Having visited Mexico on 4 separate trips, to say I’m a big fan of the country and their food is an understatement. I don’t mind a bit of spice, but it ain’t easy to get quality Mexican food back home in Australia. To ease the cravings, my regular go-to is my local Guzman y Gomez franchise.

What is Guzman y Gomez’s ASX ticker symbol?

Tasty food aside, the big news currently is Guzman y Gomez’s upcoming initial public offering (IPO). With preparations to list on the ASX well underway, Guzmen y Gomez shares will begin trading by 20 June 2024 under the ASX ticker symbol (ASX:GYG).

How Guzman y Gomez makes money

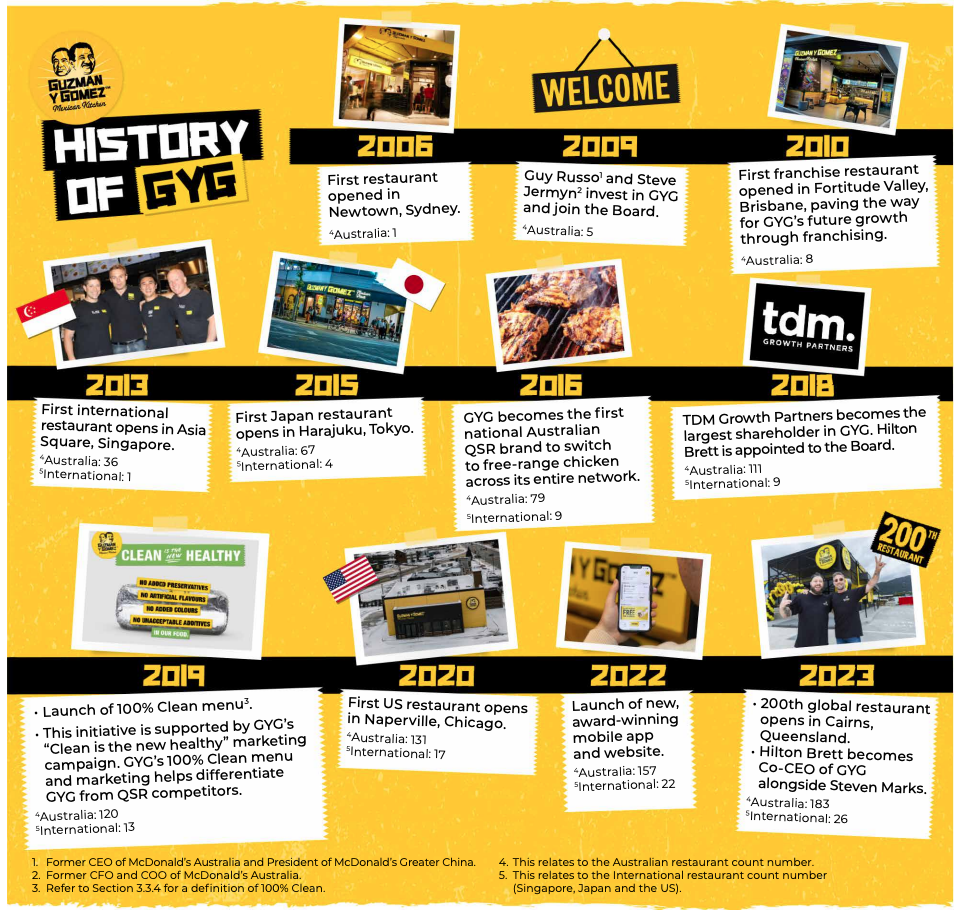

Guzman y Gomez started back in 2006, when the quick service brand started exploding with stores across the country. As of the latest count, hungry diners can get their burrito and guac fix at 185 stores in Australia, 16 in Singapore, 5 in Japan and 4 in the U.S.

With a hybrid model that’s corporate owned and operated, as well as franchise restaurants and master franchise arrangements, Guzman’s recipe book is simple.

There’s a huge focus on fresh ingredients. Its made-to-order menu contains no preservatives, no added colours, no artificial flavours, and no unacceptable additives. While success has boiled down to delicious food, served fast. Using an open-plan kitchen and a double linear preparation line, ordering bottlenecks a few and far between.

This combo of fresh, original fast food has yielded impressive organic growth.

I still remember the opening of one of its first Melbourne locations in Collins Place back in 2013. The store launched with a bang, handing out free burritos all day to hungry customers. It was manic, fun and a huge success…hooking in customers like me for countless orders since.

