The BHP share price is down ~4% in early trade today after revealing an A$59 billion bid (£31 billion) for the UK-listed miner Anglo American plc (LON: AAL).

BHP takeover proposal

BHP confirmed it made an all share bid to the Anglo American board on 16 April 2024, offering 0.7097 BHP shares per Anglo share. The market has responded negatively to BHP, with the shares dropping 4%, compared to Anglo shares jumping 14%. Anglo American shares are up 18.6% in the last 5 days, contributing to the strong FTSE Index performance overnight, up 0.5% for the day.

BHP has reportedly been on the lookout for a takeover of a smaller mining company for some time, utilising its strong balance sheet which is currently geared at 0.48x net debt/EBITDA.

BHP management and board under pressure as their future facing commodities strategy has yet to bear significant fruit. Nickel has been in the doldrums, with BHP’s Nickel West operations resorting to pleading for government support to prevent shutting down operations. Potash has been a slow mover with the monster capex Jansen potash project in Canada a risk of disappointing the market. This leaves copper, which has enjoyed stronger commodity price conditions and has caused BHP to double down on its copper growth strategy.

BHP is already the largest miner in the world, before undertaking one of its biggest acquisitions ever. The deal would have major ramifications for the construction of ASX indices. BHP currently comprises approximately 10% of the S&P/ASX 200 (INDEXASX: XJO) index, dictating the weight that passive funds hold in BHP shares.

About Anglo American

Anglo American is a global miner diversified across multiple commodities. BHP is particularly focused on its copper assets, which produce ~790,000 tonnes of copper at low unit costs of US$1.57/lb on an annualised basis.

Anglo’s coking coal mines in the Bowen Basin in Queensland, Australia may be of interest to BHP also, producing ~16Mtpa of hard coking coal from the Moranbah North, Grosvenor, Dawson, Capcoal, and Aquila mines. These mines could be of interest to BHP, despite recently divesting coal mines in Queensland to ASX-listed coal mining specialists Whitehaven Coal Ltd (ASX: WHC) and Stanmore Resources Ltd (ASX: SMR). However, given Mike Henry’s background in coal trading and the ~15Mtpa of spare capacity at BMA’s Hay Point’s ~55Mtpa export terminal), there is room in the portfolio for high quality coal assets, which BHP management can position as amenable to ‘greener steel’ production due to their premium (low impurity) hard coking coal product specifications produced being lower carbon emissions, aligning with BHP’s strategy.

The transaction is conditional on the proposed divestiture of Anglo’s platinum (Amplats, Sakatti), iron ore (40mtpa across South Africa and Brazil) and diamond (De Beers) operations, which are seen as non-core to BHP. South African Manganese assets would also likely be non-core, given BHP’s history of spinning off base metal assets into South32 Ltd (ASX: S32).

BHP’s rationale for acquisition: Seneca’s interpretation

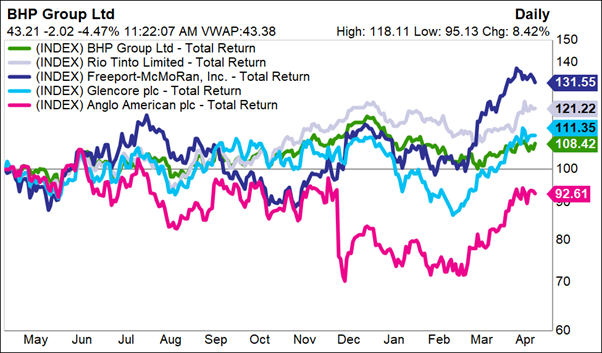

BHP is swooping in when the Anglo American share price is cyclically depressed, having lagged mining peers by 20%+ (prior to the bid announcement) since April 2023.

Source: Factset

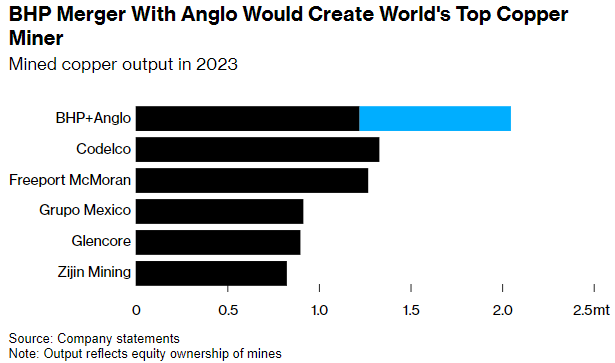

BHP has made it clear that it intends to grow its copper exposure as a future facing commodity. The OZ Minerals takeover reinforced this view. Anglo American’s existing copper production of >700,000 tonnes per annum from huge copper porphyry mines in Chile and Peru could be worth as much as US$35 billion when compared to global copper miners such as Southern Copper Corp (NYSE: SCCO), Freeport-McMoRan Inc (NYSE: FCX), Zijin Mining Group, Ivanhoe Mines Ltd (TSE: IVN), and Lundin Mining Corp (TSE: LUN).

Aside from the obvious winners of the deal (the bankers – given all the spinoffs!), we think the deal has the potential to be accretive for BHP from day 1, from the copper alone. It would transform BHP into the largest copper producer globally, head and shoulders above the rest of the pack.

Source: Bloomberg

What happens next?

It is worth noting that the takeover bid is currently being reviewed by the Anglo board and there is no certainty that a deal eventuates.

We think Glencore PLC (LON: GLEN) and Rio Tinto Ltd (ASX: RIO) will be keeping a close eye on the deal and possibly getting involved. Anglo American’s CEO Duncan Wanblad discussed the potential merits of a merger with Glencore on an earnings call just two months ago, particularly related to the North Chilean Collahuasi copper mine (44% Anglo, 44% Glencore, 12% Japanese consortium). Although BHP’s balance sheet is stronger than Glencore’s, which currently holds ~$12 billion in net debt.

In the meantime, we won’t have to wait long for progress on the deal. UK share market rules dictate that BHP has until 22 May 2024 to make its bid firm or walk away.

Are BHP shares a buy today?

We own BHP shares in the Seneca Australian Shares SMA, although we are underweight relative to the index. We also own RIO shares, and are exposed to other commodities, including through Pilbara Minerals Ltd (ASX: PLS).

If you’re interested in hearing more about our BHP weighting in our portfolios, and our other 5 largest overweight high conviction ASX shares, schedule a call with Luke today.