The Wesfarmers (ASX: WES) share price stands out as one of the best performers in Australia over recent decades. In the past 15 years, it has compounded at 12% per year, in total return terms (dividends plus growth).

Chuck in some franking credits, a deep retail moat, and an industrials business, and it’s easy to see why Wesfarmers is being considered by us as an All Star.

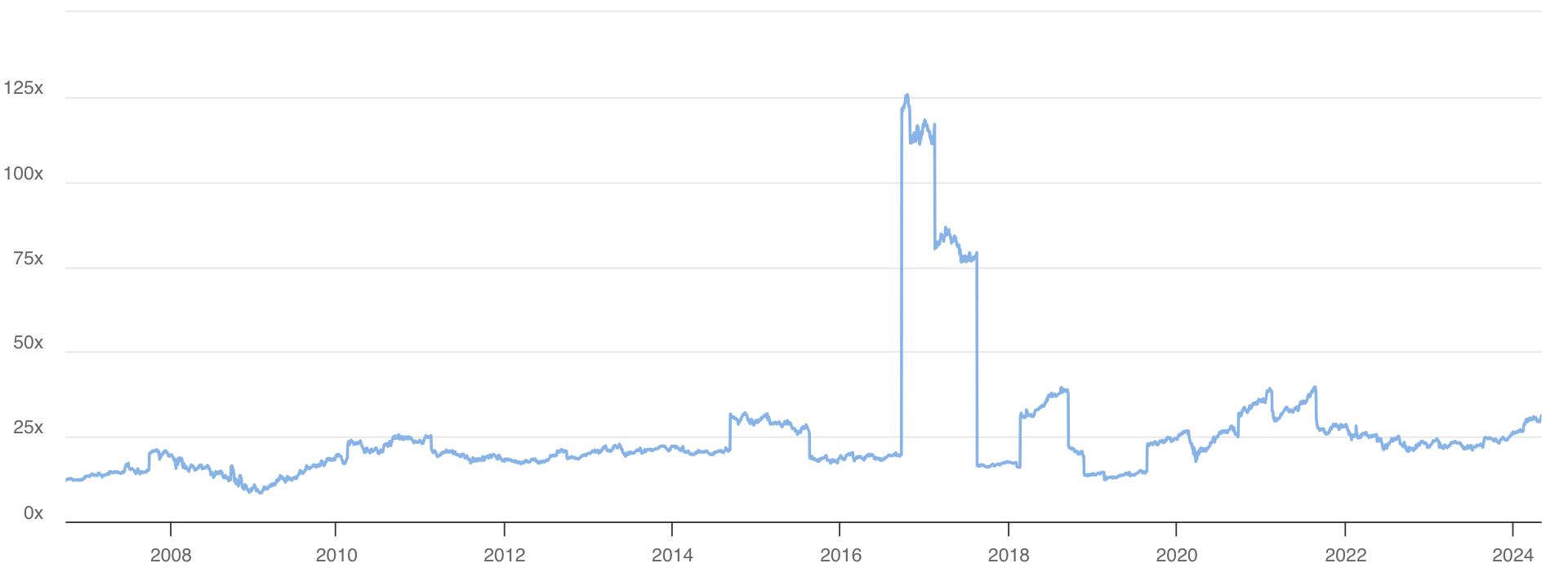

Wesfarmers share price

Wesfarmers is the owner of retail brands like Bunnings, Kmart, Beaumont Tiles, Target and Officeworks; a chemical and fertilisers business called Wesfarmers CEF; a health business which includes Priceline pharmacies; and Industrials business.

Wesfarmers has built a reputation as the quintessential bottom draw stock. Over the past five, ten and 25 years the Perth-based conglomerate has outperformed the broader market.

Established in 1914 as the Western Australian farmers cooperative (hence Wes-farmers), the business morphed into a holding company with several autonomous divisions. Past activities include agriculture, railroads, supermarkets, coal and insurance – all of which have now been divested.

Key Points:

- Focus on returns on capital

- Power of Bunnings

- Earnings stability

Today, the lion’s share of earnings/profits are derived from a portfolio of consumer retailers including Bunnings, Kmart and Officeworks. Wesfarmers also sells chemicals and industrial workwear with more nascent operations in e-commerce, mining and health (Wesfarmers also Catch Group).

The Metric that Matters

The secret sauce underpinning Wesfarmers success is an unwavering commitment to a “satisfactory return for shareholders”.

Indeed, it’s Wesfarmers primary objective and is printed plainly across annual reports and investor communications. The business is industry agnostic, and will go anywhere it can source the best risk-return profile.

To deliver great shareholder returns, Wesfarmers seeks investments with high or improving returns on capital (ROC). Wesfarmers have a finite amount of capital to deploy, and therefore seeks opportunities that offer the highest earnings. Low ROC investments eat up capital and in the long run have been shown to deliver poor shareholder returns.

The best shareholder returns occur when high returns on capital are paired with a big growth opportunity. There is no better example than Wesfarmers investment in Bunnings.

