Altium Ltd (ASX: ALU) is set to disappear from the ASX after receiving a A$9.1 billion cash takeover bid from Japanese semiconductor manufacturer giant Renesas. Altium has been one of the great success stories of the ASX, delivering returns of 33x over the last 10 years, and 232x over 15 years.

What can we learn from its success and how do we identify the next Altium?

In mid-2023, on the RASK Australian Investors Podcast, Owen & Luke discussed the factors that predict multi-bagger investments and our approach to unearthing them here at Seneca, and a few ideas that look set to be long term compounders in the Seneca Australian Small Companies Fund.

The market is often poor at identifying structurally supported growth over the long-run. Short-cut valuation metrics like price-earnings (PE) and price-earnings-growth ratios (PEG) are static and fail to accurately capture the most important factor in investing – rates of change. Take Altium for example, which traded on a PE of 25x 10 years ago, and just got taken over at an 88x valuation multiple!

However, the commonly associated tech companies like WiseTech Global Ltd (ASX: WTC) and Xero Ltd (ASX: XRO) who already trade on PE ratios of 92x and 88x respectively, are priced for the known growth rates to continue for many years into the future – we want to look for the companies that have the potential to be the next ALU, or the next WTC or XRO, and can benefit from multiple expansion as well as rapid earnings growth, that isn’t yet priced by the market.

RPMGlobal Holdings Ltd

The mining industry is relatively slow to adopt new software and technology. High risk work, coupled with high value equipment and stringent regulatory oversight bring about a reluctance to shake the apple cart.

RPMGlobal Holdings Ltd (ASX: RUL) has built and acquired range of software products includes mine planning, mobile equipment management, finance management and more. RPMGlobal’s AMT software has established itself as the go-to for major mining companies and its operations and planning product XECUTE is gaining traction with small/medium-sized miners.

Investors appear to have overlooked the multi-year transition underway at RPM. Like other multi-baggers before it [Altium, Adobe Inc (NASDAQ: ADBE), Apple Inc (NASDAQ: AAPL) and Xero spring to mind], RPM is moving from an upfront, one-off revenue model to an ongoing subscription-based revenue model.

Like Adobe in 2012, the rapid rate of underlying revenue growth has been obscured by this transition. Critically for savvy investors, Adobe has hit the inflection point – where incremental revenue growth drops down to the bottom line thanks to flattening development costs.

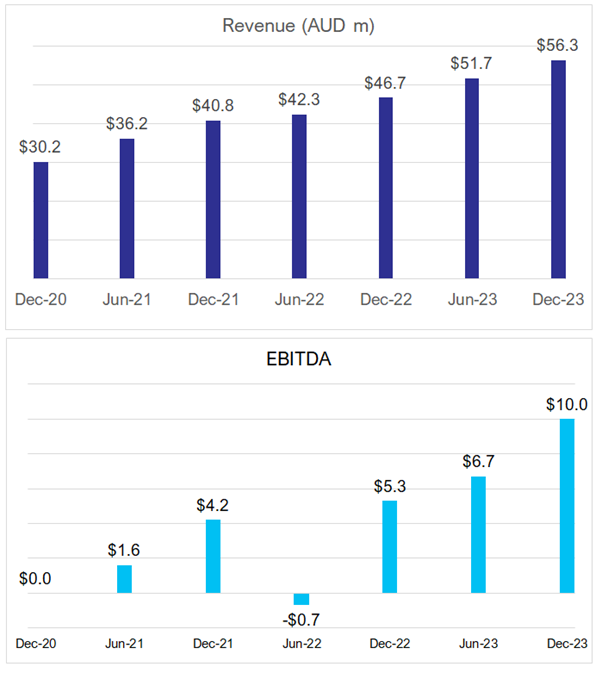

The mining software and advisory player reported 1H24 revenue up +20.6% to $56.2 million, and EBITDA up +89% to $10.0 million.

RPMGlobal expenses its development costs (unlike many of its ASX-listed software peers that capitalise them), meaning the majority of that $10m EBITDA drops down to the bottom line, with $6.8 million profit after tax. Management reaffirmed guidance for $21.5m – $23.5m EBITDA in FY24.

RPM trades on circa 4x EV/Sales on a forward-looking basis, and 10.8x EV/EBITDA (on a pre-R&D basis so that we can compare apples with apples). ASX information technology peers trade on 39x EV/EBITDA currently, up from a long-term average of 31x.

Through a combination of continued high margin earnings growth and multiple re-rate, we think RUL should generate outsized long term returns for shareholders and has the potential to be the next multi-bagger on the ASX.

If it doesn’t, don’t be surprised to see RPM get a takeover bid, considering its valuation compares very favourably to the 50x EV/EBITDA multiple represented by the Altium takeover bid, and to the ~27x average that comparable mining software peers (Micromine, Deswik) have transacted at.

Webjet Ltd

When people think of Webjet Ltd (ASX: WEB) they probably think of the old flight comparison website that helps prospective travellers shop around for cheap flight deals to holiday destinations.

Over time Webjet’s business model has shifted from a B2C online travel agent to a B2B global marketplace for the hotel industry. WebBeds is the second largest and fastest growing ‘bed bank’ in the world. It now generates the majority of Webjet’s earnings, and is the primary engine of growth, posting $89.9 million of EBITDA in 1H24 and growing by 41% year over year. This compares to the webjet.com.au division which made $26.6 million EBITDA and grew by 24%.

WEB is now a truly global marketplace business. As a holiday accommodation (hotels) aggregator, WebBeds enjoys similar hyper-scalable characteristics as some of its offshore technology peers like Airbnb Inc (NASDAQ: ABNB) on 23x EV/EBITDA or Booking Holdings Inc (NASDAQ: BKNG) on 16x. WebBeds, like other similar businesses, operates on EBITDA margins in the 50-55% range.

We think WEB is mispriced on 13x forecast EV/EBITDA, in line with its 10-year average despite being a materially higher-quality business now. Investors are still pricing WEB like it’s a low-moat travel agent, rather than a higher quality aggregator. We see no reason why in time, this high quality marketplace won’t be priced in line with other businesses that operate on similar high margins, high ROIC% and benefit from a sustainable flywheel effect.

If WEB can re-rate from a two year forward P/E of ~17x towards that of a REA Group Ltd (ASX: REA) on 38x or even a Domain Holdings Australia Ltd (ASX: DHG) on 27x, there is substantial upside for WEB shares.

On this basis, we can comfortably get to a WEB valuation implying >30% upside over the medium term. And as we’ve learned from companies like Altium, high-quality companies often deliver positive earnings surprises that in hindsight, have made forecasts look overly conservative.

We recently increased our WEB position in our Seneca Australian Shares SMA, which has outperformed the S&P/ASX 200 (INDEXASX: XJO) Accumulation Index since inception.