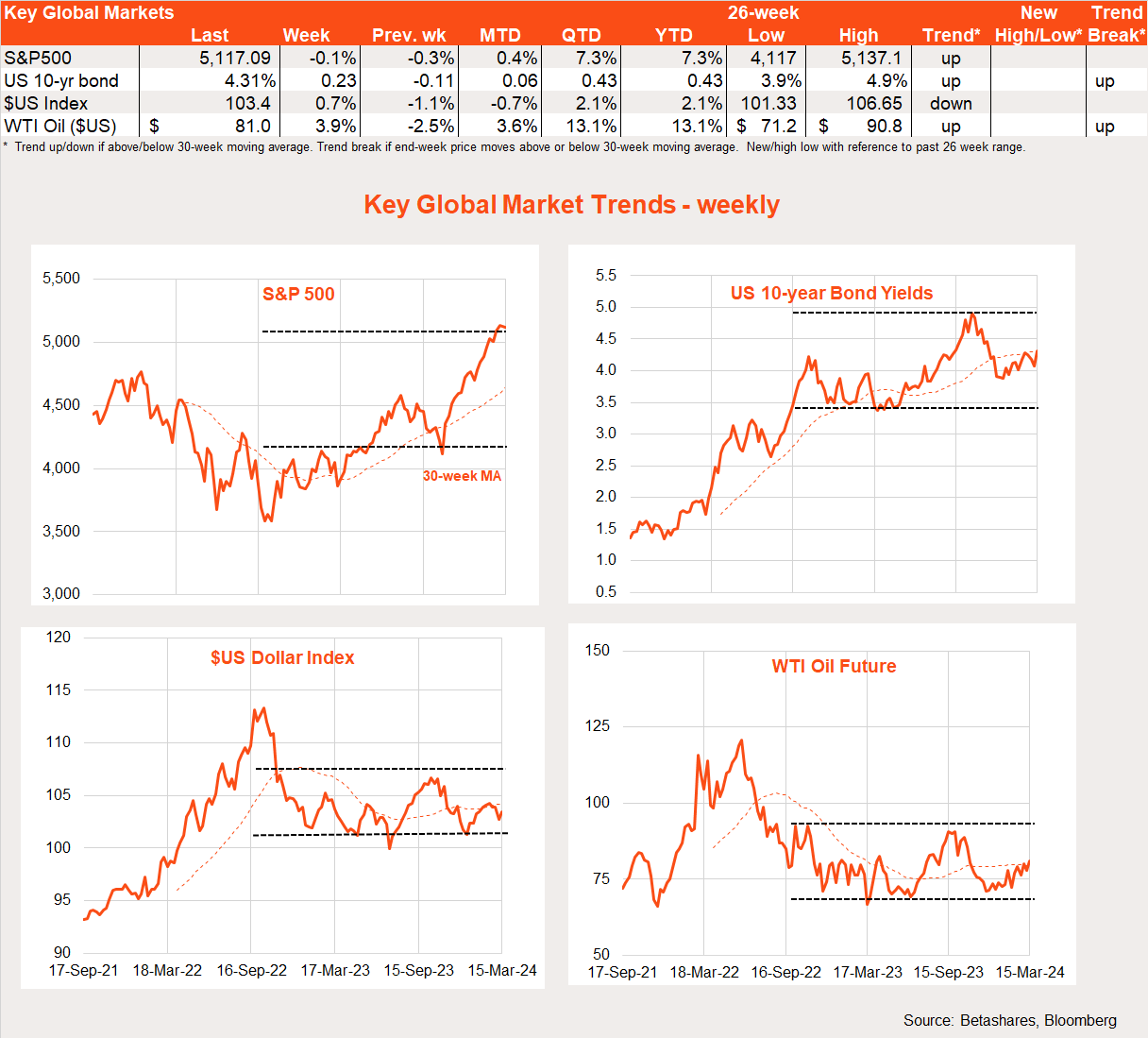

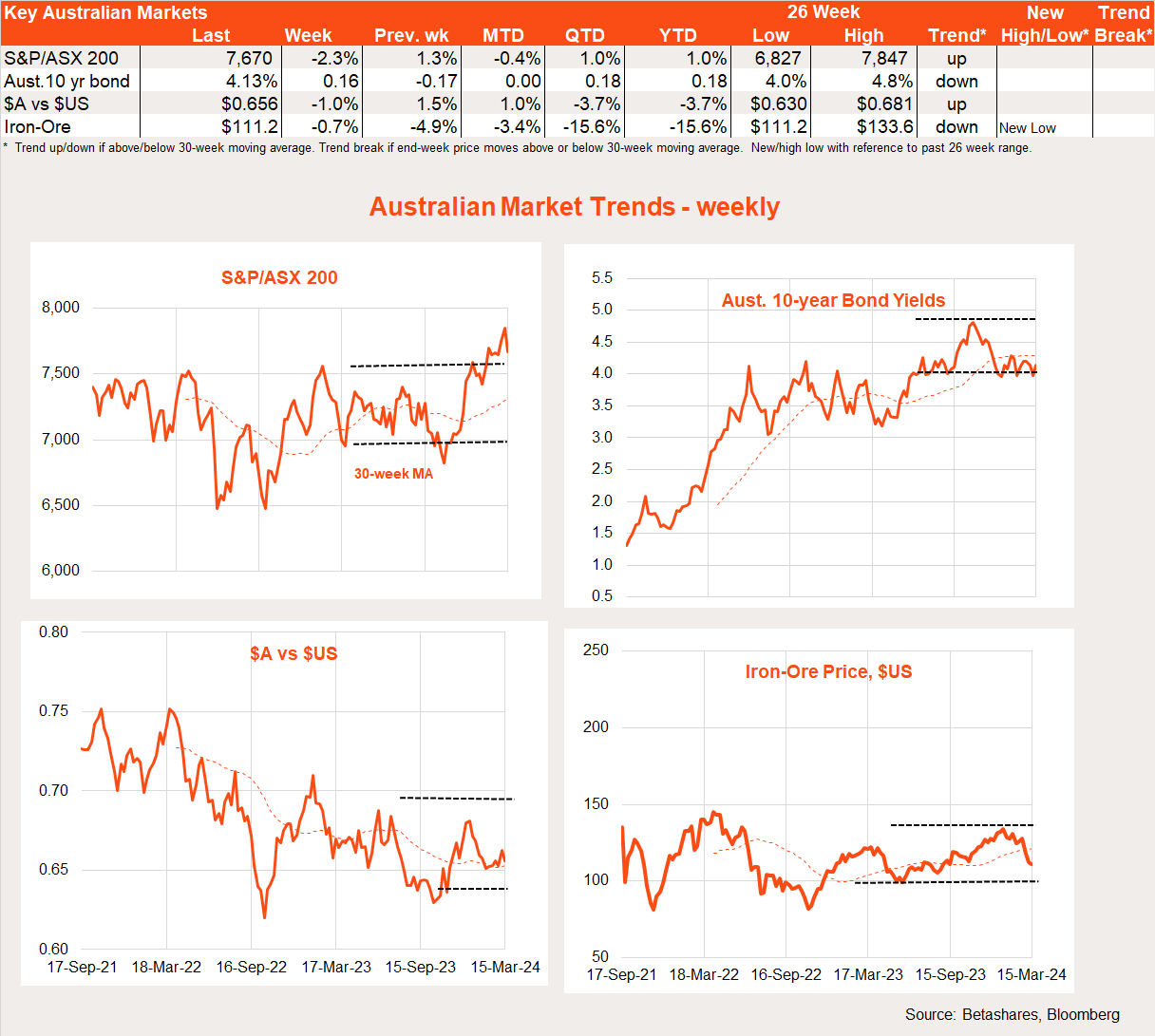

Here’s the current market update by David Bassanese, Chief Economist of Betashares: The S&P/ASX 200 (INDEXASX: XJO) is down 2.3% after a 1.3% gain in the previous week, and the S&P 500 (INDEXSP: .INX) is down 0.1% after a 0.3% loss in the previous week.

Global markets

Is it just me, or is it getting hot in here?

US stocks eased back only a touch further last week despite a lurch higher in bond yields and two stronger-than-expected inflation reports.

The $US also firmed, with markets reducing further the prospect of a US rate cut as early as June.

After bottoming around year end, US bond yields have been moving gradually higher ever since as stubbornly resilient US activity data and a renewed firming in consumer price inflation in the January and February CPI reports have pushed out the expected timing of the first US rate cut – from March to now June/July.

US 10-year bond yields have lifted from 3.9% around Xmas to 4.3% at the end of last week.

Importantly, equity markets have not been more spooked by upside surprises to inflation in recent months because the Fed does not appear to have been spooked either – with Fed chair Powell only a week earlier suggesting the Fed was “not far” from seeing enough evidence to justify a rate cut.

