Copart Inc (NASDAQ: CPRT) stock is an All Star in my opinion. And while the Copart stock price is up 33,000%+ since 1994, the best days could be in front of this proven compounder.

In this deep dive on Copart, I explore why every investor should have this stock on their watchlist. But please remember, a company like Copart would be considered as a Satellite allocation by us.

As you know, Rask follows a Core and Satellite approach to investing (read our philosophy here). Inside our Core we typically use our established, low-cost, diversified and reliable ETFs. We believe your Core is what will make you wealthy.

This report on Copart post is where things take a different turn. Here, in the Satellites, you can can include different types of investments (individual growth shares, US stocks, thematic ETFs, etc.). These positions are usually much higher risk, shorter-term (e.g. 3 years) and can be somewhat less predictable than a good ol’ fashioned ETF. Please consider building out your Core portfolio before you venture into Satellite investing.

Enough said, let’s get into Copart…

Copart: a beautiful business

Copart (NASDAQ: CPRT) is a business that can be best described as eBay for car wrecks. But unlike typical salvage auctioneers, this capital-light compounder has been busy innovating its business model from selling spare parts and scrap iron, to an auto marketplace behemoth.

Copart stock price

3 reasons to like Copart

- Network effects

- First mover advantage

- Dominant market share

Copart founder Willis Johnson has junkyard in his DNA.

Willis got his first taste as a teenager in the 1960s, thanks to his father, before starting his own dismantling yard in California in 1972.

Fast forward to 2024 and Copart has transitioned its business model, selling over 3 million vehicles annually and generating over U$3.8 billion in revenue.

Copart has flown under most investors’ radars for the longest time. Why? From the outside, its humble beginnings in the junkyard game have cloaked a masterful evolution into a dominant two-sided marketplace.

Strategically clipping the ticket on auction listings, as well as purchaser fees, Copart has been built intentionally around long-term structural advantages.

While significant barriers to entry galvanise its competitive moat. Behind this scratched and twisted metal exterior has emerged a Sotheby’s of Scrap – a monster compounder that simply controls the global car auction market it pioneered.

Copart’s dominance is built on a win-win-win business model

The major factor in Copart’s success is its ability to create and maximise the economic value for each party in its network. This win-win-win proposition is as rare as hen’s teeth in most industries. Yet it has catapulted Copart to the world’s largest online car auction provider.

While critical technology like anti-lock braking systems (ABS) and emergency brake assist systems have done wonders for traffic safety, by blunting accident rates, it has come against a tsunami of population growth, and an insatiable dependence on cars. Meaning, more scrap.

