Darren Katz of TAMIM Asset Management explains why they own Microsoft Corp (NASDAQ: MSFT), what makes Microsoft such a valuable company, and how Microsoft recently eclipsed Apple Inc (NASDAQ: AAPL) as the world’s most valuable company. Is Microsoft share price a buy today?

Microsoft is a business most readers will be familiar with. In fact, many will likely interact with products owned by the software giant daily.

Office 365 programs such as Word and Teams are ubiquitous in workplaces, schools and homes. Professionals peruse LinkedIn for new jobs and connections, while Xbox and Minecraft are staples of gaming entertainment.

The proliferation of Microsoft’s software in all corners of life is one of the key reasons the business recently eclipsed Apple Inc as the world’s most valuable company.

Microsoft is now worth US$3 trillion (yes, with a “T”). To put that into context, all of the companies listed on the ASX are collectively worth $2.5 billion.

Below we’ll discuss the divisions that make Microsoft such a valuable company, in addition to touching on why investors repeatedly misprice the business.

A short history

Founded by Bill Gates and Paul Allen in 1975, Microsoft is the world’s largest vendor of enterprise software.

The duo believed advancements in microprocessors and software (hence Micro-soft) would transform the world, and subsequently began writing code for the first personal computers.

This ultimately became the operating system we know today as Windows.

Concurrently, Microsoft developed a suite of productivity tools, including Word, Excel and PowerPoint.

The proliferation of the internet then meant customers demanded access to the software online.

This transition culminated in the creation of Azure, a platform for enterprises to manage workloads, networks and data in the cloud.

Bundle and conquer

The Productivity and Business Processes division is Microsoft’s most profitable segment with a 50% profit margin. The primary driver of earnings is the Office 365 product suite which is licensed to corporates and consumers.

Because the software is already built, revenue from each new license drops to the bottom line. Moreover, margins are protected from new competition by high switching costs. It’s an onerous exercise to retain employees and port existing data to a new software suite.

Even after overcoming those two hurdles, there’s little commercial incentive. Big corporations can go to Microsoft for all their employee productivity tools for one fee. The alternative is sourcing several tools from multiple vendors for a much higher total cost.

When a challenger product gains momentum, Microsoft can quickly create a clone with similar features and add it to the bundle for no extra fee.

This is why it’s difficult for standalone enterprise software companies to challenge Microsoft’s incumbent market share and reach profitability.

While market growth is slowing, the division remains a valuable cash cow.

Price rises and increased uptake of more products will support earnings growth.

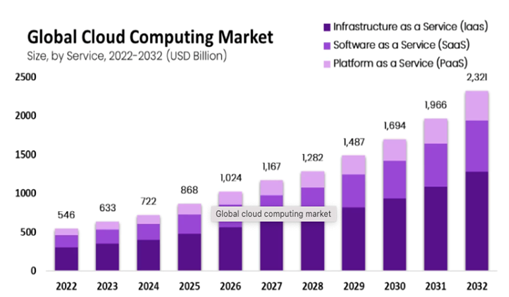

Infrastructure as a Service

Historically, an organization would manage the hardware for networks and servers internally.

However, the sheer increase of data and computing required to operate networks has become burdensome from a financial and human resources perspective.

Over several years, Microsoft built its own network of data centres and cloud capabilities to be sold to organizations – many of them already existing customers. Lower upfront costs for customers, around-the-clock service and enhanced security made the switch a simple choice for enterprises.

The Intelligent Cloud segment is the fastest-growing division at Microsoft with revenues tripling since 2018.

Nevertheless, this transition is only partially complete with 50% of data infrastructure remaining on-premise. New competitors are unlikely, owing to the significant amount of capital required to build a network capable of competing with Microsoft.

In 2024, Microsoft’s capital investment will be around US$45 billion. This is equivalent to what the company sent from 2002 to 2016.

AI leadership

Artificial intelligence (AI) is a term used loosely in the finance arena. However, Microsoft is one of the few companies making strides in this nascent market.

This is led by the investment in ChatGPT, which is powered by Azure servers.

Unlike search engines where the business model is to sell ads, language models sell an answer – a far more compelling proposition for users.

“We’ve moved from talking about AI to applying AI at scale”. – Microsoft CEO Satya Nadella

Microsoft is also rolling out Copilot, an extra service on top of the Microsoft Office programs to improve productivity.

An employee late to a Teams meeting can ask the Copilot to summarise the first 5 minutes of the conversation to avoid disrupting the call.

The same tool can then summarise the main points and draft a summary email. It even has a live translation for captains when speaking in different languages.

Undoubtedly, Copilot will take time to refine but Microsoft has the pedigree to succeed given it’s already created a US$3 trillion business building productivity software.

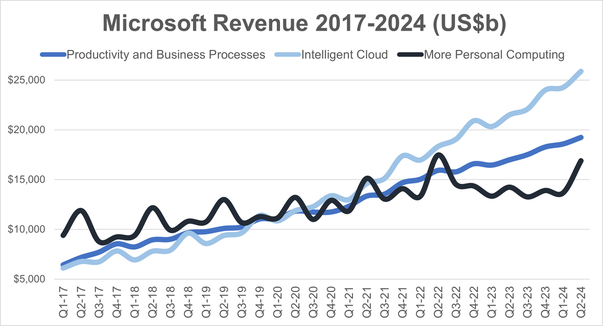

Recent results

This month Microsoft reported an 18% in revenue and a 33% rise in earnings for the December quarter. Both commercial and consumer Office 365 subscribers increased, while the cloud division benefitted from strong demand for data and capacity for AI services. The Personal Computing division also grew owing to the recent acquisition of Activision.

The result typified Microsoft’s attractiveness as an investment; the business operates in markets with large and growing runways, namely enterprise software, cloud networking and AI.

Profits are redeployed into high-return opportunities and subsequently, earnings and shareholder returns compound with time.

This is where the market often fails to value the business appropriately. Since 2010, Microsoft’s earnings have increased on average 11% annually. In a single given year, that might sound flash, but the power of compounding means over that same period earnings have quadrupled to US$80 billion.

This exponential growth goes unappreciated and is why the market is constantly playing catch up.