The Guzman Y Gomez Ltd (ASX: GYG) share price after its IPO got my pulse racing and my eye twitching.

GYG, as one of my former 20-something analysts would call it, was the ASX’s biggest IPO in recent memory. The ASX rolled out the red carpet for Guzman Y Gomez as GYG shares popped 30% on IPO.

As Rask’s favourite writer, Jaz Harrison, reported on the day:

“The Mexican food chain has arrived on the ASX boards to much fanfare and shareholders have already made some spicy returns. The IPO price was $22 and the GYG share price is currently $30.”

You might remember, a few days before the GYG IPO I said:

“…we could be unnecessarily racing into an IPO with limited shares, potentially buying from more informed sellers, at a hefty valuation, that probably doesn’t fit with most of our long-term wealth creation strategies (you can see where I’m invested here) – you probably don’t need to rush into this IPO.”

As you can imagine, I had (delicious) burrito all over my face when GYG shares rocketed north to $30.

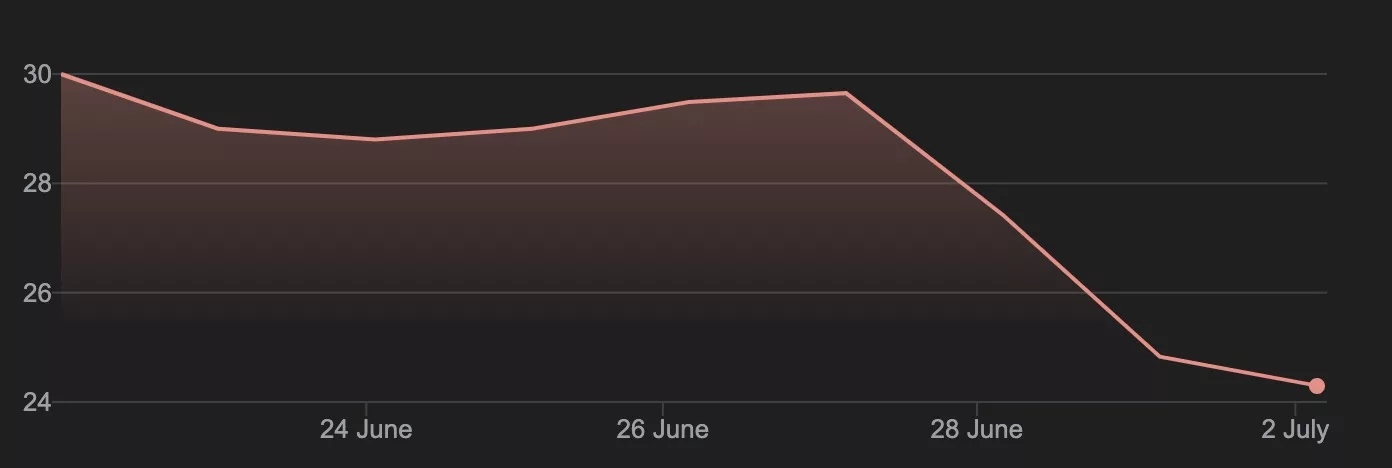

GYG share price

But now…

Hang on a moment…

Guzman Y Gomez shares are falling…

Since their “stag profit” on day one, GYG shares are now down 19% and seem to be falling fast.

Why is the GYG share price falling?

To me, it’s pretty obvious why we’re now seeing downward pressure on GYG shares.

Before I get to that, you should know I hate seeing investors lose money… which is why I started Rask in 2017 to offer free but professional education to hundreds of thousands of people.

But what I really hate is seeing people lose money when I know the financial system was set up against them.

As I wrote before the IPO, GYG is a wonderful business. But, as Buffett and Munger were fond of saying, no business is worth an infinite share price.

Similar to what Jaz said in her conclusion, don’t be surprised if I own GYG shares one day (alongside my current core portfolio).

But I’m not going to pay a lot more than the fair value of a business. I don’t pay 30% more for Nikes just because they were released on a Tuesday.

What are GYG shares really worth?

Despite what the gurus and people in suits would have you believe, valuing a business is more art than science. There are more unknowns than things we know for certain.

(Keep in mind, this is coming from the guy who runs The Value Investor Program!)

And a company’s ‘strategy’ is not a substitute for a guaranteed future.

If I had a dollar for every company that forecast growth in the IPO documents… I’d probably have one of those suits.

(Or be an investment banker.)

(Just kidding. I wouldn’t.)

As Rask’s Senior Analyst, Kevin Fung, wrote in his deep dive, Inside Guzman Y Gomez’s Spicey $2.2 billion IPO, GYG shares would trade at a significant premium to comparable peers, such as Collins Foods Ltd (ASX: CKF) (owner of KFC Australia) and Domino’s Pizza Enterprises (ASX: DMP) (owner of Domino’s Australia).

