The strong performance of the Nasdaq-100 (INDEXNASDAQ: NDX) Index underlines an important lesson.

Technology companies can produce big winners. In fact, the tech sector has produced some of the biggest wealth-creating stocks of the past century.

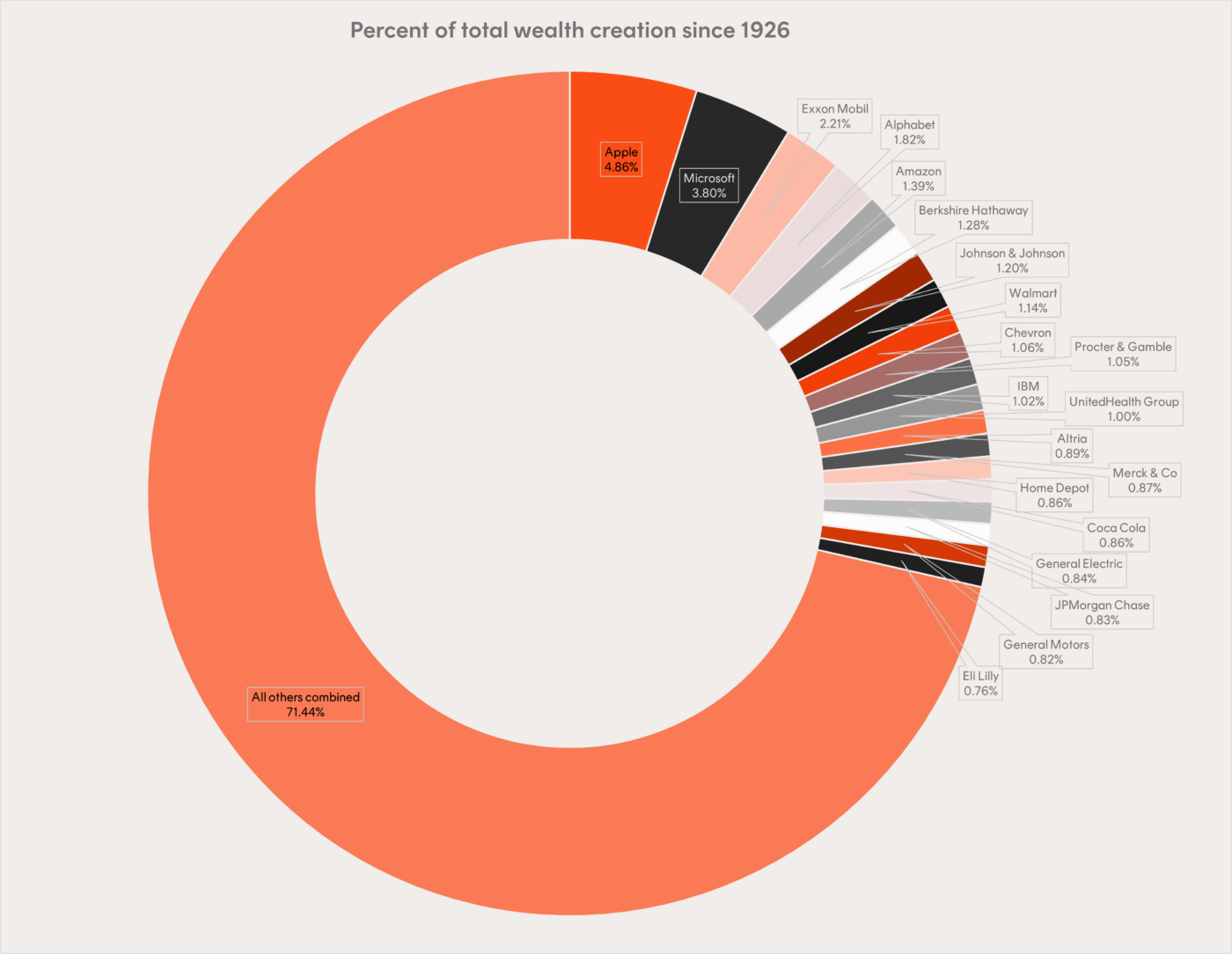

In 2023, Arizona State University business professor Hendrik Bessembinder updated his famous 2017 study, which found only a handful of stocks explained much of the wealth created by the US stock market. His expanded study covered the performance of US stocks between 1926 and 2022.

