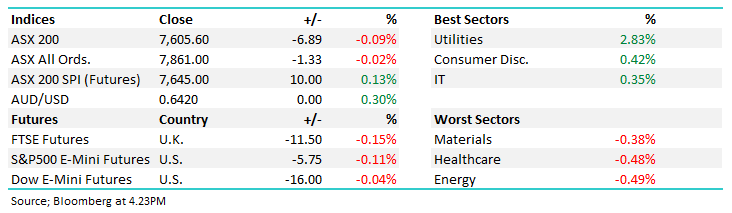

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.091% to 7,605.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

After a muted open, the market seemed to find its groove, rallying 40pts from early lows into the lunchtime peak before buying stepped away.

Shares had given back almost all of the gains by 4pm at which time the UK released their monthly CPI figure which was hotter than expected, sending down for the session, right on the close.

There was little diversion between sectors, particularly when you strip out Utilities which was supported by the heavyweights of the area.

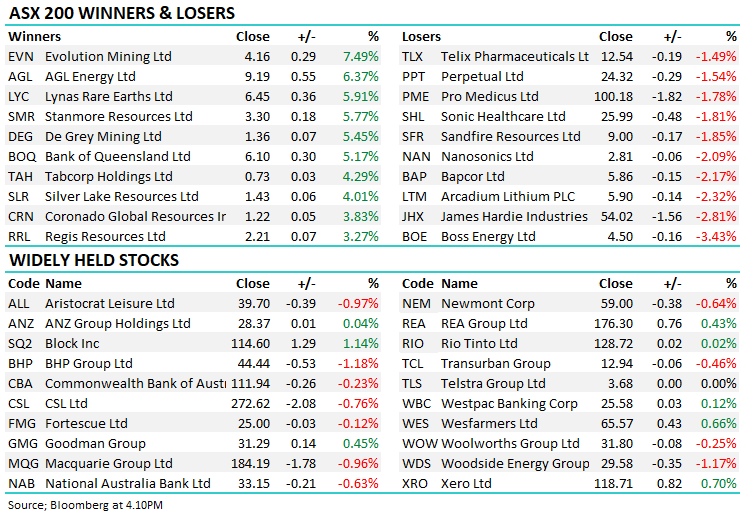

- The ASX 200 fell -6pts/ -0.09% to 7605

- Utilities (+2.83%) was best on ground today by some margin. Four other sectors closed in the green, the best being Discretionary (+0.42%) and Tech (+0.35%)

- While 6 sectors closed lower, none were worse than -0.5% down. Energy (-0.49%) the hardest hit, followed by Healthcare (-0.48%) and Materials (-0.38%).

- UK Inflation printed right on the close which sent our market back in the red, from marginally up to marginally down in the final print. Core Inflation was up 0.6%, far above the 0.3% expected which may have some cause for concern for the ECB.

- China regulators moved to allay concerns regarding new restrictions which helped to support equities for much of the day across the region. It wasn’t sustained though and, broadly speaking, indices closed lower.

- Evolution Mining Limited (ASX: EVN) +7.49% was strong following their 3Q update which showed a decent improvement operationally.

- Rio Tinto Ltd (ASX: RIO) +0.02% announced a slightly weaker than expected 1Q set with Iron Ore ~5% below 1Q23. Rio Tinto left guidance unchanged though – 3 more quarters to make up the difference.

- Bank of Queensland Ltd (ASX: BOQ) +5.17% 1H was decent, though low on quality. The regional banks remain unloved, an ok result enough to support the stock today.

- DroneShield Ltd (ASX: DRO) +18.52% popped after announcing an agreement with NATO that is likely to lead to significant orders both from the organisation and member countries.

- Gold was holding firm for much of the session but slipped -0.25% late to trade at $US2,377/oz.

- Iron Ore was strong, though this was not reflected in the bulk miners.

- Stocks in Asia are mostly lower. Nikkei down -1.32%, Hong Kong is currently -0.5% lower but China added 1.7%.

- US Futures are all down. S&P Futures -0.1% but Nasdaq futures -0.25%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Evolution Mining (EVN) $4.16

EVN +7.49%: the gold & copper miner hit near 2-year highs today on the back of a 3Q update that was better than feared.

They produced 185koz of gold in the quarter, up 15% from 2Q where they faced a few production issues including wet weather. Evolution Mining also produced 20kt of copper, up ~30% which helped their net gold All In Sustaining Cost (AISC) number fall to $1,464/oz.

Production issues have plagued the gold miners for a little while now so expectations were low heading into the update.

Evolution managed to come out largely unscathed, though production guidance for the full year was pushed to the low end of the range, while costs will have to improve substantially if they are to hit forecasts.

- We continue to like gold & copper, EVN being a great way to play both

Evolution Mining (EVN) share price

Bank of Qld (BOQ) $6.10

BOQ +5.17%: 1H results for the regional bank today caused a strong bounce in the share price, though the numbers still showed signs the smaller banks are struggling to compete with the Big 4.

Cash earnings of $172m were around 5% ahead of consensus, driven largely by beats on bad debts, costs and the Net Interest Margin (NIM) which fell less than expected to 155bps. Home loan lending fell 1%, as did asset finance while consumer lending fell 10%.

BOQ reiterated FY26 targets, however, they will have to improve volumes across these areas if they are to achieve this, flagging that additional strategies will need to be implemented given the competitive nature of the banking space at the moment.

Wholesale funding costs continue to weigh on margins as well and BOQ has a significant portion of funding coming up for renewal in 2H that may weigh on earnings.

The stock has been unloved for a while and remains cheap, the market may be forced to look through their issues if credit quality remains strong.

Bank of Qld (BOQ)

Broker Moves

- AVITA Medical Inc (ASX: AVH) GDRs Cut to Market-Weight at Wilsons

- ImpediMed Ltd (ASX: IPD) Rated New Speculative Buy at Ord Minnett

- Tuas Ltd (ASX: TUA) Rated New Buy at Citigroup Inc (NYSE: C); PT A$4.50

- Cooper Energy Ltd (ASX: COE) Cut to Hold at Bell Potter; PT 21 Australian cents

Movers & Losers