Ready to level up your financial life?

Kate Campbell & Mitchell Sneddon share 10 different money hacks to help you maximise your finances in 2024. Remember – the small changes you make add up over time, so don’t discount those small actions you take.

This episode is brought to you by PocketSmith, a productivity booster for your money. Get 50% off your first two months using PocketSmith.

#1) Join your local (toy) library

#2) Write out a flow chart for your finances and automate it where possible

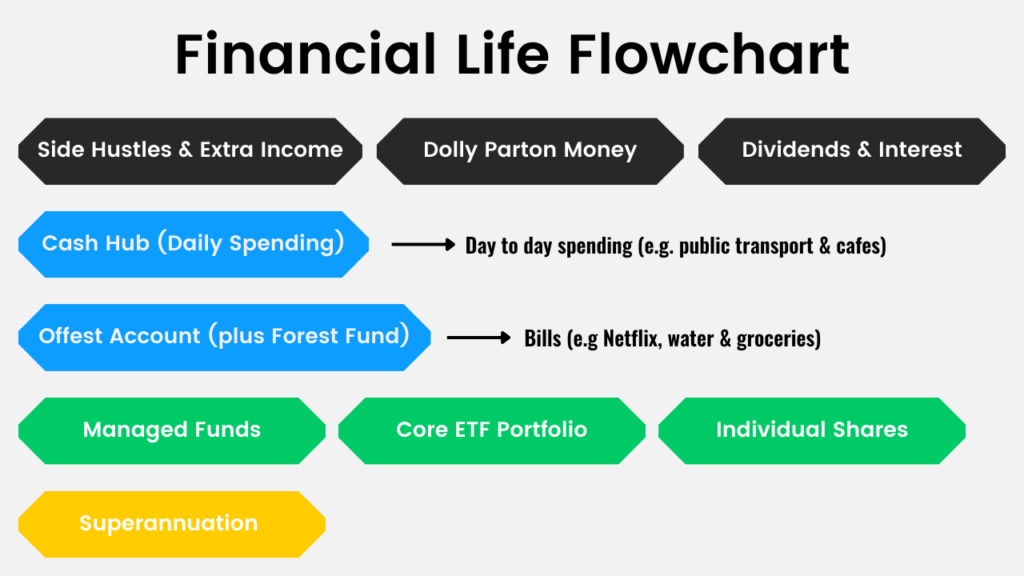

This is an interesting exercise to visualise your finances and the money flowing into and out of your bank accounts each month.

Rather than just writing a list of your income and expenses, we’re going to group them and create a visual flow chart.

#3) Rent an e-bike

#4) Cashrewards & discounts sites

For goods and services that you’re already planning to buy, get around cash-back sites like Cashrewards or discount-hunting browser extensions like Honey to keep some of your cash in your pocket.

Both of these services offer free accounts to help save you money over the year.

Using Cashrewards, on average, you’ll receive 7% cashback.

Example: Making $1,000 worth of purchases through cashback sites per year will leave an extra $70 in your pocket.

#5) Annual Zoo membership

#6) Unsubscribe from all emails that would entice you to spend money

Emails have a huge amount of power in enticing us to spend money, with stores encouraging you to sign up for rewards programs every way you look.

50% of people buy from marketing emails at least once per month. (SaleCycle, 2022).

Action: Take the time to unsubscribe from 10 brands in your trash folder today to avoid those enticing deals that’ll encourage you to spend money you had other plans for.

#7) Paying for professional help

#8) Make sure you have ambulance cover

Ambulance: potentially saving $1,358 (Vic Metro)

No limit: Emergency ambulance transport paid at 100% of the cost

Ambulance Victoria responds to over 800,000 calls for medical help from Victorians every year. That is over 2,200 calls a day. Emergency medical transport services are not free and not covered by Medicare.

#9) Sorting out budget post house/kids

Ready to manage your money like a pro? PocketSmith has a special deal for Australian Finance Podcast listeners. Click here to get 50% off your first two months of PocketSmith’s Foundation plan.

#10) Use a high-interest savings account

Can you find a savings account with 4-5% interest per year?

A $20,000 house deposit in a savings account with 5% per year, would put an extra $1,000 in your account.