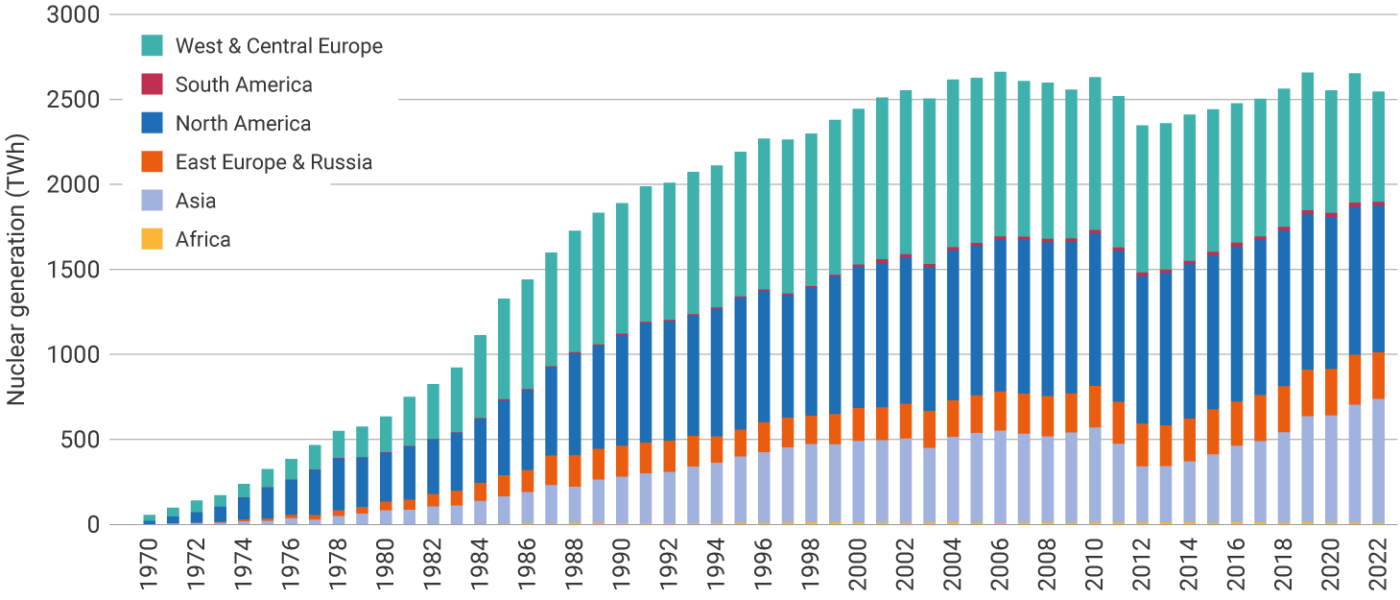

Following the disaster at Fukushima Daiichi Nuclear Power Plant in 2011, Japan suspended operations at most of its nuclear fleet. Parts of Europe and the US also saw opinions turn against nuclear. Some countries, such as Germany, chose to shut down operable reactors. Others chose to allow them to run to their end of their lives, but not repair or replace them.

Despite this, nuclear power generation actually rose globally from 2012 to 2020, as China’s expansion of nuclear more-than offset the loss of capacity elsewhere.

Nuclear electricity production

Another key difference

In most industries, an increase in prices will result in reduced demand. For example, when cobalt prices skyrocketed in 2021, battery manufacturers began to look at alternative battery chemistries that used less cobalt.

This is not the case for nuclear.

For starters, uranium is not even the only input cost for nuclear fuel, let alone the plant’s overall running costs.

Uranium needs to go through conversion, enrichment, and fabrication before it can be used as fuel.

In 2021, uranium accounted for around 51% of the total cost of fuel, which in turn accounted for around 20% of total generation costs. It should be noted that uranium costs have since risen significantly.

But more importantly, there is no alternative to uranium.

Utilities must purchase it to keep running their reactors.

Recent developments

In the last few years, opinions about nuclear have begun to change in the West. Why? Climate change.

Nuclear energy generation creates no CO2, and can reliably produce a consistent amount of electricity, day or night, regardless of weather conditions.

In December 2023, 28 counties including the US, Canada, Japan, France, South Korea, the UAE, and the UK, pledged to triple nuclear energy production by 2050.

2023 saw new grid connections for reactors in China, Slovakia, the US, Belarus, and South Korea, while 16 new reactors are scheduled to come online in 2024 across Bangladesh, China, France, India, South Korea, Slovakia, Turkey, the US, and the UAE.

On the supply side, although there are a small number of mines due to come online in the immediate future, these are small relative to the overall market.

Boss Energy Ltd’s (ASX: BOE) Honeymoon Project, for example, plans to produce 2.45Mlbs of U3O8 per annum, compared to around a projected 153Mlbs of global mine supply in 2023 – approximately 1.6% of the total.

In January, Joint Stock Company National Atomic GDR (OTCMKTS: NATKY), the world’s largest producer, announced that it would not complete its planned increase in production in 2024.

Kazatomprom had been producing at 80% of capacity, but planned to increase to 90% of capacity in 2024.

Due to a shortage of sulphuric acid, the planned increase will not occur this year.