He found that just 72 stocks accounted for half of the net wealth creation since 1926.

Of the top five firms with the largest shareholder wealth creation, four were tech stocks. The highest representation by sector. All are household names:

- Apple Inc (NASDAQ: AAPL)

- Microsoft Corp (NASDAQ: MSFT),

- Alphabet Inc Class A (NASDAQ: GOOGL), and

- Amazon.com Inc (NASDAQ: AMZN).

Australia’s low exposure to tech stocks

Thus, not having exposure to technology stocks might be suboptimal for your portfolio.

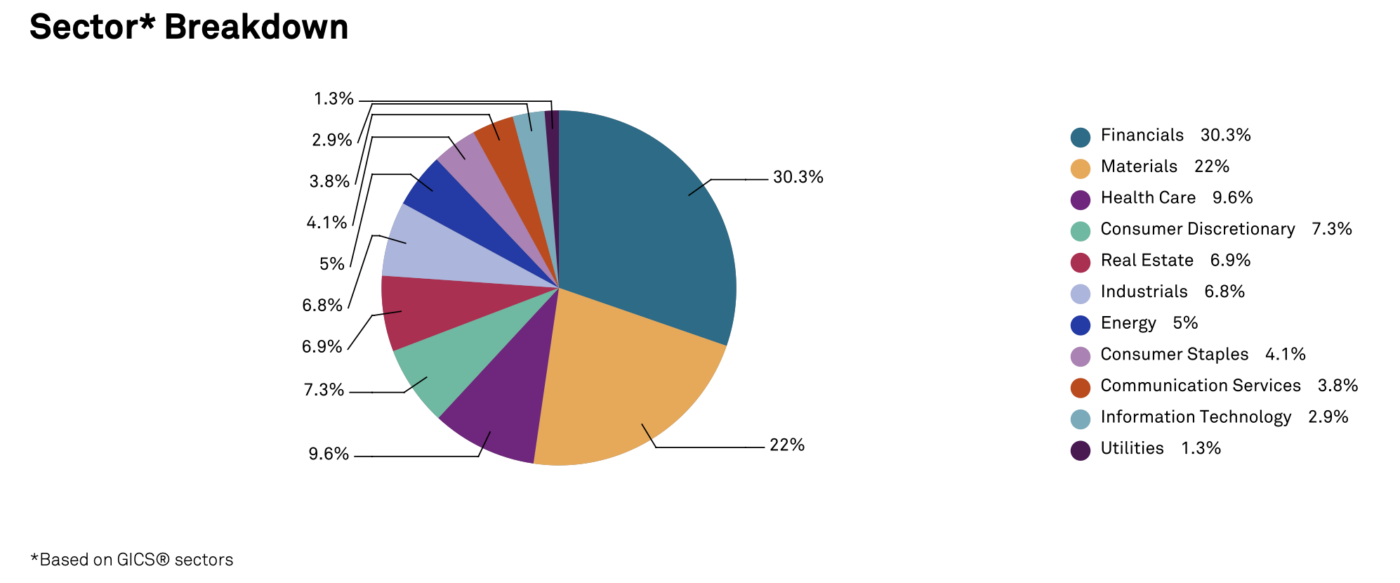

This can be a problem for Australian investors, given the low presence of tech stocks in the S&P/ASX 200 (INDEXASX: XJO).

Australia is known for its big banks and big miners, which are reflected in the stock market.

Financials and materials companies make up over 50% of the S&P/ASX 200. Information technology only 2.9%.