Adding to the sales push has been GYG’s ability to customise orders, sell beers and margaritas with its alcohol licensing, as well as barista-made coffee and breakfast menus. With great food at affordable prices and mobile app ordering, profits have snowballed and been reinvested completely through new store openings.

Guzmen y Gomez’s ASX IPO details

Sadly for individual investors like us, the biggest headline is that there is no general public offer for the Guzman y Gomez ASX IPO. Meaning, the company is only offering shares to institutional investors, staff and existing franchisees.

With new shares priced at $22, there will be around $242.5 million of new capital raised, increasing the total share count by 10.6% post-IPO.

While insiders are selling around $42.5 million worth of shares, the board, senior management and existing substantial investors will own 62% of the business after listing.

How big will the Guzman y Gomez IPO be?

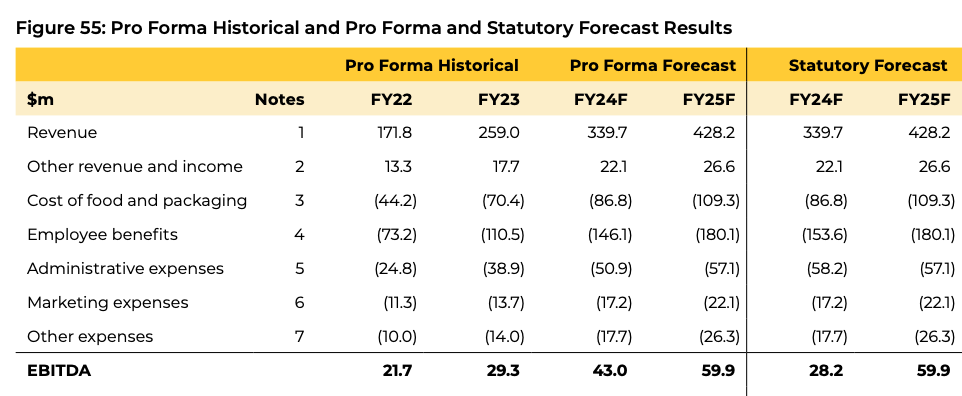

Assuming the IPO offering is fully subscribed, the valuation puts Guzman y Gomez on track to debut with a $2.2 billion market cap and an enterprise value worth $1.95 billion. Pegging this against Guzman y Gomez’s own forecasted FY25 EBITDA (earnings before interest, taxes, depreciation and amortisation) multiple of 38x.

Are Guzman y Gomez shares expensive?

Bringing this back to the most recent FY23 financials, EBITDA for the group was $29.3 million. Consequently, this is pricing the IPO at a 76x EBTIDA multiple!