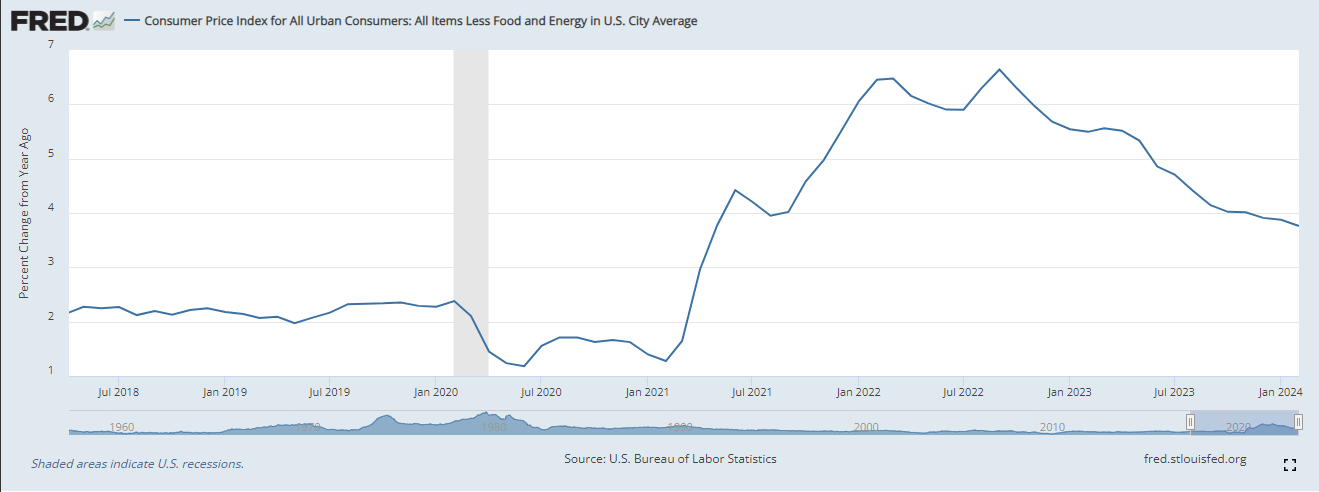

Yet last week, we learnt the core CPI for February rose 0.4% – a touch higher than the 0.3% market expectation. Annual core inflation still eased, but only just, from 3.9% to 3.8%. February producer prices were also firmer than expected.

All up, last week’s CPI and PPI results suggest the Fed’s preferred inflation measure – the private consumer expenditure (PCE) deflator – will also be firm when released in a couple of weeks.

As evident in the chart below, annual core CPI inflation is still declining, but the rate of descent has slowed a tad in recent months.

Some of the lift in inflation could be the flow through of a recent (hopefully temporary) lift in energy prices. It could also just be volatility, indicative of speed bumps on the road to the Fed’s inflation target.

My view is US inflation is still headed lower – and not about to flatten out at current levels – which will justify lower bond yields and higher equity prices over the remainder of this year.

Either way, we’ll lean more about what the Fed thinks with this week’s Tuesday/Wednesday policy meeting. While no-one expects the Fed to change interest rates, interest will focus on the updated set of economic forecasts and Fed policy rate projections.

Will the Fed pull back from its current expectation of three rate cuts this year? I don’t think so, but the market will nervously await the outcome.

