Luke Laretive, CEO & Portfolio Manager, of Seneca Financial Solutions talks about GQG Partners Inc (ASX: GQG), Fiducian Group Ltd (ASX: FID), and RPMGlobal Holdings Ltd (ASX: RUL) as their top 3 small-cap picks; and Audinate Group Ltd (ASX: AD8), one ASX share they are avoiding. Are these share prices a buy today?

GQG Partners Inc

Regular readers/listeners of our content at Seneca will know that we’ve been on GQG since ~$1.30 a few short months ago – shares are up ~65% since then.

We liked it so much, that we named GQG among our top 3 favourite dividend shares for the whole of 2023 over on RASK.

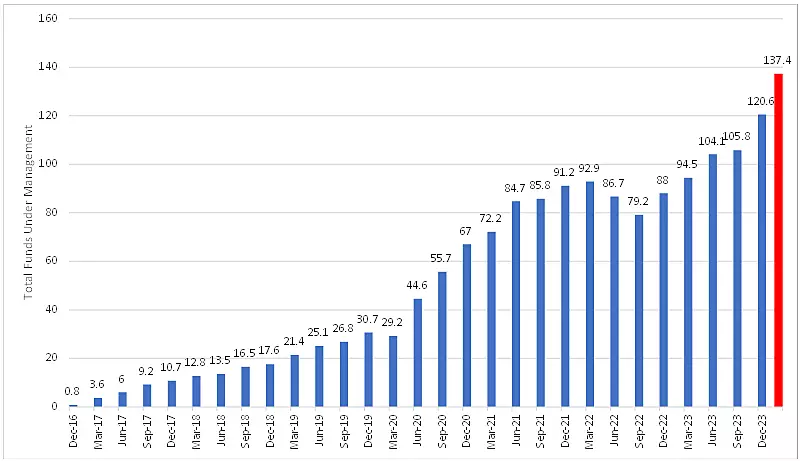

GQG is a global fund manager with US$137.4 billion in funds under management (FUM), with FUM +37% in 2023, leading to a 17% increase in dividends per share, with more to come.

For context, at the peak of Magellan Financial Group‘s (ASX: MFG) powers in June 2021, it had US$85.5 billion under management.

As much as we try and preach otherwise, past performance is THE best predictor of future fund inflows.

FUM is up 37% from US$88 billion to US$120.6 billion at the end of December 2023.

Already in February that figure is up to US$137.4 billion, and we think March flows will be strong again on the back of excellent recent performance numbers.

As much as we try and preach otherwise, past performance is THE best predictor of future fund inflows.

GQG keeps delivering strong net inflows on the back of:

Performance

All of GQG’s 4 core fund strategies (Global, International, Emerging Markets, and US) are well ahead of their respective benchmarks since inception.

Low fees

“In a competitive industry, managers have to offer attractive fee structures – that’s why we launched our Seneca Australian Small Companies Fund with zero management fees – just like the early Warren Buffett partnerships of the 1960s and 1970s.”

GQG charge product fees equal to 0.488% on a weighted average basis, well below the market average, which includes peers such as Magellan Financial Group at 0.70% and Platinum Asset Management Ltd (ASX: PTM) at 1.12%.

In a competitive industry, managers have to offer attractive fee structures – that’s why we launched our Seneca Australian Small Companies Fund with zero management fees – just like the early Warren Buffett partnerships of the 1960s and 1970s.

What are the drivers of recent performance?

GQG funds are long US big tech, including a large overweight in US semiconductor high flyer NVIDIA Corp (NASDAQ: NVDA) which is up 262% in the last 12 months. As well as Nvidia, GQG’s top holdings include Ozempic maker Novo Nordisk A/S (NYSE: NVO) and well-known, high-quality companies like Microsoft Corp (NASDAQ: MSFT) and Visa Inc (NASDAQ: V).

Founder and 69% shareholder Rajiv Jain won’t be resting on his laurels, and we think he and his team will rotate the portfolio away from big tech and towards opportunities driven by value dislocations in the market.

Past examples of GQG moving against the crowd (everyone says they do this, but it’s difficult in practice) include GQG’s rotation out of US big tech in 2022 into beaten-up coal names and subsequently bombed out Indian conglomerate Adani Enterprises Ltd (NSE: ADANIENT) before their respective rebounds.

