Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.41% to 7780.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The market is losing some steam, or at least consolidating recent gains as we head into the Easter break.

Monthly inflation data for Australia out tomorrow (3.5% exp) ahead of Retail Sales (0.4% exp) on Thursday while Good Friday sees key US personal consumption data that feeds into the all-important inflation picture, alongside a speech by Fed Treasurer Jerome Powell, both while markets are closed.

It’s therefore easy to comprehend a lack of conviction on the buy side as stocks flirt with all-time highs.

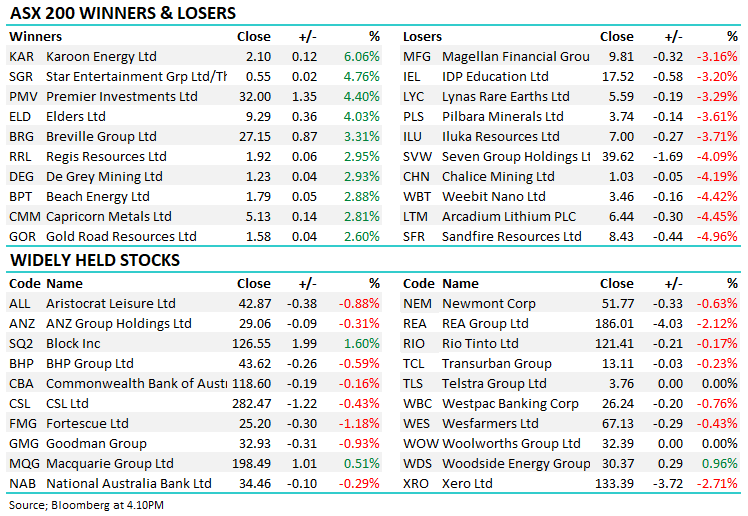

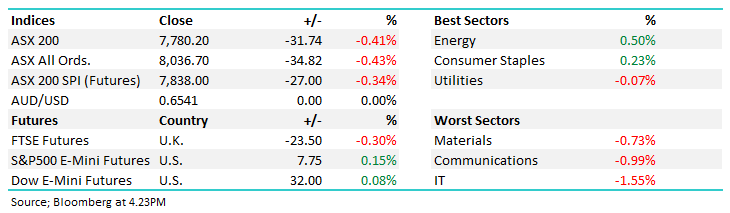

- The ASX 200 fell -31pts/ -0.41% to 7780.

- Financials (+1.74%), Consumer Discretionary (+1.50%) and Property (+1.33%) the shining lights.

- Utilities (-0.59%) and Healthcare (-0.17%) finished lower.

- APA Group (ASX: APA) +0.85% upgraded to outperform at Macquarie Group Ltd (ASX: MQG) this morning with a $9.40 PT – we’ll cover the note in the AM report tomorrow given we own in the Active Income Portfolio.

- Sandfire Resources Ltd (ASX: SFR) -4.96% on the other hand was downgraded to SELL from Citigroup Inc (NYSE: C), a stock we own across two portfolios that has had an incredible run.

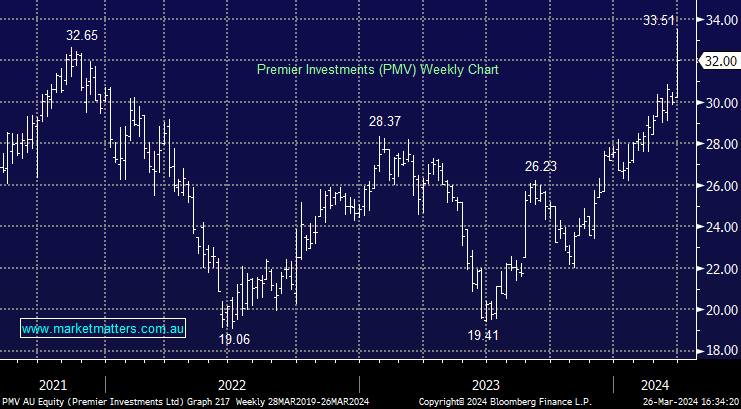

- Premier Investments Limited (ASX: PMV) +4.40% posted a strong 1H and further updates regarding spinning off retail brands, sending the shares to all-time highs.

- Beach Energy Ltd (ASX: BPT) +2.88% rallied today on a broker upgrade, however, we’ve been in multiple calls this week where their new CEO has been given plenty of wraps.

- Catapult Group International Ltd (ASX: CAT) +20.99% no news out today but the stock ripped to hit 2-year highs. Perhaps seeing smoke before the fire though CAT said nothing to see here in response to an ASX query regarding today’s price action.

- Mesoblast Ltd (ASX: MSB) +45.45% surged on a supportive statement from the US FDA regarding their treatment for Acute Graft vs Host Disease. A biotech that has been in the doldrums over the past 9 months finally seeing some positive news.

- Boral Ltd (ASX: BLD) -1.95% bidder Seven Group Holdings Ltd (ASX: SVW) -4.09% hit back at an independent expert report claiming the takeover price undervalued Boral. Seven owns ~73% of shares on issue with the report suggesting a price above $6.50/sh would be more appropriate vs the $6.05/sh currently on the table.

- Gold was flat in Asian trade, holding the small gain seen overnight.

- Iron Ore slid ~2%, which put some pressure on the miners, Fortescue Ltd (ASX: FMG) falling -1.18%

- Stocks in Asia were slightly softer today, Nikkei marginally lower while China was the worst off, down -0.38% at our close.

- US Futures pointing to a small gain on the open tonight, S&P Futures up around 0.1%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Premier Investments (PMV) $32.00

PMV +4.40%: 1H results out for Solomon Lew’s retail company posting a small beat to recent guidance followed by some positive commentary regarding 2H saw shares set new all-time highs today.

While sales of $880m was a slight miss, and retail EBIT of $209.8m was ~3% ahead of expectations and ~5% ahead of recent guidance.

PMV noted sales across their brands, including Smiggle, Peter Alexander and Just Jeans, had improved in the second half, running in line with 2H23 which puts them on track for FY24 revenue expectations.

Additional commentary regarding some corporate activity was also provided, Premier looking to spin out Smiggle by January 2025 with Peter Alexander to follow soon after.

This would leave their investments in Myer Holdings Ltd (ASX: MYR) & Breville Group Ltd (ASX: BRG), cash and remaining brands (falling under the Jeans Group), hoping to unlock value for shareholders as a result.

Premier Investments (PMV)

Broker Moves

- Monadelphous Group Ltd (ASX: MND) Rated New Buy at Bell Potter; PT A$15.40

- BHP Group Ltd (ASX: BHP) Raised to Add at Morgans Financial Limited; PT A$47.60

- Beach Energy Raised to Add at Morgans Financial Limited

- Mineral Resources Ltd (ASX: MIN) Cut to Hold at Morgans Financial Limited

- MMA Offshore Ltd (ASX: MRM) Cut to Hold at Moelis & Co (NYSE: MC); PT A$2.60

- Sandfire Cut to Sell at Citi; PT A$7.30

- APA Group Raised to Outperform at Macquarie Group Ltd (ASX: MQG); PT A$9.40

- Genesis Minerals Ltd (ASX: GMD) Raised to Outperform at Macquarie; PT A$2

- Regal Partners Ltd (ASX: RPL) Rated New Positive at Evans & Partners Pty Ltd; PT A$4.20

- MMA Offshore Cut to Hold at Shaw and Partners; PT A$2.60

- MMA Offshore Cut to Hold at Bell Potter; PT A$2.60

Movers & Losers