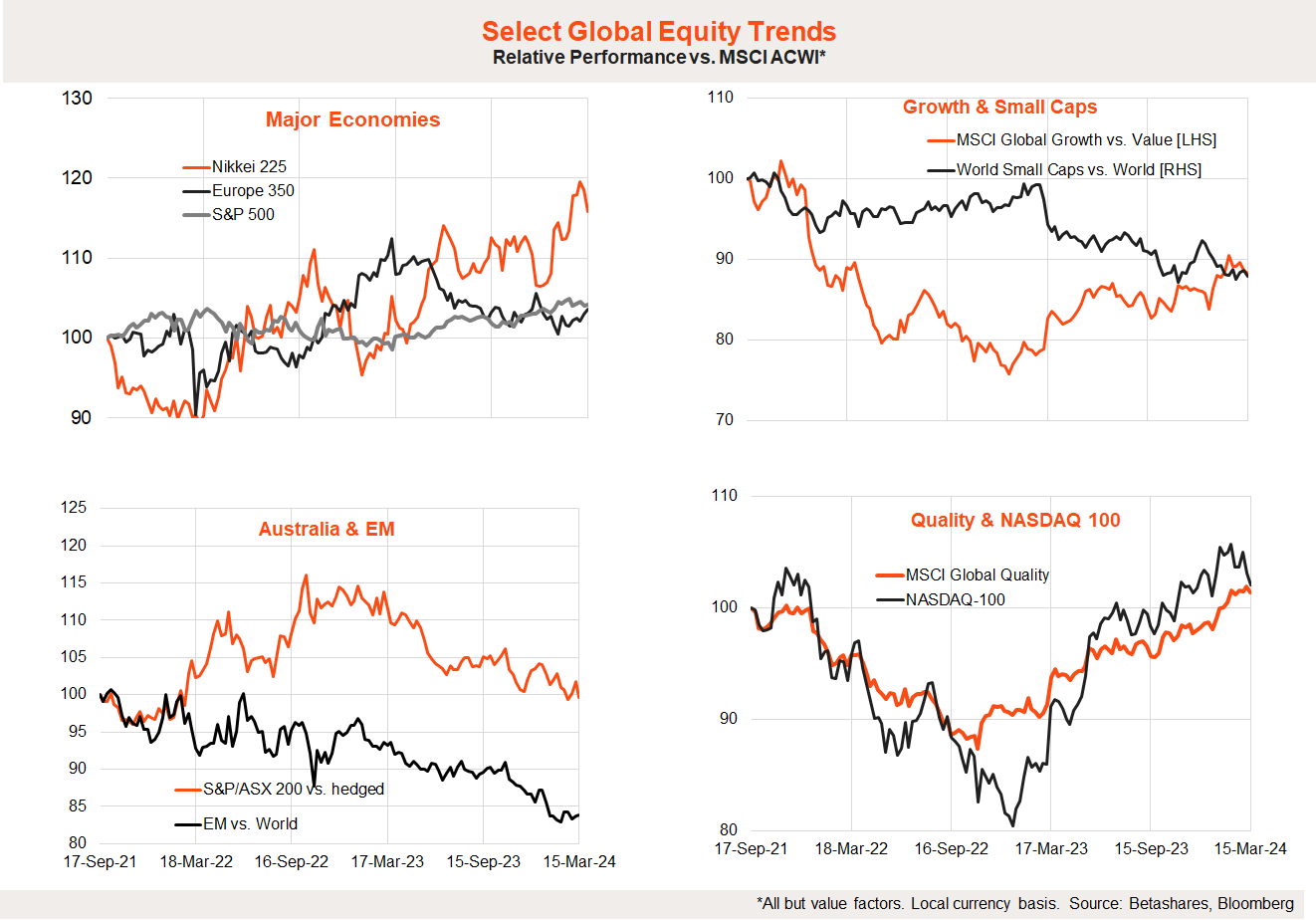

Also of interest this week will be the Bank of Japan (TYO: 8301), with expectations high (70% market risk) that it will attempt to finally extricate itself from its negative official interest rate policy tomorrow. For the record, Japan’s official interest rate remains -0.1%.

With wage and price inflation rising, and global rates notably higher than in many years – if ever there was a time for Japan to remove the policy it’s now!

Yet just how hawkish the BOJ intends to be this year remains to be seen – as it risks strengthening the Yen and undermining the competitiveness of Japanese exporters, along with potentially hurting the roaring stock market.

Last but not least, China releases its monthly update on industrial production and retail spending today. Although pessimism around the Chinese economy remains high, stock prices have recently started to move higher – with some investors perhaps sensing value and/or still anticipating major new fiscal stimulus sometime soon.

Despite these hopes, lingering pessimism has recently filtered through to the iron-ore market, with prices easing back since late January.

Australian markets

Higher bond yields, weaker iron-ore prices and perhaps an element of profit taking combined to help bring down Aussie stocks last week – with the S&P/ASX 200 down 2.3% after a 1.3% gain the previous week.

There was little major local news last week, with the National Australia Bank Ltd (ASX: NAB) business survey suggesting fairly resilient business conditions overall and weaker – but still simmering – cost/price pressures.

The resilient NAB survey contrasts with the weak Q4 GDP report a week earlier.

We’ll learn what the Reserve Bank thinks of the mixed local economic picture following its two-day policy meeting tomorrow.

With the recent soft Q4 GDP report no worse than the RBA expected, some signs of sticky US inflation, and still firm business conditions, I suspect the RBA will again retain a cautious, balanced tone – and generally less willing to signal rate cuts any time sooner than the US Federal Reserve.

Have a great week!