Investment Strategist Tom Wickenden of Betashares tells us there could be significant advantages to including some low-cost equity beta such as Betashares Australian Quality ETF (ASX: AQLT) and Betashares Global Cash Flow Kings ETF (ASX: CFLO) in client portfolios. But how do you add value beyond tracking the broad index?

The most common answer is to also include actively managed funds with the potential to deliver outperformance relative to funds that track traditional benchmarks alone.

However, generating alpha is a competitive (some would argue zero-sum), high-cost game, and the growth of indexing has exposed closet “index huggers” and created a shift towards high-conviction and index-unaware active strategies.

Investing is about the journey, not just the end point!

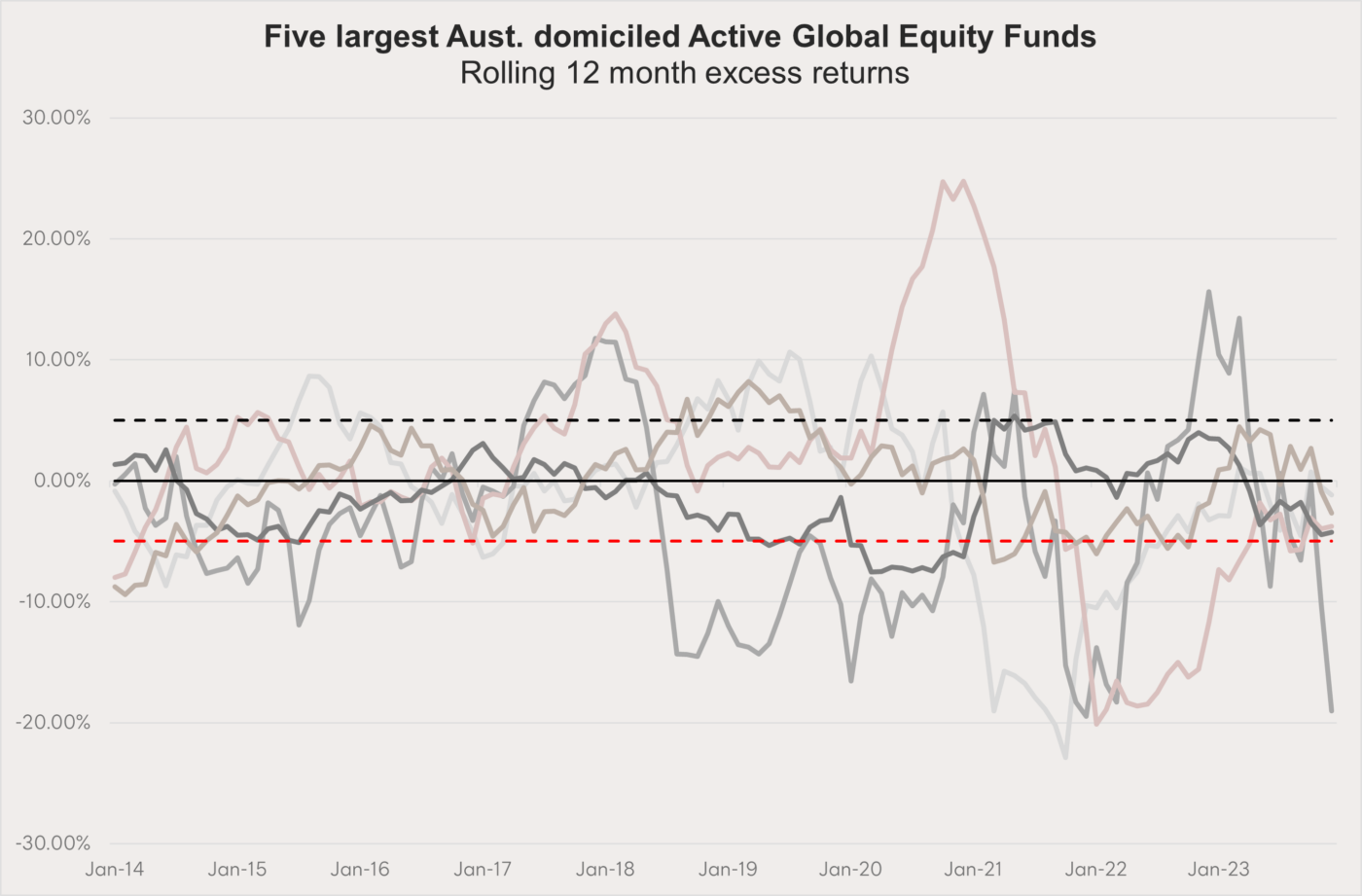

Take the five largest Australian-domiciled, active global equity fund managers for example.