GQG earns ~98% of revenue from management fees, so inflows directly correlate to FUM, which at nearly 100% incremental margins, and with a 90% payout ratio, correlates to dividends to shareholders.

We expect another significant step up in dividends in 2024.

Dividends were up +17% in 2023 to US9 cents, or A14 cents. In 2024, we think GQG can pay at least A17 cents (probably more).

We think the shares are still too cheap on an 8.4% dividend yield.

Fiducian Group Ltd

Fiducian Group offers financial planning, platform administration and funds management as a vertically integrated financial services provider. Founded by the current executive chairman Indy Singh in 1996, Fiducian’s motto is Integrity, Trust & Expertise.

Fiducian is a steady grower, and 1H24 was no exception with net revenue of +10% to $39.0 million and after-tax profits up +23% to $6.84 million for the half.

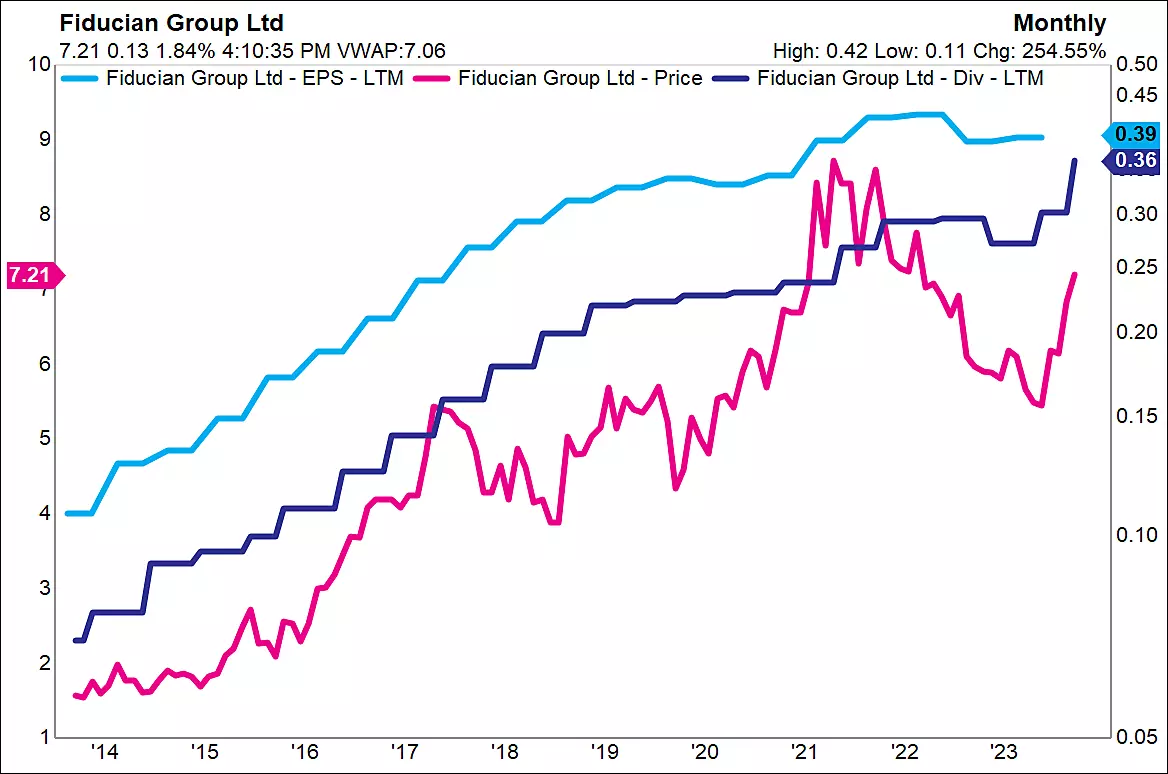

Below you can see how Fiducian’s earnings per share and dividends per share have consistently grown.

The FID share price has been more volatile than the fundamentals of the business, creating opportunities for investors who have done their homework.

In 2022, the share price diverged from its underlying earnings when small caps indiscriminately sold off, markets were broadly weaker and cost inflation (mainly wages) impacted earnings.

Over the last few months, the share price has started to recover.

