One of the more interesting questions I’ve fielded a few times this past month is, ‘what level of passive income can I get from a good stock market portfolio?’

As Charlie Munger might have said, let’s start with what we should avoid…

With interest rates, land tax, strict tenancy laws, maintenance, vacancy tax, regular income tax and political scrutiny…

… it’s fair to say, relying on property to generate passive income (pre or post retirement) could be a very bad idea.

And, fortunately… I have some really good news for passive income investors.

In the past 10 years, there’s probably never been a better time to earn passive income from… everything but property!

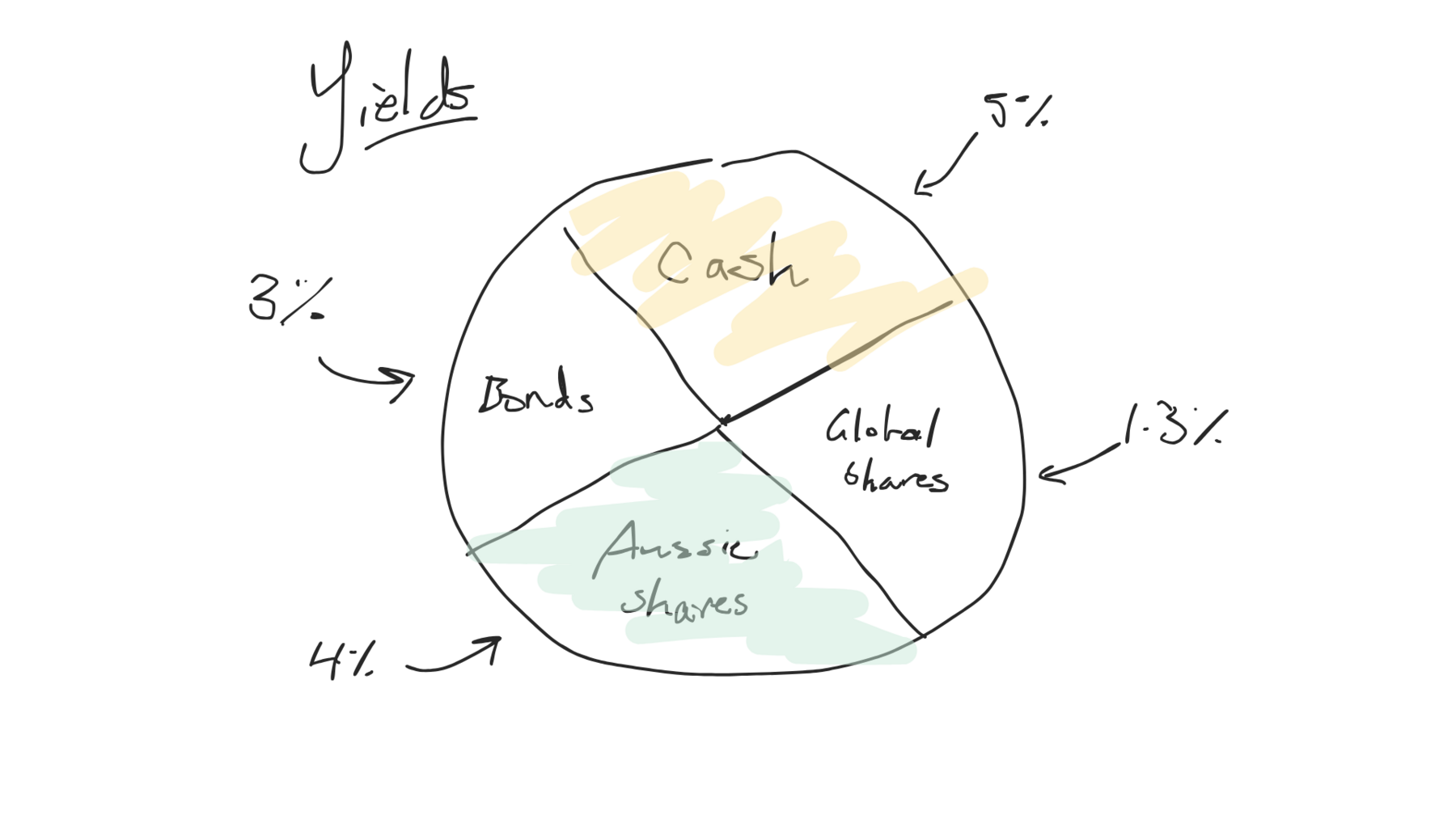

For example, right now, a boring Government bond ETF like the iShares IAF ETF can yield 3% (or more). A few years ago, that was not a good option (in my opinion).

Global X’s US Treasury Bond ETF (ASX: USTB) is yielding 4.5% for lending to the US Government.

