Superannuation matters, so let’s talk about it.

Kate Campbell chats with financial advisers from Everest Wealth, Alex Luck and Daisy Magor, about what may end up being our biggest asset: our superannuation.

They chat about investing inside vs outside of super, using super calculators, comparing super funds and making the switch, the value of financial advice and much more.

✅ Here’s what we discuss in today’s conversation:

What is the purpose of super?

How do we care about something so far out in the future?

Investing in super vs outside of super

How much super should I have?

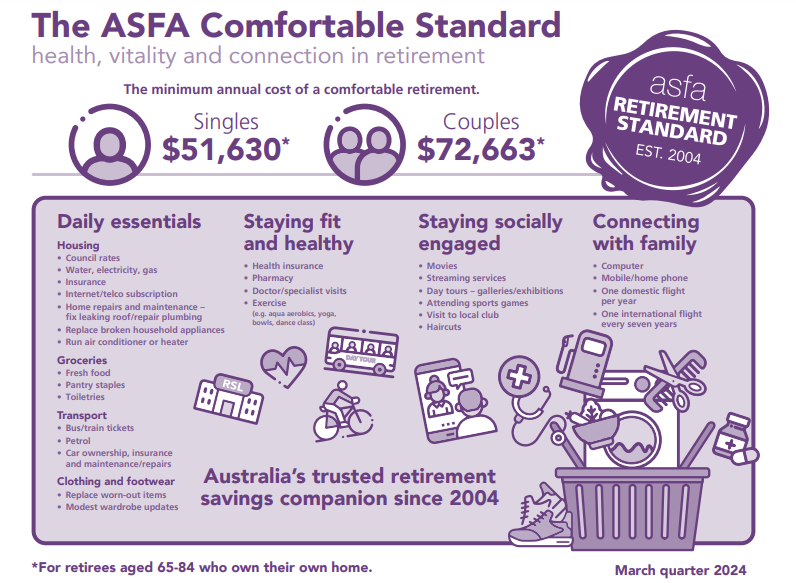

- Do you look at any of those tables that say you should have XYZ by 50?

- Do I need a million dollars to retire?

Do you have multiple super funds?

- Tools like MyGov to find if you have multiple funds

- When would you/wouldn’t you consider consolidating?

- Key things to consider before changing super funds

- Insurances

Is my super fund any good? How do I find a good super fund?

- What are the key features I should look at? Fees, investment options etc.

- Ethical investment options → how do I know if it fits my values or is just a fee-collecting exercise?

- Not all super funds are created equal → the challenge of comparing balanced funds

- Tools to compare super funds

- What important documents should I read?

How do I grow my super balance?

- Employer contributions

- Salary sacrifice

- Personal contributions

- Contribution splitting

When should I get advice about super?