Guzman y Gomez Ltd (ASX: GYG) shares will begin trading on the ASX on 20 June 2024, at $22 per share. GYG, as it’s commonly known, will be one of the hottest ASX Initial Public Offerings (IPOs) in years.

But my question is, unlike it burritos, are Guzman y Gomez shares worth waiting in line for?

This article takes a look at the behavioural elements of an IPO, and why it may be worth waiting on the sidelines…

Who are you buying from?

One thing I learned, probably a decade ago, is buying into IPO isn’t like a normal investment.

As you may know, I love technology and fast-growing compounders.

Since 2013, I been writing about ETFs and companies like Seek Ltd (ASX: SEK), Pro Medicus (ASX: PME) (still held), RPMGlobal Holdings Ltd (ASX: RUL), Lovisa Holdings (ASX: LOV), Altium Ltd (ASX: ALU), Collins Foods Ltd (ASX: CKF), Facebook / Meta (NASDAQ: META), Apple (NASDAQ: AAPL), Google / Alphabet (NASDAQ: AAPL), Trade Desk (NASDAQ: TD) and so many more.

What I’ve found time and again is that the two best sectors for proper long-term compounding (by that I mean, companies which sustainably grow profits in the period 5-10 years from now – not 1-5 years) are often technology/software companies and consumer discretionary style businesses – such as retail and food.

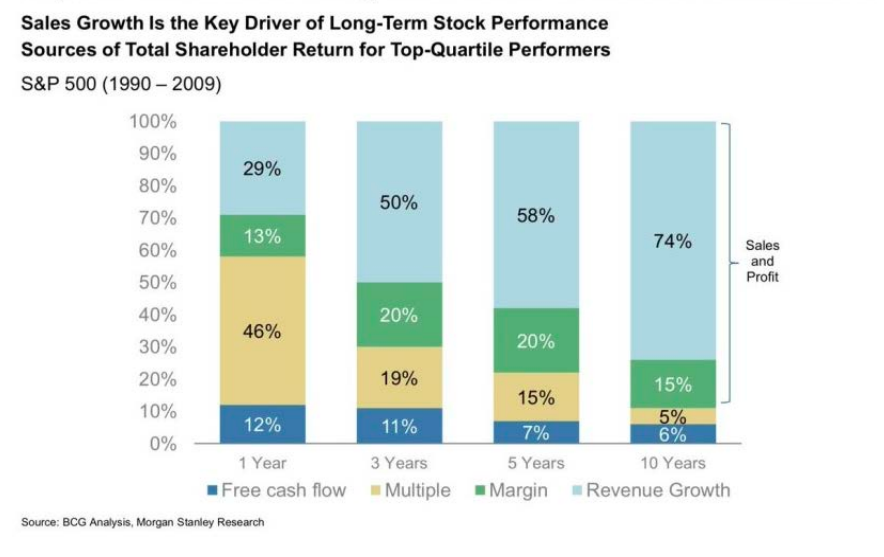

Why 5 – 10 years? Studies, such as this research from Boston Consulting Group (BCG), founder that of the top 10% of compounders, the only thing that matters for investors with a 5+ year time horizon is the company’s ability to grow sales and profit. Not P/E ratios. Not margins. And definitely not technical analysis.

The problem is, tech and consumer facing businesses are the most captivating for investors. By that I mean, the company’s origin story is easily understandable. The forecasts, and the narratives to go with it, are also very compelling.

On the one hand, it makes owning these businesses easy. After all, as any beginner investor who has read a Peter Lynch book or watched a few YouTube videos of Warren Buffett will tell you: it’s important to know what you own, and invest within your circle of understanding.

But the thing is, investment bankers also know that we want these things. And they prey on it. They prey on our biases by feeding us a bold narrative for growth (like ‘we’ll open X-number of stores for the next 5 years’) just we pay high valuations for the shares during the IPO (which their bonuses are based on). They also prey on the founders and existing shareholders of private companies.

Ask any founder and CEO of a decent sized company and they’ll tell you they loathe working with finance-type people because all they remember is flashy suits and bonus structures that are often not aligned with long-term wealth creation for real shareholders.

What does that mean for Guzman y Gomez?

My comments here are not specific to Guzman y Gomez but for any investor looking to buy into an IPO: you must know who is selling you the shares, and how they are selling it to you.

Unlike if you buy, say, Commonwealth of Australia (ASX: CBA) shares tomorrow, chances are, you’ll be buying from another everyday investor who is able to access the same information as you are. However, in an IPO situation we must acknowledge that we’re buying from someone (typically insiders or an investment bank) that has, or may have, access to far more information than you. This is simply the nature of going from unlisted to public company status.