(Note: Global X is a long-term sponsor of a Rask podcast. We’re not paid by them to write this.)

A term deposit from Mr Lion (ING) or the Silver Donut (Macquarie) will you pay nearly 5% – with virtually no risk given the Government guarantee. A few years ago, I would salivate for 1.5%.

Heck, even a vanilla Australian shares ETF like Vanguard’s most popular Vanguard Australian Shares Index ETF (ASX: VAS) or BetaShares Australia 200 ETF (ASX: A200) will pay nearly 4%. Chuck in the franking credits that’ll pass through them, and it could be pouring out 5% of income while you sleep!

(Note: Betashares is a long-term sponsor of a Rask podcast. We’re not paid by them to write this.)

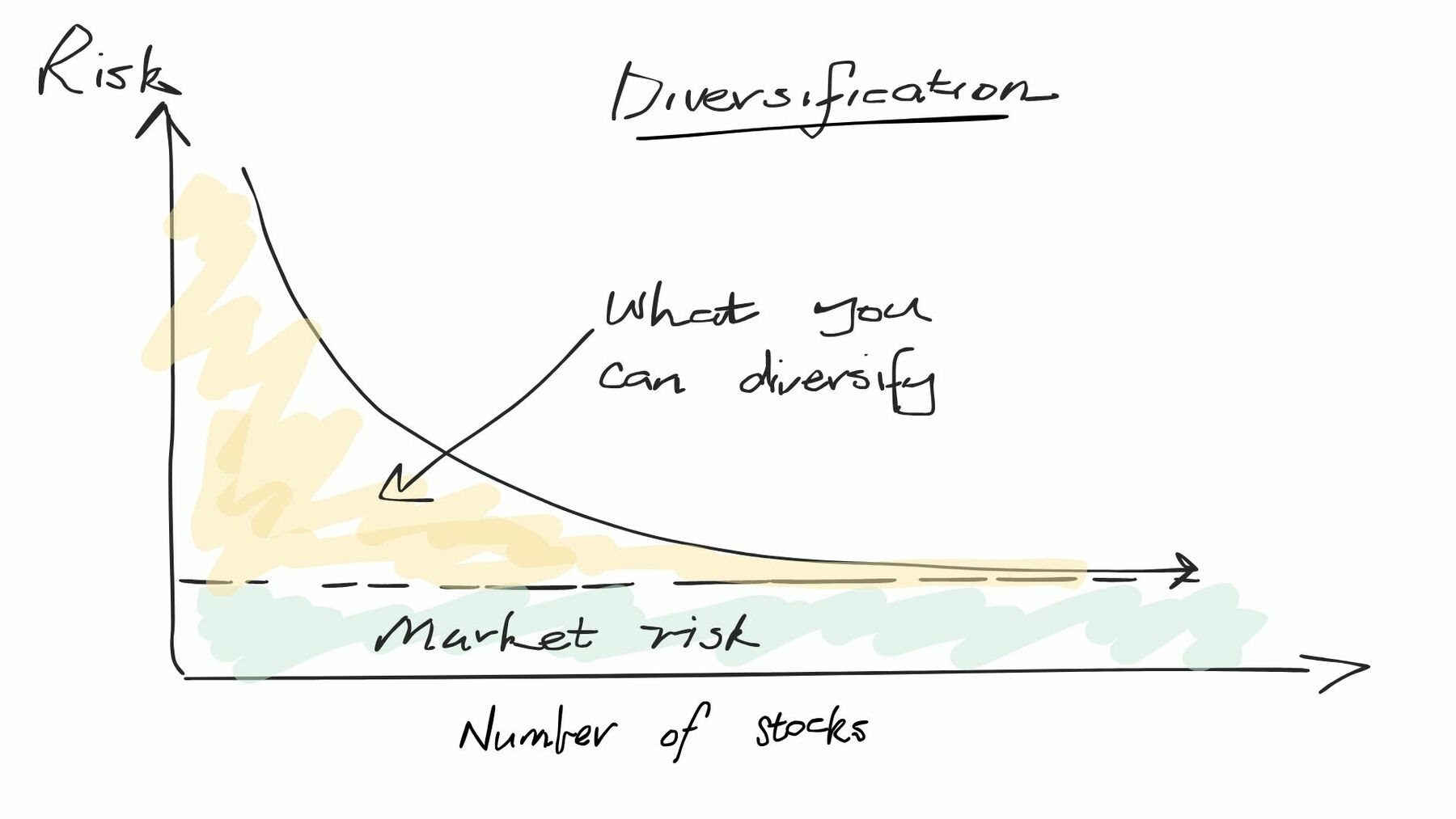

The thing is, dividends from shares are not guaranteed (like a term deposit). However, using a good ETF will be much more consistent than owning single stocks – thanks to the power of diversification.

