Content Director Patrick Poke of Betashares explains the step-by-step approach to crafting an SMSF investment strategy that uses ETFs as a means to achieve your retirement goals. Additionally, he delves into crucial aspects such as risk profiling, insurance considerations, and other obligations mandated by superannuation laws.

Taking control of your financial future by setting up a self-managed super fund (SMSF) and creating your own investment strategy can be an exciting evolution in your wealth creation and retirement journey.

Yet, as the adage goes,

“with great power comes great responsibility.”

While the autonomy of an SMSF empowers you with unprecedented investment flexibility – including the ability to buy ETFs – it’s imperative to acknowledge that you and your fellow trustees now bear the full weight of steering your nest egg towards its intended destination.

Towards the conclusion of this post, you’ll find 8 ETF ideas that could be used for both the accumulation and retirement stages.

What is an SMSF investment strategy?

Think of your SMSF investment strategy as a plan for how you’ll buy, keep, and sell assets to reach your financial goals.

It should be written down and explain how all the choices are aligning to each member’s retirement objectives.

Having an investment strategy is a legal requirement under the Superannuation Industry (Supervision) Regulations 1994 (SISA).

This means you need to:

- Create and follow an investment plan for your SMSF.

- Review and update your strategy regularly and as circumstances change.

What to include in an SMSF investment strategy?

Your investment strategy should be a living document that covers everything from what you aim to achieve with your investments, how you plan to allocate your assets, to managing cash flow, and how often you’ll review your goals.

Here’s a step-by-step guide to help you draft your document, along with a complimentary template to kickstart your journey.

Step 1 – Start with the primary goal

It’s essential for SMSF trustees to discuss and work out where they want to be financially in retirement and set the investment strategy accordingly.

For example, Raj and Linda want $1.5 million to enjoy retirement and have a high tolerance for risk.

They’re both 45 and each have a super balance of $200,000 to which they are adding $850 per member per month in the form of concessional contributions.

- Their investment strategy objective might be: Achieve a growth rate of 8% a. over the long-term, with a willingness to tolerate higher levels of volatility.

Keep in mind that the primary goal, investment objective and risk tolerance can evolve over the years as circumstances change and as members age.

Trustees are strongly encouraged to seek professional advice to help navigate the complexities of retirement planning.

Step 2 – Consider members’ risk profile

Super laws require that you invest in the best financial interest of all SMSF members.

Your strategy must explain how your investments meet each member’s retirement objectives.

Products like ETFs offer inherent diversification and relatively high liquidity, making them a viable option for SMSFs to distribute capital across different asset classes.

While ETFs can enhance diversification and provide exposure to growth investments, it’s crucial to acknowledge the volatility inherent in high-risk assets like shares, which tend to experience negative returns roughly every five to seven years.

Therefore, careful planning of asset allocation between growth and defensive assets should be based on the age and risk tolerance of each member.

Step 3 – Calculate cash flow and liquidity needs

An SMSF’s investment strategy must consider cash flow and liquidity needs, including the ability to pay for obligations including taxes, audit fees, tax preparation services, insurance premiums and other unexpected costs as they arise.

SMSFs with younger members who have opted to invest in listed assets would typically have lower cash flow needs compared to those holding property or initiating pension payments, obligated to meet minimum drawdown rates.

In cases where an SMSF holds illiquid assets, the strategy should detail the process and timeline for asset realisation, while also acknowledging associated risks such as potential challenges in obtaining fair market value.

Step 4 – Create and asset allocation framework

Once members have worked out their tolerance for risk and liquidity needs, they can then create a framework with asset allocation targets.

This will dictate the minimum and maximum amounts the SMSF can invest in any given asset class.

SMSFs can choose to establish either static targets, which represent fixed amounts allocated to specific asset classes, and asset allocation ranges for greater flexibility.

It should be noted that the Australian Taxation Office (ATO) does not consider broad investment ranges between 0-100% to be a proper consideration in satisfying the strategy requirements.

Illustrative example of a growth-oriented SMSF

The table below illustrates how a growth-focused SMSF might allocate its funds.

| Category | Allocation | Asset Classes |

| Growth assets | 70-80% | Australian shares: 35-40% |

| International equities: 35-40% | ||

| Defensive assets | 20-30% | Australian bonds: 10-15% |

| International bonds: 5-10% | ||

| Cash: 5% |

Source: Betashares (for illustrative purposes only)

Step 5 – Establish an approved investments list

Retail and industry superannuation funds invest substantial time and resources in researching investment products.

