The Australian share market has experienced heightened volatility so far in August.

On Friday 2 August, the All Ordinaries (INDEXASX: XAO) fell -2.08%, followed by a further -3.81% fall on Monday 5 August, taking August to date returns for the Australian market to -5.24%.

Australia has fortunately outperformed, with the NASDAQ Composite Index is down -7.95% and Japan’s Nikkei 225 down over 20%.

The global volatility index (VIX) spiked to 38.6 (normally 12 to 18), its highest level since the pandemic in March 2020, and the GFC before that.

What’s caused the sell-off?

Japan raised interest rates above 0% for the first time since 2007.

This is significant for the global hedge fund community – many have been betting that rates remain low/negative in Japan with what’s called a “carry trade”.

A carry is where you borrow money in a low interest rate economy, convert it at the prevailing exchange rates and lend it out in a high interest rate environment. With rates previously at -0.10% p.a. in Japan, hedge funds have been borrowing JPY to buy USD-denominated bonds which have been as high as 5% p.a in recent times.

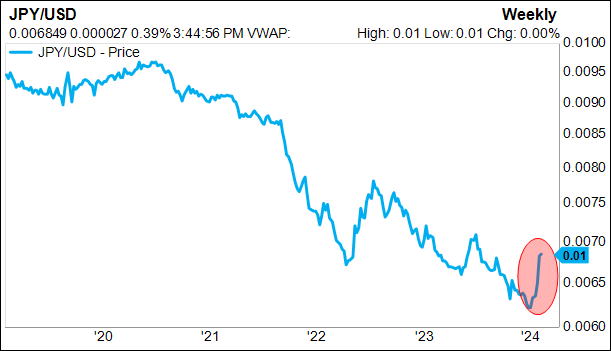

This ‘carry trade’ has resulted in an excess supply of Japanese Yen and subsequently, a significant devaluation of the Yen, relative to the USD dollar over the past 5 years.

With the Bank of Japan raising rates, hedge funds now suspect this profitable trade may reverse and the Yen spiked.

Source: Factset

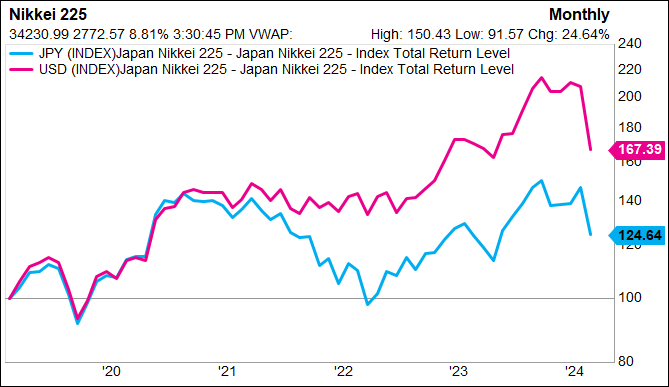

A rising Yen also has implications for equities, as USD denominated returns from Japanese shares have been “supercharged” over the last 5 years. This may also now be unwinding..

Source: Factset

While relevant for those invested heavily in Japan, Japan only makes up 5.31% of the MSCI All Country World Index (ACWI). For context, the US has a 64.5% allocation. For the average Australian investor, the main concern is the AUD-denominated cost of their upcoming trip to the ski fields of Niseko.

US economic data

Two main data points have spooked investors that the US is about to fall into recession:

- Nonfarm payrolls of 114K in July, well below the ~175K consensus. Nonfarm payrolls are a lead indicator of employment, which in turn reflects economic strength. May and June estimates were also revised lower by a collective 29K, seen as a negative sign by the market.

- ISM manufacturing index headline number of 48.7 in May was worse than expected (consensus 49.5) showed a further contraction from April’s 49.2 and down to the weakest levels seen since last November.

We don’t dispute these are relevant macroeconomic indicators, but would argue that the market has significantly overreacted to them. It was only in late June that markets were concerned that GDP growth and core inflation was too high in the US and that global bond and equity markets were getting ahead of themselves, pricing in 2H interest rate cuts.

As some widely read media pundits have pointed out, US GDP growth was much stronger than expected in June, coming in at an above-trend 2.8% for the June quarter vs consensus 2.0%. This led to calls for the RBA and Federal Reserve to increase rates because economic growth/inflation were too strong.

We think it is a big shift in assumptions in 6 weeks to go from that position, to the current view that its highly likely the US falls into recession, on the back of only two coincident data points.

Action points – how to invest today

Make no mistake, at Seneca, we see this as a buying opportunity.

