Global markets – week in review

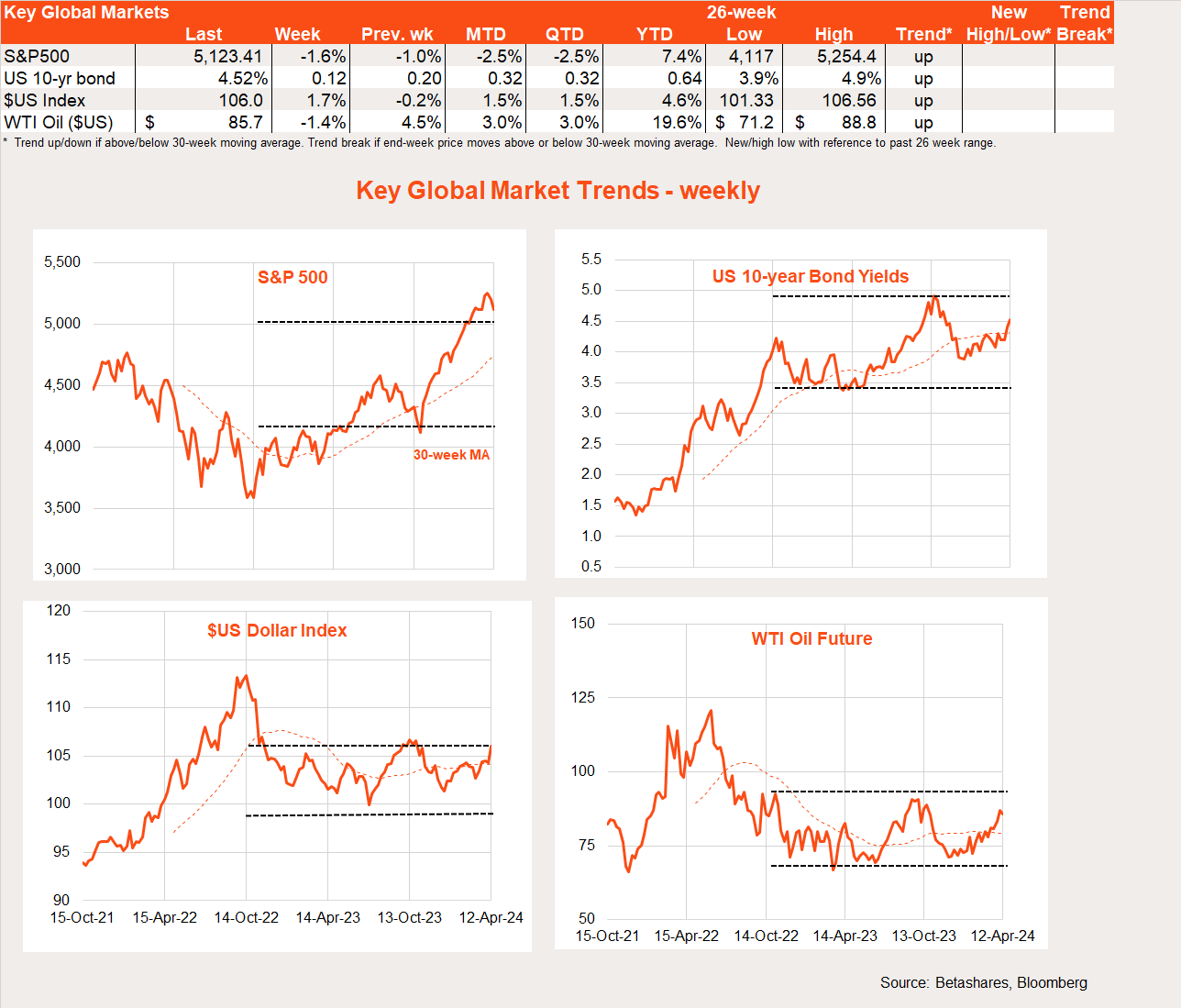

Rising Middle East tensions, a higher-than-expected US CPI report, and a soft start to the US earnings reporting season conspired to push US equities down for the second week in a row.