The chart above shows you that adding more ‘different types of stocks’ will lower your overall portfolio risk. Meaning, if you’re chasing income – don’t get yourself into a position where you rely on one stock or type of asset [e.g. BHP Group Ltd (ASX: BHP), Commonwealth Bank of Australia (ASX: CBA), etc.]. The anxiety about an upcoming dividend decision is real.

Loosely speaking, by using a truly diversified ETF, you can ‘instantly’ move your risk profile down to the bottom line “market risk”.

For example, if BHP or Fortescue Ltd (ASX: FMG) cuts its dividends this year, you can rest assured because there are 298 other stocks inside the Vanguard VAS ETF.

However, your ETF will still move up and down, as the overall market moves (hence “market risk”). But you shouldn’t suffer completely from any one stock going really bad (e.g. iron ore prices falling).

Now imagine you ALSO throw in more than one ETF, from more than one sector (e.g. Australian shares ETF, bonds ETF, cash ETF, etc.), from more than one geography (Australia, US, global), from more than one issuer (Vanguard, Betashares, iShares, Global X, VanEck, etc.).

This is special.

This is where you get passive income with some franking credits, without worrying about “trading stocks”, without picking individual winners. All the while, you don’t need to take the same level of risk.

Finally, an added bonus of using ETFs instead of property for income in retirement is that, if an ETF investor needed to top up his or her income, she wouldn’t need to sell half the bathroom or all of the ensuite to pay for a new car or a holiday or family emergency.

She would simply sell part of her ETF holding and have the money ready in a few days!

All up, I believe even the most basic (but good) retirement ETF portfolio – with only 50% in ‘growth’ assets like shares and the other 50% in defensive assets like bonds and cash – can yield close to 3.5%. But…

(and it’s a big BUT)

… in addition to the income, your portfolio should grow over the long run. Not every year, but over 10+ years.

That’s the beauty of a diversified portfolio, with ETFs inside of it.

Please Sir, can I have some more?

However, let’s say you’re not scared to go beyond the vanilla flavours.

If you told me to get a tiny bit more creative, I reckon I can move an ETF portfolio towards 5% of income, with franking credits sprinkled on top.

Simply stir in a good dividend ETF (one that pays franking credits), add a pinch of a credit ETF [e.g. VanEck Australian Subordinated Debt ETF (ASX: SUBD)], then bring the portfolio slightly back to Australian shares (for more franking).

Delicious, tax-effective, passive income, via a low-cost ETF portfolio… no land tax in sight!

(Psst. a word of warning: if you try to ‘add’ too much income to your portfolio, you – or your adviser – is likely taking too much risk… probably without realising it. The best-performing investment over the long run is the share market, which has returned around 9-10% per year on average. I’m using loose figures, but you can use this level as a rule of thumb: if you expect 5% in income, your growth may be more muted (e.g. 4%). The thing is, if you try to turn your income dial up to, say, 10%, your portfolio may even go backwards because of the risk you’re taking. That’s the real risk. You’ve been warned.)

But Owen, what happens when interest rates fall?

If interest rates fall – ideally before they fall – a good investor would tweak their portfolio to benefit.

A common misconception is that when the stock/property/bond market crashes, all wealth disappears. That’s not how it works.

As least, not if you’re invested in a truly diversified portfolio and have a plan. You may actually benefit from changes in the economic environment.

For example…

By locking in some term deposits with different maturities (instead of keeping cash parked in one savings accounts), adding some Government bonds (which should go up as interest rates fall) and diversifying across different types of shares and currencies, we can build an ‘all weather’ portfolio.

This means, the portfolio’s value might go up when interest rates fall – and you may be able to preserve some of your passive income stream. At least for a little while.

(Psst. I believe predicting market crashes is impossible. What I’m talking about is akin to ‘hope for the best, but be prepared for the worst’. Or… more simply, it’s probably going to be sunny in Melbourne this month, but you may as well pack an umbrella. All of the investment strategies I’ve seen will go up and down, sometimes for longer than we expect.

Bottom line

The bottom line to my email is pretty darn good news for investors who have a focus on Super, an SMSF, or for those thinking of reducing their exposure to property to get true passive income.

Right now, the yields on offer for truly diversified portfolio are some of the best I’ve seen in the past 10 years.

On top of that, I think it’s never been easier to invest in a portfolio of ETFs and get professional guidance while you do it. This is why I designed the Rask Terra retirement portfolio the way I did.

(Please note: There are many reasons I see ETFs and the stock market playing a bigger role in my own portfolio. Many of which I first laid out, in detail, many years ago in the Rask philosophy and 10 rules of wealth. Or, more recently, in the article, ‘where I’m invested and how it’ll change.’)

P.S. if you plan to invest with us, you can book a call with our team.