Jewel in the Crown

In the 1990s Wesfarmers recognised there was a large but fragmented market for construction supplies.

Management acquired a foothold in 1994 via the acquisition of Bunnings, and its attractive timber and forest assets. The aim was to provide low-cost construction materials, rolling out the offering across the country in addition to acquiring and repurposing competitors.

However, Bunnings ultimately became a household name by branching out into hardware and the do-it-yourself (DIY) market. Knowledgeable staff attendants, in many cases ex-tradespeople, were employed to broaden the target market from commercial sales to homeowners. The product range evolved from primarily building supplies to include gardening, pet food, paints and lighting.

(Psst. if you have already read our deep dive into JB Hi-Fi (opens in new tab), you will remember JB also employed extremely skilled floor staff to attract the highest quality customers and drive incremental sales. Don’t forget to read our JB Hi-Fi company report next – good investing is often due to enhanced pattern recognition.)

At Bunnings, the humble Saturday sausage sizzle fostered a sense of community and broadened its range of customers. Profits were reinvested into the business to drive economies of scale and lower prices – keeping competitors at bay.

Costs were kept low with simple store fit outs, and warehouses were located in industrial areas to reduce land and leasing expenses.

Each new store was more profitable than the last, with return on capital increasing from 17% in 2003 to over 65% in 2023. That’s extremely good returns on capital.

Competitors were unable to match the low prices, creating an enviable barrier to entry and entrenching Bunnings as the market leader.

Today, Bunnings is the strongest hardware and DIY brand in Australia and contributes over $2.2 billion of earnings, equal to 60% of Wesfarmers profits.

Expiry date

Wesfarmers track record of shareholder returns speaks for itself, but that doesn’t mean the business hasn’t stumbled.

The decision to purchase Coles Group (ASX: COL) in 2007 diluted returns on capital from above 25%, down to just 7% due to the capital intensity and fierce competition in supermarket retailing.

Coles accounted for 64% of the capital employed, but just 35% of the profits. As a result, the share price barely budged over those ten years, serving as yet another lesson for investors that a strong brand doesn’t automatically equate to strong returns. Coles’ internal economics weren’t nearly as good as Bunnings.

In 2017, Wesfarmers divested Coles, with returns on capital surging back above 20% and the share price rocketing up 75%.

Out of favour, but still good

The conglomerate structure (i.e. buying other companies and holding on for many years) broadly is out of favour with investors today. Corners of the market have questioned the attractiveness of conglomerates given the primary feature of instant diversification is now available easily via exchange-traded funds (ETFs). For example, Wesfarmers isn’t an ETF. Yet it’s not quite a managed fund. Nor is it a Listed Investment Company (LIC). And it’s not exactly a retailer. Or a pharmacy. Or construction business.

As a result, the divisions that form a conglomerate often trade at a valuation discount when stuck together. If each of those divisions is listed on the ASX separately, in theory, they might trade at a higher price.

Finally, while Wesfarmers deserves transparency regarding disclosures, it’s inherently difficult to ascertain the financial health of each division with an aggregate set of financial statements muddying the waters. For example, we don’t know exactly how Officeworks is performing, since some of its financials are bunched in with other businesses.

Wesfarmers: next chapter

We would argue that given Wesfarmers’ history of shareholder returns, it deserves the benefit of the doubt.

The business has instilled a culture of investment discipline, with just seven CEOs and eight Chairman across its 109 years of operations. That’s quite incredible.

The conglomerate structure also means it’s able to offset difficulties in one division (e.g. a slowing construction sector) with growth in others (e.g. rising healthcare costs). As a result, earnings are more stable and therefore less susceptible to share price fluctuations than nearly all other blue chip stocks on the ASX.

Growth avenues, such as the Mt Holland lithium mine and its budding Health division, should underwrite earnings growth over the medium term. This, in turn, should help the business maintain a premium price-earnings ratio (shown above) in the market, together with a generous dividend payment.

In all, we expect Wesfarmers to retain its title as the quintessential bottom-draw stock and continue to reward long term shareholders. Just wait for some bad media attention or a share price sell-off before taking a nibble.

Is the Wesfarmers share price a buy right now?

Would I buy Wesfarmers shares right now? Given the slow-down in earnings growth and mature nature of the business overall, plus a ‘decent’ 2.8% dividend yield, I don’t believe Wesfarmers is screaming good value today.

What’s more, as I discussed recently in this article, Buy CBA shares for income? Here’s a much Better Idea, you can buy a boring ol’ index fund, like the Betashares Australia 200 ETF (ASX: A200) or Vanguard Australian Shares Index Fund ETF (ASX: VAS), and get 4% + franking credits. And you’ve got diversification across 200+ companies… it’s a no brainer.

What’s more, if you’re studying something like Wesfarmers, it may be worth looking at Washington H. Soul Pattinson & Co. Ltd (ASX: SOL), the ASX’s other dominant conglomerate. While it too is a little on the expensive side, it’s a wonderfully impressive business with a fantastic management team.

For disclosure: we own VAS inside Rask Invest.