Bond yields and the $US rose as US rate cut expectations were pushed back further.

The market now expects no more than two US rate cuts later this year.

Prior to Friday’s reports that Iran was planning an attack on Israel, the major global highlight last week was the slightly hotter-than-expected March US CPI report.

Both headline and core inflation rose 0.4% in the month, compared to market expectations for a 0.3% gain in both.

It was the third month in a row that the US CPI has surprised on the upside – in part because the imputed rent on owner-occupied housing (yes it is an actual element of the CPI!) is not easing as much as estimates of private rents on new leases usually suggests. Strong gains in car insurance, reflecting the lagged impact of COVID-related car price increases, is not helping.

Irrespective of the cause, the fact remains that the US economy remains in surprisingly rude health which is perhaps contributing to inflation being a little stickier than expected.

The market has rightly scaled back mid-year rate cut expectations and, especially given stretched valuations, Wall Street remains vulnerable to a deeper correction if the bad run on inflation continues and/or the Fed starts to sound more hawkish.

We can now throw into the mix the upsurge in Middle East tensions.

From a markets perspective, the main risk is a resumption of oil export sanctions on Iran which could further drive up oil prices, inflation and bond yields.

The question now is whether the tit-for-tat between Israel and Iran continues.

For its part Iran has signalled it does not want escalation, indicating its weekend attack was in retaliation for Israel’s attack in Syria (which killed a top Iranian military commander) and that

“the matter can be deemed concluded”.

We’ll soon see if Israel agrees.

Last Friday also saw the start of the US Q1 earnings reporting season, with less than impressive results for JPMorgan Chase & Co (NYSE: JPM), Citigroup Inc (NYSE: C) and Wells Fargo & Co (NYSE: WFC) further dragging on the market.

The week ahead

With little in the way of major US data this week, the focus is likely to remain on Middle East tensions (especially Israel’s response – or lack thereof – to the Iran attack).

Corporate earnings will also be in focus, with results from Goldman Sachs Group Inc (NYSE: GS) and Netflix Inc (NASDAQ: NFLX) among a swag of reports due this week.

