Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.072% to 7,675.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

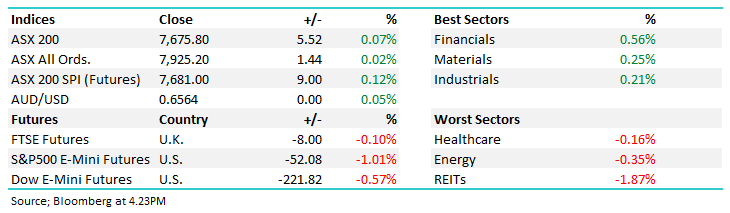

A quiet start to the trading week ahead of important Central Bank meetings – the RBA is set to decide on rates tomorrow (no change expected) while the US Fed step up on Thursday, again, no change expected; however, the rhetoric and associated economic projections will be influential on markets.

As it stands, markets are pricing on 3 cuts in the US and 1.6 cuts locally this side of Christmas, which seems on the money from MM’s perspective. i.e. markets and central banks now seem aligned.

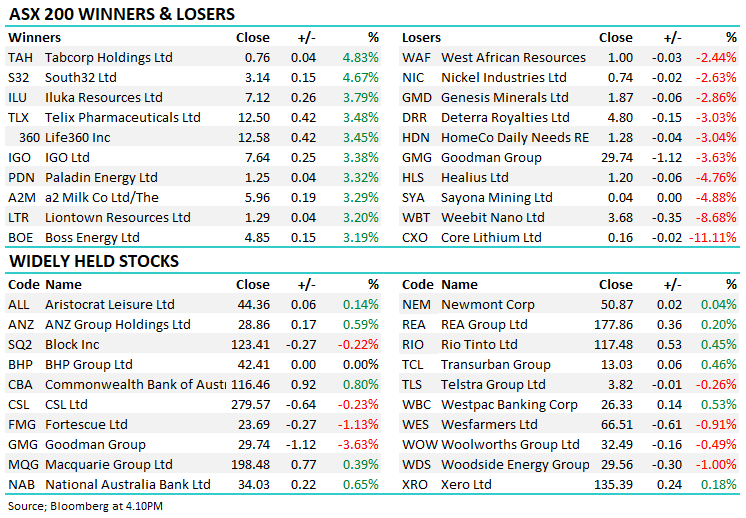

- The ASX 200 up +5pts/ +0.07% to 7675, a strong bounce back from early lows

- Financials (+0.56%) was the standout, Materials (+0.25%) and Industrials (+0.21%) also did well.

- Real Estate (-1.87%) was the hardest hit, Energy (-0.35%) was the only other notable detractor.

- China’s industrial output was up 7% YoY in Jan-Feb, faster than expectations of 5.2%.

- Commodities bounced on the back of this, Iron Ore moved back over $US100/mt after trading at $US97/mt on Friday though BHP Group Ltd (ASX: BHP) finished flat today, trading in a tight 37c range.

- Iluka Resources Limited (ASX: ILU) +3.79% looked good today on a sniff of less negative news, we continue to see this as a good risk/reward buy, South32 Ltd (ASX: S32) +4.67% fits the same bucket though they have been forced to halt their manganese production due to a cyclone off the NT.

- Nickel Industries Ltd (ASX: NIC) -2.63% struggled on licencing delays and higher cash costs, guiding EBITDA for the quarter to $65-75m.

- The world’s largest Uranium producer Kazatomprom released results on Friday night, talking to a modest increase in production in the year ahead, but stressed the globe will be short Uranium by 2030.

- Paladin Energy Ltd (ASX: PDN) +3.32%, Boss Energy Ltd (ASX: BOE) +3.19% and Deep Yellow Limited (ASX: DYL) +3.38% rallied as a result

- Aussie Broadband Ltd (ASX: ABB) +0.56% a strong bounce off the low today, ABB will need to reduce their stake in Superloop Ltd (ASX: SLC) to below 12% (currently 19.9%) due to regulatory requirements out of Singapore.

- Mineral Resources Ltd (ASX: MIN) +0.39% acquiring a nickel concentrator plant in WA, looking to convert it into a lithium processing hub.

- Gold was down $US8 in Asia, trading at $US2147/oz at our close, a mixed day for Gold stocks today.

- Stocks in Asia were up across the board, Nikkei 225 (INDEXNIKKEI: NI225) +2.34%, China +0.5% and Hang Seng marginally higher.

- US Futures are up, S&P 500 (INDEXSP: .INX) pointing 0.25% higher, Nasdaq Composite (INDEXNASDAQ: .IXIC) +0.45%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Metals Acquisition CDI (ASX: MAC) GDRs Rated New Overweight at Barrenjoey

- Aurelia Metals Ltd (ASX: AMI) Cut to Hold at Jefferies; PT 15 Australian cents

Movers & Losers