What is the valuation of GYG?

Another consideration all investors should make during an IPO is the valuation. Remember, valuation is not share price.

If you want a deep dive into Guzmen y Gomez shares, my colleague and fellow analyst for Rask Invest and Rask Core, Kevin Fung, wrote about it at length yesterday.

As Kevin wrote:

“… bringing this back to the most recent FY23 financials, EBITDA for the group was $29.3 million. Consequently, this is pricing the IPO at a 76x EBTIDA multiple!

… and compare the valuation to fellow Aussie-based competitors like Collins Foods (ASX: CKF) at just 10x EBITDA, and Domino’s Pizza (ASX: DMP) at 17x EBITDA and it looks like Guzman y Gomez shares may begin trading on the ASX at a very spicy premium!”

While it’s fair to say Guzman y Gomez is still earl-ier in its growth phase, with only ~185 Australian stores versus Collins and Domino’s which have about 750 (give or take). And Collins Foods and Domino’s are ‘just’ master franchisors of Yum!Brands (KFC) and Dominos Pizza Inc (NYSE: DPZ), and therefore their upside could be meaningfully constrained and the economics won’t be as good as Guzman y Gomez. Still, you’re paying significantly more for Guzman y Gomez’s current profits than all of the others that are already available.

Obviously, valuation isn’t a static idea. A company’s valuation will rise (or fall) (or both!) from one year to the next, depending on the company’s execution, industry, strategy and management. In short, GYG is a great business but it will really need to turn the dial on profitability if it’s going to live up to its price tag.

But maybe it can? It’s at least one for the watchlist.

Side note: for any ETF investors reading this, Guzman y Gomez will likely be included in the most popular Australian shares ETFs – like the Vanguard Australian Shares Index ETF (ASX: VAS) or Betashares Australia 200 ETF (ASX: A200).

What’s the rush?

As Professor Robert Cialdini wrote in his masterpiece, Influence: The Psychology of Persuasion, two of the most powerful ways to convince someone to do something is to use Social Proof and Scarcity. An IPO of Guzman y Gomez will see both of those powerful forces at play.

For example, my understanding is that no individual investor (who isn’t staff or a franchisee owner) can buy into the IPO before it trades on the ASX. That’s fine. But with insiders owning a considerable number of shares, the number of shares available may be scarce.

By waiting to see how shares trade, you’ll get a better idea of liquidity and how current owners will behave.

What I’m trying to say is, there’s no rush to buy, though the persuasive techniques say otherwise.

Does it fit your wealth strategy?

As Australian author Michael Kemp wrote in his wonderful book, The Ulysses Contract, owning shares is a bit like owning a farm. It takes many years, many seasons and a consistent method to growing wealthy. Behave accordingly.

(Psst. even words like ‘stock’ and ‘yield’ come from farming, and the original stock markets were for trading… stock (sheep)!)

The key takeaway from this point is, if owning GYG shares is part of your methodical, built-in-advance strategy, feel free to ignore my ideas and jump straight in.

Believe me or not, not buying shares during an IPO can actually make us money. Even for the best companies in the world.

One look at Facebook’s shares shortly after its IPO will tell you that.

Facebook (now Meta) was easily one of the world’s most sought-after IPOs during the past few decades. And for good reason – it’s potentially the most financially beautiful business model ever invented.

Nonetheless, if you use the interactive stock chart below and select “max” for the time period, you may be able to see that Facebook shares actually fell – over 50% – after its $38 IPO back in 2012.

GYG IPO – Bottom line

If we combine the ideas that we could be unnecessarily racing into an IPO with limited shares, potentially buying from more informed sellers, at a hefty valuation, that probably doesn’t fit with most of our long-term wealth creation strategies (you can see where I’m invested here) – you probably don’t need to rush into this IPO.

I believe GYG has all the trappings of a great business. Not as great as Facebook in 2012, but still great. And while I would never guarantee it falls after its IPO, I’m happy to wait and see what happens. But I’ll be keeping an eye on it over the next few months.

Chances are, Kevin and I will be running the ruler over GYG for our members and investors, as we do every month in our Satellite stock reports. If you’re interested, you can also ask us any questions you like in the Rask Community – it’s free.

P.S. for the record, I think investors could do a lot worse than consider GYG, in time. Especially if I was a franchisee or staff member. It’s a proven business model. And who doesn’t like a founder-run company with a long growth runway.