By comparing these funds’ performance to the benchmark MSCI World Ex Australia Index (AUD), we get a picture of how high-conviction active strategies can deviate from market benchmark returns.

The below graph charts each of these funds’ excess returns to the benchmark over 12-month rolling periods.

Periods below the red line indicate when these managers have underperformed the market by 5% or more – a level that can become hard to justify.

Particularly when you consider that only one of these five managers beat the benchmark’s total performance over this period.

The myth of outperformance

These active managers will often highlight the importance of their unique expertise, research process and security selection in constructing their investment portfolio.

However, over the last twenty years, a whole new field in indexing has developed around factor or smart-beta investing.

And it turns out that factor investing targets the same risk premia that many active managers have long relied on.

Investors can now get exposure to these risk premia through lower-cost funds that seek to track a rules-based factor index.

Regarding active managers that pursue a style bias, we have observed the following:

- Often, any ‘outperformance’ above broad market beta is in fact partially or fully attributable to a factor exposure rather than the manager’s stock-specific bets (i.e. true alpha).

- The management costs of rules-based factor index ETFs are generally far lower than those of active funds.

- Over longer investment time horizons, rules-based factor index ETFs have tended to outperform the majority of active funds with the same factor or style bias on a net-of-fee basis.

In addition, the systematic approach of rules-based factor index ETFs does not allow for a subjective active judgement call to allocate to cash, which could otherwise create the risk of unintentionally altering the strategic asset allocation for end investors.

How you can get ‘smarter’ with client portfolios?

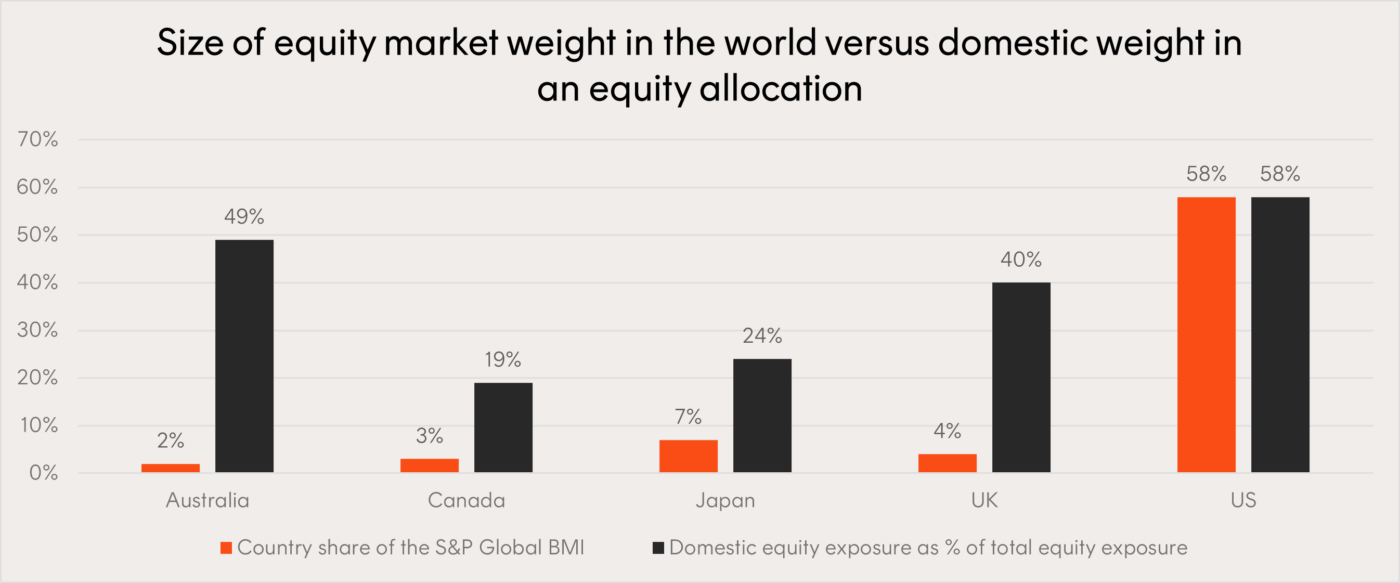

An obvious reason to look beyond broad market beta is our home country bias and the skewed sector makeup of the Australian equity market.