For comparison, the same two sectors make up only 15.6% of the US S&P 500 (INDEXSP: .INX) index, while information technology comprises 29.6%.

Thankfully, there are ETFs available on the ASX today for Australian investors seeking exposure to local tech stocks.

The S&P/ASX All Technology Index tracks Australia’s leading tech businesses. And Betashares S&P/ASX Australian Technology ETF (ASX: ATEC) is the only ETF traded on Australian exchanges offering exposure to this index.

Let’s canvas reasons why you should consider ATEC.

Australia’s underrated tech sector

- 42 million people visit CAR Group Limited (ASX: CAR) websites a month.

- 49 million applications are placed through Seek Ltd’s (ASX: SEK) platforms a month.

- 2.7 million Australians visit realestate.com.au every day.

Australia, despite its association with resources, is home to multiple dominant tech firms. But the local tech sector has flown under the radar. That may be a boon.

The success of the ‘Magnificent Seven’ over the past year has attracted plenty of attention and stoked high expectations.

But with these few companies already accounting for large portions of many investors’ portfolios, it may make sense to diversify technology exposures by looking closer to home.

ASX tech sector’s outperformance

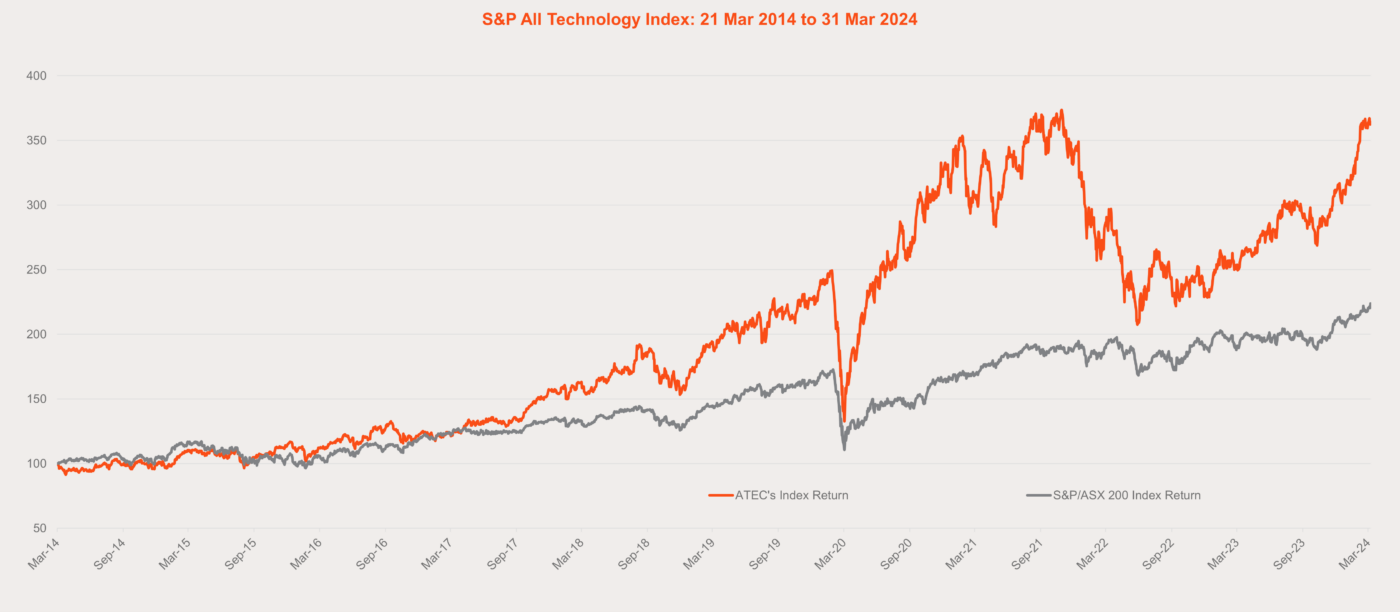

The S&P/ASX 200 Index set a record high earlier this year. Yet it has still underperformed the local tech sector over the last decade.

