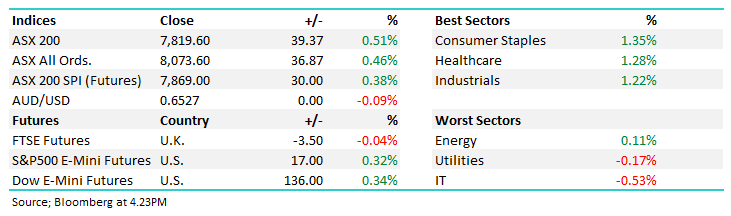

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.51% to 7,819.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

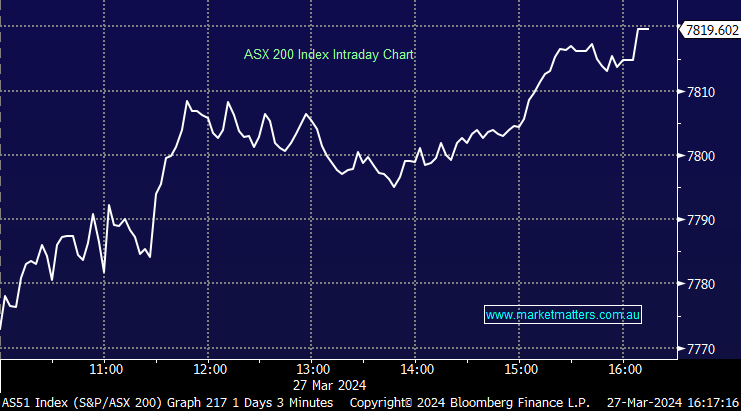

The market opened on the back foot this morning before buyers stepped in, aided by softer-than-expected monthly inflation data that underpinned a good turnaround in stocks, particularly from the more defensive areas while IT took a breather.

- The ASX 200 finished up +39pts/+0.51% at 7819.

- The Staples Sector was best on ground today (+1.35%), with gains of more than 1% by Healthcare (+1.28%) and Industrials (+1.22%)

- Tech was the weakest sector (-0.53%) followed by Utilities (-0.17%) as the only other sector in the red today.

- Monthly Inflation Data released at 11.30am was a touch more benign than expected coming in at 3.4% YoY vs consensus of 3.5% for Feb.

- If we annualise the last 6 months of data, inflation is running at just 2.2%, at the lower end of the RBA’s target range, and also well below the RBA’s current forecasts.

- Having peaked at 8.4% in December 2022, inflation has been in free fall, and when we think about what drove inflation in the first place, being a once-in-a-generation pandemic that significantly impacted global supply chains, it’s easy to mount a case that the RBA should be cutting sooner rather than later.

- We doubt this figure will change their thinking, and timing around the first cut, with the market pricing an ~80% probability of a cut in August, 100% by September, and a total of 0.46% of cuts this side of Christmas.

- Bond yields ticked mildly lower today, following their US peers overnight aided by the softer inflation print, Australian 3’s down 2bps at 3.64%.

- The AUD also ticked down but not meaningfully, off 0.12% at 65.25c

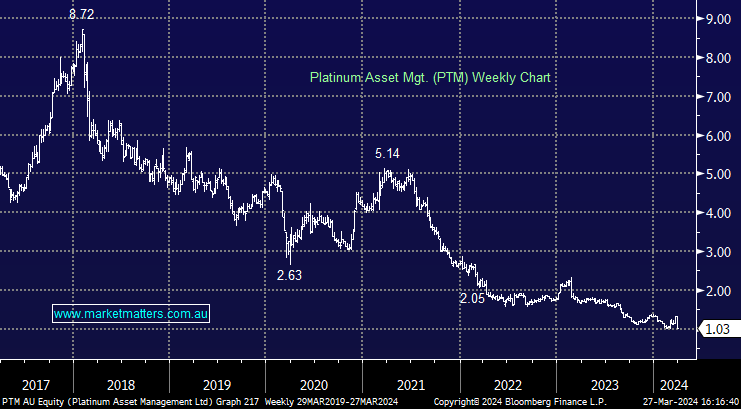

- Platinum Asset Management Ltd (ASX: PTM) -21.07% in the cross hairs today, saying a $1.4b redemption had been requested, around 9% of total FUM which will impact earnings moving forward. PTM is looking to cut costs to offset this.