In aggregate, Australian investors have among the largest home country equity portfolio allocations relative to the size of our equity capital markets, and therefore tend to be skewed to value/cyclical stocks and underweight growth/defensive stocks.

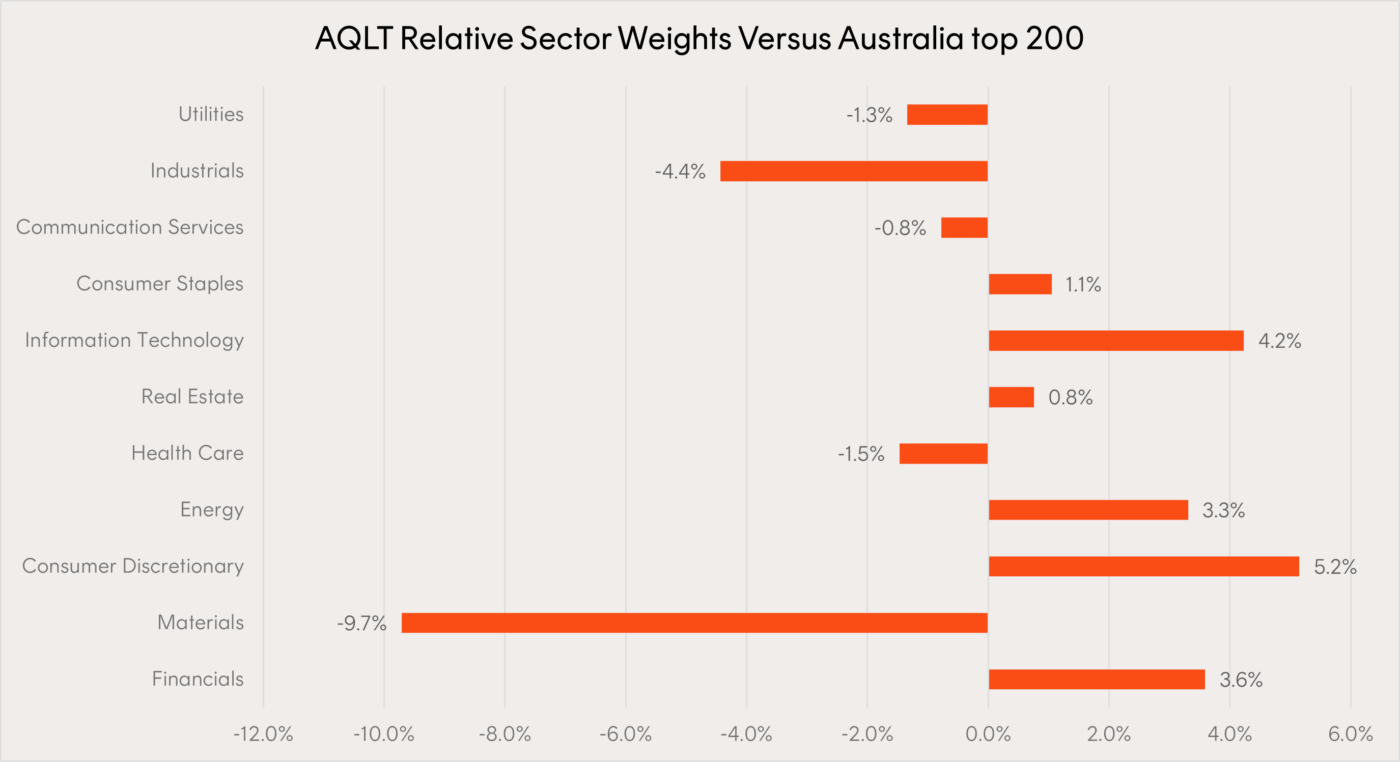

AQLT index’s sector differences compared to the Betashares Australia 200 ETF (ASX: A200) index.

While this makeup typically caters to our high dividend yield preferences, it has historically come at the expense of profitability, growth and price appreciation.