This is because the selection, integration, and liquidity of these products are fundamental to the performance of a super fund.

Now, this task falls squarely on the trustees of your SMSF.

Super laws don’t require specifying precise products, but effective strategies often include a broad list of approved investments to steer their investment decisions.

Think of establishing this list – and a process to identify products – as adding guardrails to an SMSF, preventing members from investing in unfamiliar territory and ensuring thorough due diligence before any new products or investments are introduced to the portfolio.

Illustrative example of an approved investments list

Here’s a practical example of what an SMSF’s approved investments list could look like:

| Investment Type | Products | Rationale | Due Diligence |

| ETFs | Betashares ETFs (A200, AQLT, QOZ, NDQ, OZBD) and other select providers | Cost effective and liquid investment options that align with our investment philosophy and assessment of market trends. | Manager track record, review of product disclosure statements of individual funds. |

| Direct shares | Select companies in the S&P/ASX 50 | We prioritise large-cap exposure for stable dividends and reduced risk. | Broker reports and fundamental analysis. |

| Cash & term deposits | Savings and deposit accounts with various Australian banks | Ensures liquidity and the ability to pay fund expenses while earning attractive interest rates.

|

Accounts must be covered by the Financial Claims Scheme. |

Step 6 – Consider insurance needs

The ability to generate income and contribute funds to an SMSF is instrumental.

This is why super laws mandate that you consider holding personal insurance for each member of your SMSF in the event of death or incapacity.

There may also be non-personal requirements and options such as liability insurance for trustees, a landlord policy if a rental property is being held in the fund, and cover for collectibles.

Consider obtaining advice to ensure you have the appropriate insurance products and adequate coverage.

Step 7 – Monitor, rebalance and review

Bringing together a solid investment strategy involves maintaining discipline in three key areas.

Trustees should agree on the frequency of the following activities following implementation of their strategy:

- Monitoring: Determine how often to check your SMSF and its performance including verifying contributions, cash reserves, managing expenses, and assessing investment opportunities. It’s good practice to do this at least quarterly.

- Rebalancing: Adjust the portfolio to ensure it stays within the asset allocation framework established within the strategy. Typically done annually, more frequent adjustments may be needed in response to significant market shifts.

- Investment strategy review: Regularly evaluate the overall investment strategy to ensure alignment with the SMSF’s objectives. This review must be conducted every financial year, but may be required more often due to falling markets, members leaving or joining the fund, or a member starting a pension.

It’s recommended to conduct the investment strategy review during the annual trustee meeting and document the discussion and outcomes in the meeting minutes.

This ensures evidence of the review is available for your auditor.

SMSF investment restrictions: What can’t you do?

While SMSFs have the freedom to invest in a wide variety of assets, but, there are some restrictions. Generally speaking, trustees cannot buy assets from, or lend money to, fund members or other related parties, nor can they borrow money.

There are exceptions to these rules, however, they are highly complex and professional advice should be sought to understand how exactly they work.

Can an SMSF invest its capital in one asset?

SMSFs wield significant autonomy in their investment decisions.

While super laws don’t impose restrictions on concentrating all retirement savings in a single asset or asset class, they mandate that trustees:

- Carefully assess the composition of the SMSF’s investments and the risks associated with inadequate diversification for all members.

- Consider the individual circumstances of each member, including their age and risk tolerance.

Moreover, trustees must articulate how investing in a single asset aligns with the SMSF’s objectives and cash flow needs.

Failure to diversify or manage concentration risk can expose an SMSF and its members to unnecessary vulnerabilities if a substantial investment underperforms or fails.

The benefits of buying ETFs in an SMSF

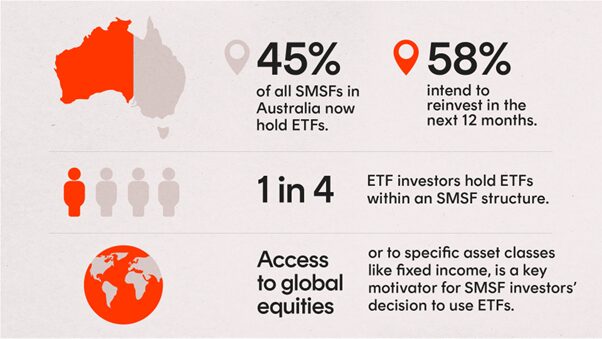

ETFs have gained significant traction among SMSF investors due to their facilitation of investment strategy execution.

