For over a decade, backyard barbecues and dinner gatherings have been dominated by conversations about the relentless surge in house prices. However, this enduring narrative now finds itself in competition with an equally pressing question: How best to approach the tech rally?

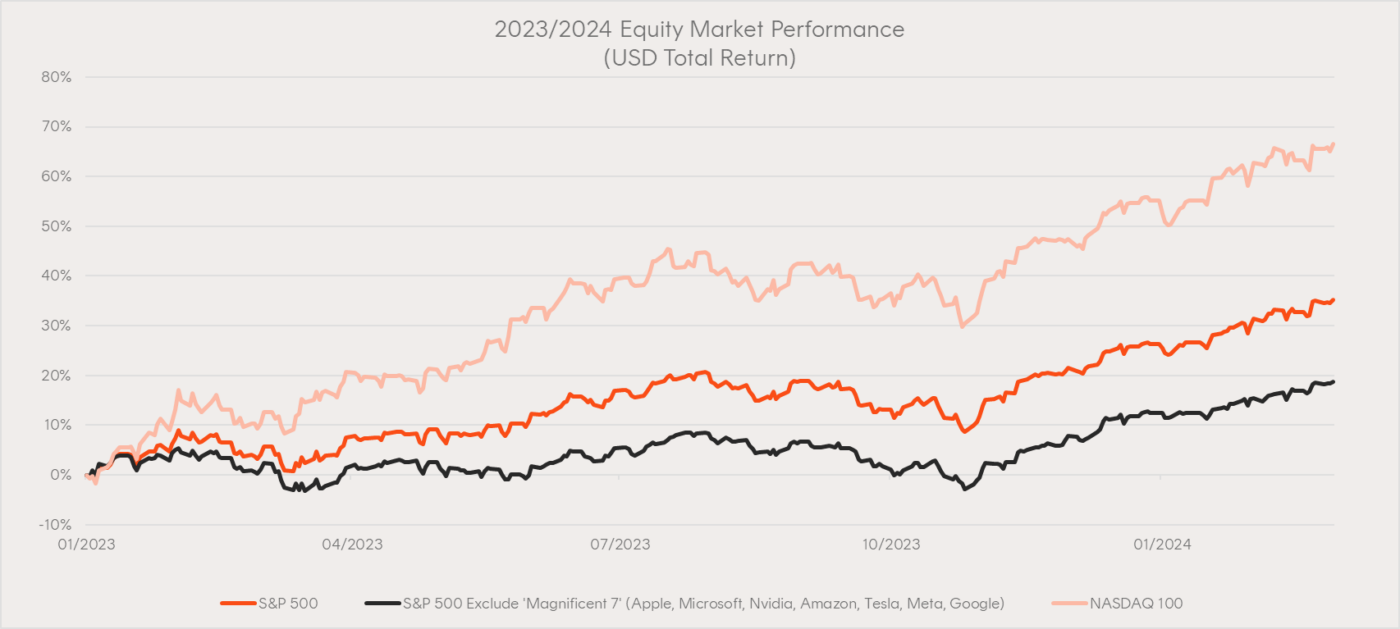

With interest rates seeming to have stabilised and investors awakening to the immense potential of artificial intelligence (AI), the ‘Magnificent Seven’ stocks drove an impressive 53.8% surge in the Nasdaq-100 (INDEXNASDAQ: NDX) Index in 2023 and propelled the S&P 500 (INDEXSP: .INX) past 5,000 for the first time in February 2024.

Nevertheless, amid the massive gains and optimistic projections, a number of key questions have emerged:

- Has the ‘easy money’ been made?

- Is it prudent to overweight NVIDIA Corp (NASDAQ: NVDA) and other AI leaders among the Magnificent Seven?

- Is there better value elsewhere in the market?

In this blog, we assess the pros and cons of the tech sector’s performance and look at ETF ideas for investors looking to gain exposure to the sector.

Weighing the positives

The surge in ‘Big Tech’ stocks has been remarkable, with some stocks experiencing significant gains. For instance, Nvidia’s stock has more than tripled in the 12 months to 29 February 2023, while Meta Platforms Inc (NASDAQ: META) has more than doubled. Amazon.com Inc (NASDAQ: AMZN), Microsoft Corp (NASDAQ: MSFT), and Alphabet Inc Class A (NASDAQ: GOOGL) are up over 50% over the same period.

If we consider where we were this time last year, arguments could be made that the tech sector’s surge appears justified.

- First, after a period of intense interest rate hikes and recession fears, the sector was undervalued. However, the strong structural growth story and key themes like AI, digital advertising and cybersecurity, have so far remained intact.

