Poor Charlie’s Almanack is easily one of the most influential books I have ever read. Charlie Munger is in a class all of his own.

It’s May 7th 2024 as I write this review but so far I have already listened to this book 4 times on Audible in 2024. Each time I jot down more notes and begin connecting dots I hadn’t thought about.

There are only a few business-focused books that have come close to stimulating my thinking like Poor Charlie’s Almanack. They are Prof. Cialdini’s Influence, and Zen in the Martial Arts. If you like them, you’ll love this.

But as with all books, it’s not always ‘what’ you read, but ‘when’ you read them.

I wouldn’t read this book if I didn’t have any appreciation for business or investing. Nor would I read this book (or any) just to say I’ve read it.

You’ll need highlighters, dozens of pages of notes and a filing system to really grasp some of these ideas.

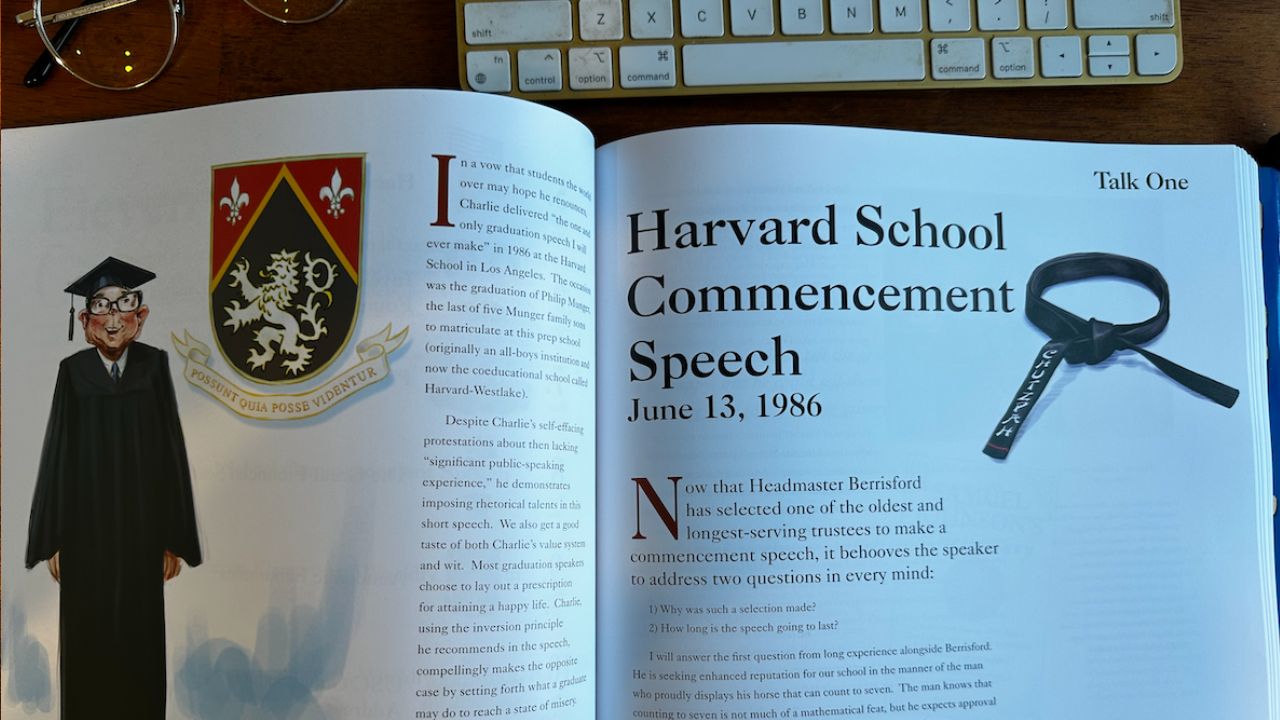

Basically, Poor Charlie’s Almanack (the pure version) is a collection of 11 talks given throughout the life of Charlie Munger, a lawyer, investor, father and architect.

These talks are captured in the book, but Charlie gave Peter D. Kaufman permission to go through papers in his office and collate all of the material. Charlie was then given the opportunity to reflect on his various speeches, sometimes with decades between the speech and the reflection. These are also captured in the book.

A good example of the speech is this one on The Psychology of Misjudgement. You can listen to it here.

When he died in 2023, at the age of 99, Warren Buffett, the world’s greatest investor; described Charlie as the architect of Berkshire Hathaway – now probably the world’s most successful independent investment conglomerate.

Some ideas from the book

I could never do a review any justice here.

Charlie was the supreme master of connecting ‘the big ideas’ of multiple disciplines by laying down a latticework of mental models.

A much more simplified and digestible version of the ‘big ideas’ was later written by Robert G. Hagstorm in his wonderful book, Investing: The Last Liberal Art. Thank you to Claude Walker from A Rich Life for first suggesting that book to me.

I would probably read Hagstorm’s book first, so that Poor Charlie’s Almanack doesn’t scare you off the pursuit of multidisciplinary learning.

Poor Charlie’s Almanack, to me, is far more profound in its instruction for life than its investing application. Here are some things I saved in my phone while driving home the other night:

[I realised early on that…] “The safest way to try and get what you want is to try and deserve what you want.”

Stacking the odds of success in your favour by ‘doing the work’, as some might say.

“One thing to avoid is intense ideology because it cabbages up the mind.”

Intense tribal views or beliefs like religion or allegiance to one political party or investing ethos leaves you less receptive to new and good ideas.

“It’s not necessary to hope in order to persevere.”

Being prepared and well researched means you don’t have to rely on hope or lady luck.

“Intense interest in any subject is indispensable if you’re going to excel in it.”

A key ingredient for me when someone tells me they own individual stocks. Do you truly LOVE investing? If not, you might find yourself falling off the horse and never getting back up.

[Quoting Cicero] “Not to know what happened before you were born is to remain a child forever.”

This reminds me of the line that, he who has no master has a fool for a master. Why make the same mistakes others have already figured out? Why not learn from the success of others? The iPhone was a great product and Steve Jobs was a marvel. But the iPhone could never have existed without the work of others gone before him, such as Tim Berners-Lee.

“We’re too soon old and too late smart” [German proverb”]

Find a way to learn from other disciplines, before it’s too late to take advantage of that knowledge.

What do you think of Poor Charlie’s Almanack? Let me know in the Rask Community. Click here to comment.