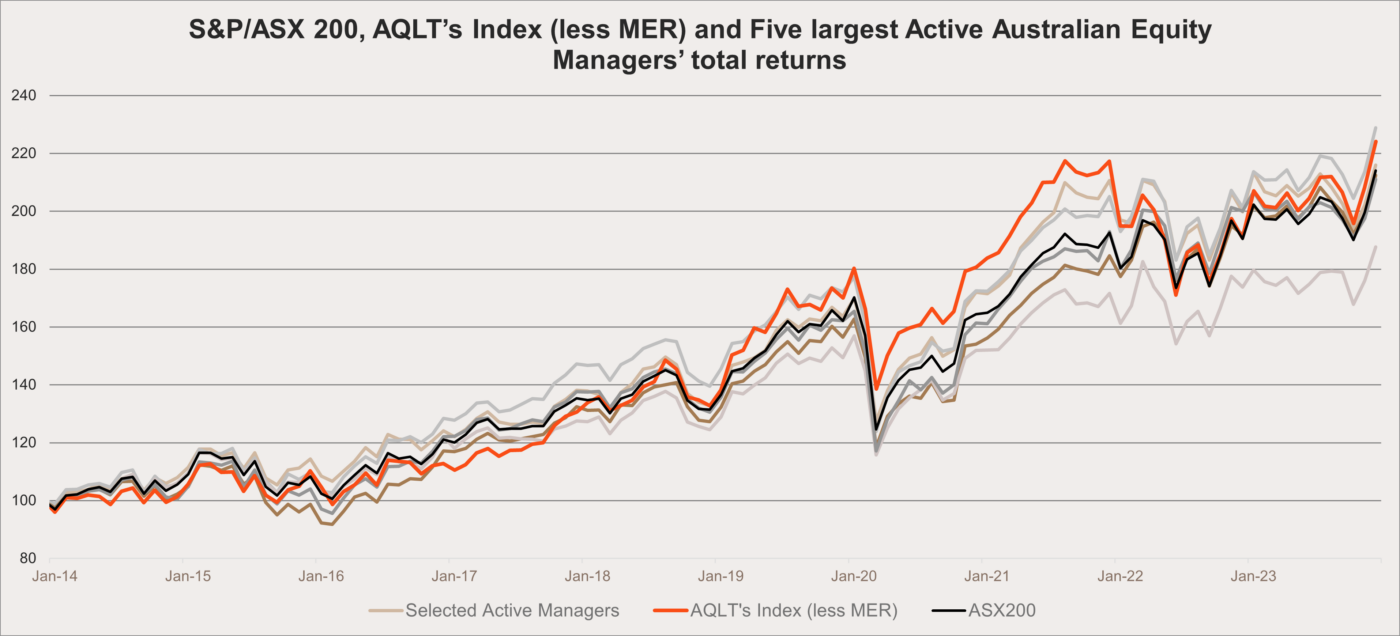

From 2014 to 2023, the companies underlying the S&P/ASX 200 (INDEXASX: XJO) grew earnings 4% p.a. on average while the index’s price returned 42% (excluding distributions).

By comparison, over the same period, the US’ S&P 500 (INDEXSP: .INX) companies experienced 7% p.a. average earnings growth and 237% price growth – significantly higher than our market.

Considering this, and examining the profile of the broad Australian market, we can hypothesise an enhanced solution to broad market investing in Australia – i.e. upweighting to higher-quality companies.

Quality companies are defined by their high return on invested equity, low levels of leverage, and earnings stability.

Companies with these attributes have the potential to outperform broader benchmarks, while generally experiencing smaller drawdowns than the broader market during declines.

Taking a quality investment approach in Australia could therefore improve profitability and solve for our market’s relatively low returns.

AQLT’s index maintains exposure to the largest Australian companies – weighting them by their quality attributes rather than size.

It also holds and weights the highest-quality companies from the remainder of the Solactive Australia 200.

The result is a more balanced portfolio profile with an emphasis on quality.

Seeking alpha in global equities without significant deviation

One of the challenges for advisers looking beyond low-cost broad market index exposures is finding a core global equities allocation that can provide long-term net of fee outperformance while mitigating these periods of significant deviation, particularly underperformance, from the benchmark.