Fiducian’s business model is that its low-margin financial planning business (which includes 40 salaried planners and 40 franchisees totalling $4.737 billion in funds under advice) feeds it’s higher-margin revenues from:

- Platform administration – think Hub24 Ltd (ASX: HUB), Netwealth Group Ltd (ASX: NWL), or Praemium Ltd (ASX: PPS) style earnings from platform fees. This segment earns 63% PBT margins.

- Funds management – multimanager ‘fund of funds’. This segment earns 48% PBT margins.

Fiducian’s business model is highly scalable and incremental margins from here on out should prove attractive. Further ‘low hanging fruit’ growth opportunities include transitioning $1.774 billion in external platforms across onto Fiducian’s platform where in clients’ best interest.

Fiducian can achieve further growth from:

- Macro: exposure/leverage to rising markets

- Inorganic: opportunities to add more planners to its network

Directors are putting their money where their mouths are and buying FID shares on market.

- Kelly Skellern bought $34k prior to the result, Samir Hallab bought $33k after the result.

- Founder Indy Singh (who already owns 34.8% of the company, valued at ~$50 million) bought a further ~$35k during November/December 2023.

Prior to these recent purchases, directors have consistently added to their shareholdings.

On an annualised basis, FID trades on an ex-cash P/E of just 15x and a fully franked dividend yield of 5.1% (after accounting for the share price rally during the month). We think this is undemanding considering the earnings outlook/momentum and a healthy $22 million net cash balance for acquisitions or accretive capital management.

FID shares are thinly traded, and although it flies under the radar of mainstream media and investors (for now), FID has quietly been a 10-bagger since June 2012, outperforming the All Ordinaries (INDEXASX: XAO) which is up 3x in the same period.

RPMGlobal Holdings Ltd

We wrote about RUL’s earnings upgrade in December 2023 for Livewire.

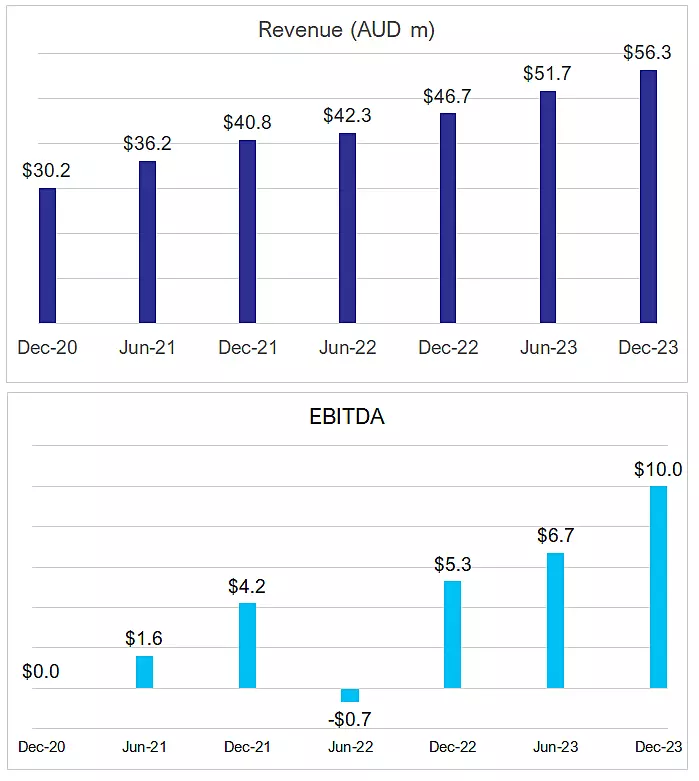

The mining software and advisory player reported 1H24 revenue up +20.6% to $56.2 million, and EBITDA up +89% to $10.0 million.

RPMGlobal expenses its development costs (unlike many of its ASX-listed software peers), so the majority of that $10m EBITDA drops down to the bottom line, with $6.8 million profit after tax.

Management reaffirmed guidance for $21.5m – $23.5m EBITDA in FY24.

RPMGlobal’s AMT software continues to be the go-to for major global miners and its operations and planning product XECUTE is gaining traction with small/medium-sized miners.

RPMGlobal highlighted a strong software sales outlook across multiple geographies having replenished the pipeline after a heavy selling period in mid-2023.