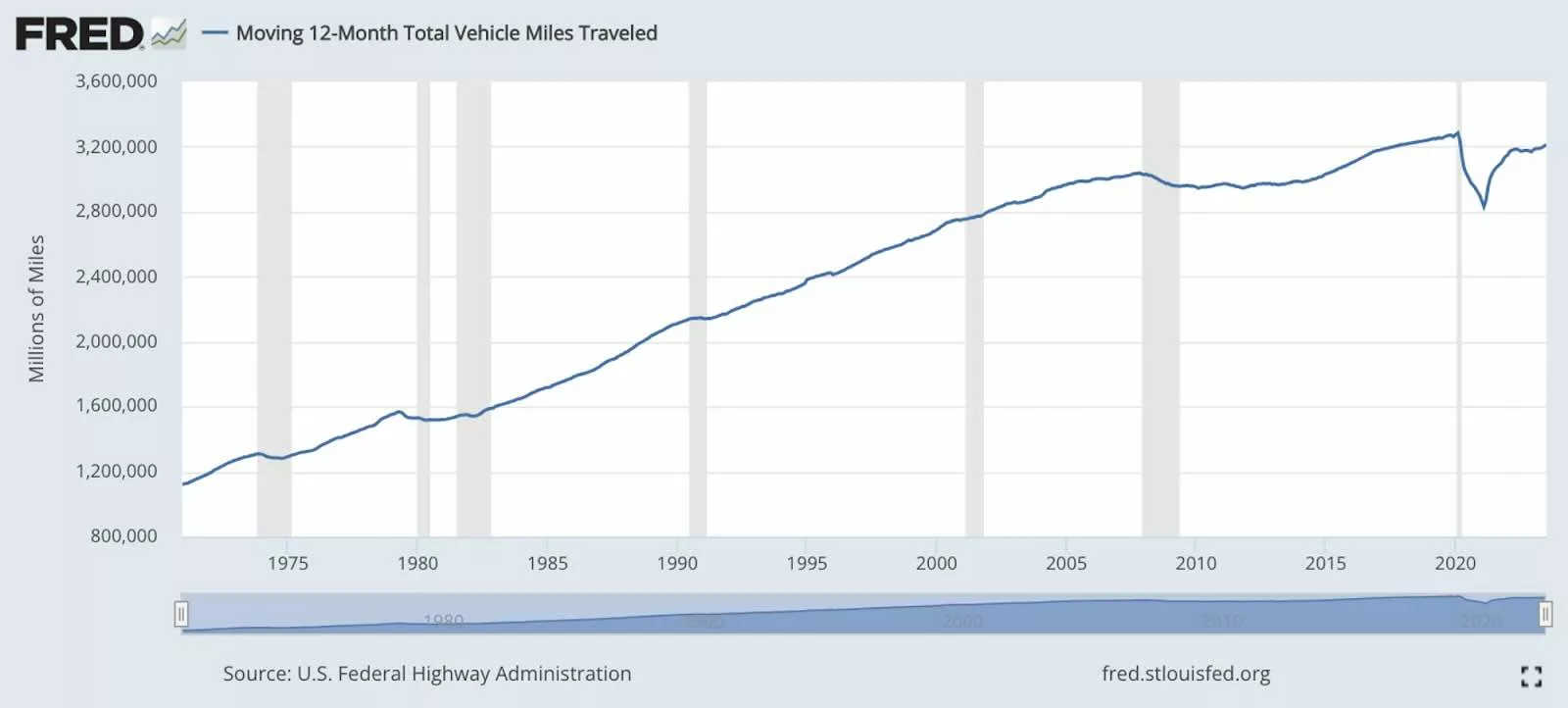

Just take a look at the data in Copart’s biggest market, the US.

In the US, over 6 million passenger car accidents happen every year from a growing pool of 286 million vehicles. This is a trend which means more cars on roads, more miles driven and, unfortunately, many more accidents.

As long as manufacturers continue to produce new cars, consumers keep buying them and insurance companies offer protection, Copart will maintain its crucial role – which is kind of like the septic tank for the car industry.

The salvage market is hugely lucrative given vehicle values at stake, and makes up 80% of Copart’s auction volumes. Copart’s auction model is simple and can be explained by taking a look behind the curtain when an insurer writes off a vehicle…

How car insurance fuels scrapyards like Copart

When accidents result in un-drivable and unroadworthy cars, Copart is quick to assume its primary role as vehicle undertaker. Working with insurance companies, on increasingly exclusive contracts, it will tow and transport wrecks to one of its 200 locations across 11 countries.

At the scrapyard, it generates the first of two major revenue streams…

Firstly, it clips the ticket from services like vehicle assessment, damage inspection, minor repairs and cleaning, paid by major insurers. There’s fancy tech here, too. ProQuote is its own machine learning system, so insurance companies get fast and accurate estimates for repair costs and damages.

Bringing speed and automation to their claims process means informed repair and total loss decisions can be calculated and made quickly. This solves heavy admin and labour-intensive problems, unblocking huge bottlenecks for insurance companies which traditionally need to send out assessors who manually take photos and write-up damage reports.

More importantly, this technology supercharges the supply side of the Copart network. The more cars Copart can store, assess and process for sale, the bigger its auction database becomes.

It’s a power law dynamic that can be seen for all top-dog marketplaces. Just like Airbnb, Realestate.com.au (another Rask Invest All-Star) or carsales.com.au, buyers flock to destinations with the most selection and best prices, while sellers naturally join the market with the most buyers.

It’s a self-reinforcing cycle that naturally elevates Copart as the apex predator at the top of the wreckage food chain.

This systematic process is one that Copart has spent decades refining.

Incredibly, it takes only 45-60 days for a damaged vehicle to come through Copart’s system and turn over.

Inventory risk is mitigated too, as Copart rarely buys or holds any physical car stock. Instead, they focus on moving thousands of cars from the yard to assessments before receiving insurers’ sale instructions. Then they get it sold and shipped to new owners.

Copart’s real bread and butter however is found on the other side of the network: auction buyers pay Copart.

VB3 spearheads Copart’s crown jewel and is the third-generation virtual bidding platform. Winning buyers pay anywhere from $25 to $900 to Copart for cars valued up to $15,000. Above this, Copart charges 7.5% of the final bid, on top of membership fees for higher volumes and extra features.

