Happy End of Financial Year!

New (financial) year, new (financial) you… right?

Unfortunately, for most of us, the four letters E-O-F-Y means…

Your accountant asking you to stand naked in front of a crowd.*

Reviewing the household budget (I’d rather get PocketSmith to do it).

Logging into share registries to check for lost dividends (I’d rather visit my dentist than computershare.com).

Patting some dogs stuck in your Commsec account.

Screaming “the Government did wot?!” when reviewing recent changes to Super.

It’s all… a darn headache.

(And that’s coming from a finance guy!)

Sure, some people say they are prepared to dial a 1300-number for a $2.56 refund on out-of-date Fairy laundry tablets.

Others believe an Excel sparkline will get them a hot date.

Let’s get real.

No-one wants to spend more time than they should on these things.

In the spirit of minimising headaches this EOFY, here are 5 simple things you can do to make your financial life easier – now and forever.

1. Consider if you need a financial planner.

A good financial planner is worth their weight in gold. Especially since the Royal Commission forced the banks and unqualified planners out.

But there are now fewer of them.

So how and where do you find a good one?

To make life easier for you, I’ve prepared a 5-part checklist for finding a good financial planner. You can also get matched with one of my four chosen financial advice firms (one does insurance only).

A financial adviser will cost anywhere between $4,000 and $20,000 (or more!) for a comprehensive plan (“SOA”). The price depends on your situation, the advice offered, and the scope of your assets.

Many advisers will offer once-off advice but be prepared to pay a decent chunk for ongoing professional advice and management of your assets.

If your situation is simple, or if you want advice on insurance (click here for a 15-minute call with my preferred insurance adviser – Skye Wealth) or Super – your financial planner may be able to take some of their fees from that.

Remember, all of my trusted financial advice businesses provide free upfront calls to assess your fit. Even if you follow my instructions to find your own adviser, don’t be afraid to shop around with a few introductory calls until you find your match.

(Side note: Skye Wealth is our chosen insurance adviser and they operate a little differently to most others because they are insurance specialists. I just booked in for a review of my insurance in July. Click here to do the same!)

2. Get an automated tax reporting tool – NOW

Everyone who invests will know that tax time can be a pickle.

While most PAYG (employees) can get away with a relatively simple tax return, provided you rarely trade shares/ETFs, most of us want to automate our tax calculations.

We’ve partnered with Navexa to get 20% off an annual plan. You can also use Sharesight (we don’t make anything from mentioning either of these). Our free guide, tax on shares explained, explains how it all works – it’s tedious.

You can use these tools to automatically track all of your buys and sells for tax purposes, but also to visualise your investments, track your investment performance and more.

It’s simple to set it up too. Click here for a tutorial for syncing your brokerage to Navexa.

Once June 30 rolls around, and your ETF/share info is up-to-date, simply export the tax reports and hand them straight to your accountant.

(P.S. Rask Invest automates tax reports for the portfolios of all of our investors. Your report is sent to you after we receive the information from the ETF providers.)

3. Review your budget

I don’t like to review our budget all that often.

Instead, we prefer to do 1-2 sessions per year and automate EVERYTHING.

We bank with ING and for years we have automated all transfers and BPAYs (e.g. BPAY-ing Super top-ups, BPAY-ing into Rask Invest, automating transfers to savings accounts, etc.). They fire after payday, every month. Without fail.

Savings. Done.

Dollar-cost averaging. Done.

All of our emergency fund (“Go Bag”) is held in an offset account with Bank of Melbourne / St George (both part of Westpac). Note: Westpac is not a recommendation – it simply offered the cheapest rate (see below).