You could argue that GYG is a higher quality business than Collins Foods and Domino’s Pizza Enterprises, since it owns the brand, and thus deserves a premium valuation. And I’d agree. But it was already at a steep valuation premium to peers and then shares went up 30%.

And all of that valuation was based on pretty strong forecasts for future growth. Collins Foods and Domino’s are profitable. As is Chipotle.

Remember, if you genuinely do have a 5-10+ year time horizon, you can afford to ignore a lot of the investment gobbledygook about valuation – provided you buy a great business.

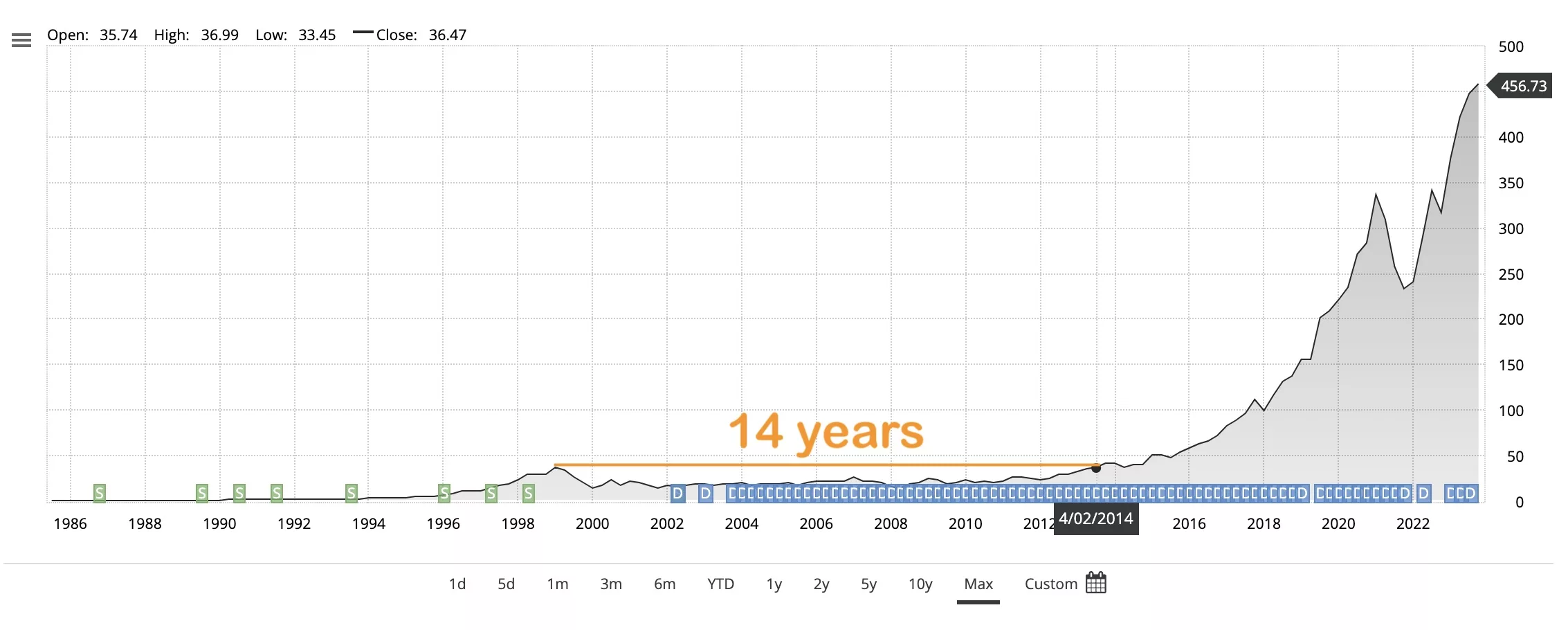

But what a lot of people forget is that even the world’s best companies, like Microsoft Inc (NASDAQ: MSFT), can be horrible investments if you overpay.

Hindsight is a wonderful thing. But zoom in a little.

Microsoft shares took 14 years to get back to their dot-com boom share price highs (not including dividends). Yikes.

Bottom line

I think the Guzman Y Gomez business has the hallmarks of a great long-term compounder. But its IPO was priced to perfection and then some. Its investment banks used many tricks to boost investor enthusiasm and get a hefty valuation and share price pop at GYG’s IPO.

I don’t blame them for a falling share price or doing good marketing. They’re just doing their job for the company, like a real estate agent selling a house (just with better suits). Remember, the real estate agent works for the seller, not the buyer.

Bottom line: I wouldn’t buy GYG now because it currently fails our Best Expression principle. I’d rather invest my dollars into a long-term growth ETF like Vanguard Australian Shares Index Fund ETF (ASX: VAS), which is already part of the portfolios I run; or even compare GYG alongside some smaller companies like Laserbond Ltd (ASX: LBL) or even RPMGlobal Holdings (ASX: RUL), which is down 10% today.