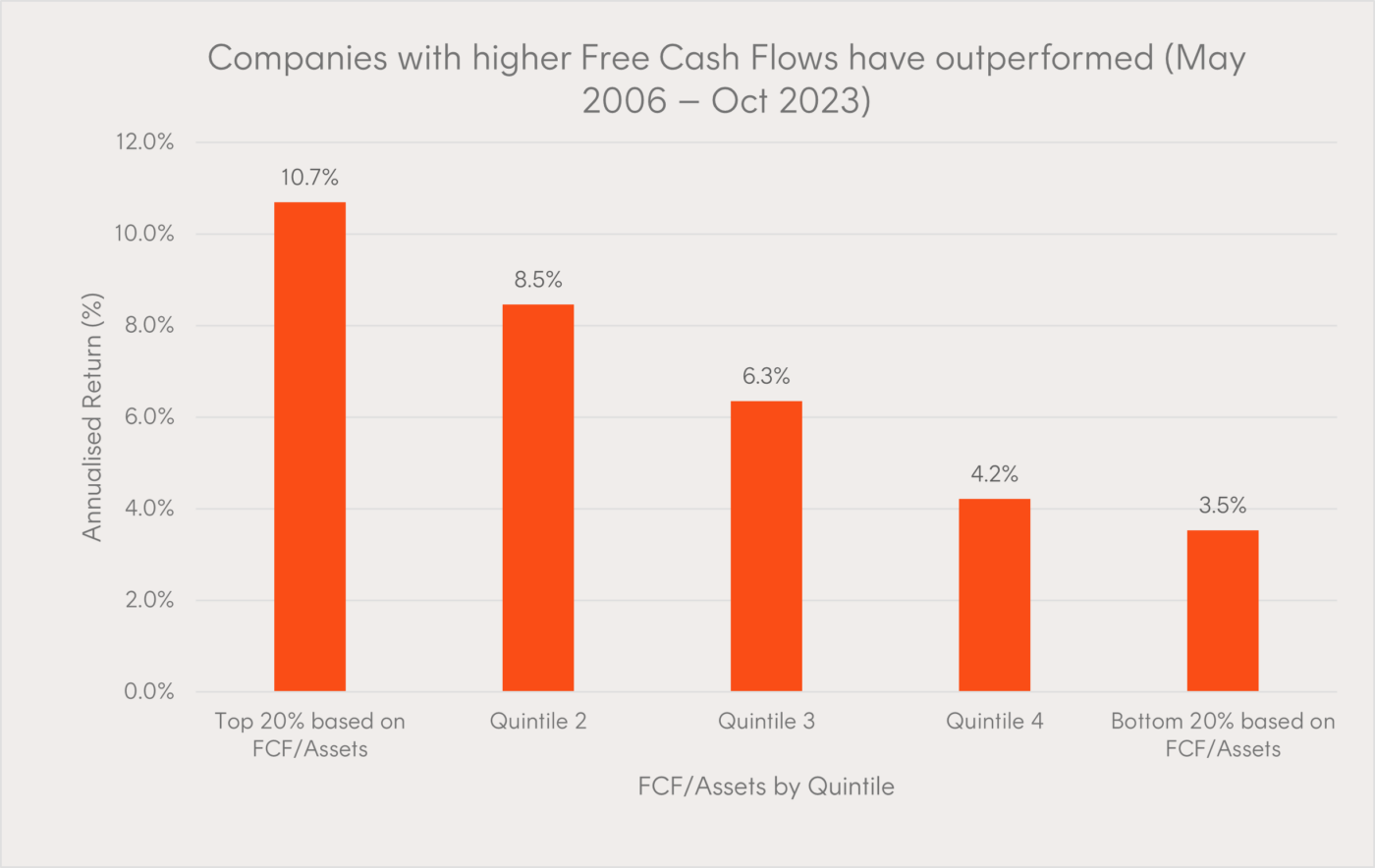

One of the central pillars of modern financial analysis dictates that an asset’s value is represented by the present value of all future cash flows.

The index that CFLO seeks to track uniquely neutralises sector differences to the broad market benchmark, and controls for country differences.

In doing so, it aims to achieve two important goals:

- Better control for the alpha generated by the portfolio truly being derived from the selection of companies with greater cash flows, rather than skewing away from the market benchmark to a particular region or sector for outperformance – which risks concentration and mean reversion.

- Reduce the risk of periods of significant underperformance to the broad market benchmark.

This allows the potential for outperformance relative to a fund that tracks a traditional benchmark alone, with the cost-effectiveness typically expected of ETFs.

ETFs for a variety of market conditions

Smart beta ETFs like CFLO and AQLT can act as the ‘bedrock’ of the equities allocation of a well-diversified portfolio for various economic environments.

These funds are intended to be held throughout the market cycle in the core of your portfolio – ‘all weather’ solutions that can be held over the long-term, reducing turnover and transaction costs.

CFLO and AQLT can also be used alongside existing low-cost passive ETFs for clients seeking to improve portfolio diversification and fundamentals.

Many advisers seek to include broad equity market beta at the lowest possible cost as part of an ‘all weather’ core.

But solutions like these allow advisers to add value beyond low-cost beta.