Copart’s well-oiled machine can pool and spin off wrecks in just 7-20 days. Meaning an astonishing 3 million cars on its platform to find new homes each year. That’s over 8,200 cars sold per day, or 342 cars every hour, every day. Talk about a V8 cash engine!

Who is going around buying undriveable cars?

The fact is that most of the cars sold on the Copart platform can actually be restored.

Typically, the cars are purchased by resellers and car dealers from international markets, accounting for over 50% of platform sales. In developing countries, vehicles simply need to get from point A to B. With far less stringent repair and roadworthy laws, it’s about drive-ability, not as-new repairs.

Cars that can’t be brought back to life are purchased by dismantlers, who recycle and refurbish parts. Failing this, they are ultimately scrapped for their raw materials.

This three-phase afterlife is a win for everyone along the value chain, while also providing essential breathing room for overflowing waste, landfills, and the environment.

More recently, Copart has extended its tentacles into used wholesale segments, as well as recreational and industrial vehicles, while also capturing rental, fleet and financing companies on the supply side.

With eyes now firmly focused on its global opportunity, Copart has been busy flexing its playbook internationally. It has gained significant traction in fragmented markets like Canada, the UK, Brazil, Ireland, Germany, Finland, the UAE, Oman, Bahrain, and Spain.

Copart’s hidden advantages

Technology is your friend

– Willis Johnson Sr (Copart Founder)

High-tech isn’t what springs to mind when most of us picture junkyards. But Copart has always leveraged technology to unlock new phases of growth.

Early on this meant implementing computerised systems for inventory, long before other yards. It seems basic for today’s world of booming AI but Copart has a history of spending big on tech. It forked out $110,000 on a reel-to-reel computer when the internet wasn’t even around (that was around double the cost of an average home).

In the 1980s, Copart even built and paid for a $40,000 digital system out of its own pocket to solve California’s DMV admin bottleneck, just so it could turn over more cars.

By 1996, only a year after eBay was founded, Copart removed the geographical limit of its yards with a $3 million project. By bringing a global view of every vehicle in its system, capable of unifying all yards under a single brand. This shifted its auction throughput capacity to meet customer demand on a digital scale.

Land for days

An essential part of Copart’s moat is its vast land holdings. Freehold and mortgage-free, there are over 6,800 hectares (17,000 acres) for Copart to store and process wrecks all from its own balance sheet. These new yard developments not only give Copart operating leverage and certainty for the long term, but a first-mover advantage and extremely high barriers to entry.

It’s a unique case where smaller population clusters can’t support more than a single yard, while larger ones don’t want a second. This means Copart’s moat can’t simply be out-muscled by competitors with flush chequebooks. With strict local laws for yard permits, Copart has the keys to local monopolies and total land control.

Write-offs aplenty

For those old enough, you may have noticed an increasing velocity of minor prangs resulting in car write-offs. The rising ‘total loss ratios’ comes from the ever-increasing complexity of car repairs.

The shifts from steel to aluminium, as well as more sensors, airbags and electronics, mean pricier and longer damage repair bills. With total loss frequencies trending upward, it’s cheaper to payout than to repair. This leaves Copart with an ever-growing pile of damaged vehicles.

Copart is built for disasters

Copart’s network is also made to absorb large-scale catastrophic weather events like floods and hurricanes.

Having long acquired land holdings in disaster-prone areas, Copart plays a key role in recovery efforts, flexing up volumes when crises arise.

In extreme cases like Hurricane Katrina in 2005, Copart mobilised its team, entered into emergency leases, and engaged a multitude of service providers to retrieve, store, and market tens of thousands of flood-damaged vehicles.

More importantly, Copart didn’t flex its pricing power, instead absorbing these costs itself, demonstrating a now ongoing capacity to do the right thing for the long term, proving to its customers and the community it wasn’t a capitalist mercenary but a business they could rely on. Even at the worst possible time.

Copart’s founder & the next generation

“Take care of your pennies and your dollars will take care of themselves.”

– Willis Johnson Sr (Copart Founder)

Copart’s Willis Johnson isn’t a normal Wall St founder. This is a true rags-to-riches tale.

He inherited the love of hard work, dismantling and reselling scrap from his father, before being drafted into the military and serving in the Vietnam War.

Johnson wasn’t your typical grease monkey either, Johnson ran Copart differently to other yards. He prided himself on servicing customers. Drawing on skills learned at supermarket giant Safeway, as well as unashamedly copying ideas from anywhere he could learn: competitors, other industries, and even Disneyland (with upselling and package techniques).