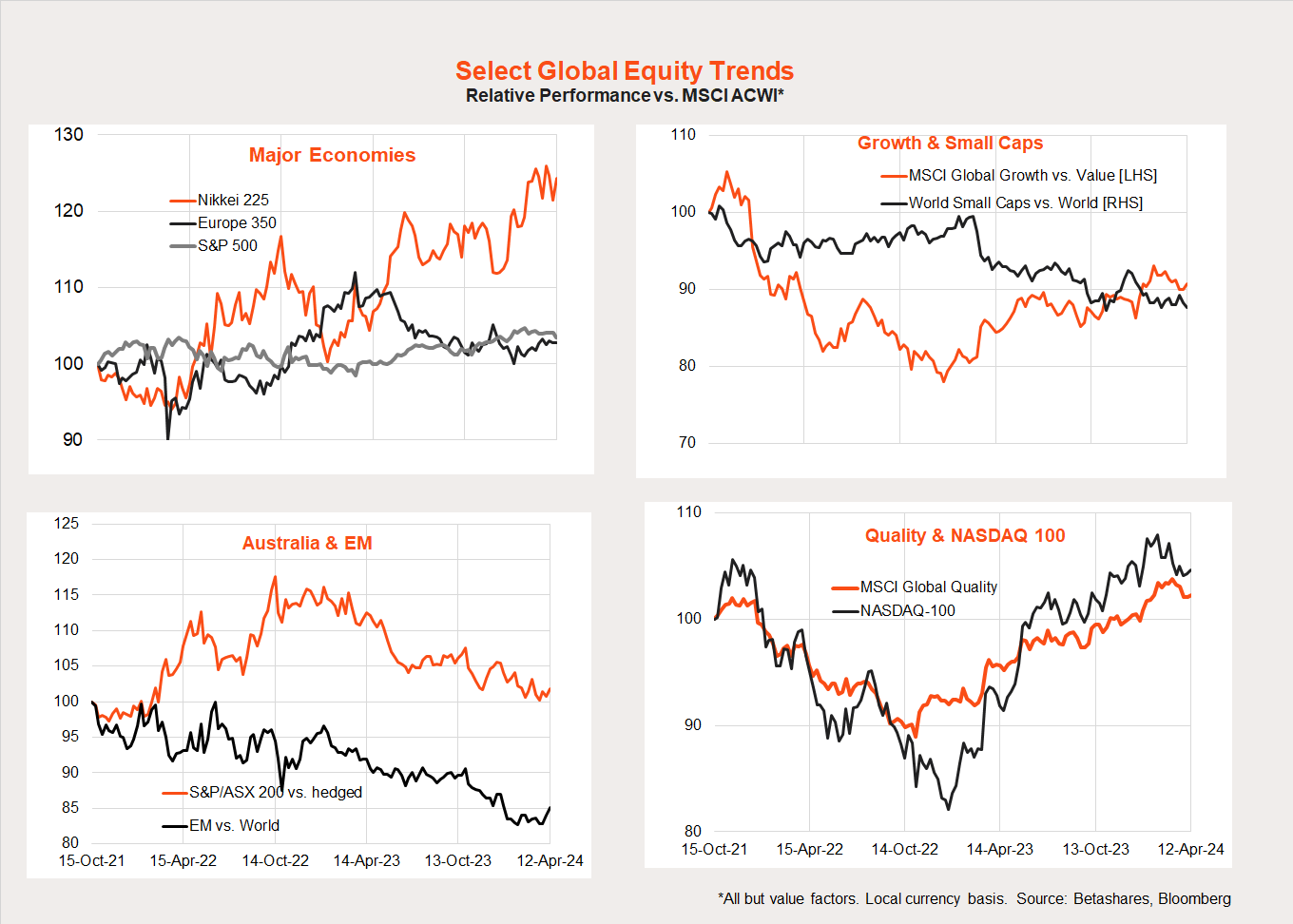

Global equity trends

Looking at global equity trends, the rebound in bond yields is helping drag back the relative performance of growth over value, as evident in the pullback in Nasdaq-100 (INDEXNASDAQ: NDX) relative performance.

Japan and Europe are also faring better, while Australia and emerging markets less so.

