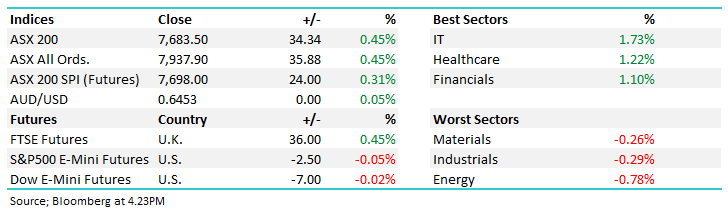

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.45% to 7,683.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Investors continued the 180-degree about-face from last week’s sentiment, happy to take on risk for the second consecutive day to start this week seeing the ASX200 through a 200pt gain from Friday’s panic lows early in today’s session.

Tech was the standout as US 2-yr yields retreated (marginally) from the spike above 5% last week while Healthcare and Financials also joined in the rebound.

Energy and Gold were the main areas finding it tough again today, for the same geopolitical reasons as Monday’s session.

- The ASX 200 rallied +34pts/ +0.45% to 7683

- Tech (+1.73%) was best on ground today, followed by Healthcare (+1.22% and Financials (1.10%).

- Energy (-0.78%) continued to struggle. Industrials (-0.29%) and Materials (-0.26%) were the only other sectors in the red.

- Lifestyle Communities Ltd (ASX: LIC) -13.54% made fresh 52-week lows after staying 92 homes due to be settled in FY24 were being offered for sale by the buyers to facilitate settlement.

- Chrysos Corporation Ltd (ASX: C79) -4.66% revised revenue guidance lower as their Photon Assay unit instalments missed expectations. We will cover this in tomorrow’s AM report.

- Brambles Ltd (ASX: BXB) -6.33% sales growth slowed to 2% in Q3, now needing to reaccelerate into the end of FY24 to meet guidance.

- Northern Star Resources Ltd (ASX: NST) -3.53% weighed on by weakness in Gold, they also released 3Q production numbers. More on that below

- Select Harvests Ltd (ASX: SHV) -9.54% the almond grower downgraded crop expectations, lowered expected prices and lost their CFO – the market already had concerns regarding their balance sheet, and this triple whammy didn’t help.

- Plenti Group Ltd (ASX: PLT) +4.84% the non-bank lender expects to deliver FY24 NPAT of $6.1, a solid result. They did say 90-day arrears had climbed in the last three months, though this was likely a result of Easter timing.

- Gold slipped back below $US2,300/oz for the first time in a fortnight before finding some support. The precious metal is currently down -1% today at $2,304/oz, more than $100 below Friday’s peak

- Iron Ore was just marginally lower today, BHP Group Ltd (ASX: BHP) the only gainer in the space.

- Stocks in Asia are mostly higher. Nikkei up +0.3%, Hong Kong is currently +1.57% but China slipped -0.84%.

- US Futures are all slightly lower, Nasdaq the worst but only -0.15%.

- Quarterly reporting picks up pace tonight, International Equities Portfolio holding Freeport-McMoRan Inc (NYSE: FCX) reporting alongside Visa Inc (NYSE: V) & Tesla Inc (NASDAQ: TSLA)

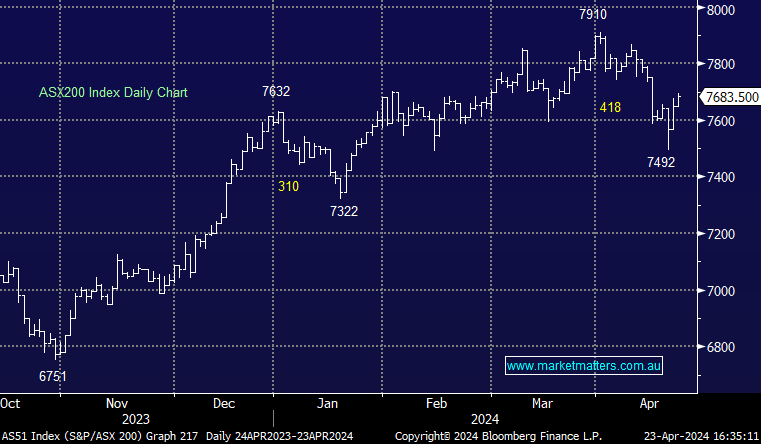

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Northern Star (NST) $14.74

NST -3.53%: the gold stocks struggled today alongside the price of the precious metal, and Northern Star’s 1Q update did little to stem the flow on NST shares.

Northern Star sold 401koz of gold in the quarter, with an All In Sustaining Cost (AISC) of $1,844/oz. Weather and mill downtime impacted the quarter, with sales falling ~6% from 3Q23 and ~3% from the prior period as a result.

Northern Star maintained FY24 guidance of 1.6-1.75moz of sales at an AISC of $1,810-1,860/oz implying the June quarter will have to be their best in FY24, selling at least 419koz just to meet the low end.

They noted grades had improved in April while mill capacity had also increased – still, not much wiggle room at this stage.

Cash & Bullion on hand fell slightly after paying the interim dividend, still holding $1.08b.

Northern Star (NST)

Broker Moves

- South32 Ltd (ASX: S32) Cut to Neutral at Citigroup Inc (NYSE: C); PT A$3.80

- Galan Lithium Ltd (ASX: GLN) Cut to Neutral at Macquarie Group Ltd (ASX: MQG)

- Karoon Energy Ltd (ASX: KAR) Cut to Neutral at Evans & Partners Pty Ltd

- Rex Minerals Ltd (ASX: RXM) Rated New Buy at Moelis & Co (NYSE: MC)

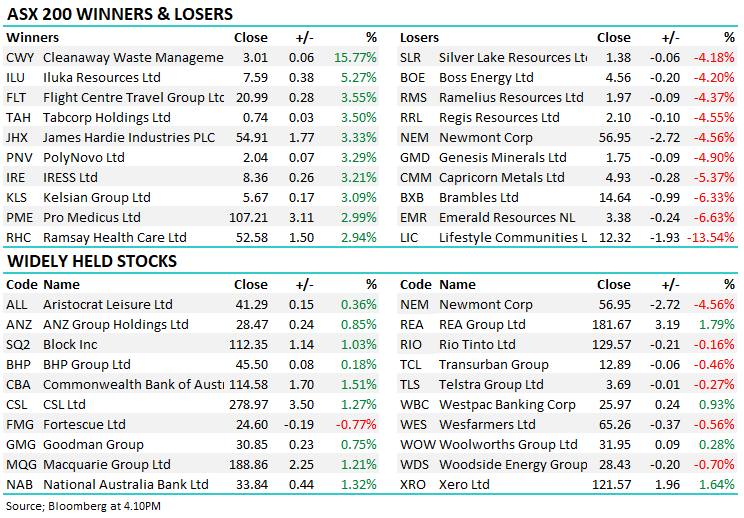

Movers & Losers