Old cars were lined up and organised with military precision, while Johnson also became the first in the industry to disassemble and clean parts. The little details mattered and it meant happy customers only buying the parts they needed – and they looked good.

From here, he relentlessly pursued more revenue streams, specialising in Chrysler OEM parts, as well as scaling new pick-a-part models. These tiny wins soon snowballed into something much bigger and rewarded him in spectacular style. Johnson still holds just shy of 54.7 million shares today.

Jay Adair is Copart’s new Executive Chairman, having recently stepped down as co-CEO after 14 years, he is also Willis Johnson’s son-in-law.

But don’t assume the family connection meant any handouts for Adair. Begrudgingly at first, Jay was given his chance at Copart at age 19 in 1989. Unafraid to be challenged, Adair put his natural knack for efficiency and sharp business mind to work, observing and learning before improving processes across the entire company.

A decade later, it was Jay who instigated Copart’s crucial move into online bidding. By 2003, Adair had driven auctions fully online, while Copart’s footprint grew exponentially to 100 locations across America. This capital-light framework allowed the business to increase capture and control both sides of the marketplace, and launch Copart internationally. Adair holds plenty of skin in the game with just shy of 34 million shares.

Jeff Liaw recently took sole CEO duties after sharing them with Adair through a successful transition period. Liaw has been Copart’s CFO since 2016, before being promoted in 2019 and named CEO North America in February 2021.

Just like Johnson had taken Adair under his wing before stepping down, so too has there been another shift of power internally from Adair to Liaw. With over 650,000 shares held personally, and a compensation package that is 55% performance-based, interests are aligned with Copart shareholders.