- Second, as indications of a halt in rate increases emerged from central banks in late 2023, many investors sought to capitalise on relatively appealing valuations, particularly among AI leaders such as Amazon, Apple Inc (NASDAQ: AAPL), Alphabet, Microsoft, Meta, and Nvidia.

- Third, tech stocks’ earnings in Q1 2024 showed significant growth and bullish outlooks, with Nvidia’s revenue soaring by 217% over the 12 months to Q4 FY24, prompting the company’s CEO Jensen Huang to declare that

“accelerated computing and generative AI have hit the tipping point.”

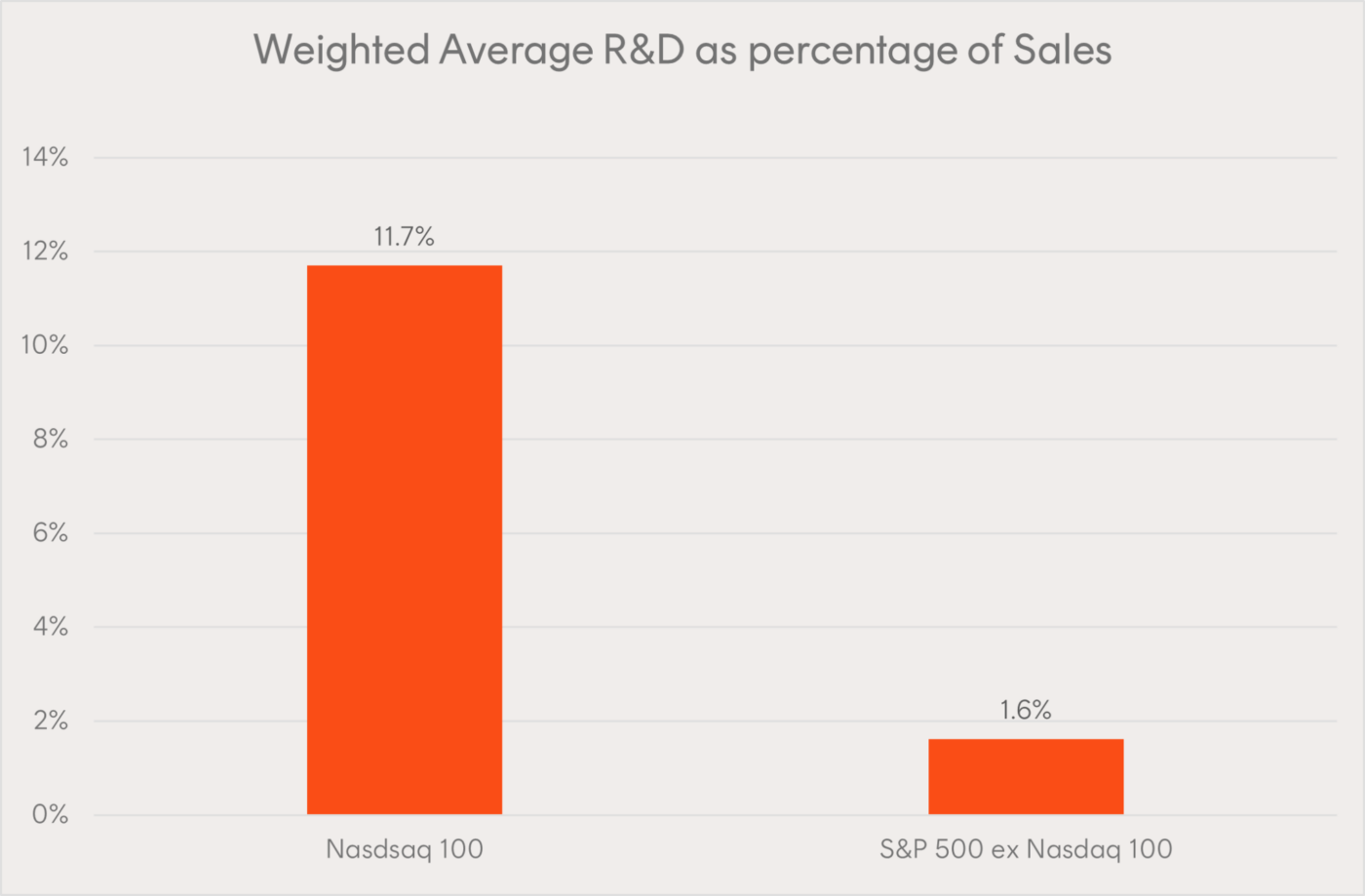

- Lastly, companies in the Nasdaq-100 Index invested far more in research and development (R&D) than their peers in the S&P 500 Index (as of 30 June 2023), as shown in the chart below. R&D is a key driver of growth, and high spending may reflect tech-oriented companies’ intention to keep innovating with the aim of creating more and bigger revenue streams.