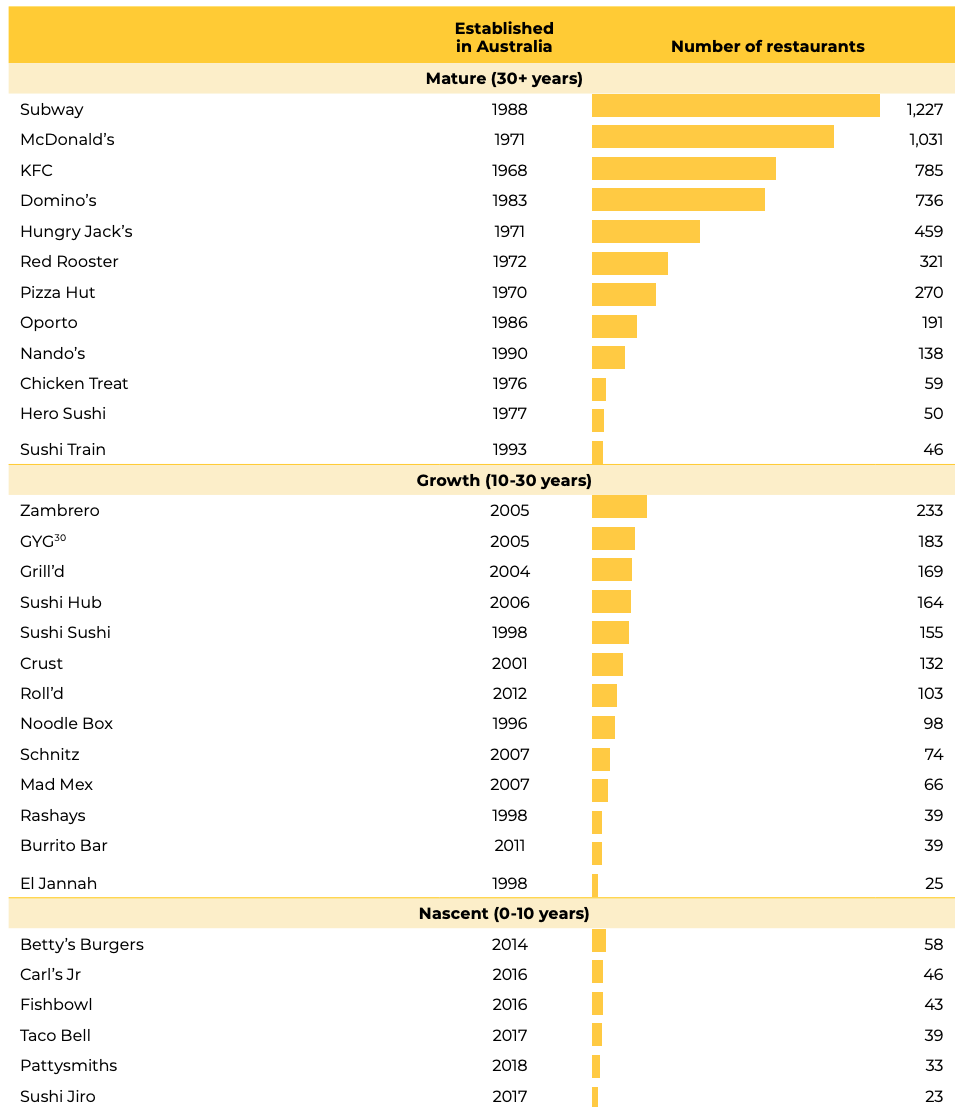

For reference, market leader and US giant Chipotle (NYSE: CMG) has over 3,419 stores and a market cap of U$84.5 billion. It is currently trading at 43x its total enterprise value / EBITDA, according to Yahoo Finance. You could argue Guzman y Gomez has more growth potential, but it’s hard for Australian brands to expand overseas.

And compare the valuation to fellow Aussie-based competitors like Collins Foods (ASX: CKF) at just 10x EBITDA, and Domino’s Pizza (ASX: DMP) at 17x EBITDA and it looks like Guzman y Gomez shares may begin trading on the ASX at a very spicy premium!

GYG’s founders and management

Despite the branding, GYG’s founders aren’t the ones you think of from their black and yellow logo. Before moving to Australia 20 years ago, Steven Marks was a hedge fund manager from New York City.

Landing in Sydney he quickly realised the low bar for authentic Mexican food. Bootstrapping the business, he partnered and co-founded GYG with his friend Robert Hazan. Named after two of Marks’ childhood friends, GYG employed chefs from Mexico and used traditional ingredients like pork shoulder and brisket.

It was just the taste Aussie diners were looking for, with sales exploding.

Marks will hold 8.8 million shares or 18% of the business post-IPO, while co-CEO Hilton Brett will hold 367,000 shares or 0.7% of the business.

While there has been some turbulence among the leadership and executive roles in the past, Guzman’s chairman Guy Russo has been with the business since 2018.

He is most known for his turn-around of Kmart as well as being CEO of McDonalds Australia. With vast experience in retail and quick service restaurants, Russo has plenty of skin in the game with 6 million shares, equating to a 12.5% ownership stake.

Guzman y Gomez’s big growth plans

While the growth so far has been impressive, GYG’s management has big plans not to take the foot off the accelerator. Armed with a $200 million post-IPO war chest, they expect to scale up operations with an aggressive push on stores with drive-through ordering.

GYG plans to open 30 new Australian restaurants in FY25 and aims to increase this number to 40 restaurant openings per year, within the next five years.

“We look forward to sharing our food with more guests across Australia and overseas as we aim to grow our network to over 1,000 restaurants in the next 20-plus years”

Steven Marks – Founder and Co-CEO

This means that Guzman y Gomez can see store count and market offering growing still by almost 5 fold on current numbers.

Final thoughts

With GYG shares expected to hit ASX trading lists in just a few short weeks, time will tell whether Guzman y Gomez’s IPO has been priced as well as its tasty burritos. With a loyal customer base (this author included) and a winning menu, this high growth fast-food chain has set itself some big targets for store openings for Australia and beyond.