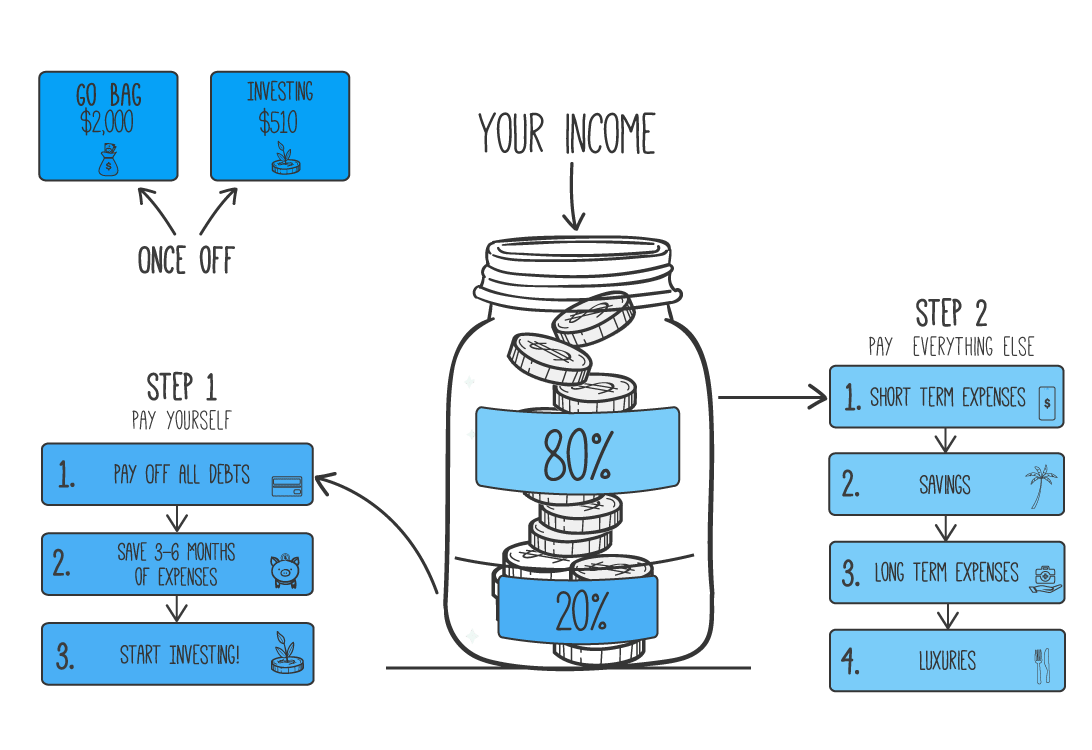

If you need some budget ‘inspo’, you can get the full rundown of our budget inside my Free Money & Budgeting Course on Rask Education. Here’s a sneak peak…

(Click here or the image below to enrol for free.)

4. Get a better rate

Forget your brother-in-law’s BBQ stock tip.

If you haven’t reviewed your mortgage’s interest rate in 12 months, chances are, your time would be far better spent getting a better rate on your mortgage than picking the next investment.

Like all financial admin, I can’t be bothered constantly checking the bank websites to see if my interest rate is better-than-average.

Instead, I get Australia’s top mortgage broker and his team to do for me – automatically.

Thanks to our partnership with Chris Bates and the team at Flint Group (previously Blusk), everyone can join me and become a Flint client (and support Rask) this financial year.

Flint was Rask’s first-ever partnership. And so far, it’s been amazing.

Why did we partner with Flint?

Anyone who’s ever bought a property will tell you that refinancing or buying a property with a proper mortgage broker by your side makes the world of difference.

This is why more consumers are using brokers – rather than going direct to banks.

I found it so hard to find good help. In banking, no-one cares about you if you’re little different. And finding a professional to trust on your property journey is incredibly difficult.

While all of the banks and many local brokers seem keen to just ‘tick and flick’ for a commission, Chris and his team are different.

Click here to book a free call and get started with Flint.

5. Invest with ETFs at your core

Buying and selling individual stocks for the core of my wealth was not only the biggest cause of financial headaches I’ve had, it came with very complicated tax returns.

(It’s even worse for cryptocurrency and day traders.)

I’m all for our community researching and buying individual stocks (I still do!). But the core of your wealth shouldn’t be a headache, or cause you to lose sleep.

That’s where passive index ETFs come in: instantly diversified, typically lower cost and easy to manage.

As I wrote in last month’s newsletter, you can use a broker like Pearler to automate your share investing.

For example, you could subscribe to our model portfolios with a Rask Core membership, then automate regular purchases to happen in the background… with Navexa or Sharesight keeping tabs on the trades for tax.

Alternatively, you can get us to do it via Rask Invest. Simply head over to the Rask Invest website to learn more and get started investing with us.

(For all investors inside Rask Invest, we’ll research the ETFs, try to minimise taxes and fees at every turn, rebalance the portfolios, stay on top of the market, and do a full tax report every tax year.)

Takeaway

I want you to imagine yourself 12 months from today…

1. Your budget is on autopilot

2. You’re investing in ETFs for the long haul (with automatic dollar-cost averaging & tax reports)

3. Your broker is keeping tabs on your biggest expense (your mortgage)

4. Your insurance is sorted (via Skye)

5. You’ve got way more time for life!

It’s really that simple.

If you have any feedback or improvements on what I can do to make my financial life even easier, let me know in the Rask Community.