We should see excellent operating leverage come through to profits in the next couple of years from any incremental revenue growth, thanks to flattening development costs.

Additionally, RPMGlobal’s cash flow is typically weighted to the second half of the financial year due to the bulk of recurring subscription revenues and maintenance revenues being received in 2H, as well as management incentives being paid in the first half.

We forecast a rebound in operating cash flow to c.$22 million in 2H24 (vs -$5.4 million in 1H24).

RUL trades on circa 4x EV/Sales on a forward-looking basis, and 10.8x EV/EBITDA on a pre-R&D basis (so that we can compare apples with apples).

ASX information technology peers trade on 39x EV/EBITDA currently, up from a long-term average of 31x. Comparable software companies have transacted at an average of 27x.

Even after a moderate share price run, we think this is the cheapest software stock on the ASX.

Management agrees, with the on-market share buyback continuing at current prices.

RPMGlobal is starting to gain broader institutional awareness, and increasing investor relations should help this. We look forward to catching up with management later in the month.

Audinate Group Ltd

Audinate grew 1H24 revenue by +51% to A$47m, a ~6% beat to expectations. EBITDA of $10.1 million was up from $4.3 million and NPAT of $4.7 million (vs $0.4 million loss in the pcp) excited investors as Audinate passes through the profitability inflection point while still growing strongly.

Audinate offers audiovisual networking solutions for live sound events and broadcasts, benefitting from the natural transition from analogue to digital. Dante has reduced time lag (key to avoiding sound distortion) down to 1 microsecond, a crucial selling point for high-performance environments like concert stages.

Dante has established itself as the market leader and is now the “industry standard” for sound system OEMs like Yamaha and Bose. This generates network effects with Dante’s in different pieces of equipment ‘talking to each other’.

Piggybacking on its audio success, Audinate is expanding into similar video solutions, which are showing promise but are in an earlier stage.

Audinate is also leveraging the installed base of Audinate chips to provide a competitive advantage in accompanying software solutions. Software revenue grew 56.2% to US$7.3 million in the period, up from US$4.7 million.

This lifted overall gross margins to 71.8%, up from 71.2%.

There’s no denying this is an innovative, high-quality company and an Australian tech success story.

This all sounds positive, so why don’t we own it today?

It’s a company we’d like to own, but not at any price.

The valuation is, in our view, extreme, bordering on bubble territory. Trading on ~100x FY25 EV/EBITDA, heroic growth assumptions are required to justify the current share price, even for a company with a clear growth runway.

On our numbers, it’s effectively pricing in ~30% sales CAGR for the next 6 years (with limited growth in expenses). Such strong, sustained profit growth is rare in ASX company history.

Though the result was strong, the company did benefit from the previously highlighted backlog in orders coming into FY24 due to the global chip shortage.

Ultimo chips had 3x the sales vs the prior corresponding period in 2023 as the backlog unwinds, so revenue growth may normalise to a lower rate as the company cycles this ‘sugar hit’ growth.

Management’s conservative guidance looks designed to be beaten, with reiterated FY24 guidance of “US$ gross profit dollars consistent with historical performance” implying gross profit growth between +24% and +32%.

Separately, management commentary of a 48:52 gross profit split across halves suggests that gross profit will come in ahead of guidance.

When you’re pricing in perfection, there’s no room for error

Our reservations go beyond simply ‘valuation’.

Growth runways are not infinite.

We estimate Dante to have achieved c.16% market penetration, and while we commend management’s initiative to expand the company’s software sales, chasing growth from new lines is not without risk.

Atomos Ltd (ASX: AMS), attempted to sell software into their installed base of live recording cameras, and to this point in time, it has largely been unsuccessful.

While this risk alone probably doesn’t scare us off completely, the combination of recent Director selling, index-inclusion momentum, and a non-specific (and seemingly unnecessary) September 2023 capital raise reinforces our caution.

The AD8 share price pulled back from about $10 to about $6 in 2022 on the back of a macro-fueled tech sell-off.

We see the stock, from current prices, as again susceptible to a change in sentiment.

While standing pat on Audinate (for now) might bite us on the backside, we prefer to stick to our process and avoid the temptation to chase momentum at any price.