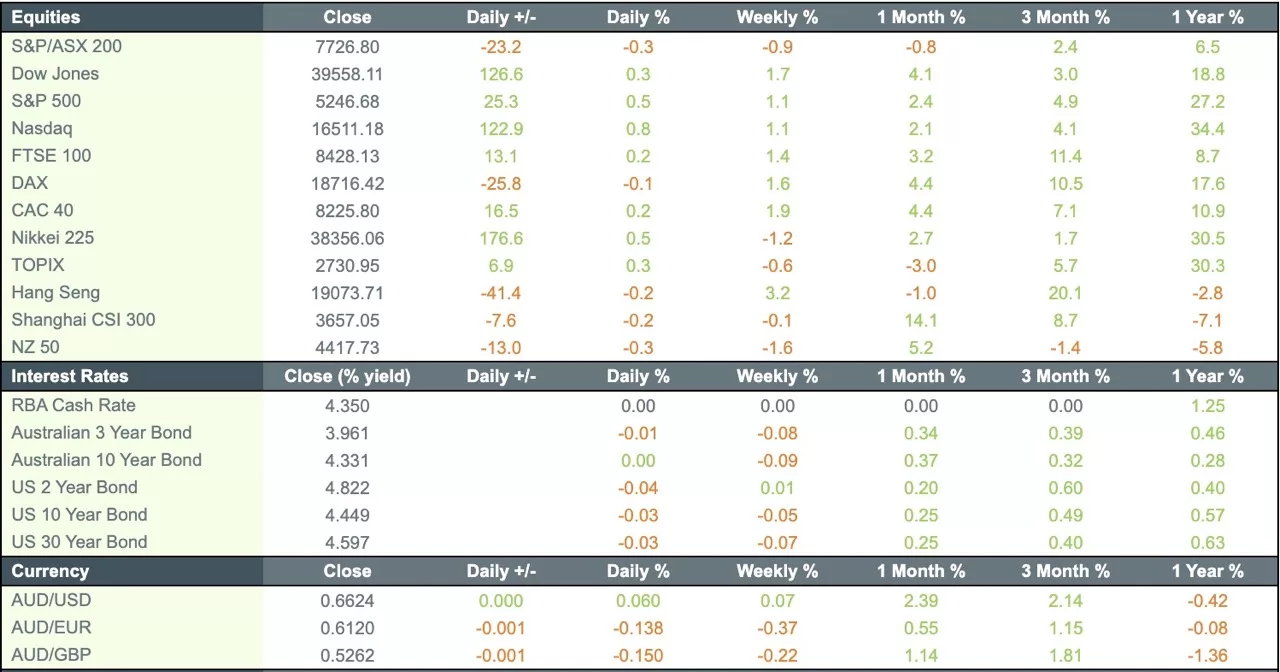

It was another rough day for interest rate-sensitive sectors on the S&P/ASX 200 (ASX: XJO) on Tuesday, as the ASX 200 fell 0.3 per cent ahead of a cost of living focused Federal Budget.

Every sector barring consumer discretionary and healthcare were lower, with both industrials and real estate falling the most, down 0.9 per cent on spending concerns. Among the biggest detractors in the ASX 200 was continued weakness in Fletcher Building (ASX: FBU), which fell more than 4 per cent, while both Boral (ASX: BLD) and Seven Group (ASX: SVW) fell as the threat of infrastructure and home spending weakness grew.

On the positive side was after-market car parts retailer GUD Holdings Ltd (ASX:GUD) which rallied more than 12 per cent after the confirmed it was on track to meet full years earnings guidance of $193 million. The lithium and critical minerals sector was another standout, moving higher ahead of a budget announcement that would support further production, Chalice Mining (ASX: CHC) added 6.6 per cent.

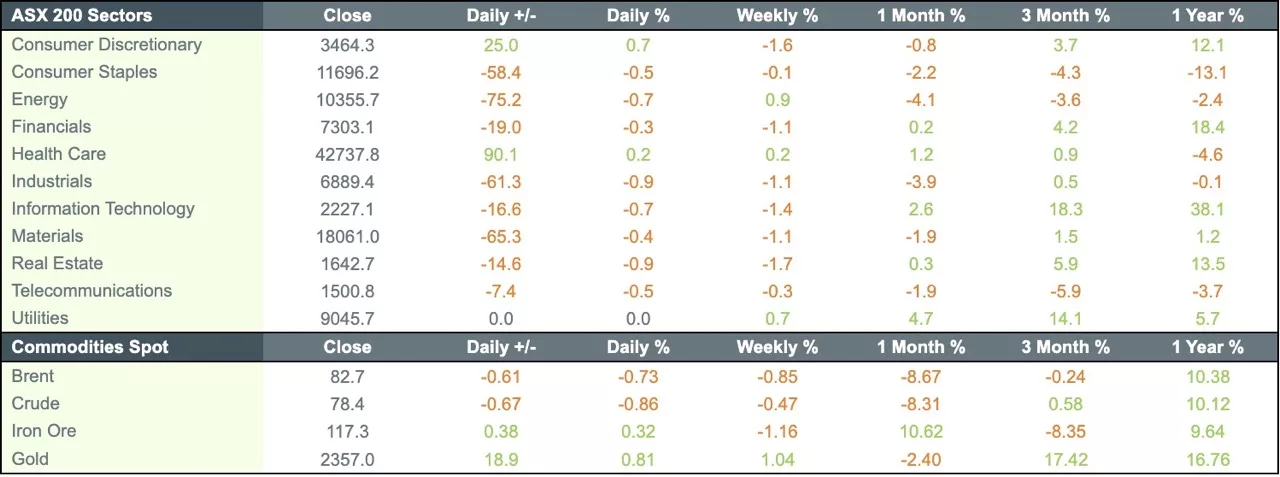

ASX 200 sectors

Anglo rebuffs BHP & Southern Cross slips again

As reported on Rask Media, Anglo American once again rebuffed the takeover offer from BHP Group Ltd (ASX: BHP), with management announcing its plans to exit diamond, platinum and coal mining in a bid to set a more growth-oriented course into the future.

These assets will be sold as the company seeks to gain shareholder support to fight the takeover bid from BHP.

Southern Cross (ASX: SXA) management confirmed that they would continue to seek closure on the acquisition of ARN Media, with reports showing a combined $10 million had been spent on the deal to date.

Producer prices point to positive inflation result, meme stocks return, HomeDepot struggles continue

The Chinese share market continues to be a standout, having rallied 6 per cent already in May, taking the gain from January lows to 27 per cent, with Tencent delivering a strong result this week.

In the USA, the largest technology companies continued to drive the market, with the Nasdaq gaining 0.8 per cent on Tuesday, while the S&P500 added 0.5 and the Dow Jones 0.3.

Google/Alphabet (ASX: GOOGL) benefitted from an announcement that Google would be adding an AI-powered bot as part of Google search going forward.

In positive news, producer price inflation increased just 0.5 per cent, driven primarily by services, which is expected to bode well for consumer inflation data later this week. Shares in Boeing (NYSE: BA) added 1.3 per cent as the company reported its lowest monthly tally of deliveries, just 24, amid a renewed focus on quality rather than quantity. Home Depot (NYSE:HD) remained broadly flat despite the company reporting a sixth straight negative quarter of sales, as the big box retailer struggled in the face of higher prices.