Australian markets

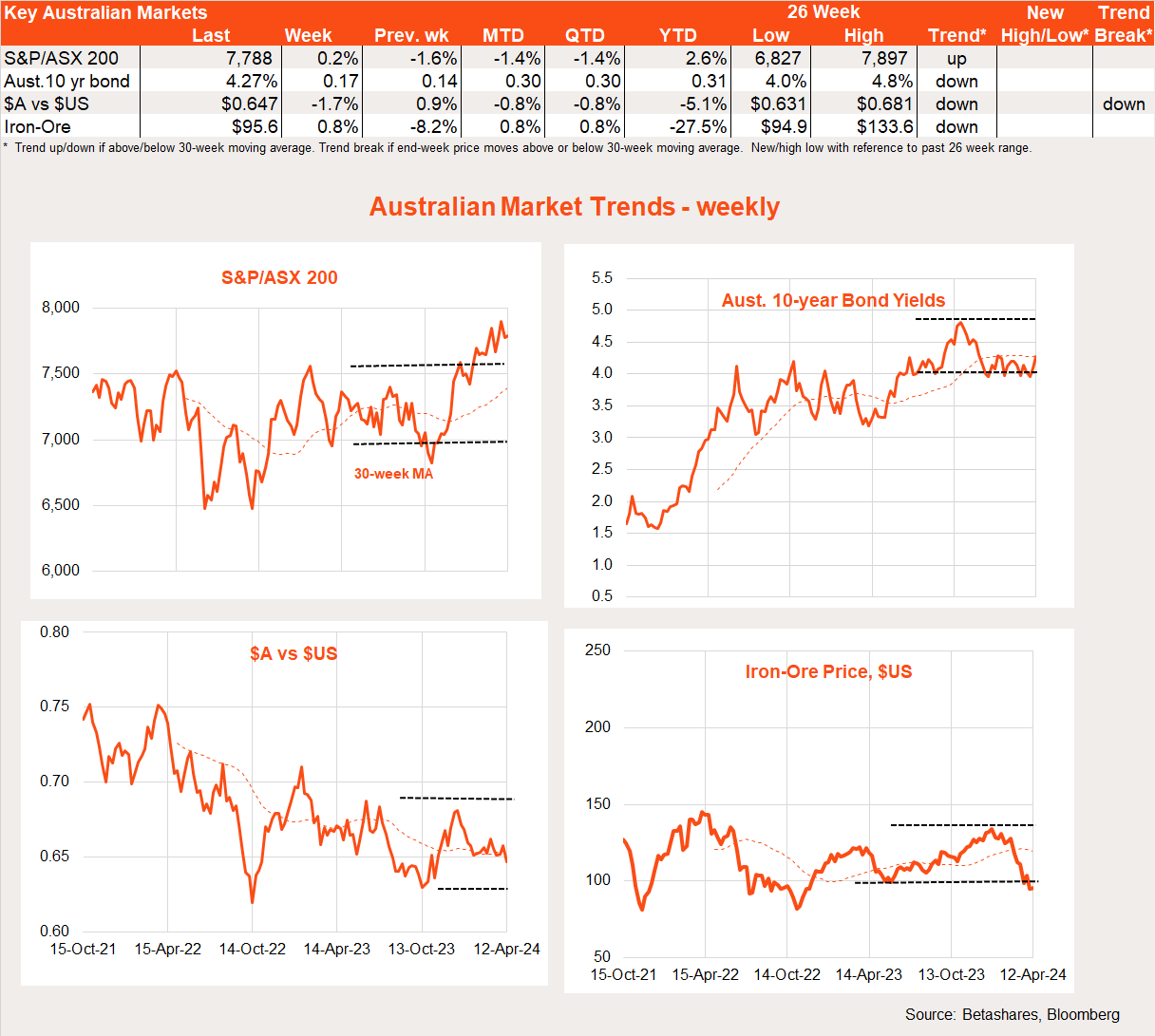

Despite rising bond yields, the S&P/ASX 200 (INDEXASX: XJO) held up reasonably well last week, with a 0.2% gain after a 1.6% decline the previous week.

That said, Friday’s Wall Street weakness and Iran’s weekend attack on Israel will likely drag on the market this morning.

The $A remains on the back foot, given a strong US economy, soggy iron-ore prices and heightened geo-political risk.

The local highlights data-wise last week were the continued dichotomy between firm business conditions and confidence in the National Australia Bank Ltd (ASX: NAB) business survey and weak consumer confidence in the Westpac Banking Corp (ASX: WBC)/Melbourne Institute consumer survey.

The split highlights the fact that spending by domestic residents has taken the biggest hit from higher RBA rates and inflation thus far – and, so far at least, this has not bled into weaker business sentiment due to healthy levels of non-residential construction activity and higher immigration.

The key local highlight this week will be Thursday’s March labour force report – which follow’s February blockbuster report in which employment surged by 100k and the unemployment rate dropped from 4.1% to 3.7%.

Although this week’s report is unlikely to be as strong (how could it be!), even a modest rise in unemployment and small corrective decline in employment would leave the labour market looking fairly tight.

Have a great week!