Notably, SMSFs have been pioneers in embracing ETFs in Australia, with a record of 505,000 funds currently using this investment vehicle—a notable 26% increase from the previous year, according to the Betashares SMSF Report 2024.

What’s driving the surge in ETF usage?

Our research suggests 3 core reasons why SMSFs choose to use ETFs:

| Wider access | Lower costs | Reduced complexity |

| ETFs provide instant access to a wider set of asset classes and investment styles, notably including international equities, market sectors and bonds. | SMSFs are opting to replace active managers with ETFs to reduce investment fees and avoid the hassle of paperwork associated with unlisted funds. | SMSFs are substituting individual stock trading with ETFs to simplify portfolio management while maintaining diversification. |

What are the tax implications of investing through an SMSF?

SMSFs are obligated to lodge an annual income tax return, which entails reporting the fund’s assessable income, allowable deductions, and any applicable tax offsets. Filing an income tax return for an SMSF requires accurate record-keeping throughout the financial year.

When operating an SMSF, it’s important to understand the following:

- The tax treatment capital gains, income, franking credits, contributions, and pension payments.

- Common deductions, such as expenses directly related to the fund’s operation including accounting fees, administration costs, and investment-related expenses. Detailed records should be kept to substantiate claims.

- Eligibility for deductions related to insurance premiums.

- Concessional and non-concessional contributions, and their implications.

It is important to consider seeking the services of an SMSF tax specialist to assist with meeting your fund’s tax obligations.

ETF ideas for SMSFs

With a firm understanding of what an SMSF investment strategy entails, let’s consider some ETF ideas that may be relevant for trustees in the accumulation and retirement phases of their journey:

ETFs for SMSFs in the accumulation phase

- BetaShares Australia 200 ETF (ASX: A200) offers access to Australia’s top 200 companies, serving as a low-cost, liquid, and diversified core holding. This fund aims to replicate the performance of the Australian sharemarket (before fees and expenses) while providing quarterly distributions.

- Betashares Australian Quality ETF (ASX: AQLT) is designed to target companies with strong returns on equity, minimal leverage, and steady earnings. For SMSFs aiming to enhance the quality of their portfolio, AQLT may be a useful addition.

- Betashares Nasdaq 100 ETF (ASX: NDQ) gives exposure to top-tier US technology giants such as Microsoft Corp (NASDAQ: MSFT), Alphabet Inc Class C (NASDAQ: GOOG), and NVIDIA Corp (NASDAQ: NVDA), NDQ offers investors a gateway to the innovation economy. This includes substantial exposure to artificial intelligence for example.

- Betashares Global Cybersecurity Etf (ASX: HACK) In a time where safeguarding personal and sensitive data is crucial, HACK seek to capitalise on the booming growth of the cybersecurity sector. Offering exposure to a diverse range of global cybersecurity firms, this ETF provides SMSFs with thematic access to a sector with the potential for high growth.

ETFs for SMSFs in the retirement phase

The retirement phase marks the period when investors begin accessing their nest egg through pensions, lump sums, or a combination of both.

During this stage, the emphasis typically shifts towards capital preservation and stable income.

For investors in search of a low-risk profile yet aiming for returns higher than those offered by cash, the following funds may prove suitable:

- Australian Cash Plus Fund (managed fund) (ASX: MMKT) provides access to money market securities, offering retail investors enhanced returns on cash while maintaining a high degree of capital stability.

- Betashares Australian Composite Bond ETF (ASX: OZBD) serves as a core allocation for Australian fixed income, investing in a diversified portfolio of high-quality Australian government and corporate fixed-rate bonds.

- Active Australian Hybrids Fund (managed fund) (ASX: HBRD) offers exposure to a diversified portfolio of hybrids, providing monthly income payments at rates expected to surpass cash and senior bonds, along with franking credits.

- Australian Top 20 Equity Yield Maximiser Fund (managed fund) (ASX: YMAX) utilises a covered call strategy to enhance income over and above dividends, which may be particularly beneficial in sideways trading markets. Explore covered call strategies with this video.

Final thoughts

Crafting a comprehensive investment plan that addresses members’ needs, risk tolerance, and long-term goals is not only a legal obligation but also a vital step toward achieving a financially secure retirement.

Remember to periodically review your strategy to ensure it remains aligned with members’ needs.

Seeking professional advice can provide expertise to ensure compliance and informed decision-making.