- APM Human Services International Ltd (ASX: APM) in halt after CVC Asia Pacific walked away from a $1.83bn/$2.00 buyout proposal.

- Sandfire Resources Ltd (ASX: SFR) +2.14% bounced back after being hit yesterday on a Citi downgrade. A lesson here; If an influential broker downgrades a stock, be a seller early on or not at all, and be patient for a day or two.

- Magellan Financial Group Ltd (ASX: MFG) +1.53% had a strong turnaround today, hit a low of $9.64 mid-morning before closing on the high at $9.96. Two weak sessions and buyers emerged into weakness today. We think this looks good here for further upside.

- Uranium stocks pulled back, Paladin Energy Ltd (ASX: PDN) -2.5% & Boss Energy Ltd (ASX: BOE) -3.14%, we attended a Uranium Conference yesterday and gave some high-level thoughts on the bigger picture + individual stocks this morning here

- Mesoblast Ltd (ASX: MSB) +3.13% stormed higher after the FDA cleared the way to resubmit their cell therapy treatment.

- Iron Ore was lower again in Asia, BHP Group Ltd (ASX: BHP) lagged the broader market strength.

- Gold was flat trading at US$2177 at our close, still within striking distance of $US2200/oz breakout level

- Asian stocks were mostly lower, Hong Kong off -0.63%, while Chinese stocks dipped -0.52%, Japan bucked the trend to rise +1%

- US Futures are slightly higher, up around +0.35% each

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Platinum Investment Management (PTM) $1.03

PTM -21.07%: more pain is being felt at the fund manager, Platinum today announcing a significant mandate loss to come through in March in a release to the market that landed at 6.14 pm last night… A $1.4b redemption has been requested, worth ~9% of FUM held by the company with a client moving away from benchmark agnostic investments.

There remains a risk of further outflows with the client not fully closing their position with PTM. To try and offset some of the loss, Platinum is looking to take a knife to costs and streamline the business.

They provided further detail into their restructuring plans that were released with the result in Feb, looking to cut ~25% of the cost base using the 1H as the marker, with the bulk of savings to be seen in FY25.

Platinum Asset Mgmt (PTM)

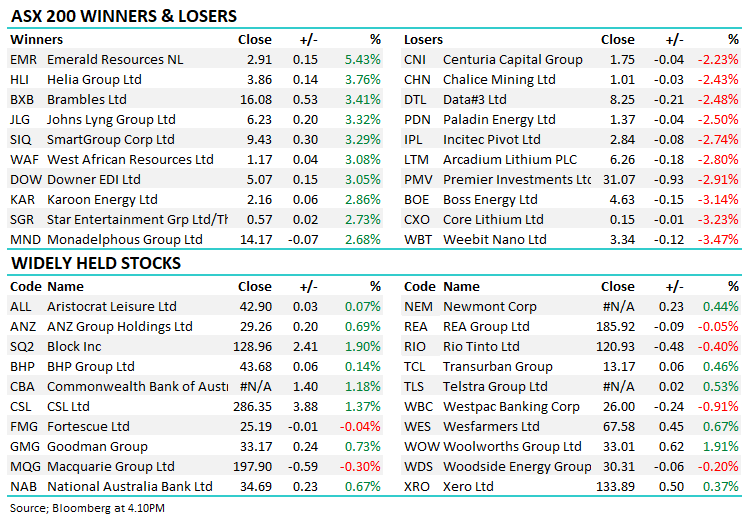

Broker Moves

- Spartan Resources Ltd (ASX: SPR) Reinstated Speculative Buy at Argonaut Securities

- Premier Investments Raised to Neutral at UBS; PT A$31

- Objective Corporation Ltd (ASX: OCL) Rated New Buy at Blue Ocean Acquisition Corp (NASDAQ: BOCN); PT A$15.81

- Platinum Asset Cut to Sell at CLSA; PT A$1

- 29Metals Ltd (ASX: 29M) Cut to Underperform at Macquarie Group Ltd (ASX: MQG)

Major Movers Today