Annualised historical earnings growth (for the 20 years to 31 December 2022):

- Nasdaq-100: 19.7% p.a.

- S&P 500: 9.5% p.a.

Weighing the negatives

Despite the prevailing optimism, there are risks on the horizon.

- First, the sustainability of the current market rally heavily relies on central banks cutting rates and achieving a soft landing, a scenario already factored into current share prices. However, if central banks fail to meet economists’ expectations due to lingering inflation, it could potentially undermine the ongoing rally.

- Second, geopolitical events pose a significant concern. Case in point, the US has imposed bans on Nvidia, Intel Corp (NASDAQ: INTC) and Advanced Micro Devices, Inc. (NASDAQ: AMD), preventing them from selling their top-tier chips to China. Should these restrictions escalate into a full-blown trade conflict, it may significantly hamper the revenue streams of chipmakers and other tech firms, potentially sparking volatility.

- Third, a case can be constructed for a shift from growth to value stocks amid economic uncertainty. The chart below shows the ‘Magnificent Seven’ contributed to almost half of the S&P 500’s returns in 2023, indicating a disparity where non-tech stocks have trailed.

How should investors approach the tech rally?

When considering both the upsides and downsides, it’s clear that the tech sector, particularly the AI market, presents significant long-term growth potential.

However, investors should be mindful of the risks and how much has already been factored into share prices when determining their allocation.

For investors seeking a strong emphasis on AI or aiming to integrate this theme as a satellite position, Betashares Global Robotics and Artificial Intelligence ETF (ASX: RBTZ) presents an option. While Nvidia currently holds the top spot in the fund’s portfolio, it also provides exposure to a variety of other significant players in the AI and robotics sector, including medical devices company Intuitive Surgical, Inc. (NASDAQ: ISRG) and factory automations leader Keyence Corp (TYO: 6861).

Betashares Nasdaq 100 Equal Weight ETF (ASX: QNDQ) offers investors a more diversified exposure overall to non-financial US equities listed on the Nasdaq market. With each stock allocated a 1% weighting at every rebalance, there is low stock concentration, mitigating overexposure to the ‘Magnificent Seven’.

Alternatively, investors seeking to diversify their global equity exposure may consider Betashares Global Cash Flow Kings ETF (ASX: CFLO). This ETF focuses on companies known for their robust free cash flow (FCF) generation and relatively low levels of debt, serving as an option for a core global equity allocation.

CFLO’s holdings encompass not only tech giants with strong FCF like Microsoft but also notable non-tech firms such as Procter & Gamble Co (NYSE: PG), American Express Company (NYSE: AXP), and Novartis AG (SWX: NOVN).

Top 10 holdings of RBTZ, QNDQ and CFLO

The following table offers further insight into the level of diversification within the above-mentioned ETFs’ top 10 holdings. It’s important to keep in mind that a higher concentration could yield greater returns if those stocks with large weightings continue to perform strongly, whereas a lower concentration may potentially result in reduced volatility.

| RBTZ | Weight | QNDQ | Weight | CFLO | Weight |

| Nvidia | 22.30% | Nvidia | 1.70% | Costco Wholesale | 4.50% |

| Intuitive Surgical | 10.20% | Constellation Energy | 1.40% | Microsoft | 4.30% |

| Abb | 8.30% | Advanced Micro Devices | 1.40% | Visa | 4.20% |

| Keyence | 7.00% | Meta Platforms | 1.40% | Novo Nordisk A/S | 3.90% |

| Fanuc | 5.30% | Marvell Technology | 1.30% | Accenture Plc | 3.50% |

| Uipath | 4.00% | Doordash | 1.20% | Adobe | 3.40% |

| Smc | 4.00% | Netflix | 1.20% | Alphabet | 3.40% |

| Dynatrace | 3.80% | Applied Materials | 1.20% | Unitedhealth Group | 3.20% |

| Yaskawa Electric | 3.70% | Asml Holding | 1.20% | Procter & Gamble | 3.10% |

| Daifuku | 3.30% | Lam Research | 1.20% | Cisco Systems | 2.80% |

Source: Betashares (as at 6 March 2024). Excludes cash. Subject to change.

Final thoughts

Whether you’ve already benefited from the tech rally or are considering investing in the sector, it’s prudent to plan your next move carefully.

One approach is to consider thematic ETFs for satellite exposure or choose funds that offer diversification across the broader tech industry and global equities.

This strategy allows the integration of the tech theme while mitigating concentration risk within your portfolio.