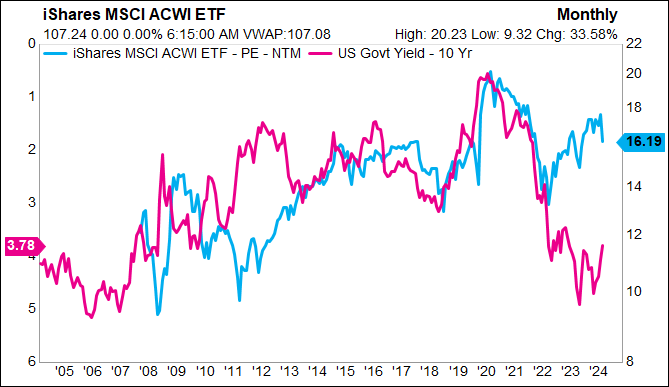

The yield on a US 10-year Government Bonds has declined from c.4.6% in May to c.3.8% today. For context, that is back to the same yields we saw in late 2023 after which the market ripped another c.20% (MSCI ACWI). This wasn’t driven by earnings, as much as it was rising valuations with the PE of the market expanding from 16 to 18x, on the back of the falling risk free rate.

As you can see below, the PE of the market is inversely correlated with bond yields (LHS inverted).

Source: Factset

3 key areas of investment opportunity

Australian Equities

Resources-companies typically underperform when bond yields are declining, so with much of our index exposed to resources, passive index investing in Australia will likely underperform. A rising AUD is a headwind for exporters like mining companies, who earn USD but pay most of their input costs (read: labour) in AUD.

Examples of offshore earners include large companies such as CSL Ltd (ASX: CSL) which primarily generates its blood collection revenue in the US, as well as smaller growth companies such as Catapult Group International Ltd (ASX: CAT) which sells its wearables technology to global sports players who mainly reside offshore.

For this same reason, many foreign investors fail to recognise the opportunity that exists in the high-quality industrial businesses that exist on the ASX, keeping a lid of valuations until the earnings growth is obvious. A rising AUD will likely also keep them at bay (USD-denominated returns lower, as AUD appreciates)

This is a distinct opportunity for nimble, locally-focused, active managers.

Small Companies

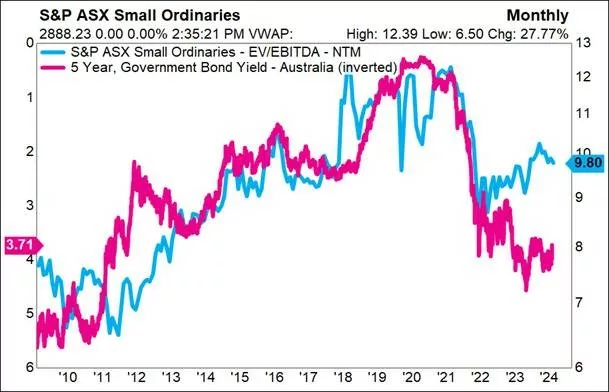

Lower bond yields means a lower cost of equity. With small companies primarily funded by equity, they asymmetrically benefit from this lower cost of capital. Cheaper capital also means larger corporates are more likely to make takeover bids, again, benefiting those emerging growth names.

History has shown small caps outperform large caps when central banks cut interest rates.

Source: Factset

Emerging markets

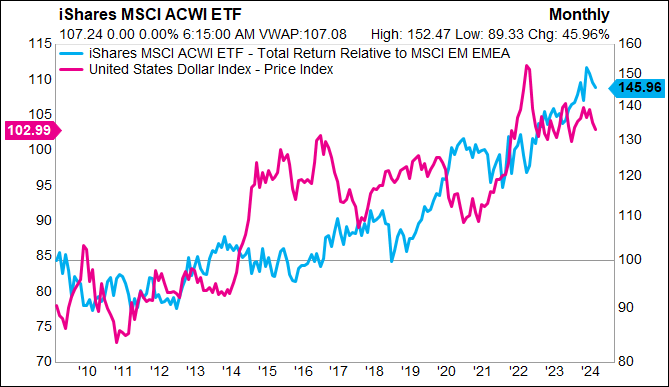

Emerging markets have underperformed Developed markets as the USD has rallied against major currency pairs. The chart below shows developed market returns, relative to emerging markets and the USD. Blue line up and to the right is developed markets outperforming.

We think this trend reverses and we see an early-2000s style decline in the USD and a significant period of outperformance for Emerging Markets.

Source: Factset

Summary

- The c. 5% decline in the Australian share market is a rare and distinct opportunity for investors to increase exposure to equity markets.

- The Seneca Investment Committee have actively prepared our portfolios to benefit from declining bond yields, a falling USD and outperformance across key Emerging Market geographies.

- At a company-specific level, we continue to tilt our Australian Shares SMA and Small Companies Fund to those companies which asymmetrically benefit from declining bond yields and interest rates, while avoiding exposure to those companies who face the headwind of an appreciating AUD.

If you’d like Seneca’s CEO Luke Laretive to review your portfolio and how it’s positioned for this significant pivot point in the economic cycle, schedule a meeting with him using the link below.