ATEC outperformed the broader S&P/ASX 200 over the year to March 2024, gaining 40.77%, while the S&P/ASX 200 gained 14.4%.

Over the five-year period to March 2024, ATEC’s index returned 13.2% p.a., beating the S&P/ASX 200’s gain of 9.2% p.a..

Tech sector’s strong year

Why the strong outperformance?

Some of this can be attributed to the excitement around the tech sector emanating from the US. Big rallies in the US tend to reverberate locally, too.

Other factors include global excitement about artificial intelligence (AI) and the expectation of falling interest rates.

The US is not the only market featuring AI stocks. Both WiseTech Global Ltd (ASX: WTC) and Nextdc Ltd (ASX: NXT) — large components of ATEC — gained in 2023 as investors boosted revenue growth expectations driven by AI. WiseTech was up 35% over the past year. NEXTDC was up 40%.

In February, logistics software firm WiseTech reported a 32% increase in revenue and an 8% increase in profits for the first half of FY24.

In an earnings call following the results, WiseTech’s CEO and founder Richard White said WiseTech is

“putting enormous amounts of investment into forward product development using AI, machine learning, big data, [and] automation.”

And at its latest annual general meeting in November, data centre infrastructure provider NEXTDC also talked up the growth potential of servicing AI demand:

At present, artificial intelligence is stimulating unprecedented demand for data centre services globally. It’s encouraging to note we’re yet to experience AI’s full impact on demand at NEXTDC. The wave of artificial intelligence infrastructure deployment is just arriving in Australia.

Expectations of falling interest rates are helping the sector too as tech stock valuations are highly sensitive to interest rates.

Other factors are home grown.

Australian tech companies like Carsales, Rea Group Ltd (ASX: REA), Xero Ltd (ASX: XRO), and Seek Ltd (ASX: SEK) hold dominant market positions in their segments. Their competitive advantages lead to strong operating margins and pricing power.

There is local innovation, too.

Take medical imaging software firm Pro Medicus Limited (ASX: PME), one of the largest components of ATEC. Pro Medicus has been a quiet success story, gaining over 8,000% since listing in 2000. It has continued to grow sales each year, cementing a leading position in its industry. FY25 analyst estimates have the firm boasting a Return on Equity of 48.8%.

Tech stocks may grow further

In the long run, stock prices tend to follow earnings. And many of Australia’s leading tech stocks — like Pro Medicus — are highly profitable. This bodes well for the long-term potential of many of these businesses and the sector as a whole.

For instance, constituents of ATEC’s index are expected to outpace the sales and earnings of S&P/ASX 200 constituents.

As of 10 April 2024, consensus estimates have ATEC sales growing 17.4% in CY24, 9% in CY25 and 9.3% in CY26.

Yet S&P/ASX 200 sales are expected to rise only 4.5% in CY24, 2.8% in CY25 and 3.8% in CY26.

Summing up

With the nascent adoption of AI, cloud computing, big data, automation, and the Internet of Things, there’s a good chance that the next decade’s major winners will come from the tech sector.

Despite Australia’s sharemarket skewing heavily towards financials and resources, investors can gain direct exposure to Aussie tech stocks via ATEC.

Gain exposure to leading ASX technology stocks

All investing involves risk. Tech stocks, especially, are not immune from volatility. But you don’t have to pick individual winners.

In one trade, investors can gain exposure to a basket of leading Aussie tech companies.

Investing in the tech sector as a whole mitigates stock-specific risks through diversification.

Why seek the needle when you can buy the haystack?

ATEC offers the following:

- Diversified exposure to Australia’s leading technology businesses like REA Group, Xero, Carsales.com and more

- Portfolio diversification for Australian investors with heavy exposure to large-cap financials and resource stocks

- Cost-effective: management costs of only 0.48% p.a. with no ‘active manager’ fees