Copart’s competitors

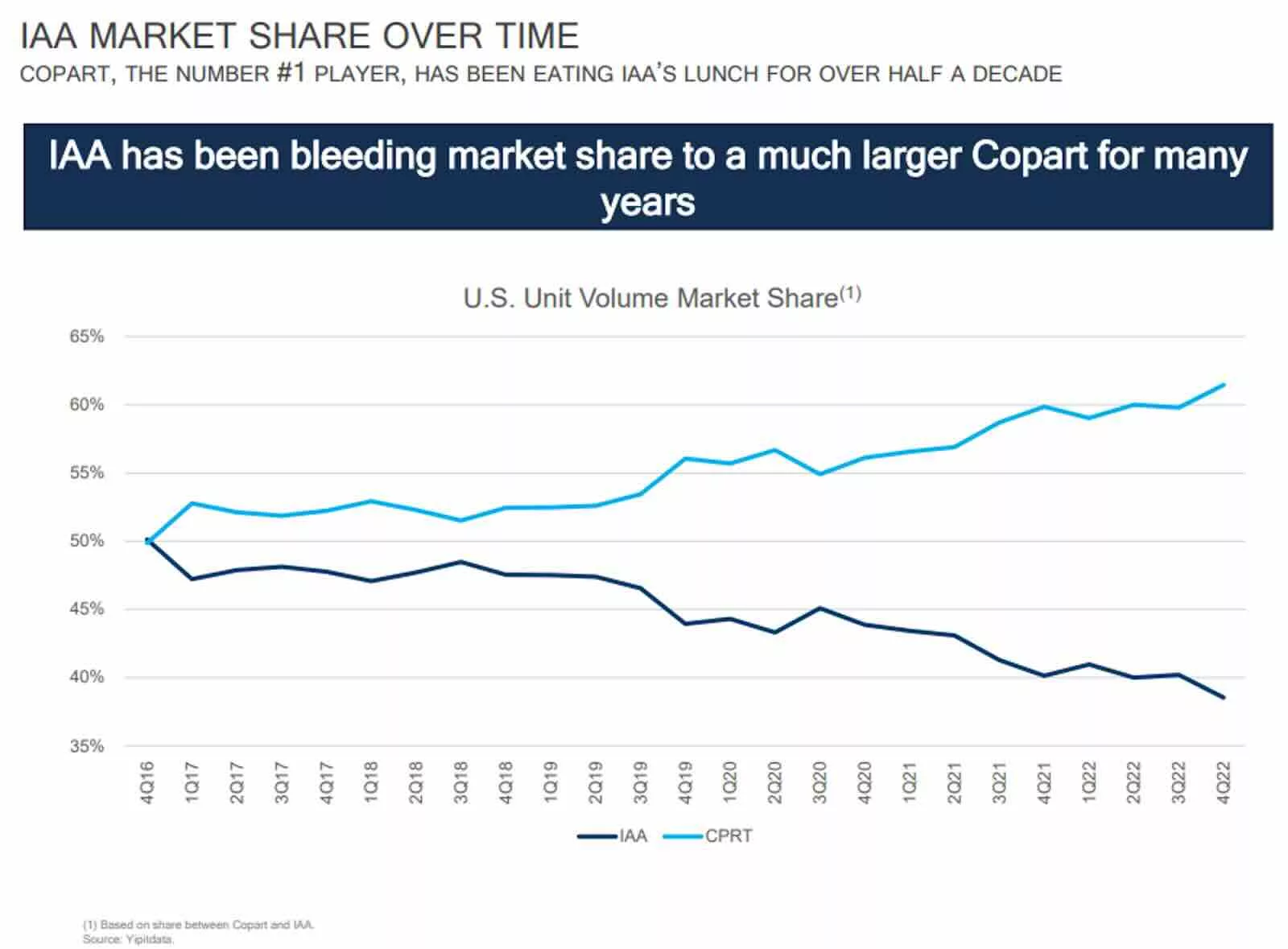

Insurance Auto Auctions (IAA) is Copart’s largest competitor and has been the best thing to happen to the business. Between them, they control an estimated 80% of the total USA market, with IAA holding around 30% market share. But this is where the similarities end for this duopoly.

Rewind three decades and IAA had the early advantage. Flush with cash and first to IPO on the public markets, IAA was a clear number-one and was acquiring new yards aggressively. It also operated with an even lighter business model, by simply leasing its land and yard holdings.

Favouring fast growth, it chose a path of least resistance, appeasing short-term profitability while Copart played the long game.

What IAA really lacked however was Johnson’s obsession with the business and years of salvage knowledge. While IAA signed deals based on balance sheets and numbers that made headlines, Johnson focused on strategic partnerships that added to the network advantage. With land deals that included 10-year leases and options to purchase and insurance agreements, Copart knew this was a marathon, not a sprint.

As IAA returned steady dividends, Copart zoned in on the bigger opportunity, gobbling up aligned partners with talented teams.

Reinvesting 4x the amount of capex has seen Copart’s lead grow increasingly larger over the past decade. The difference has been none more stark than in IAA’s late response to the online auction arena, only entering after Covid-19’s lockdowns had crippled its physical-only operations.

Global website traffic data shows Copart with close to 3x the number of unique visitors globally. Capturing the bulk of this salvage pie has meant Copart paying down $700m of debt while IAA took on a further $1.3 billion during the same period.

We see IAA playing second fiddle to Copart’s exceptional business model across all areas.

Lower costs without increasing yard rental expenses mean operating leverage for Copart. Superior long-term management and capital allocation quality is also shining through. It led to a widely criticised $7 billion acquisition of IAA by Ritchie Bros in March 2023.

The bear case for Copart

Finally, to risks.

If you’re a Tesla fan then it’s no secret that Musk and other electric vehicle makers have made enormous strides in the past decade towards the holy grail of autonomous vehicles. With software upgrades that allow full self-driving, the future looks bright for road safety and a drastic reduction in accident rates.

However, auto industry analysts expect it to take 15-20 years before the entire traffic fleet of non-autonomous driving vehicles cycle out, particularly with inflation and cost of living issues blunting early adopter growth.

Add in equally critical legislative laws that need to be passed, and this fully autonomous future isn’t here just yet…

Another factor working to Copart’s advantage is that its salvage vehicles are shipped off and resold to developing countries – which primarily need functional cars rather than fancy tech. Between now and the self-driving nirvana, we unfortunately expect accident and total loss ratios to grow, particularly with the increasing repair complexity of new vehicle designs, EVs and use of battery tech.

Another argument against Copart is the rise of ride-sharing giants, like Uber and Lyft, pushing more consumers away from direct car ownership. While at face value it may appear that these apps work against Copart, the data shows an ever-increasing amount of total miles driven, Covid-19’s dip aside.

Final thoughts

Although Copart doesn’t often make headlines, its powerful network effects and incredibly high barriers to entry fuel a hidden compounding machine.

With a fortress-like balance sheet that is constantly replenished by rivers of free cash flow, it’s a business we’d love to bring into a Rask Invest portfolio – at the right price.

Coupled with a disciplined, aligned and long-term thinking management team to deploy and reinvest capital, we think it means this junkyard dog is just getting started.

Disclosure: Kevin does not own shares of Copart (CPRT).